Tag Archive: newsletter

Political Turmoil in UK & US Sees Gold Hit 2 Week High

For first time in over 16 years, palladium futures settle at a premium to gold futures. Gold futures on Wednesday resumed their climb toward the psychologically important price of $1,300 an ounce, settling at their highest in nearly two weeks on the back of political turmoil in the U.K. and U.S.

Read More »

Read More »

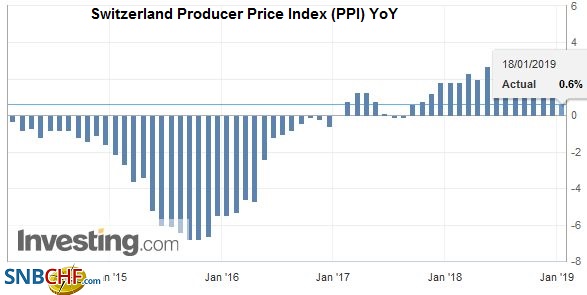

Swiss Producer and Import Price Index in December 2018: +0.6 percent YoY, -0.6 percent MoM

18.01.2019 - The Producer and Import Price Index fell in December 2018 by 0.6% compared with the previous month, reaching 102.5 points (December 2015 = 100). Compared with December 2017, the price level of the whole range of domestic and imported products rose by 0.6%. The average annualised inflation rate in 2018 was 2.4%.

Read More »

Read More »

FX Daily, January 18: Markets Finishing Week on Positive Note

Sentiment has improved since the volatility last month spooked investors and, perhaps, some policymakers. Global equities are rallying. The Shanghai Composite and the Nikkei are at their best levels in almost a month, while the Dow Jones Stoxx 600 is at its best level since early December, gapping above a downtrend in place since late last September.

Read More »

Read More »

Swiss and Italian leaders discuss cross-border tax deal

By spring, the Italian government is expected to clarify its position on a new tax system for cross-border commuters between Italy and Switzerland. “It is a delicate issue that must be digested sufficiently, with both administrative and political evaluations. It takes time, but spring is not far away,” Italian Foreign Affairs Minister Enzo Moavero Milanesi told Swiss Foreign Affairs Minister Ignazio Cassis in Lugano in southern Switzerland on...

Read More »

Read More »

Spreading Sour Not Soar

We are starting to get a better sense of what happened to turn everything so drastically in December. Not that we hadn’t suspected while it was all taking place, but more and more in January the economic data for the last couple months of 2018 backs up the market action. These were no speculators looking to break Jay Powell, probing for weakness in Mario Draghi’s resolve.

Read More »

Read More »

FX Daily, January 17: Risk Assets Underperform as Investors Await Fresh Developments

The capital markets remain relatively subdued as fresh trading incentives are awaited, including US corporate earnings. Some of the enthusiasm for risk-assets has diminished. The MSCI Emerging Markets Index has stalled after trading at six-week highs yesterday, though most bourses in Asia were higher, but the Nikkei (Topix gained), China, and Singapore.

Read More »

Read More »

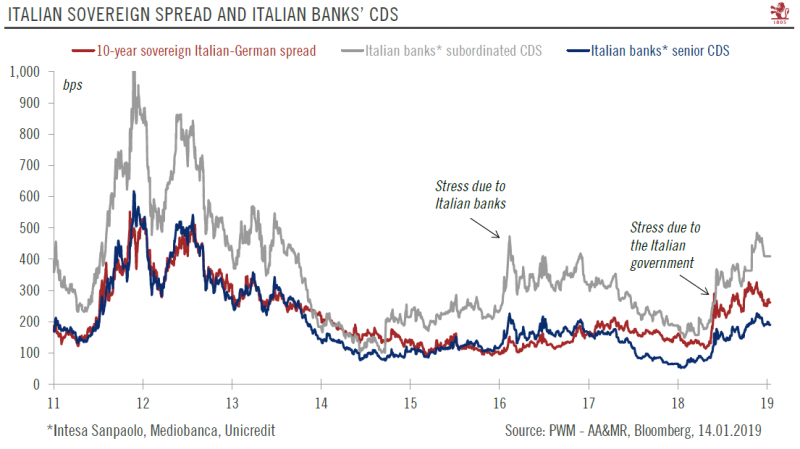

Outlook for euro periphery bonds

Economic fundamentals should come back into focus, but politics still a factor.After a year when peripheral countries’ old demons made a reappearance, with, in particular, Italy’s public debt back in the spotlight, the focus should shift to economic fundamentals in 2019. Both the Spanish and Italian economies are set to slow down, although the situation is more serious in Italy.

Read More »

Read More »

Gold Holds Steady Near $1,300/oz As Geopolitical Risks Including Brexit Loom Large

Gold Holds Steady Over £1,000 – Increased Likelihood Of A Disorderly Brexit. – Gold supported near $1,300/oz ahead of important British Brexit no-confidence vote. – Gold is consolidating in range between $1,280 and $1,300/oz (over £1,000/oz and €1,100/oz) – A break of resistance at $1,300 will likely see gold rise rapidly in all currencies.

Read More »

Read More »

As Germany and France Come Apart, So Too Will the EU

If we follow the logic and evidence presented in these seven points, we are forced to conclude that the fractures in France, Germany and the EU are widening by the day. When is a nation-state no longer a functional state? It's an interesting question to ask of the European nation-states trapped in the devolving European Union.

Read More »

Read More »

Financial watchdog pushes for upgrade of cyber defence

The chief executive of the Swiss financial watchdog, Mark Branson, has called for the creation of a national cyber defence centre. In an interview with the SonntagsZeitung newspaper, Branson reiterated that Switzerland was lagging on safety standards behind other financial centres.

Read More »

Read More »

The Death of a Business Cycle

How do business cycles end? In the US, conventional wisdom is that they are murdered by the Federal Reserve. It is too slow to raise rates and then goes too quickly. This view is espoused by numerous well-respected economists and policymakers. President Trump's criticism of the Federal Reserve is anchored by such views.

Read More »

Read More »

FX Daily, January 16: Markets are Eerily Calm

Overview: There is an eerie calm over in the capital market through the European morning today despite some ostensibly worrisome developments. While many, like ourselves, expect UK Prime Minister May to survive a vote of confidence, it hardly clarifies the outlook.

Read More »

Read More »

SNB Grants Fintechs Access to SIC

In a press release the Swiss National Bank explains that it: "grants access to … [fintechs] that make a significant contribution to the fulfilment of the SNB’s statutory tasks, and whose admission does not pose any major risks.

Read More »

Read More »

SIHH watch fair opens in Geneva

The Salon International de la Haute Horlogerie (SIHH) has opened in Geneva with 35 watch brands showing off their wares. SIHHexternal link will run until Thursday, when it is open to the public, who must register and pay CHF70 ($71.20) in advance. It is the first watch fair of the year and important in terms of setting trends, particularly in the luxury segment.

Read More »

Read More »

Cool Video: Brexit–Now What?

I joined Wilf Frost, and Sara Eisen on the CNBC set at the NYSE shortly after the House of Commons delivered an unprecedented defeat to UK Prime Minister May. Catherine Mann (Citi) and Christopher Smart (Barings). The guests generally agreed that a delay in Brexit was likely.

Read More »

Read More »

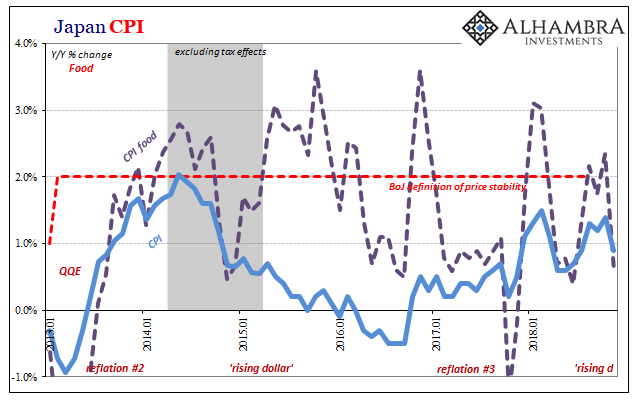

Insight Japan

As I wrote yesterday, “In the West, consumer prices overall are pushed around by oil. In the East, by food.” In neither case is inflation buoyed by “money printing.” Central banks both West and East are doing things, of course, but none of them amount to increasing the effective supply of money. Failure of inflation, more so economy, the predictable cost.

Read More »

Read More »

FX Daily, January 15: New Phase Begins with UK Vote

Several of the equity benchmarks are flirting with six-week highs, including MSCI Asia Pacific Index and the Emerging Markets Index. The Dow Jones Stoxx 600 is trying to extend its advancing streak for a third week, something not done since July.

Read More »

Read More »

Former US interior secretary lands first job since stepping down

Former United States interior secretary Ryan Zinke has landed his first job since leaving the Trump administration two weeks ago. Zinke has joined investment company Artillery One as managing director, swissinfo.ch has learned.

Read More »

Read More »

The Decline and Fall of the European Union

This exhaustion of the neocolonial-neofeudal model was inevitable, and as a result, so too is the decline and fall of the European integration/exploitation project. That a single currency, the euro, would fracture rather than unite Europe was understood long before the euro's introduction as legal tender on January 1, 2002.

Read More »

Read More »