Tag Archive: newsletter

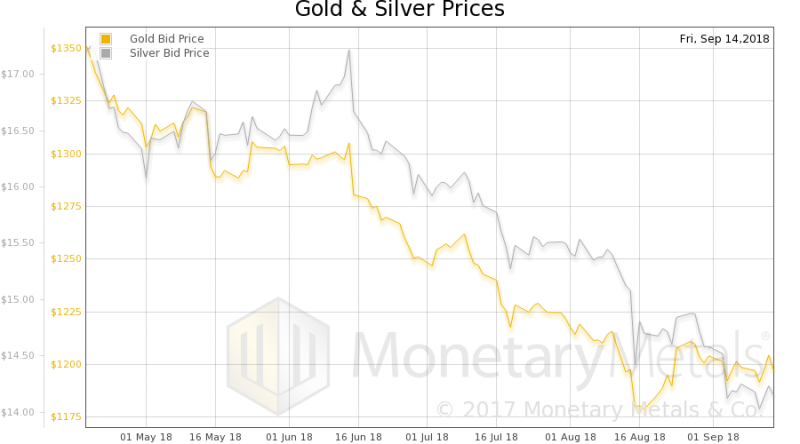

Silver Is ‘Undervalued’ Relative to Stocks, Bonds, Gold – GoldCore

– Silver is ‘undervalued’ relative to stocks, bonds and gold: GoldCore. – Silver at $14/oz is cheap relative to gold with gold-silver ratio over 85. – Silver drops to 32-month lows prompting sellout of Silver Eagle coins at U.S. Mint. – U.S. Mint said “recent increased demand” prompted a “temporary sell out” of its American Silver Eagle bullion coins as investors see silver coins as a bargain.

Read More »

Read More »

FX Daily, September 19: Dollar Trades Heavily as Emerging Markets Follow China

One would not have a clue looking at global equities that there has been a sharp escalation in trade tensions in the past 36 hours. As was well tipped the US imposed a 10% tariff on $200 bln of Chinese goods and indicated that the tariff will rise to 25% at the start of next year. President Trump also threatened to quickly follow up with another tariff on $267 bln of Chinese goods it retaliated.

Read More »

Read More »

Unsere Nationalbank befeuert Dax und Wallstreet statt SMI

Im Januar 2010 betrugen die Devisenanlagen der Schweizerischen Nationalbank (SNB) 94 Milliarden Franken. Innerhalb der nächsten fünf Monate, also bis Mai 2010, explodierten diese auf 238 Milliarden. Das entspricht einem Plus von 150 Prozent (Faktor 2.5x). Was war geschehen?

Read More »

Read More »

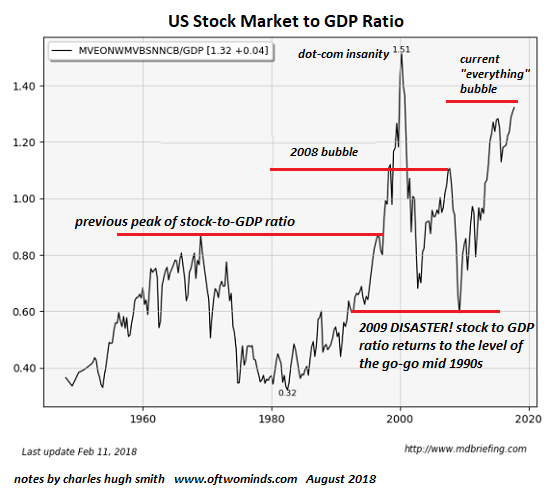

US Equities – Approaching an Inflection Point

A Lengthy Non-Confirmation. As we have frequently pointed out in recent months, since beginning to rise from the lows of the sharp but brief downturn after the late January blow-off high, the US stock market is bereft of uniformity. Instead, an uncommonly lengthy non-confirmation between the the strongest indexes and the broad market has been established.

Read More »

Read More »

Swiss Housing – the hardest and easiest places to find a home

Recent government figures show a 13% rise in the number of vacant homes over the 12 months to June 2018. The number has more than doubled since 2009 when there were close to 35,000 vacant dwellings. By 1 June 2018, there were more than 72,000, a vacancy rate of 1.62%.

Read More »

Read More »

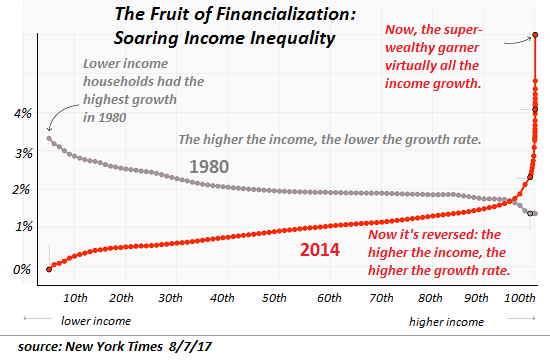

We’re All Speculators Now

When the herd thunders off the cliff, most participants are trapped in the stampede.. One of the most perverse consequences of the central banks "saving the world" (i.e. saving banks and the super-wealthy) is the destruction of low-risk investments: we're all speculators now, whether we know it or acknowledge it.

Read More »

Read More »

Die richtige Unternehmensgesellschaft für Immobilieninvestments | Achim Zimmermann

Unternehmensgesellschaft für Immobilieninvestments - - sichere dir jetzt dein Ticket für den nächsten Immopreneur Kongress 2019: http://bit.ly/IPK19YT

Welche Unternehmensgesellschaft ist die sinnvollste für mich als Immobilieninvestor? Diese Frage stellen sich viele Investoren, denn die falsche Wahl kann viel Geld und viele Nerven kosten.

Achim Zimmermann erklärt dir in diesem Video, worauf du dabei achten solltest.

Jetzt für die Immopreneur...

Read More »

Read More »

Dollar Slips, though Emerging Markets Trade Heavily

The US dollar is beginning the new week on a soft note, as China threatens not to accept the invitation for trade talks in Washington if the US imposes new tariffs on $200 bln of its goods, which the Wall Street Journal reports could come as early as today. Meanwhile, the MSCI Emerging Markets Index is giving back half of the 2.5% rally seen in the second half of last week.

Read More »

Read More »

BNS. Peuple suisse, tu peux trembler pour ton épargne et ta retraite! LHK

Le financement du bilan de la BNS se fait en grande partie par les liquidités des banques cantonales et les Raiffeisen. Va-t-elle nous rendre un jour nos économies? LHK

Les forcenés de la printing press: le plus forcené ce n’est pas celui que l’on croit, non c’est la Banque Nationale Suisse!

Total du bilan par rapport à la taille du GDP.

Les forcenés de la printing press: la BNS!

Cette entrée a été publiée dans Autres...

Read More »

Read More »

Over 7,000 farms get lower subsidies due to irregularities

The federal authorities last year cut direct subsidies paid to 16% of all Swiss farms due to irregularities often due to animal protection and welfare issues. In all, 7,145 farms, or 16% of the total, received lower payments, the SonntagsZeitung wrote on Sunday. The report was based on figures that have yet to be published by the Federal Office for Agriculture, but which were confirmed by the economics ministry.

Read More »

Read More »

Massive Deficit Spending Greenlights Waste, Fraud, Profiteering and Dysfunction

The nice thing about free to me money from any source is the recipients don't have to change anything. Free money is the ultimate free-pass from consequence and adaptation: instead of having to make difficult trade-offs or suffer the consequences of profligacy, the recipients of free money are saved: they can continue on their merry way, ignoring the monumental dysfunction of their lifestyle.

Read More »

Read More »

Der Nationalbank sind die Hände gebunden

EZB-Präsident Mario Draghi konstatierte letzte Woche zufrieden, dass die aktuellen Turbulenzen in einzelnen Staaten auch dort bleiben und nicht andere Länder anstecken. Seine Kollegen in der Nationalbank, die diese Woche ihren geldpolitischen Entscheid fällen, dürften das etwas anders sehen.

Read More »

Read More »

Credit Suisse found lacking in fight against money laundering

Swiss bank Credit Suisse has failed to meet its obligations to prevent money laundering, says Switzerland’s financial supervisory authority. According to FINMA, the Financial Market Supervisory Authorityexternal link, the misconduct is related to the alleged corruption cases around FIFA, world football’s governing body, and the oil companies Petrobas and PDVSA.

Read More »

Read More »

FX Weekly Preview: Dollar Pullbacks Remain Shallow as Rate Differentials Widen

The trajectory of monetary policy in the US and Europe has been fairly clear. There is practically no doubt that the Fed will hike rates on September 26. Despite softer than expected PPI and CPI figures, the market has become more confident of another move in December. The Federal Reserve's balance sheet unwind reaches its maximum velocity of $50 bln a month in Q4.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned.

Read More »

Read More »

Some Swiss Rail ticket machines set to disappear

Ticket machines once replaced many of the people selling ticket from counters. Now the internet and mobile phones threatens ticket machines. As more and more people use dash past ticket machines with an electronic train ticket in their pocket, Swiss Rail is looking at phasing out some machines according to various newspapers including 20 Minutes.

Read More »

Read More »

Basel-EuroAirport rail link should open in 2028

The EuroAirport Basel-Mulhouse-Fribourg Airport should be accessible by rail by 2028. Project leaders are convinced that trains will replace the buses currently connecting the city of Basel to the airport within ten years. The French national railway company SNCF said on Thursday that is it is normal that financing for a project of this magnitude is not yet fully secured in France.

Read More »

Read More »

Downslope CPI

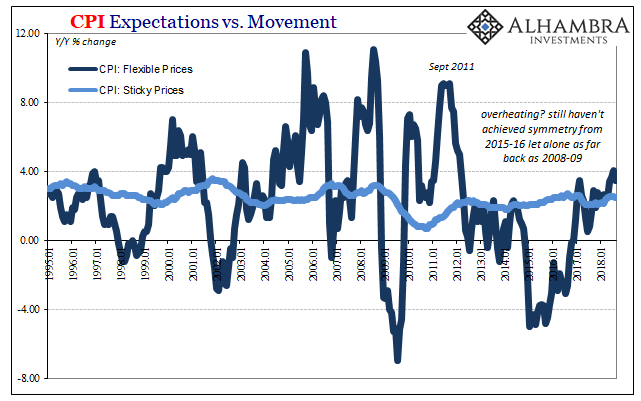

Cushing, OK, delivered what it could for the CPI. The contribution to the inflation rate from oil prices was again substantial in August 2018. The energy component of the index gained 10.3% year-over-year, compared to 11.9% in July. It was the fourth straight month of double digit gains.

Read More »

Read More »

European labour market remains in rude health

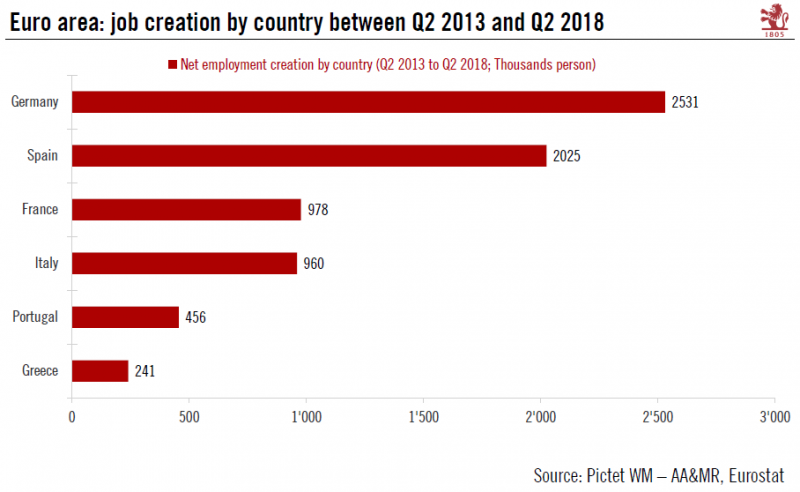

But there is room for further improvement.This week euro area employment data confirmed that labour market recovery remains on track. Employment grew at 0.4% q-o-q in Q2 2018, marking the 20th consecutive quarter of expansion. Employment is now 2.4% above its pre-crisis (2008) level. Since Q2 2013, 9.2 million jobs have been created in the euro area.

Read More »

Read More »