Tag Archive: Gold

Isn’t it wonderful to trade with a strong central bank behind you?

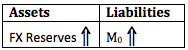

Isn’t it wonderful to have a strong central bank like the SNB sitting behind you when trading Forex? Losses are limited to the floor of 1.20 and in the meantime you can gain forward swaps with the higher euro zone interest rates. Today the Swiss National Bank (SNB) decided in its monetary policy assessment …

Read More »

Read More »

SNB prints nearly 5 billion francs in one week, FX traders poised to get ripped off

As we expected in our post “What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?“, long-time investors, global macro funds and US investment banks are moving into gold and the Swiss franc again. The SNB had to buy euros and print new Swiss francs of around 5 billion francs last week, as … Continue reading »

Read More »

Read More »

What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?

On Friday there was a big movement in the EUR/CHF. First it went up to 1.2154, fell later down to 1.2080 in the main American trading and rose again to 1.21 in the low-volume trading time. We repeat our entry from Friday, because we continuously updated the post after new developments, e.g. after the … Continue reading »

Read More »

Read More »

The Big Swiss Faustian Bargain: Differences between SNB, ECB and Fed Money Printing Explained

In this post we show that the risks the Fed, the ECB and the Bundesbank incur are far smaller than the one the Swiss SNB takes. The Fed has “just” an inflation risk, that could cost 200 billion US$, 1.2% of US GDP. The ECB and Bundesbank have the risk that the euro zone splits … Continue reading »

Read More »

Read More »

The Swiss television interview with Thomas Jordan, or was it Leonid Brezhnev ?

Today Thomas Jordan gave a quick interview in the Swiss television. Everything was so well prepared and as sterilized. Thomas Jordan learned all answers by heart and was answered the questions about one second after the question was asked. It reminded me of an interview in Soviet television with former Soviet leader Leonid Brezhnev. Each …

Read More »

Read More »

SNB only major central bank missing at Jackson Hole, are important SNB decisions looming ?

The Jackson Hole Symposium is traditionally a meeting of global central bankers, here the 2010 attendance list. This year it takes place between August 30 and September 1. Central bankers assemble The annual economic symposium for central bankers staged by the Federal Reserve Bank of Kansas City begins in Jackson Hole, Colorado (until September 1). …

Read More »

Read More »

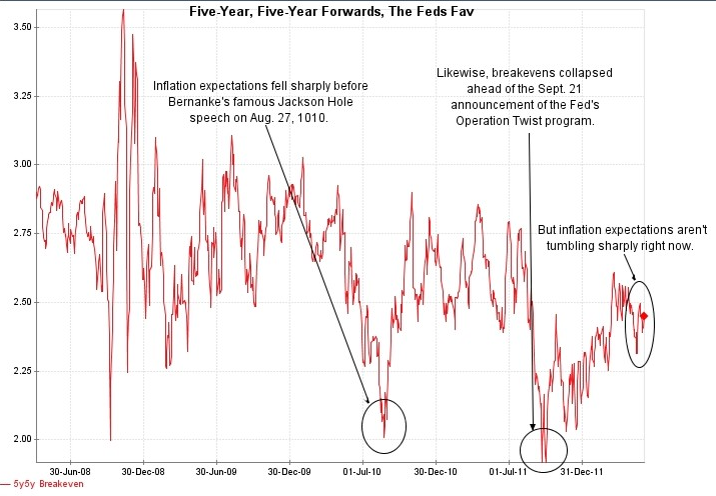

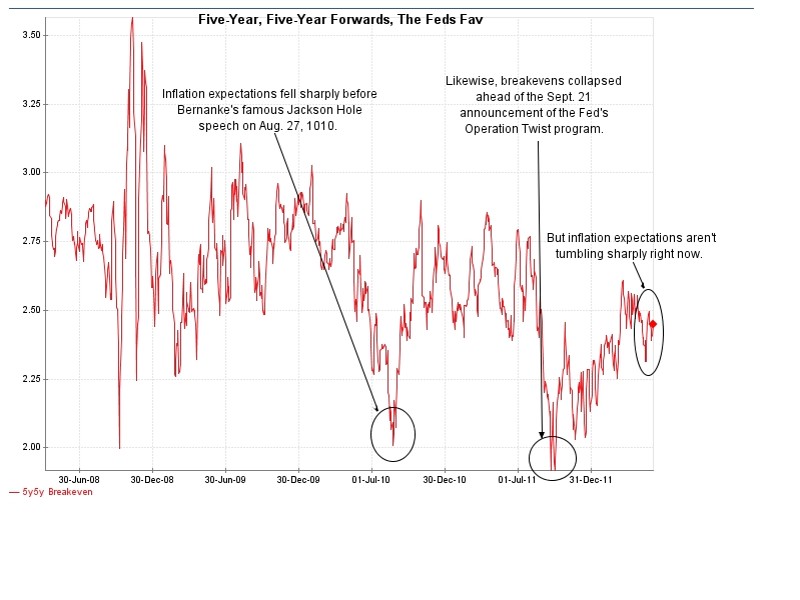

Fed Violates its Own Inflation Targets. Should QE3 Be Postponed?

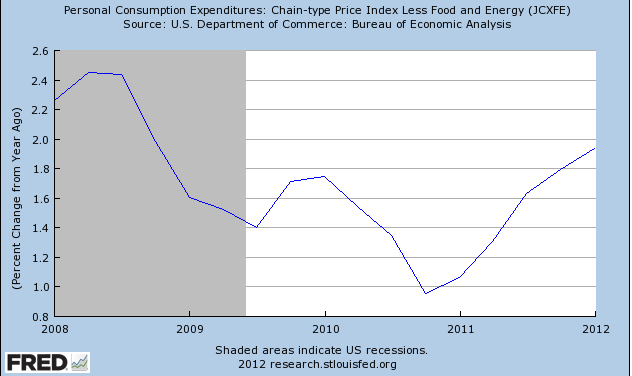

At this year’s Jackson Hole symposium, Ben Bernanke promised to help the economy via further easing if needed. We doubt his promises because because the Fed might contradict their inflation targets. Current levels of around 2 % for the consumer price inflation excluding food and energy (“core CPI“) and the deflator of the GDP …

Read More »

Read More »

How former central bankers stepped up against the central banks

There are already three former European central bankers who criticize more or less openly the European Central Bank (ECB).

Read More »

Read More »

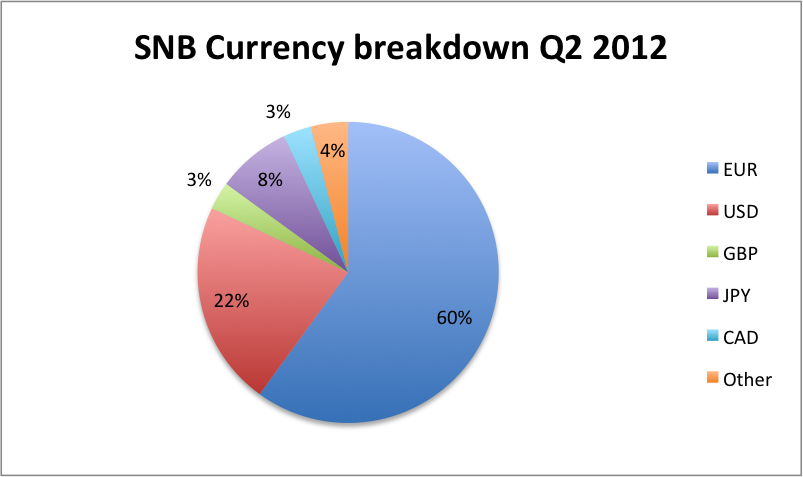

SNB results: SNB invested 77% of the huge Q2 increase in reserves into Euros. Peg at risk ?

The Swiss National Bank (SNB) reported a profit of 6.5 billion Swiss Franc for the first half year (H1). After a loss of 1.7 bln. francs in the first quarter (Q1), it had a 8.2 billion profit for the second quarter (Q2). The Q2 SNB results of 8.2 bln. CHF were less than our … Continue reading »

Read More »

Read More »

SNB Results: SNB poised for 10 billion CHF quarterly profit

On July 31st the Swiss National Bank will publish interim results for the second quarter 2012. Already now we offer an estimate to our readers. Our estimate does not cover the central bank’s Forex trading results, they are difficult to estimate. A central bank is not a day trader, therefore the influence should be limited. …

Read More »

Read More »

Guest Post: Six Reasons Why Italy May Exit the Euro Before Spain; Ultimate Occupy Movement

Six Reasons Why Italy May Exit Before Spain

1) Rise of the Five Star Movement

2) 44% of Italians view the euro negatively, only 30% favorably. That is biggest negative spread in the eurozone. In Spain more view the euro positively than negative, albeit by a small 4 percentage point spread.

Read More »

Read More »

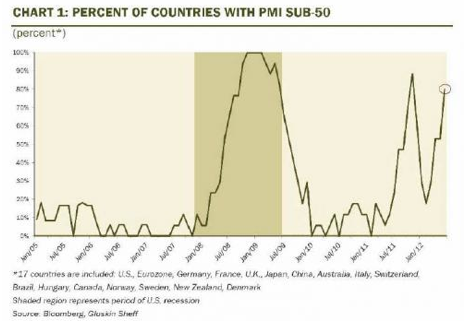

Global Macro with all Global PMIs July 4th

updated July 4,2012 This page inside our macro data menu contains global PMIs compared with the main risk indicators S&P500, Copper, Brent and AUD/USD as of the day after most PMIs came out. JP Morgan’s Global PMI: Click for details inside the table, History of composite PMI

Read More »

Read More »

Some of our Twitter followers

Here a quick list of some of our Twitter followers:

Marc Faber Blog @marcfaberblog FOLLOWS YOU

Marc Faber is an investor and economist known for his spot-on assessment of the world economy. He also manages his own investment company, Marc Faber Limited.· http://marcfaberblog.com

economie_suisse @economie_suisse FOLLOWS YOU

La principale organisation faîtière de l'économie suisse

Read More »

Read More »

Quantitative Easing Indicators, June 2012

The main drivers for demand for Swiss francs are the Euro crisis, but even more the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and in the fear of Quantitative Easing. This will push down the dollar and safe-havens like the CHF, gold or the … Continue reading »

Read More »

Read More »

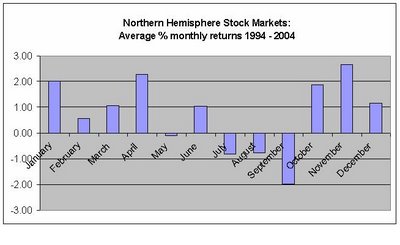

The “Sell in May, come back in October” effect and its equivalent for the SNB

The "Sell in May, come back in October" effect It is the same seasonal anomaly nearly every year: The statistically flawed (see here and here) Non-Farm Payrolls (NFP) report delivers some good winter readings with 200K new jobs, this time additionally fuelled by a weather effect; biased data that let hard-core Keynesian policy makers doubt Okun's law. Consequently the stock markets rally …

Read More »

Read More »

CNBC rumors: Different peg methods for the SNB

There are currently rumors going on on CNBC that the SNB is planning something this night. As we explained here, the SNB had to strongly restart the printing press and printed tremendous 13 bln francs in one week. Moreover, they probably sold some of their in Q4 2011 and Q1 2012 acquired GBP, JYP and …

Read More »

Read More »

The vicious cycle of the US economy or why the US dollar must ultimately fall again

Just some simple words about the vicious cycle of the US economy and the consequences on the US dollar: A stronger USD will not rescue the US economy, quite the contrary. US companies will not hire in the US, but outsource or hire overseas. If they hire in the US, due to the high number …

Read More »

Read More »

SNB buys Swiss Francs and sells Euro: Welcome to the EUR/CHF peg

Why the big Q1 loss of the SNB was actually a big win for the central bank Anybody watching the EUR/CHF exchange rate this year was wondering why the volatility the pair saw last year had completely left. The pair slowly fell from 1.2156 over 1.2040 at the end of Q1 to 1.2014 today. FX … Continue reading...

Read More »

Read More »

SNB meeting on March 15th, 2012: Pure Speculation that SNB raises floor, How to Trade it ?

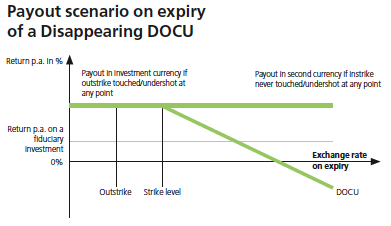

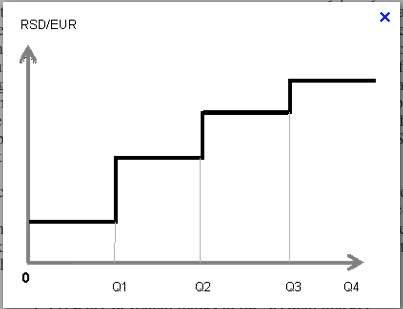

Between November 2011 and January 2012 mostly left-wing politicians and trade unions wanted the EUR/CHF floor to be risen to 1.30 or 1.40 and uttered their wishes regularly in the Swiss newspapers, triggering many FX traders to speculate on this hike. Recently these demands have become more silent even if some UBS analysts still see the floor to …

Read More »

Read More »