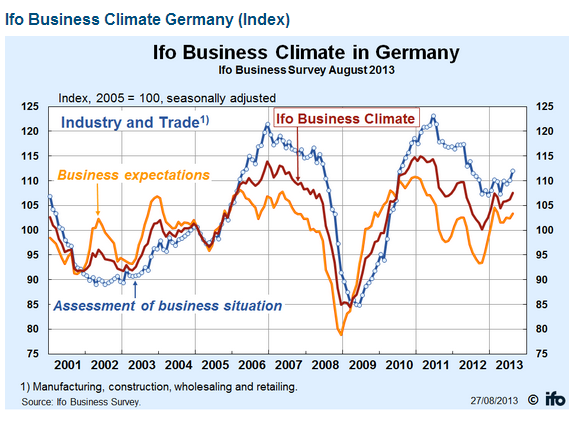

Tag Archive: Germany IFO Business Climate Index

The German Ifo Business Climate Index rates the current German business climate and measures expectations for the next six months. It is a composite index based on a survey of manufacturers, builders, wholesalers and retailers. The index is compiled by the Ifo Institute for Economic Research.

FX Daily, January 25: Dollar is on the Defensive Despite Firmer Rates

The US dollar is softer against nearly all the major currencies. Participants appear to be growing increasingly frustrated with emerging priorities of the new US Administration. They want to hear more details and discussion of the tax reform, deregulation, and infrastructure plans.

Read More »

Read More »

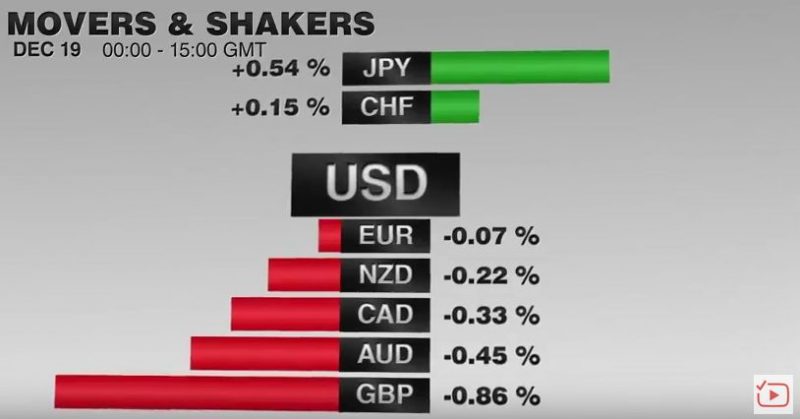

FX Daily, December 19: EUR/CHF Dives under 1.07

Once again a line in sand for the Swiss National Bank is broken. The EUR/CHF falls under 1.07. But trading algorithms are like this: When the EUR/USD is falling, then the EUR/CHF must follow. The SNB decided not to intervene any more at 1.07.

Read More »

Read More »

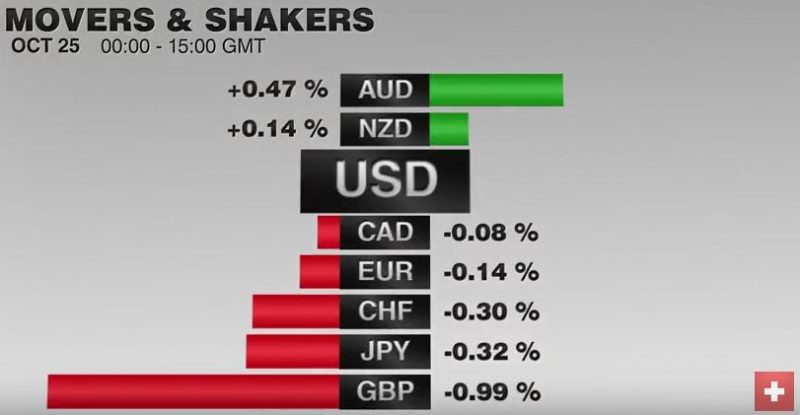

FX Daily, October 25: Germany IFO, Dollar Going Nowhere

The US dollar has been confined to extremely narrow ranges against the euro, yen, and sterling. To the extent that there is much action in the foreign exchange market, it is with the dollar-bloc and emerging market currencies.The Canadian dollar was whipsawed by comments from the Bank of Canada.

Read More »

Read More »

FX Daily, September 26: Dollar Mixed while Stocks Slide to Begin Last Week of Q3

The US dollar is narrowly mixed. The euro, yen and Swiss franc are higher, while the dollar-bloc and sterling are softer. The moving element here is not so much the greenback, which serving more as a fulcrum, but idiosyncratic, country-level developments.

Read More »

Read More »

FX Daily, August 25: Narrow Ranges Prevail as Breakouts Fail

The US dollar remains mostly within the ranges seen yesterday against the major currencies.The market awaits fresh trading incentives and the end of the summer lull, which is expected next week. The Jackson Hole Fed gathering at which Yellen speaks tomorrow is seen as the highlight of this quiet week.

Read More »

Read More »

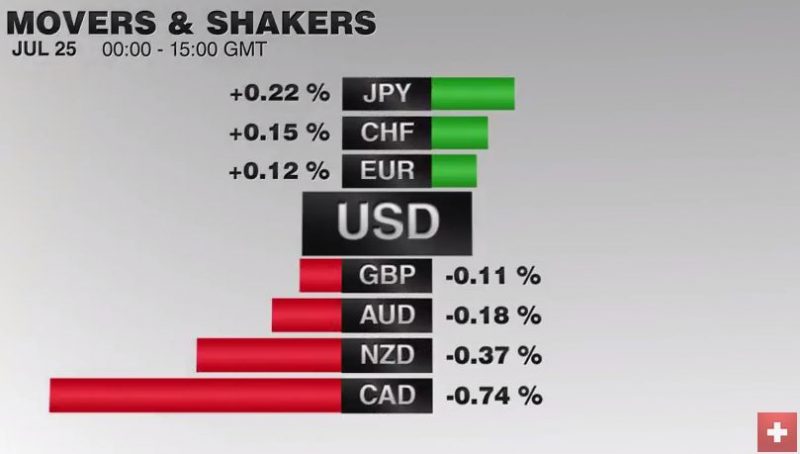

FX Daily, July 25: Big Week Begins Slowly

What promises to be a busy week has begun off slowly. The US dollar has been largely confined to its pre-weekend ranges against most of the major currencies. Equity markets are mostly firmer following the new record highs on Wall Street. The MSCI Asia Pacific Index eked out a small gain (0.1%), with losses in Japan, Taiwan, and Singapore offsetting gains elsewhere.

Read More »

Read More »

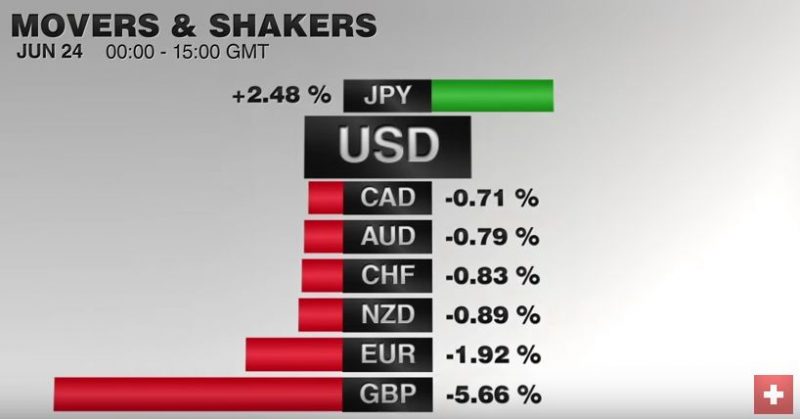

FX Daily, June 24: Brexit Sends Shock Waves, SNB Intervenes

The UK's decision to leave the EU spurred a dramatic risk-off move through the capital markets. The dollar, yen, and gold soared. Equities and emerging market assets sold off hard. The SNB had to intervene.

Read More »

Read More »

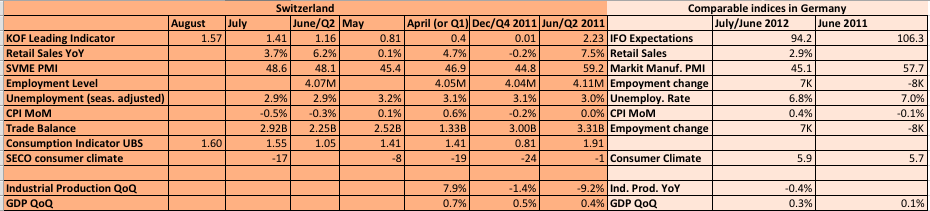

Fundamentals,FX,Gold and CHF:Week November 18 to November 22

Fundamentals with highest importance: The HSBC Flash Purchasing Manager Index (PMI) for China weakened from 50.8 to 50.4. In particular, new export orders, output prices and employment started to decrease again, while output increased. The preliminary Markit manufacturing PMI for the United States edged up to 54.3 (vs. 52.3 expected), a 9-month high after the …

Read More »

Read More »

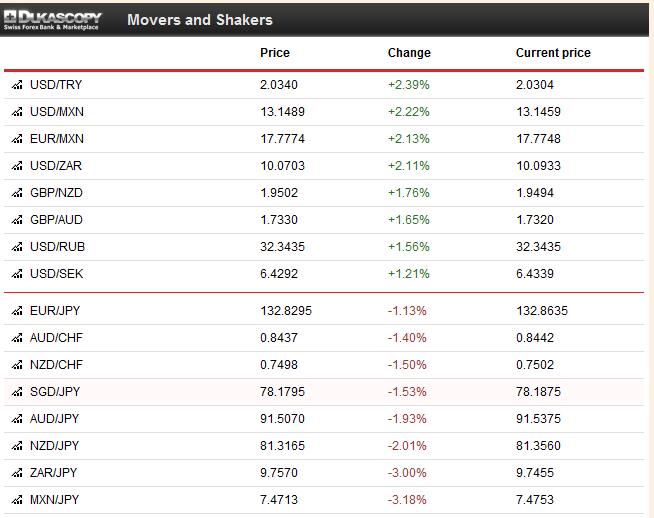

Fundamentals and FX Movements, Week September 23 to September 27

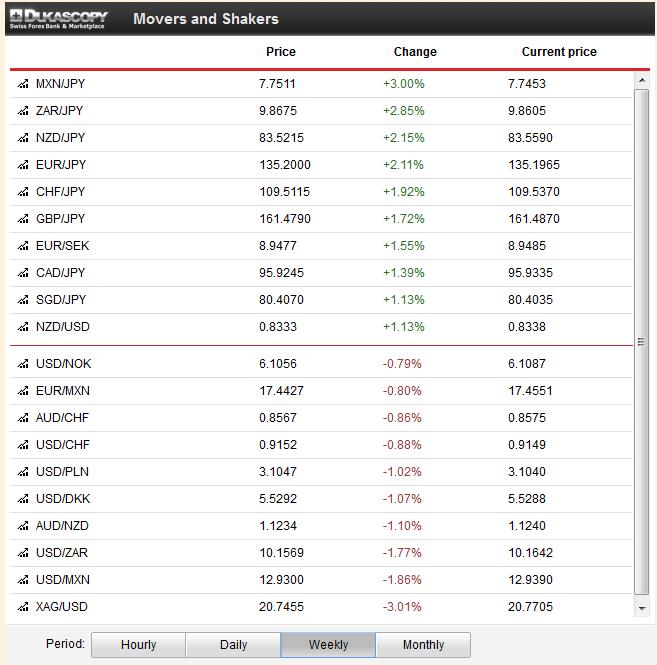

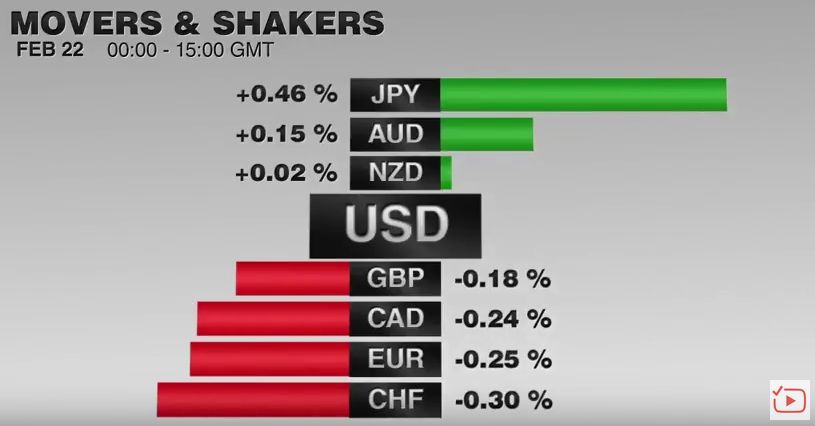

Weekly summary of fundamental news on FX with a focus on CHF and gold price movements. Weekly price movements The U.S. budget discussion and rather bad U.S. fundamental data made JPY and CHF the winners of the week. After weeks of improvements, the currencies of the Emerging Markets and carry trade currencies, like NZD, AUD …

Read More »

Read More »