Weekly summary of fundamental news on FX with a focus on CHF and gold price movements.

Weekly price movements

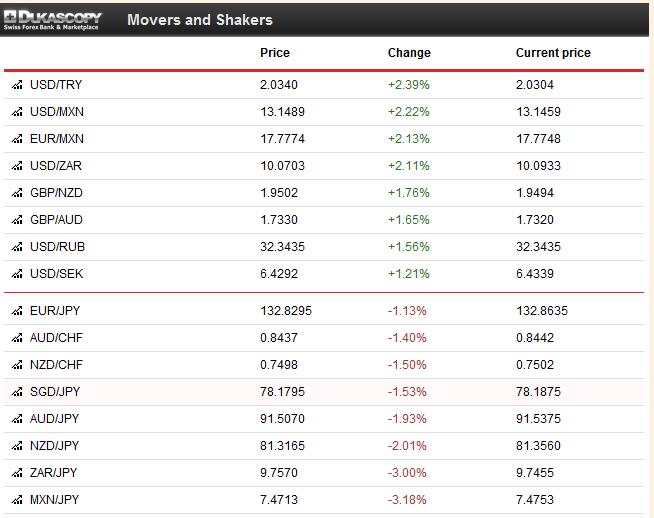

The U.S. budget discussion and rather bad U.S. fundamental data made JPY and CHF the winners of the week. After weeks of improvements, the currencies of the Emerging Markets and carry trade currencies, like NZD, AUD and NOK, depreciated again. One reason was that tapering fears persisted given that U.S. unemployment claims dropped to 2007 levels.

Friday, September 27

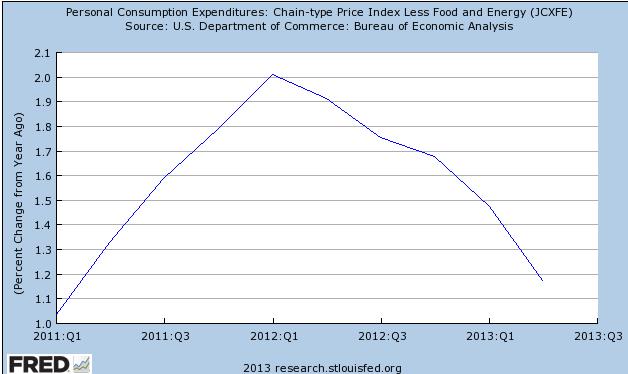

For a couple of months politics has not been able to influence currencies a lot: they moved with fundamental data. Today things were different: the potential government shutdown let the dollar fall against the safe-havens gold, CHF and JPY, most risk-on currencies depreciated. The good U.S. personal income reading of +0.4% MoM, the personal spending of +0.3% combined with very low U.S. inflation figures could not stop the fear. The preferred US Fed gauge “Core Personal Consumption Expenditures Deflator” was only 1.1% in Q2/2013, well below the Fed target. The continuing decline points to “never-ending” Quantitative Easing.

Rising Japanese inflation intensified the JPY strength, headline inflation is now +0.9%. Our interpretation is different: Japan is slowly reaching the end of its inflationary episode in terms of y/y price increases. We judge that by December 2013 the y/y CPI should fall to zero again. The yen has stopped falling, so fuel and energy price appreciation has slowed down. Prices for services are unchanged y/y and the CPI index ex. fresh food and energy is down -0.1% y/y for Japan in August and -0.3% for Tokyo in September.

Rising Japanese inflation intensified the JPY strength, headline inflation is now +0.9%. Our interpretation is different: Japan is slowly reaching the end of its inflationary episode in terms of y/y price increases. We judge that by December 2013 the y/y CPI should fall to zero again. The yen has stopped falling, so fuel and energy price appreciation has slowed down. Prices for services are unchanged y/y and the CPI index ex. fresh food and energy is down -0.1% y/y for Japan in August and -0.3% for Tokyo in September.

The BoJ is desperately calling for wage rises to stop a return to deflation. In Europe, however, politicians would be happy when unemployment comes down; while, European wage increases are slowing or even falling. Only in Germany is it different: despite a decline in the headline CPI to 1.4% caused by falling energy prices, Germany sees wage hikes and price increases for services of +1.6%.

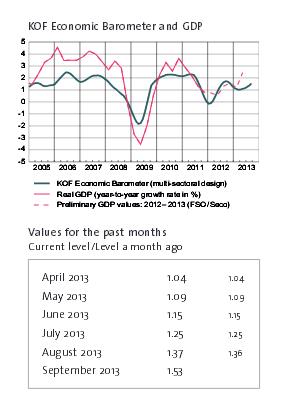

With rising fears, Gold inched up by 1% to 1336$. Due to the fear factor, silver could not follow gold and appreciated only slightly. USD/CHF inched down -0.5% to 0.9047. EUR/CHF -0.2% to 1.2253. The continuing improvement of the Swiss economy visible in the KOF index was not able to move the CHF, but it was rather the U.S. budget.

Thursday, September 26

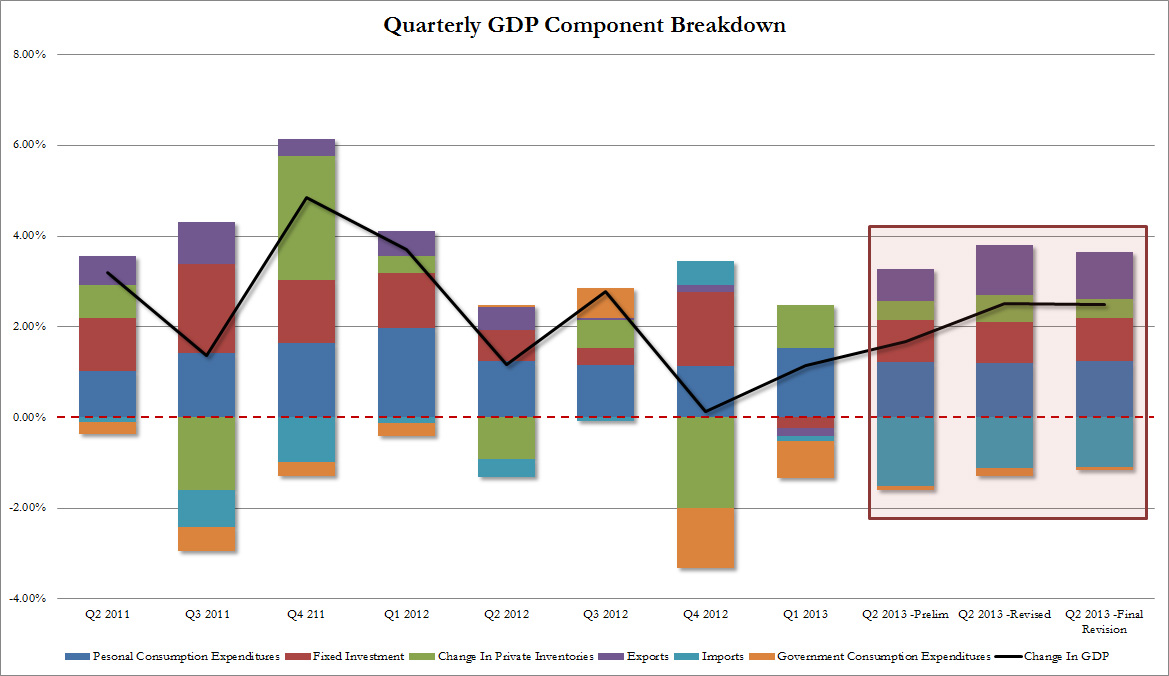

The major pieces of news were the “final” revision of U.S. Q2 GDP and the drop in U.S. unemployment claims to 305K, the lowest since 2007. With a 2.5% rise in GDP, growth was weaker than expected. The data showed that growth is driven mostly by investments and inventories, while U.S. personal consumption increases (+1.8%) are weaker than in Switzerland (+2.5%), for example.

click on graph to expand, source Zerohedge

Lower US unemployment figures drove some risk-on currencies lower, namely those that depend more on U.S. capital, e.g. BRL, MXN and AUD. With better U.S data, also gold (-0.9% to 1322$) and silver weakened. Potentially due to the broken 200 Day Moving Average the EUR/CHF did not appreciate despite rather good U.S. data, but fell 0.18% to 1.2278. USD/CHF went slightly up to 0.9106.

Wednesday, September 25:

The major news was that U.S. durable goods orders only slightly increased. The more significant Core Durable Goods Orders fell by -0.1% vs. +1.0% expected. As a consequence, gold (+0.91% to 1335$) and the safe-havens CHF and JPY but also the (“German safe-haven” related) euro appreciated. Commodity currencies got hit again: BRL fell the most, followed by MXN, NZD, NOK and AUD. EUR/USD is approaching new highs and – like always since 2008 – USD/CHF new lows (see why). On Wednesday EUR/CHF fell slightly to 1.2298 and USD/CHF more strongly to 0.9088 (-0.45%).

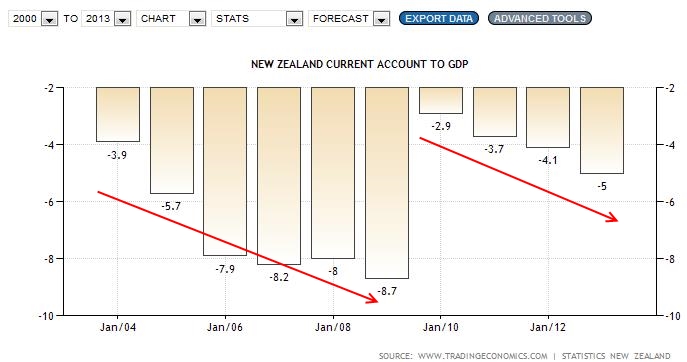

The bad New Zealand trade balance data was explained by the purchase and import of a drilling platform. Still – provided that Chinese growth remains relatively modest – it is fairly possible that the Kiwi might soon collapse, similar to 2008/2009. The NZD could finally join NOK, AUD and the currencies of the Emerging Markets in the continuing the collapse of the carry trade – especially because the NZ economy is not only driven by China but even more by demand from Australian that is weakening. New Zealand seems to be one of the last countries where consumers are spending – visible in rising imports – while the rest of world – not only Europe but also Emerging Markets and the U.S. – limit expenditures (see Paul Krugman). Fed tapering and the increasing NZ current account deficit could lead to the phenomenon that a carry trade must end in a currency collapse (see more).

Fed tapering and the increasing NZ current account deficit could lead to the phenomenon that a carry trade must end in a currency collapse (see more).

Tuesday, September 24:

The Richmond Fed Index dropped unexpectedly from 14 to zero (vs. 12 exp.). The board consumer confidence fell slightly, while the Case Shiller Index continued its strong performance: a 12.4% y/y price increase. The IFO business expectations from Germany improved to 104.2, the best reading for 17 months, but the current situation was weaker. With the mostly bad fundamental data commodities, especially oil prices, weakened once again while stocks remained positive for most of the day, but depreciated in late U.S. trading. Commodity currencies were hit, biggest losers were NZD, NOK and MXN. Thanks to bad U.S. news, gold contradicted the downtrend in commodities and was nearly unchanged. The rather good German data was not enough to let EUR and CHF rise. The dollar appreciated against CHF by 0.20% to 0.9126, while the euro was nearly unchanged vs. CHF.

Monday, September 23:

Merkel was the clear winner of the German elections, but she has no majority. Merkel has the habit of crushing her junior partners politically: the social democrats of the SPD have been weak since their coalition with Merkel in 2005, the liberal FDP since their coalition with Merkel in 2009. Hence, the potential coalition partners, the greens or the SPD might prefer to stay in the opposition or demand big political concessions from Merkel. Therefore, we judge that the Germans will not build a government very quickly; uncertainty may arise and affect markets. As for fundamentals, we observed a returning pattern from summer 2011: good Asian, mixed European and rather bad U.S. data. The Chinese HSBC Manufacturing PMI improved to 51.2 (from 50.1), European Services PMIs rose, but Manufacturing PMIs depreciated. Once again the U.S. Markit Manufacturing PMI strongly contradicted the recently strong ISM values: the Markit PMI value was at 52.8 vs. 54 expected. The US Chicago Fed activity index came in close to contraction. Driven by better Chinese data the whole Asian bloc appreciated: AUD led, then JPY, NOK, NZD, SGD, KRW and CHF. The euro inched down driven by Draghi’s comments that there might be a third Long Term Refinancing Operation. EUR/CHF recovered from an intra-day low of 1.2277 (under the 200-DMA) to 1.2294 (-0.17%), USD/CHF was unchanged around 0.9110. Due to the stronger dollar against EUR and the continuing technical downtrend, gold could not take profit from the better Chinese data as usual. The yellow metal depreciated by -0.53% to 1325$.

This post is an extract of our CHF and Gold News Bar on our home page or at this address.

It explains daily CHF and gold price movements based on the most important fundamental indicators in a few sentences. Keep in mind that the only Swiss fundamental data that is able to move the CHF must come from the SNB and from Swiss inflation data – from 1% y/y CPI the SNB should remove the CHF cap. The other data is global macro: mostly US and German data, some European and Chinese/Japanese news publications determine CHF behaviour. CHF is positively correlated to good data from Germany and to some extent China and Japan. Good data from the United States lets CHF fall against both USD and EUR; it is hence negatively correlated to good US news. As for EUR/CHF, the Swissie is negatively correlated to good Southern European and French data. Understand the terms “American bloc” and “Asian bloc” (read here). As for gold prices please understand the basis here. Remember also that the currency movement over months is a combination of the daily movements explained here.

Are you the author? Previous post See more for Next postTags: 200-day moving average,American bloc,Asian bloc,FX news,Germany IFO Business Climate Index,Gold,silver,Switzerland Trade Balance,U.S. Case Shiller Home Price Index (Macro),U.S. Core Durable Goods Orders (ZH)