Our weekly summary of fundamental news on FX that aims to explains price movements, with particular emphasis on the possibly biggest mysteries: the gold price (GLD) and the Swiss franc (FXF) .

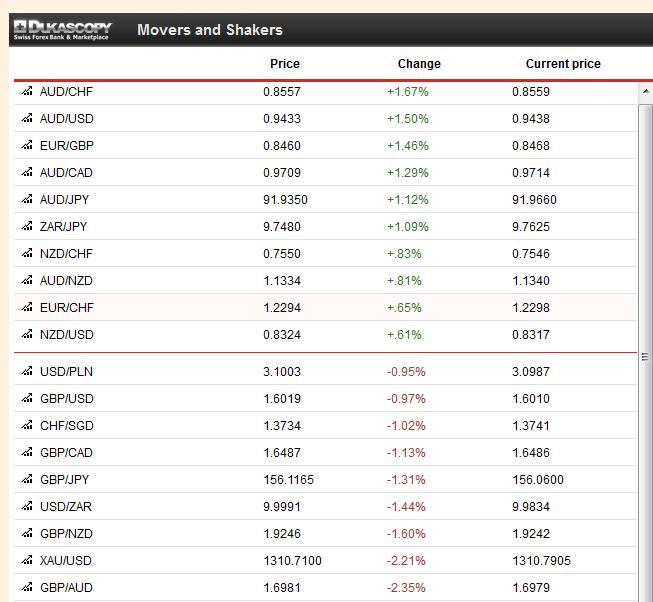

The clear winner of the week was the Aussie, supported by a positive PMI and positive news from the RBA. In the previous week, the U.S. government shutdown made the risk-off currencies CHF and JPY the winners, this development was partially reversed this week. The biggest weekly loser, however, was Sterling.

Friday, October 4

Due to the government shutdown the Non-Farm Payrolls report has been cancelled. The major news was that US House Speaker, the Republican Boehner, is determined to avoid a U.S. default and that Republicans are supposed to allow furloughed government workers to receive their pay (see the Senate decision on Saturday). The greenback, stocks and the risk-on currencies AUD, NZD and MXN inched up. In absence of further BoJ easing measures the yen depreciated only 0.2% despite rising stock markets. The strong improvements of European currencies during this week was partially reversed: SEK fell the most, followed by GBP, CHF, and the euro. Gold was negatively affected by the positive news on the shutdown, but rising copper and oil prices supported the yellow metal. It lost 0.5% to 1310$; while, silver moved upwards together with other commodities. USD/CHF appreciated +0.88% to 0.9072, EUR/CHF +0.39% to 1.2296.

Thursday, October 3

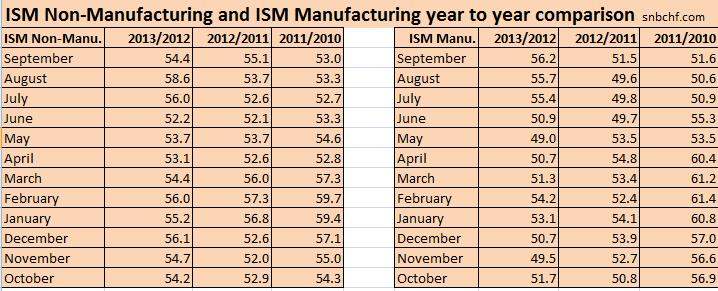

For us, the U.S. Non-Manufacturing ISM index is the most important and leading global economic indicator because it reflects the state of a big part of the U.S. economy and the U.S. consumer, the main driver of global demand. The index came in short of expectations, 54.4, far weaker than the 57.4 expected. Since it is still on similar levels as in 2011 and 2012, it can be expected that GDP growth for 2013 won’t be higher than in 2011 or 2012.

On the other side, U.S. manufacturing has recovered: major reasons are the relatively low oil prices and the falling competition from Emerging Markets due to quickly rising wages.

A recovery of manufacturing together with weak oil prices would imply a reduction of the U.S. trade deficit and it would exercise further downwards pressure on gold. At 55.4, the Chinese Non-Manufacturing PMI was stronger than the previous reading at 53.9. European retail sales came in better than expected, but a look on the details shows the massive contraction compared to last year in Greece, Cyprus or Spain (between -6% and -14%), the continuing Germans reluctance to spend (+0.4% y/y) and the French resistance to austerity (+1.7% y/y). The Italian Services PMI managed to be close to the German Services PMI (52.7 vs. 53.7). If the PMIs for the rest of the eurozone are able to overtake the German one, then this might imply a rising EUR/CHF. The PMIs usually reflect y/y GDP growth (see below). However, given that Italy was in a big economic trough, it is far easier for them to grow than for Germany that has had stronger GDP growth for years.

With better European and Chinese news and weaker U.S. data, “anti-dollar currencies” or safe-havens like AUD, NOK, SEK, JPY and CHF appreciated. USD/CHF fell slightly under the 0.90 support (-0.33%) and EUR/CHF to 1.2246 (-0.11%). Gold was nearly unchanged at 1315$.

Wednesday, October 2

The only really market-moving piece of fundamental news was the release of the ADP unemployment report. The increase of 166K jobs came short of the expected 180K. Therefore, traders could concentrate again on the U.S. government shutdown that seems to take longer than they initially expected. Stocks fell and consequently the funding currency JPY was up – potentially helped by the increase of the Japanese sales tax. After the Italian confidence vote for prime minister Letta, the euro was a second winner. As usual, the ECB’s monthly meeting supported the euro. And as usual, but also bizarrely – the ECB-internal discussion about lowering interest rates helped the common currency to appreciate. The euro moved up against the dollar, but also against both the European safe-haven CHF and the European risk-on currencies NOK and SEK. The greenback was broadly lower, because the market thought that the shutdown will prolong the Fed’s monetary easing. The pound fell because GDP growth will be limited due to the continuing British balance sheet recession and the desire of Brits to pay down mortgage debt. Thanks to bad fundamental data from the U.S. and the expectation of a longer period of QE, gold jumped over the 1300$ support again and appreciated 2% to 1315$. As usual gold traders focused on monetary policy and ignored that the government shutdown will help to reduce U.S. debt. The rising gold price is, to a certain extent, also a reflection of rising U.S. debt and should actually decrease when debt gets limited. EUR/CHF was slightly up to 1.2260 and USD/CHF fell by 0.5% to 0.9020.

Tuesday, October 1

Once again China delivered a weak PMI reading. The official Manufacturing PMI arrived at 51.0 vs. 51.5 expected, PMIs of other Emerging Markets like Brazil, Russia and India were even in contraction to this area. The European Manufacturing PMI was unchanged at 51.1 against the provisional reading and slightly down vs. August. The ISM Manufacturing index, however, was strong again (56.5 vs. 55.0 expected). But it contradicted the relatively weak Markit Manufacturing PMI of 52.8, the recently not very convincing Non-Farm Payrolls and the local manufacturing readings from the New York Fed and the Richmond Fed. Still the slowing orders and exports components compared with the rising ISM price index did not convince markets of U.S. industrial strength. Despite continuing Fed support, the American standard Crude Oil fell to 101.62$, nearly 8 dollars away from the highs seen in July. Japanese average cash earnings of -0.6% y/y proved our impression that the Japanese inflation rate (recently +0.9%) will fall again to zero. For months, lower inflation and low wage increases contributed to better European PMI readings and higher company margins.

Many currencies were driven by positive news from their local PMI readings (e.g. SEK and AUD), from their central banks (e.g. AUD) or lower wage increases combined with a good Tankan reading for JPY. Currencies that depend on U.S. funding, like BRL or MXN depreciated. Gold, however, was slaughtered by the reappearance of a divergence between good U.S. and bad Chinese data. Consequently, the yellow metal inched down by 3% to 1288$ and broke major support levels around 1300$. With better U.S data, both EUR and USD rose slightly against CHF. As usually Swiss data did not move the franc: The strong SVME PMI of 55.3 could not move the franc upwards. Potentially CHF was depressed by the rising German unemployment rate (6.9% vs. 6.8% expected). Germany was finally affected by slow global growth.

Monday, September 30

The Chinese HSBC Manufacturing PMI came in weaker at 50.2 vs. 51.2 expected, while the Chicago PMI was strong with 55.7 (vs. 54.0 expected). The provisional September reading showed a record-low inflation level for the Eurozone of 1.1%, helped by low energy prices compared to one year ago, when Draghi and Bernanke had fueled oil prices. One year ago Europe exhibited stagflationary tendencies. This has changed completely now. Italian producer prices, for example, are down 2% y/y, labor costs and wages in the euro zone are rising at the slowest pace since the euro introduction, last years efforts of ECB and European leaders to slash labor costs in the periphery has started to be successful.

source Eurostat

With weak Chinese data and good U.S. news, gold depreciated to 1328$ (-0.61%). Despite better American fundamental data, CHF could appreciate; reasons were the US government shutdown and the withdrawal of Berlusconi ministers from the Italian coalition. On the other hand, weak European inflation lowers the possibility of a carry trade EUR vs. CHF and the chances of a rising EUR/CHF. With appreciating stocks most risk-on currencies were up against the dollar. One exception was NOK where the central bank is exercising financial repression: 1.5% key rate versus 3.2% inflation. NOK depreciated once again compared to the “low inflation Euro”. USD/CHF fell 0.23% to 0.9040, EUR/CHF 0.2% to 1.2230.

Remark:

This post is an extract of daily posts on our CHF and Gold News Bar on our home page or at this address.

It explains daily CHF and gold price movements based on the most important fundamental indicators in a few sentences. Keep in mind that the only Swiss fundamental data that is able to move the CHF must come from the SNB and from Swiss inflation data – from 1% y/y CPI the SNB should remove the CHF cap. The other data is global macro: mostly US and German data, some European and Chinese/Japanese news publications determine CHF behaviour. CHF is positively correlated to good data from Germany and to some extent China and Japan. Good data from the United States lets CHF fall against both USD and EUR; it is hence negatively correlated to good US news. As for EUR/CHF, the Swissie is negatively correlated to good Southern European and French data. Understand the terms “American bloc” and “Asian bloc” (read here). As for gold prices please understand the basis here. Remember also that the currency movement over months is a combination of the daily movements explained here.

Are you the author? Previous post See more for Next postTags: American bloc,Asian bloc,FX news,Germany Unemployment Rate,Gold,Italy Services PMI,silver,U.S. Chicago PMI,U.S. Nonfarm Payrolls