Tag Archive: gbp-chf

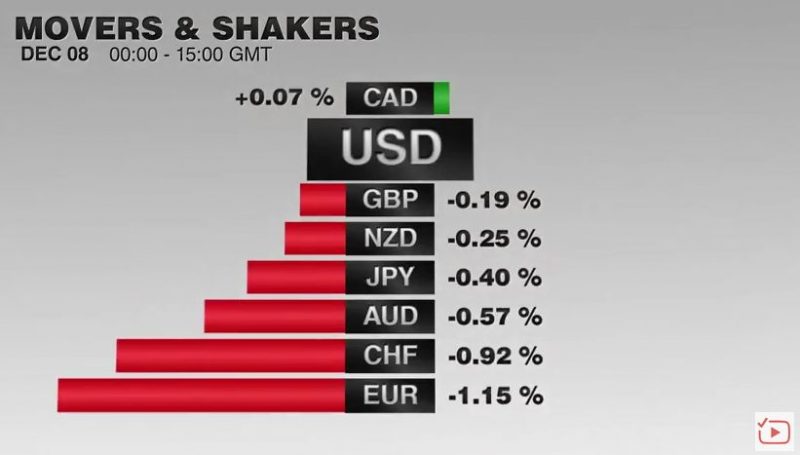

FX Daily, December 08: Dollar Heavy into ECB

The ECB prolonged its bond purchases, which came unexpected for markets. Consequently the EUR/CHF lost nearly half of its big gains that it registered in the beginning of the week. The ECB expects lower inflation for longer, which makes the life for the SNB harder for longer.

Read More »

Read More »

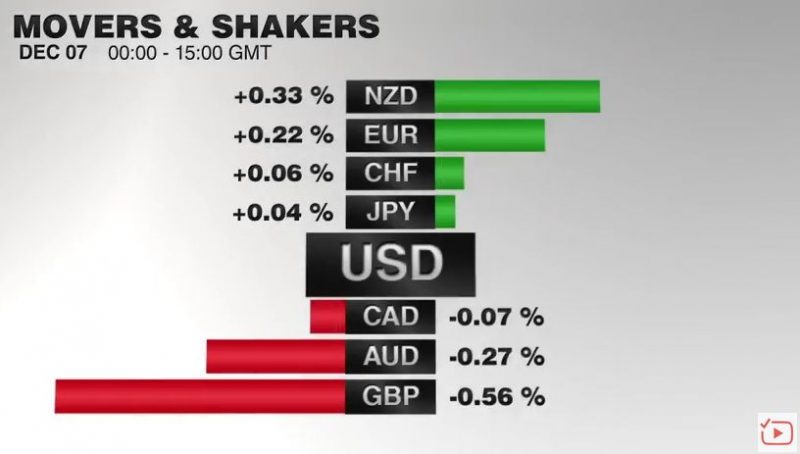

FX Daily, December 07: Greenback is Broadly Steady While Sterling Slides

The US dollar is little changed against most of the major currencies. Sterling is the notable exception, losing about 0.75% to trade at three-day lows. It was on the defensive in early European turnover but got the run pulled from beneath by the unexpectedly poor data. UK industrial output fell by 1.3% in October. The median forecast was for a small increase.

Read More »

Read More »

FX Daily, December 01: Dollar is on the Defensive, though Yields Rise

The US dollar is trading heavily against most of the major currencies, but the general tone appears consolidative in nature. Despite a disappointing UK manufacturing PMI (53.4, a four-month low), sterling is near a three-week high above $1.2600.

Read More »

Read More »

Brexit Minister Sends Sterling Higher

UK could pay for single market access. UK's position still seems fluid. The Supreme Court will hear the government's appeal next week.

Read More »

Read More »

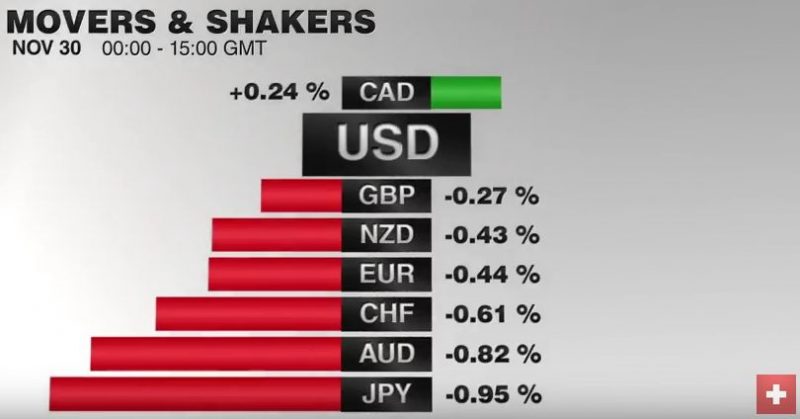

FX Daily, November 30: Renewed OPEC Hopes and Month End Featured

Rates for buying Swiss Francs dollars remain incredibly subdued post Brexit but there has been a general improvement over the last month. Rates for the moment appear to have found support over 1.24 for GBP CHF and this has largely come about following the Trump US presidential election victory. Despite a leaked government document titled Have cake and eat it, the markets and sterling were largely unphased.

Read More »

Read More »

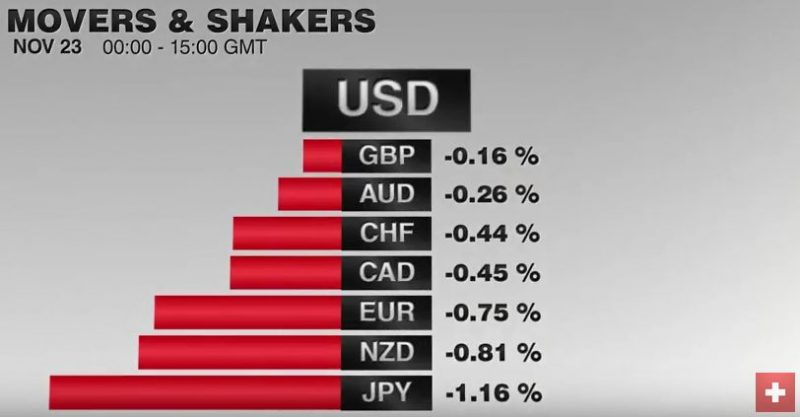

FX Daily, November 23: Dollar Sees Flat Consolidation while the Equity Advance Fizzles in Europe

The US dollar is trading inside yesterday's ranges against the euro and yen. The dollar's tone matches the consolidation in the debt market ahead of today's slew of US data and tomorrow's holiday. Tokyo markets were on holiday.

Read More »

Read More »

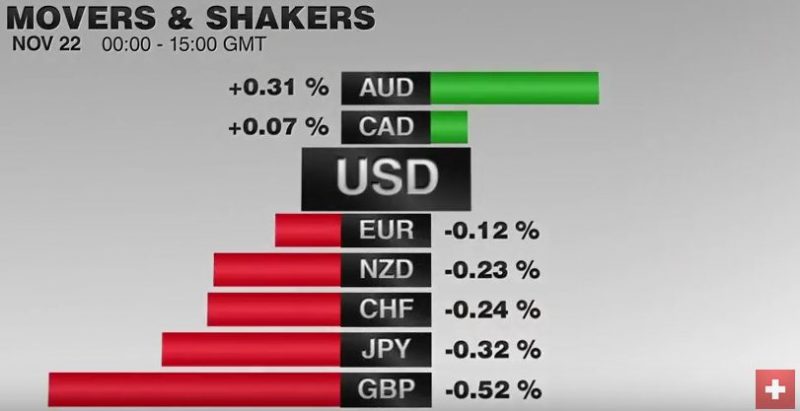

FX Daily, November 22: Bonds and Stocks Rally, Leaving Greenback to Meander

The US dollar entered a consolidative phase yesterday, and this carried into today's activity.While the foreign exchange market is sidelined as the two-week trend slows, the stocks and bonds are posting strong gains today. Equities are being led by energy and materials, as oil and industrial metals continue to advance. Bond are recovering from their recent slide.

Read More »

Read More »

FX Daily, November 17: Consolidation Gives Dollar Heavier Tone

The US dollar is trading with a heavier bias today as its recent run is consolidated. The euro is trying to snap the eight-day slide that brought it to nearly $1.0665 yesterday, the lows for the year. It is almost as if participant saw the proximity of last year's lows ($1.0460-$1.0525) and decided to pause, perhaps to wait for additional developments, such a Fed Chief's Yellen's testimony before the Joint Economic Committee of Congress.

Read More »

Read More »

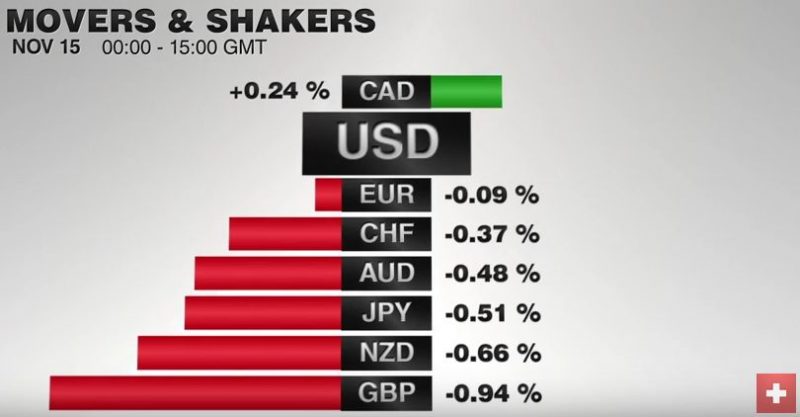

FX Daily, November 15: Investors Catch Breath, Markets Consolidate

After a dramatic run since the US election, the capital markets are consolidating today. It is a bit too restrained to such a Turn Around Tuesday is unfolding. The euro is struggling to sustain corrective upticks through $1.08, and after a pullback is, the greenback pushed back above the JPY108 level like a beach ball held under water.

Read More »

Read More »

FX Daily, November 10: US Dollar, Equities, and Commodities Firmer as Reflation Trade Takes Hold

GBP/CHF rates spiked by almost two cents during Wednesday’s trading, providing those clients holding Sterling with some of the best rates they’ve seen in the past few weeks. This move came following confirmation that Donald Trump had won the race for the White House, news which sent shockwaves through the market. How the outcome will affect the global markets is difficult to analyse at this point but could yesterday’s positive spike indicate better...

Read More »

Read More »

FX Daily, November 03: Political Angst Drives Markets

GBP/CHF rates are trading below 1.20 on the exchange, providing those clients holding CHF with some of the best rates they’ve seen in the past six years. The Pounds woes have been well documented but with a key day of economic data releases ahead, is it all about to change?

Read More »

Read More »

FX Daily, November 02: Standpat FOMC Trumped by US Political Jitters

The single biggest driver in the capital markets is the continued narrowing of the US election polls. The prospect of a Trump presidency and the dramatic changes that could entail is rattling investors and spurring position squaring.The dollar is broadly lower as are stocks. The surge in global yields has been arrested.

Read More »

Read More »

FX Daily, November 01: Dollar and Yen Slip in Quiet even if Eventful Turnover

The US dollar is posting minor losses against most of the major currencies today.The Japanese yen is the exception, as the greenback continues to straddle JPY105. There have been several developments today, and the US also has a full economic calendar today. The most important of the developments was the upbeat message from the Reserve Bank of Australia.

Read More »

Read More »

FX Daily, October 28: Dollar Sidelined, Krona Stabilizes, Rates Firm

The main development here in the last full week of October is the sharp rise in bond yields. US 10-year yields rose nine bp this week coming into today's session, which features the first look at Q3 GDP. The two-year yield is up four bp. European 10-year benchmark yields mostly rose 11-17 bp. UK Gilts were are the upper end of that range. Two-year yields are 3-5 bp higher.

Read More »

Read More »

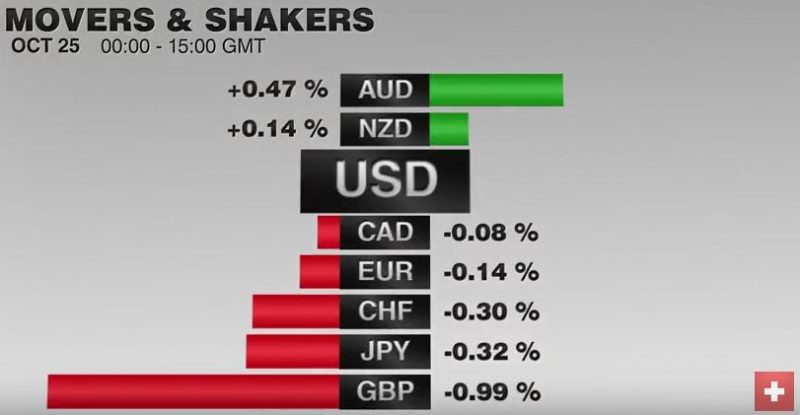

FX Daily, October 25: Germany IFO, Dollar Going Nowhere

The US dollar has been confined to extremely narrow ranges against the euro, yen, and sterling. To the extent that there is much action in the foreign exchange market, it is with the dollar-bloc and emerging market currencies.The Canadian dollar was whipsawed by comments from the Bank of Canada.

Read More »

Read More »

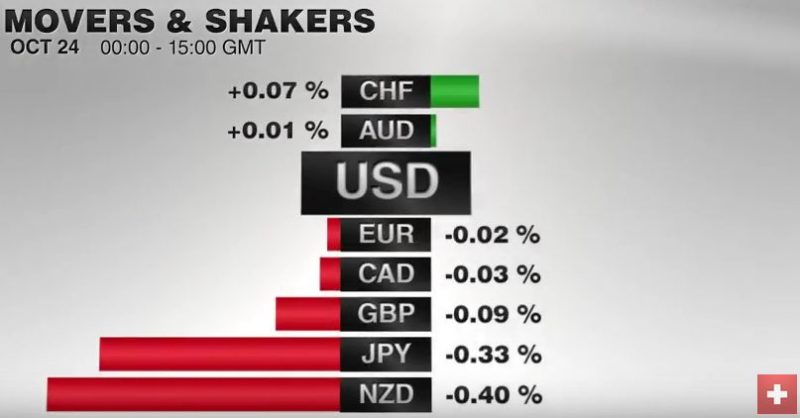

FX Daily, October 24: Dollar Begins Mostly Slightly Lower, and Risk is On to Start the Week

Sterling vs the Swiss Franc has remained close to its lowest level in history caused by the aftermath of the Brexit vote back in June and more recently the announcement that Article 50 will be triggered by March 2017. Confidence in Sterling exchange rates has plummeted recently and until we get some form of assurances as to how the talks may go with the European Union we could see Sterling fall even further against the Swiss Franc than its current...

Read More »

Read More »

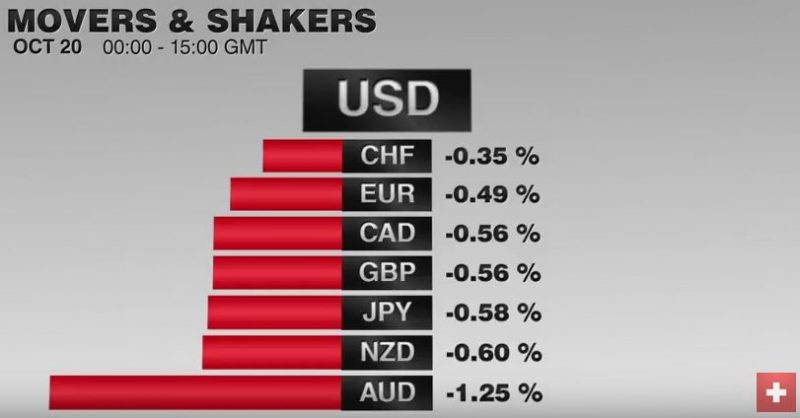

FX Daily, October 20: ECB Unlikely to Shake Dollar’s Slumber

GBP/CHF rates have fallen dramatically over the past month, as Sterling continues to find itself under pressure against the major currencies. However, despite these losses it is not all doom and gloom for those clients holding GBP, as Tuesday’s positive spike for the Pound proved. Currency does not move in a straight line and therefore we will see opportunities for those clients holding GBP to take advantage of, even if a sustainable Sterling...

Read More »

Read More »

FX Daily, October 19: FX After China GDP

The Swiss Franc has strengthened against the pound as global uncertainty persists in the form of the UK’s Brexit vote and the US Presidential Election. Looking ahead it seems the CHF may soften a little as we learn of the new President, I found it very interesting that yesterday Paddy Power paid out on any bets for Hilary Clinton to become President in the United States.

Read More »

Read More »

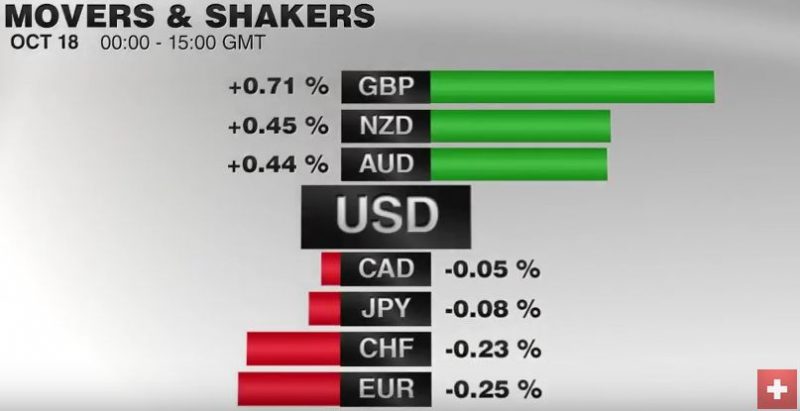

FX Daily, October 18: Dollar Slips Broadly but not Deeply

According to Bank of England deputy governor Ben Broadbent the drop in the value of Sterling has helped to stop the UK economy from falling further since the shock of the Brexit vote. He went on to say ‘in the shape of the referendum, we’ve had exactly one of those shocks’ and added that the Bank of England would not interfere with monetary policy to boost the Pound’s value.

Read More »

Read More »