Swiss FrancThe Swiss Franc has strengthened against the pound as global uncertainty persists in the form of the UK’s Brexit vote and the US Presidential Election. Looking ahead it seems the CHF may soften a little as we learn of the new President, I found it very interesting that yesterday Paddy Power paid out on any bets for Hilary Clinton to become President in the United States. This is a great indication of the US Election result and since the CHF generally is seen as a safe haven currency used by investors to hedge against uncertainty elsewhere, it could see the CHF loosen a little. |

EUR/CHF - Euro Swiss Franc, October 19 2016(see more posts on EUR/CHF, ) |

| The pound has been a big driver on GBP/CHF rates as the fear and worry over the UK’s Brexit vote weighs on the performance of sterling. The vote represents an unknown and generally speaking investors do not like the unknown! It hampers business and consumer investment and spending. If business and consumers are fearful over the future they are less likely to spend the money which drives the economy and provides growth.

If you are looking to move any currency in the future the pound does seem to have bottomed out for the time being but there is plenty ahead to rock the boat. The rates could easily slip lower and if you need to buy CHF I would be very cautious about the future on GBP/CHF exchange rates. We have the latest news on the UK Unemployment data at 09.30 am today before tomorrow is the latest European Central Bank Interest Rate decision in the Eurozone. |

GBP/CHF - British Pound Swiss Franc, October 19 2016(see more posts on GBP/CHF, ) |

Federal ReserveThe US dollar has slipped lower against the major currencies and is mixed against the emerging market currencies. Still, the consolidative tone seen since the start of the week has continued. There seems to be a technical component here, but after a big push higher, US rates have also eased. News yesterday that nine of the 12 regional Federal Reserve banks called for a discount rate hike last month. The regional Federal Reserve branches make an non-binding recommendation to the Board of Governors. The Atlanta Fed became the news convert to the cause. This is the highest number requesting that the discount rate be lifted from 1.0% to 1.25% since last December. The Board obviously did not acquiesce, however, it is indicative of the mood. |

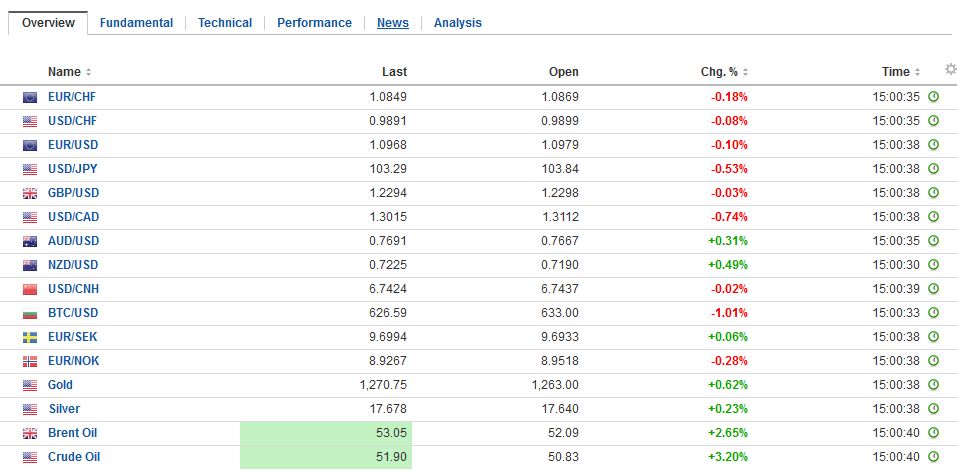

FX Performance, October 19 2016 Movers and Shakers . Source: Dukascopy - Click to enlarge |

| The three regional Fed branches that did go with the majority are interesting in their own right. NY, which is understandable in our framework that sees Dudley as part of the core Fed leadership that drives policy. Chicago is not much of a surprise. Evans is among the leading doves. The Minneapolis Fed may be the most surprising, but Kashkari has taken a dovish line. |

FX Daily Rates, October 19 (GMT 15:00) |

Recall that the September dot plots showed three officials thinking that a rate hike this year would not be appropriate. At the time, many, including ourselves, suspected Governors Brainard and/or Tarullo were among those outliers. It appeared that Yellen had to chose between dissents from the Governors if the Fed hiked or dissents from regional Fed presidents if it stood pat. However, with the discount rate minutes, there are other scenarios that ought to be considered, and in any event, will likely prevent the odds of a December hike unwind too far ahead of the jobs data early next month.

EurozoneNews that Monte dei Paschi will likely get its board approval next week for its capital raising and sale of a portfolio of bad loans is helping to lift Italian bank shares today, and extending the rally into the fourth sessions. Deutsche Bank shares are trading slightly lower, though still on pace to record its third weekly gain. Overall though European financials are underperforming the market today. |

FX Performance, October 19 |

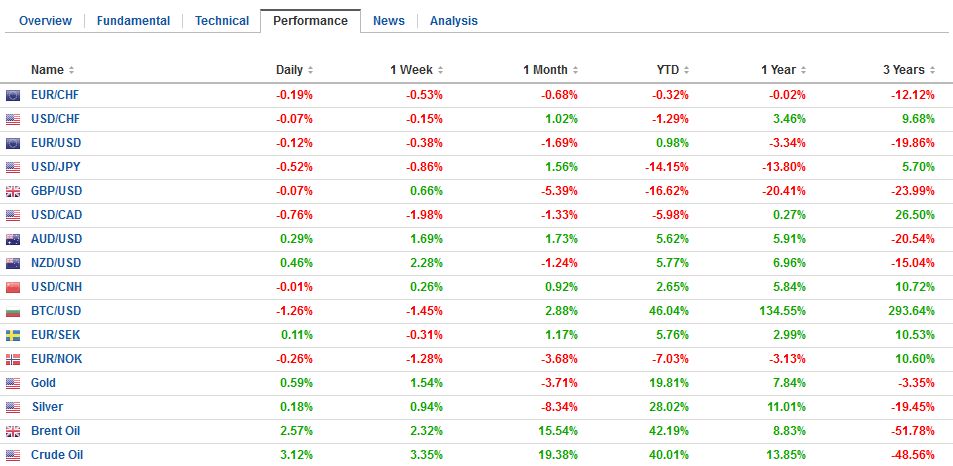

ChinaThere have been two economic reports that investors are digesting now. First came from China. The world’s second largest economy expanded by 1.8% in Q3 for a 6.7% year-over-year pace.

|

China Gross Domestic Product (GDP) YoY, July - September 2016(see more posts on China Gross Domestic Product, ) . Source: Investing.com - Click to enlarge |

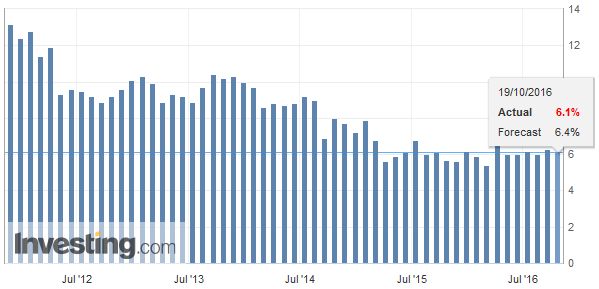

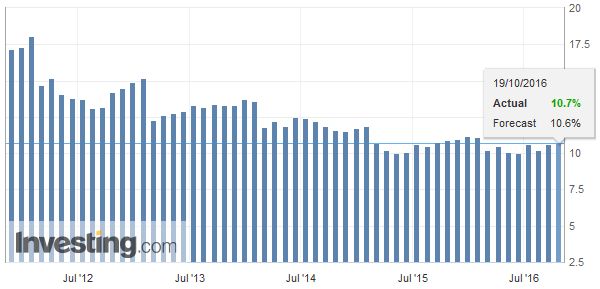

| It is spot on expectations and is the third quarter at this reported pace. The GDP estimate sapped the interest from the September industrial output (6.1% vs 6.3% in August) and retail sales (10.7% vs 10.6% in August). |

China Industrial Production YoY, September 2016(see more posts on China Industrial Production, ) . Source: Investing.com - Click to enlarge |

| Perhaps the real takeaway from both the Chinese data and the fact that the dollar is holding above what was previously believed to have been the dollar’s cap (~CNY6.7) is that there is not a takeaway. In August 2015 and again at the start of this year, the global capital markets appeared to be driven by events in China. This has ceased to be the case. It is not the focus or linkages cannot be reestablished, but rather it is to appreciate that events in Beijing are not among the key drivers now. |

China Retail Sales YoY, September 2016(see more posts on China Retail Sales, ) . Source: Investing.com - Click to enlarge |

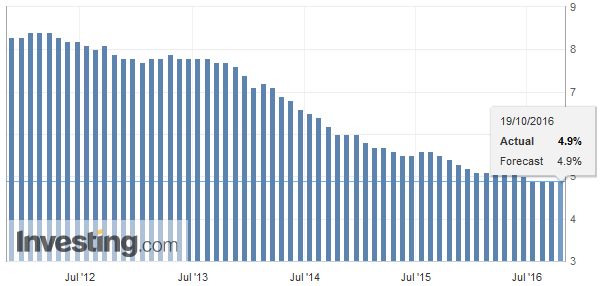

United KingdomThe second economic report was UK employment. It was unremarkable and not significant, though for the record, the claimant count edged seven hundred higher, a little more than a quarter of what economists expected. The ILO unemployment rate was flat at 4.9%, an 11-year low.

|

U.K. Unemployment Rate, September 2016(see more posts on U.K. Unemployment Rate, ) . Source: Investing.com - Click to enlarge |

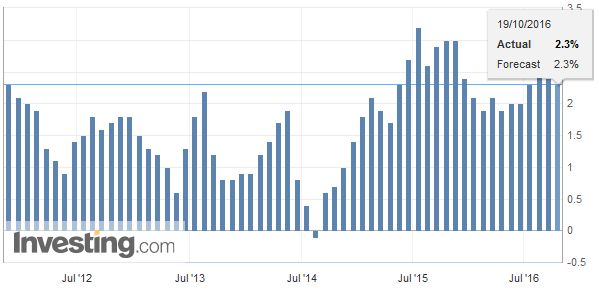

| Overall earnings growth slowed slightly to 2.3% from a revised 2.4%, though excluding bonuses, the 2.3% pace was a tad higher than 2.2% previously. With inflation rising, as the CPI showed yesterday, real earnings are softening and will continue to do so. Over time, this will likely soften household demand. |

U.K. Average Earnings Index +Bonus, September 2016(see more posts on U.K. Average Earnings, ) . Source: Investing.com - Click to enlarge |

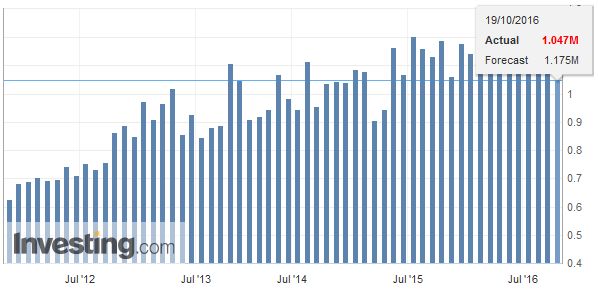

United StatesThe North American session features the Bank of Canada meeting, US housing starts and the Fed’s Beige Book (ahead of the early November FOMC meeting). The Bank of Canada is not expected to change policy, but downward revisions in its economic forecasts and pushing further out when the output gap is projected to close will likely give a dovish cast to the stand pat policy. The market appears to be pricing in steady policy next year. Bloomberg’s calculation puts the odds of a November Fed hike at 17.1% and December at 53.2%. Like our interpolation, the CME estimates the odds at 8.3% for November and 60% for December. Neither the housing starts nor the Beige Book will likely change this materially. |

U.S. Housing Starts, September 2016(see more posts on U.S. Housing Starts, ) . Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,China,China Gross Domestic Product,China Industrial Production,China Retail Sales,EUR/CHF,Federal Reserve,FX Daily,gbp-chf,newslettersent,U.K. Average Earnings,U.K. Unemployment Rate,U.S. Housing Starts