Swiss Franc and Sterling (Tom Holian)According to Bank of England deputy governor Ben Broadbent the drop in the value of Sterling has helped to stop the UK economy from falling further since the shock of the Brexit vote. He went on to say ‘in the shape of the referendum, we’ve had exactly one of those shocks’ and added that the Bank of England would not interfere with monetary policy to boost the Pound’s value. This was similar to Bank of England governor Mark Carney’s comments made last week and it appears as though the central bank is not too fussed about the drop in the value of the Pound. The Bank of England even considering cutting interest rates from their current historic low of 0.25% at next month’s meeting in order to keep the economy strong. |

|

| GBPCHF exchange rates have dropped by as much as 5% since the start of the month in the wake of the announcement that the UK will trigger Article 50 by March 2017.

Clearly a low Pound is not in the interests of the UK economy in the long term especially against the US Dollar as we import so much from overseas. As we saw recently with the stand off between Tesco and Unilever it seems to me that it’s a matter of time before the cost of an average basket of goods goes up for the British consumer. |

GBP/CHF Overview, October 18 2016(see more posts on GBP/CHF, ) |

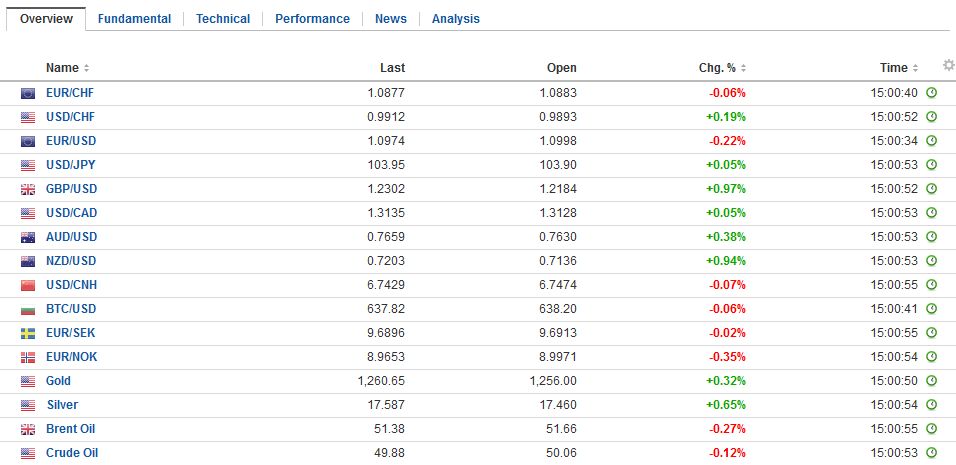

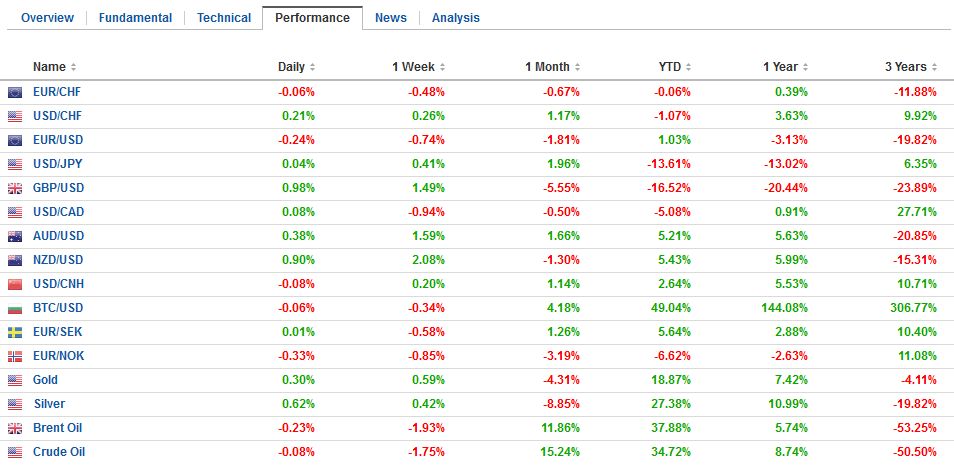

FX RatesThe US dollar’s upside momentum eased yesterday in North America, and follow-through selling was seen in Asia and the European morning. The dollar is lower against nearly all the major and emerging market currencies. The yen is the chief exception, and only barely, as the greenback straddles the JPY104 area. |

FX Performance, October 18 2016 Movers and Shakers . Source: Dukascopy - Click to enlarge |

| It is tempting to attribute this disappointment to the dollar’s pullback, but such logic needs a middle term, and that is changed expectations of Fed policy. That is the missing link, so far. Net-net, and with little volatility, the December Fed funds futures contract is unchanged since October 4, and implies a slightly higher chance of a hike than at the end of September. Still, US yields have softened somewhat. The two-year note yield is seven basis points off last week’s high. The 10-year yield is five basis points below yesterday’s four-month high. |

FX Daily Rates, October 18 (GMT 15:00) |

| Sterling was posting corrective upticks before news that prices rose more than expected in September. Sterling made a marginal new high near $1.2275, but progress quickly stalled. Comments from the UK government attorney (Eadie) that seemed to recognize parliament’s right to ratify the Brexit Treaty was understood by the market as making a hard exit marginally less gave a fresh boost to sterling that made new highs on near midday in London. |

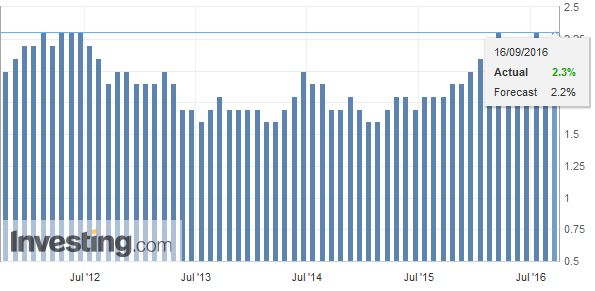

FX Performance, October 18 |

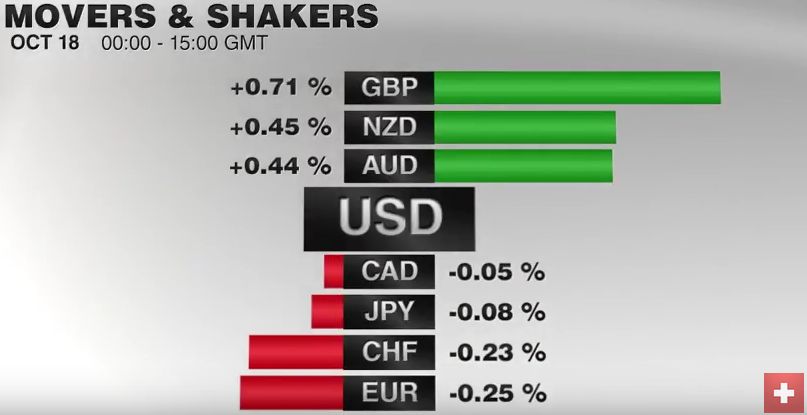

New ZealandThe Australian and New Zealand dollars are leading the move against the US dollar today (up to ~0.7% and 0.8% respectively). The driving force is not Fed expectations, but a greater sense that the RBA is in no hurry to cut interest rates and that an RBNZ rate cut next month is near a done deal that had been discounted. The Aussie is having another run at its nemesis near $0.7700 that has blocked the upside over for several months. Slightly stronger than expected CPI helped the Kiwi has come up to test the 20-day moving average (~$0.7200) and a retracement objective of the nearly five-cent decline since early-September ($0.7210). A break could spur a move toward $0.7260-$0.7300. Consumer prices rose 0.2% in Q3. The median guesstimate was flat after a 0.4% rise in Q2. The year-over-year rate also stands at 0.2%. It was expected to ease to 0.1%. Kiwi is sitting just below its highs ahead of the dairy auction. |

New Zealand Consumer Price Index (CPI) YoY, July - September 2016 . Source: Investing.com - Click to enlarge |

United StatesLast week’s US retail sales and yesterday’s industrial output figures are disappointed. What looked to be such a promising quarter in terms of growth appears to have fizzled, and economists are no longer confident that the three-quarter streak of sub-2% GDP prints will be snapped.

|

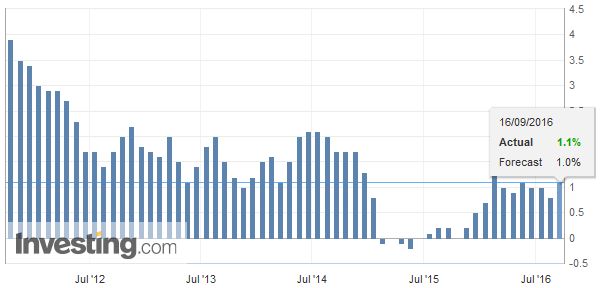

U.S. Core Consumer Price Index (CPI) YoY, Septeber 2016(see more posts on U.S. Core Consumer Price Index, ) . Source: Investing.com - Click to enlarge |

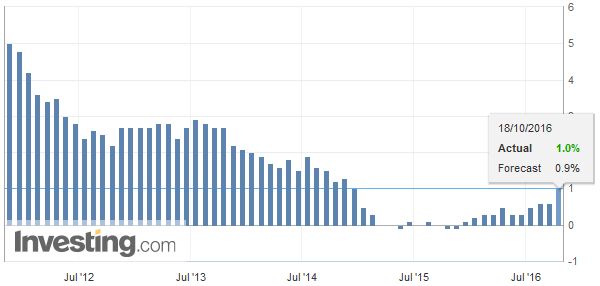

| Headline CPI rose 0.2% on the month for a 1.0% year-over-year pace. This was slightly more than expected and compares with a 0.6% pace in August. The core rate rose to 1.5% from 1.3%, which is also a little more than expected. |

U.S. Consumer Price Index (CPI) YoY, September 2016(see more posts on U.S. Consumer Price Index, ) . Source: Investing.com - Click to enlarge |

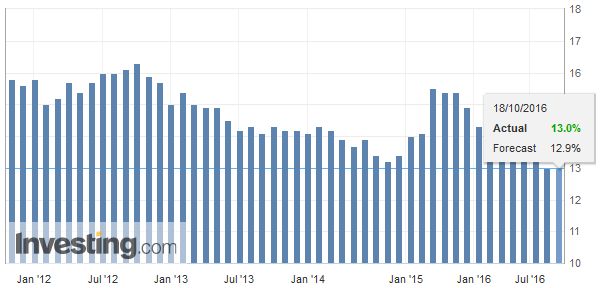

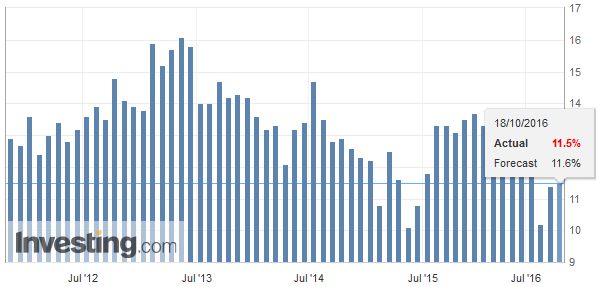

United KingdomThe UK and New Zealand reported higher than expected CPI figures. This gives more evidence of our macroeconomic views: Deflationary pressures, outside of Japan have bottomed. Price pressures will gradually increase. This is an important turn for investors. Attention is turning to the US CPI report. The pace is also expected to increase. At the headline level, a 0.3% increase will lift the year-over-year pace to 1.5%, while the core rate may be steady at 2.3%. Remember, the Fed targets the core PCE deflator, which lags behind the CPI. One of the reasons that higher inflation is not good for sterling is that the middle terms are lacking here. Bank of England Governor Carney has made it clear that the higher inflation readings will be accepted and will not trigger a tightening of monetary policy. There are at least two chains of reasoning. First, the currency impact is transitory. Second, higher inflation may offer some cushion to the economic headwinds that are prudent to expect. The European trade ministers meet to see if there is a compromise to be found to ensure that free-trade agreement with Canada remains on track. Objections from part of Belgium threaten to gum up the works. A breakthrough does not seem particularly likely at this level, and it may require a solution from the heads of state who hold a summit at the weekend. |

U.K. Consumer Price Index (CPI) YoY, September 2016(see more posts on U.K. Consumer Price Index, ) . Source: Investing.com - Click to enlarge |

China

|

China Outstanding Loan Growth YoY, October 18 2016(see more posts on China New Loans, ) . Source: Investing.com - Click to enlarge |

| Although China has not exhausted monetary policy, it appears to be having a similar experience in terms of its money supply as high income countries. While M1 is expecting rapidly (24.7% year-over-year in September, slowing slightly from 25.3% in August), what is actually getting into the economy is growing much slower (6.6% in September, the slowest pace in three months). The immediate focus of Chinese policymakers is on reining in the housing market. This will also encourage a stand pat monetary policy. |

China M2 Money Stock YoY, October 18 2016 . Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$AUD,$CAD,$EUR,$JPY,China New Loans,EUR/CHF,FX Daily,gbp-chf,newslettersent,U.K. Consumer Price Index,U.S. Consumer Price Index,U.S. Core Consumer Price Index,US dollar