Tag Archive: $EUR

Trump and the Dollar

US official comments on the FX market appear to have increased in frequency. They are mostly warnings about a strong dollar, but not all comments are dollar-negative. Policy is the ultimate driver but comments pose headline risk.

Read More »

Read More »

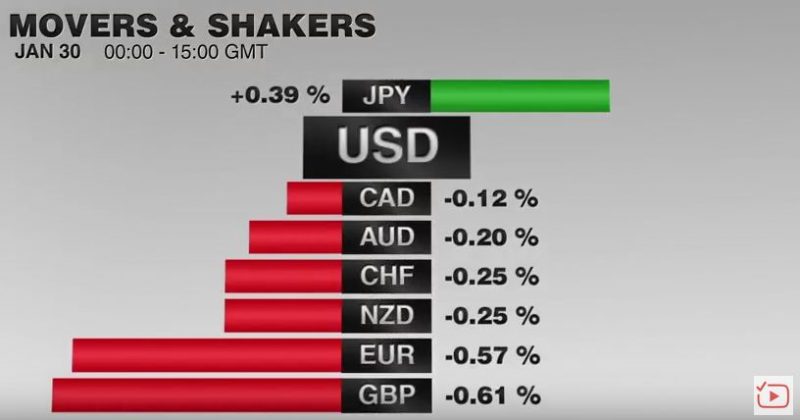

FX Daily, January 30: EUR/CHF falls further to 1.650

The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 - 1.0700 that constituted the previous intervention area.

Reasons can be found in the weak U.S. GDP weak, in Trump's foreign trade policy and in the strong Swiss trade balance.

Read More »

Read More »

FX Daily, January 27: Week Ending on Mixed Note as Year of Rooster Begins

The Lunar New Year celebration thinned participation in Asia, where several centers are closed. Although the MSCI Asia Pacific Index slipped slightly, it rose 1.5% on the week, the fourth weekly gain in the past five weeks. The Nikkei advanced 0.35%, the third rise in a row. The 1.75% gain for the week snaps a two-week decline.

Read More »

Read More »

US GDP Misses, but Final Domestic Sales Accelerate

Net exports was a large drag on growth. Inventories flattered growth. Underlying signal, final domestic demand, increased 2.5% after 2.1% in Q3.

Read More »

Read More »

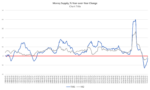

Are Interest Rates No Longer Driving the Dollar?

Many are concerned that the dollar and interest rates have become decoupled. We are not convinced. Correlations, not to be eyeballed, are still robust.

Read More »

Read More »

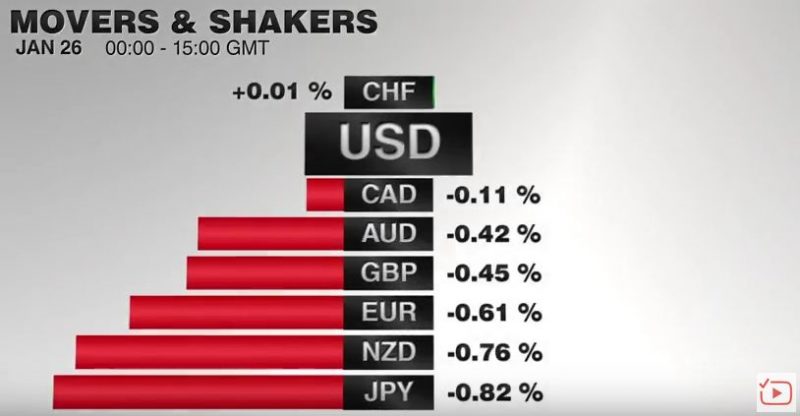

FX Daily, January 26: EUR/CHF collapses to 1.670

The US dollar is mostly firmer against the major currencies but is confined to narrow ranges, and well-worn ranges at that, but the focus has shifted to the strong advance in equities. Yesterday, the Dow Jones Industrials finally rose through the psychologically-important 20k level, and the S&P 500 gapped higher to new record levels.

Read More »

Read More »

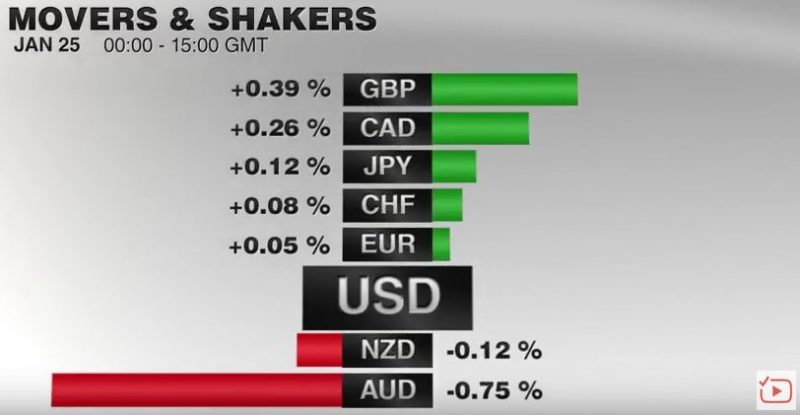

FX Daily, January 25: Dollar is on the Defensive Despite Firmer Rates

The US dollar is softer against nearly all the major currencies. Participants appear to be growing increasingly frustrated with emerging priorities of the new US Administration. They want to hear more details and discussion of the tax reform, deregulation, and infrastructure plans.

Read More »

Read More »

FX Daily, January 24: UK Supreme Court Requires May to Submit Bill on Brexit to Parliament

As widely expected, the UK Supreme Court ruled that Parliament approval is needed to trigger Article 50 start the divorce proceedings with the EU. The Court decided by an 8-3 majority that a bill needs to be submitted to both chambers, but that the approval of the regional assemblies (e.g. Scotland, Northern Ireland) is not necessary.

Read More »

Read More »

UK Supreme Court Decision: Anti-Climactic?

Sterling retreats on court ruling but key supports hold and it recoups initial loss. The US dollar is recovering with the help of firming US yields. Investors are still anxious for details of new US government's tax, deregulation, and infrastructure investment plans.

Read More »

Read More »

FX Daily, January 23: Dollar’s Pre-Weekend Retreat Extended in Asia Before Stabilizing in Europe

The US dollar had a poor close in the North American session before the weekend as investors appear increasing anxious about the new US Administration's economic policies and priorities.With no fresh details emerging over the weekend, some stale dollar longs exited. The dollar stabilized in the European morning, but broader risk appetites were not rekindled, and the Dow Jones Stoxx 600, led by financials, was sold to its lowest level this month.

Read More »

Read More »

FX Weekly Preview: The Challenging Week Ahead

Investors will finally be able to focus on what the new US President does rather than what he says. The UK Supreme Court decision is expected, but it may not be the driver than it may have previously seemed likely. The dollar-yen rate does not appear to be driven by domestic variable as much as US yields and equities. Prices not real sector data may be the key for the euro.

Read More »

Read More »

Cool Video: Bloomberg’s Daybreak – Dollar Correction

I was on Bloomberg's Daybreak: Americas today. The issue at hand was about the dollar's losses since the start of the year. I suggest that the correction actually began a day or so after the Federal Reserve hiked rates in mid-December. I noted that the correction was not just about the dollar but also interest rates.

Read More »

Read More »

FX Daily, January 20: Trump Day

The dollar peaked against the yuan two days after the Federal Reserve hiked interest rates in the middle of last month. We argue that that is when the market correction began, not at the turn of the calendar. Despite claims that China's currency is dropping like a rock, it has actually risen for the fifth consecutive week. That is the longest rising streak for the yuan since early 2016.

Read More »

Read More »

Draghi Lets Steam out of Euro

US reported stronger than expected series of data, including a large drop in weekly jobless claims for the week of the next NFP survey. Draghi remained dovish, with key phrases retained. Euro needs to break $1.0575 now to confirm a top is in place. Markets still uncertain ahead of the start of the new Administration.

Read More »

Read More »

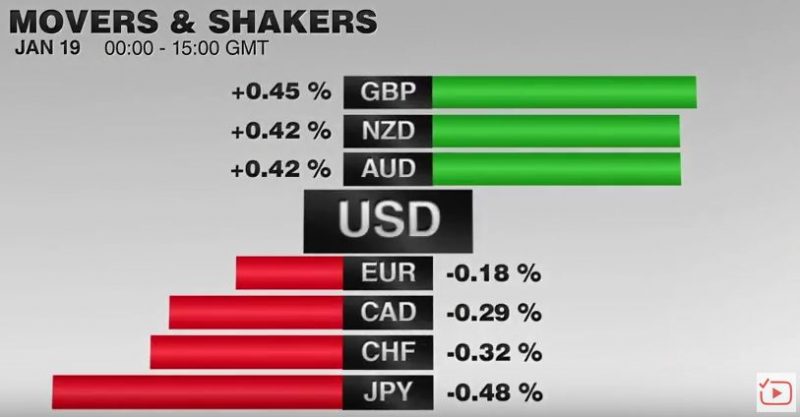

FX Daily, January 19: Dollar Gives Back Most of Yellen-Inspired Gains

While the US 10-year yield is unchanged, the dollar is consolidating its gains against the yen in a relatively narrow range of about half a big figure below JPY115.00. It has seen its gains pared more against the euro and sterling, where most of Yellen-inspired gains have been unwound. Sterling found support near $1.2250 and was bid up to $1.2335 by early in the European sessions.

Read More »

Read More »

FX Daily, January 18: Markets Stabilize, Awaiting Fresh Cues

The US dollar has stabilized after yesterday's bruising. From a fundamental perspective, little has changed. After hard exit signals from the UK government sent sterling down from $1.2430 on January 5 and 6, to below $1.20 at the start of the week, the pound rallied back to almost $1.2430 yesterday amid "sell the rumor buy the fact" activity.

Read More »

Read More »

FX Daily, January 17: Trump’s Comments Send the Dollar Reeling

The Pound has been subjected to a heavy amount of pressure as we progress further into 2017, with GBP/CHF rates being one of the heaviest losers. The pairing is now trading at a similar level to GBP/USD levels below the 1.22 mark. Their is an enjoyable symmetry between the two from an analysts point of view. Both are well regarded as safe-haven currencies, and in this time of increased uncertainty, both have almost the exact same value in the...

Read More »

Read More »

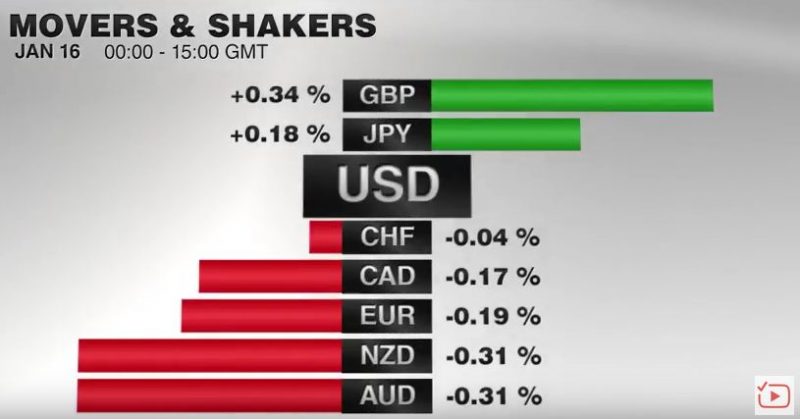

FX Daily, January 16: Hard Exit Talk Sent Sterling Below $1.20

The euro has been sold to $1.0580 in the European morning, a cent lower from the pre-weekend high. In addition to the drag from sterling, the euro appears to have been sold in response to the interview in two European papers of the next US President. Among other things, Trump reported claimed that NATO was obsolete and that other countries will leave the European Union, which is largely a German project.

Read More »

Read More »

The Difference of an A and BBB for Italy

DBRS cut Italy's rating to BBB from A. It will increase the haircut on Italy's sovereign bonds used for collateral by Italian banks. It is not a mortal blow or a significant hit, but is not helpful, except to add pressure on Italy and further reduce its ability to respond to another shock.

Read More »

Read More »

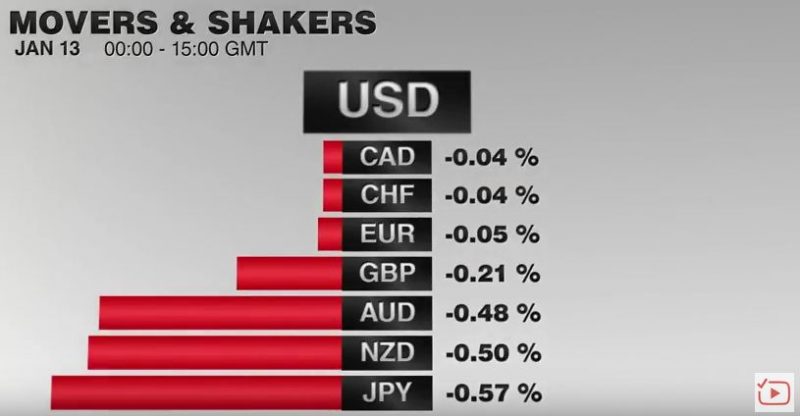

FX Daily, January 13: Corrective Forces Persist

The Supreme Court Judgement on whether parliament will have to O.K the triggering of article 50 is ongoing and when the ruling is announced expect big swings on GBP/CHF. I think the likely outcome will be that parliament will get the vote, most broad sheet papers have indicated the majority of the judges are in favour of the parliamentary vote.

Read More »

Read More »