Tag Archive: Crude Oil

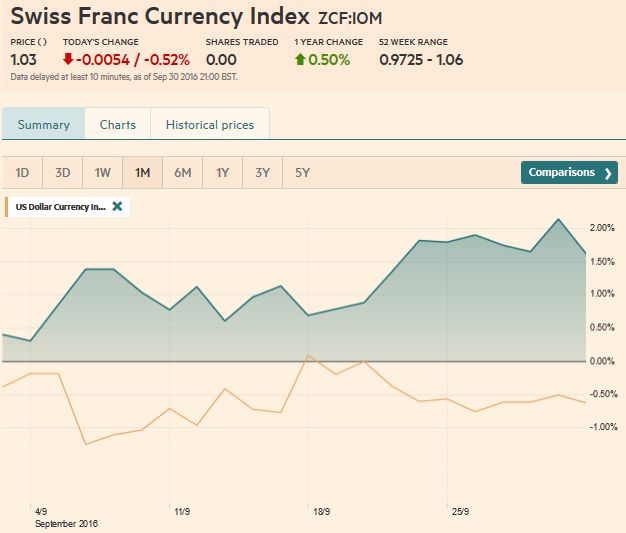

FX Weekly Review, September 26-30: Dollar vulnerable at the Start of Q4, CHF collapses at Quarter End

The US dollar fell against most of the major currencies in Q3. The Norwegian krone was the best performer, gaining 4.4% against the greenback, followed by Aussie and Kiwi. The Swiss Franc collapsed on Friday at quarter end.

Read More »

Read More »

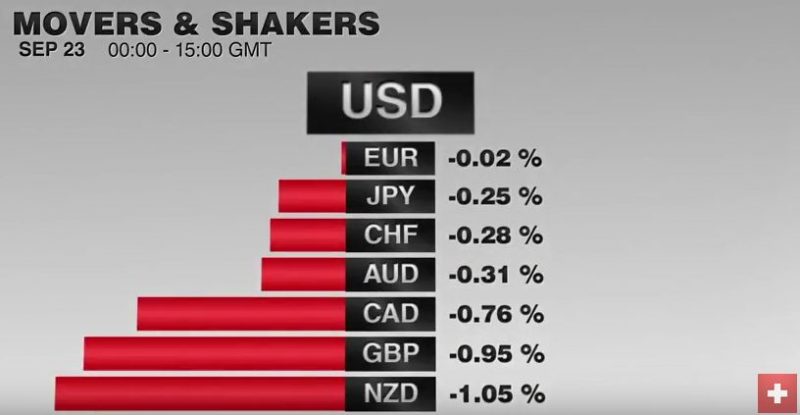

FX Daily, September 23: It is Friday and the Dollar is Firmer Again

As Nassim Taleb instructed, we should not be fooled by randomness. If you see six red results in a row at a roulette table, do not conclude the game is rigged. If you flip a coin, and it is tails six consecutive times, the contest is not necessarily rigged.

Read More »

Read More »

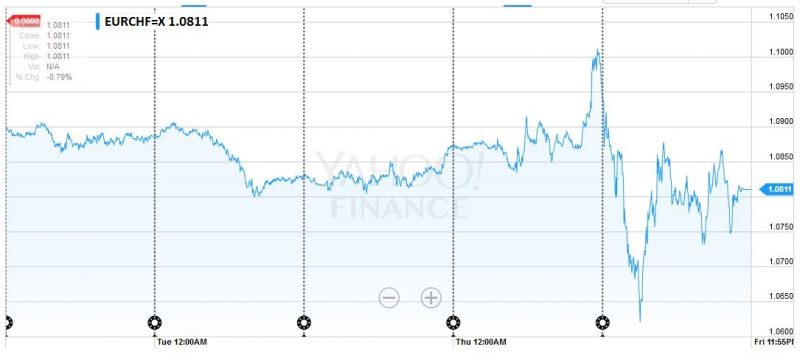

FX Daily, September 21: BOJ Can’t Weaken Yen, Fed keeps Rates Unchanged, CHF Stronger

The EUR/CHF accelerated its decline since yesterday's strong Swiss trade balance data. The second reason was certainly the Fed decided to keep rates unchanged.

We know that the Swiss Franc has similar "counter-dollar" status as gold.

Read More »

Read More »

FX Weekly Review, September 12 – 16: U.S. Dollar Resilience Despite Hawkish ECB and bad ISM

The dollar was surprisingly strong this week. This despite a more hawkish ECB, bad U.S. economic data in the ISM surveys.

Read More »

Read More »

FX Weekly Review, September 05 – September 09: Dollar Proves Resilient as Market Rates Rise

It took the market a few days to overcome the shockingly poor non-manufacturing ISM (51.4 vs. 55.5). However, by the end of the week, the US dollar bulls had regained the upper end.

Read More »

Read More »

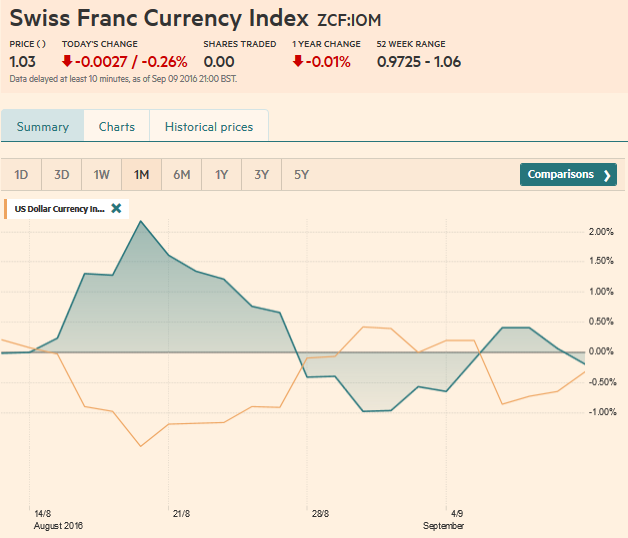

FX Weekly Review, August 29 – September 2: Disappointing Jobs Data Doesn’t Break the Buck

During this week the Swiss Franc index lost against both dollar and euro. The CHF index ended one percent down. Despite not convincing US jobs, the dollar index ended in positive territory.

Read More »

Read More »

FX Weekly Review, August 22 – August 26: Swiss Franc Loses Most Gains Again

After winning 5% against the dollar index last week, the Swiss Franc index lost 3% again. CHF lost against both USD and EUR. Reason: An increased probability of a rate hike in the U.S.

Read More »

Read More »

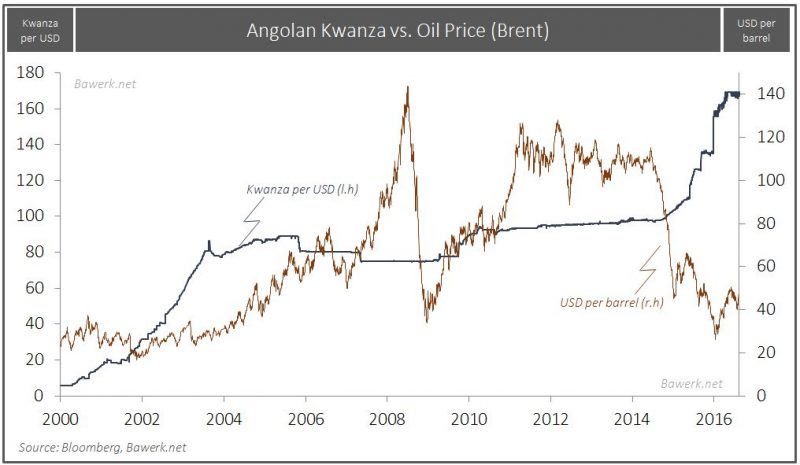

The Dos Santos Succession Saga

Arguably one of the easier calls for us to make after 37 years in power was that President dos Santos would find ways of affording himself another 5 years in. Like any ‘effective’ leader, Mr. Santos made sure the final deal to do just that was stitched up long before the Party Congress formally convenes in Luanda, with a lower level MPLA ‘Central Committee’ already rubber stamping his name in mid-August.

Read More »

Read More »

FX Weekly Review, August 15 – August 19: Swiss Franc index improves 5% compared to dollar index

The US dollar lost ground against nearly all the major currencies last week. The sole exceptions were the Australian dollar, where Moody's decision to cut the outlook for five Australian banks wiped out the previous small gain. The Swiss Franc index gained nearly 5% compared to the dollar index.

Read More »

Read More »

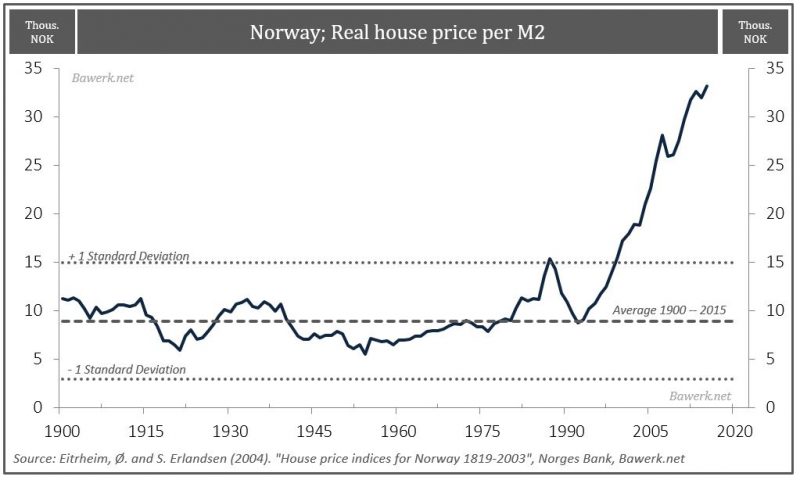

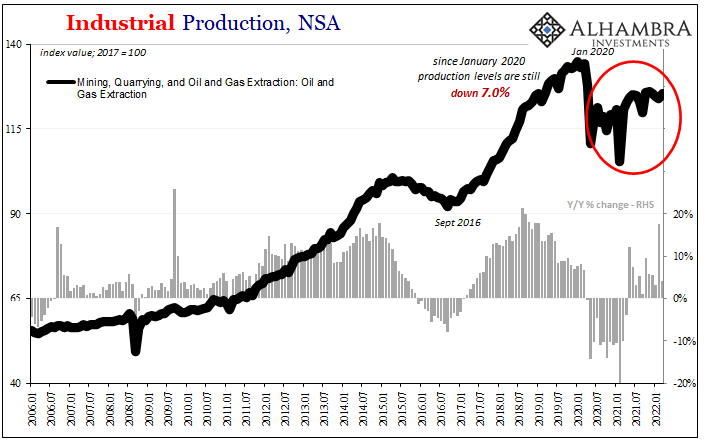

Norway: Towards Stagflation

We have all heard the incredible stories of housing riches in commodity producing hotspots such as Western Australia and Canada. People have become millionaires simply by leveraging up and holding on to properties. These are the beneficiaries of a global money-printing spree that pre-dates the financial crisis by decades.

Read More »

Read More »

FX Weekly Review, August 08 – August 12: Finally an Improvement of the CHF Index

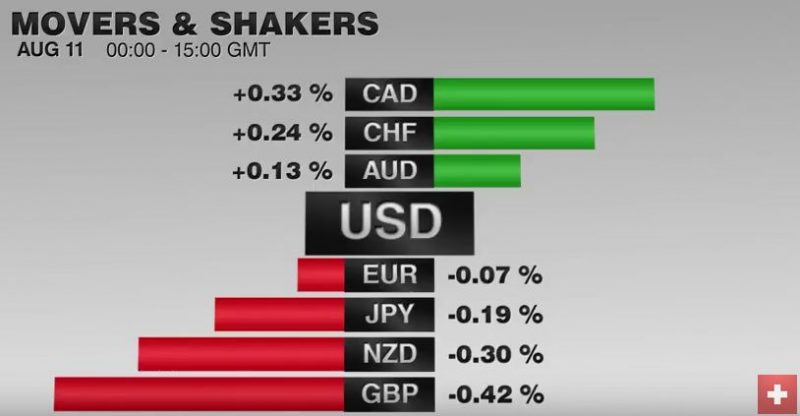

The CHF index experienced its first good week since many weeks, when we compare it against the dollar index. On a three years interval, the Swiss Franc had a weak performance.

Read More »

Read More »

FX Daily, August 11: Sterling Struggles to Find a Bid, While RBNZ Can’t Knock Kiwi Down

Once again, EUR/CHF reverses in the middle of the week. A part from technical reasons, the weak French CPI (+0.4% YoY) and Italian CPI (-0.2% YoY) exercised downwards pressure on the euro. The US dollar has found steadier footing today after trading heavily yesterday. There are two main themes. The first is sterling’s heavy tone.

Read More »

Read More »

FX Weekly Review, August 01 – August 05: Does the Jobs Report Give the Greenback Legs?

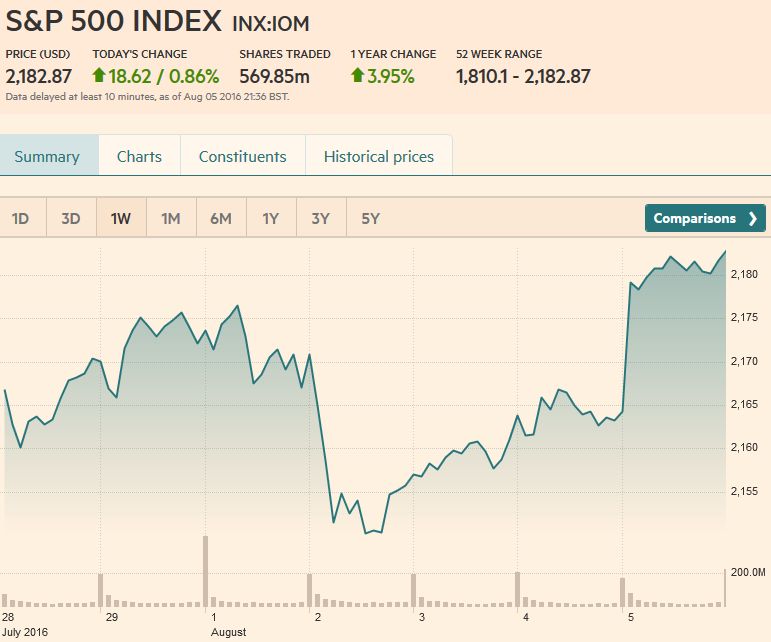

The robust US employment report before the weekend allowed the dollar to recoup the losses it experienced earlier in the

week against most of the major currencies. The Australian dollar and Japanese yen managed to hold onto minor gains for the

week.

Read More »

Read More »

Weekly Speculative Positions: Record Sterling Shorts, Net Short in Swiss Francs

For a period that included a BOJ and FOMC meeting and the US GDP, speculators in the currency futures were unusually quiet. Summer holidays with family may be more important. Of the 16 gross currency futures speculative positions we track, 12 of them were less than 5k contracts. There was only one gross position adjustment more than 10k contracts. Euro bears covered …

Read More »

Read More »

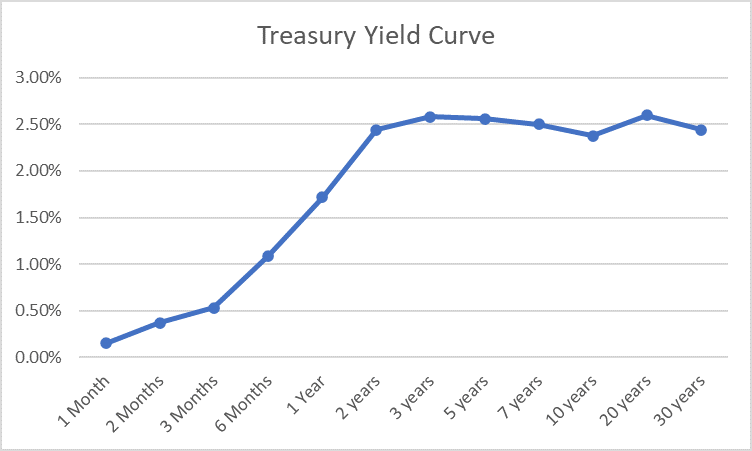

FX Weekly Review, July 25 – July 29: Dollar Hobbled; Technicals Warn of More Losses

The US dollar advance was stopped in its tracks by the

disappointingly weak Q2 GDP figures. The 1.2% annualized growth rate was

roughly half of the pace expected. The FOMC statement earlier in the week did not leave the impression that a September hike was likely, and with the poor growth numbers, the odds were downgraded

further.

Read More »

Read More »

FX Weekly Review, July 18 – July 22: Will the FOMC Halt the Dollar’s Advance?

The US dollar gained against all the major currencies over the past week. It also rose against many emerging market currencies. A notable exception was the Chinese yuan.

Read More »

Read More »

FX Weekly Review, July 11 – July 15: It is not About the Dollar, but About Other Currencies

Our weekly review of currency movements, with focus on the Swiss franc. This week: The US dollar is easily the most traded currency, and despite the plethora of other currencies, it is on one side of nearly 90% of all trades. Yet the movement in the foreign exchange market presently is not so much driven by the dollar as it is by other currencies.

Read More »

Read More »

FX Weekly Review, July 04 – July 08: Further SNB Interventions, Good Dollar Week

In the Brexit month, the Swiss franc index clearly underperformed the dollar index. The major reason is that the dollar is seen as a better safe-haven than the Swiss Franc, possibly because Swiss sales are affected more when British demand falls.

Read More »

Read More »

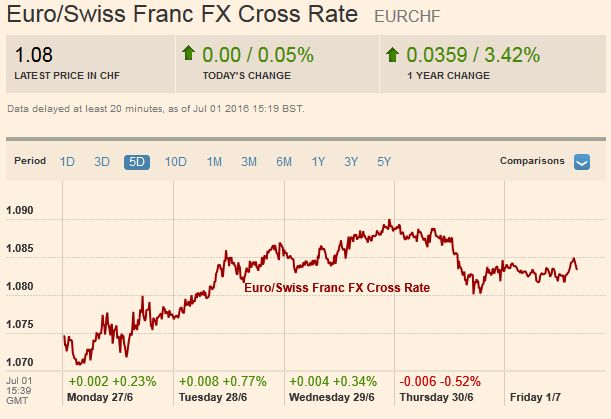

FX Weekly Review: June 27 – July 01: Swiss Franc Strength Reversed

Week after Brexit.: The Swiss franc (-0.3%) and the yen (-0.5%) were the worst performers, as so-called safe haven buying was reversed.

But the Swiss Franc index is still stronger in the last month than the dollar index.

Read More »

Read More »

FX Weekly Review: June 20 – June 24: Dollar Appreciates with Brexit

The dramatic reaction to the UK decision to leave the European Union has changed the technical condition in the foreign exchange market. The EUR/CHF peaked shortly before the Brexit referendum, when traders were anticipating a yes. It found its trough when the No was published. Then the SNB intervened.

Read More »

Read More »