| Trust the Fed. Ha! It’s one thing for money dealers to look upon Jay Powell’s stash of bank reserves with remarkable disdain, more immediately damning when effects of the same liquidity premiums in the real economy create serious frictions leaving the entire world exposed to the consequences. When all is said and done, the Federal Reserve has created its own doom-loop from which it won’t likely escape.

The 2022 FOMC has made itself plain, incredibly hawkish to an extent not seen since 2006, if not 1994. The reason is quite simple: the US CPI continues to embarrass both policymakers and the politicians holding their leashes (five open nominations). Rate hikes are the political theater where the primary Fed actors appear to be doing something about rampaging consumer prices. What these or any rate hikes can’t do is get more oil up out from the ground. Crude, not inflation, is the reason for the CPIs in the first place. This only raises another perhaps even more pressing question: why aren’t oil companies drilling, extracting, and producing more crude oil? As the price of black gold has surged, production of the substance has not. |

|

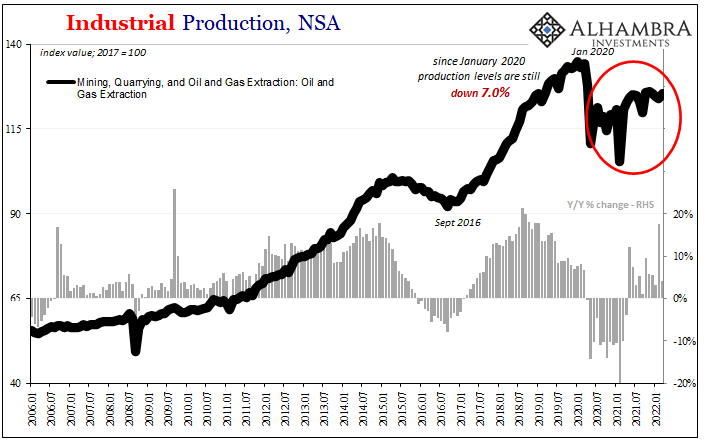

| Here again we turn to the same chart I’ve used for years now, the one derived from the Federal Reserve’s very own statistics for this “inflation” counterpoint, today the very definition of commercial inelasticity on the supply side.

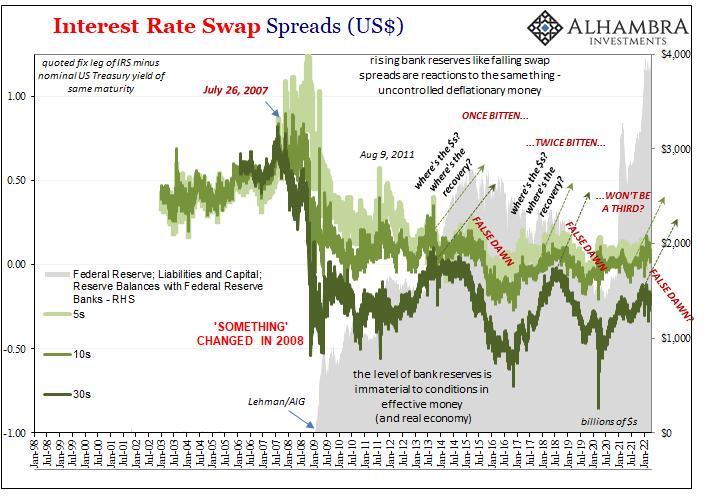

According to last week’s Industrial Production estimates for the month of March 2022, oil/natural gas output remains nearly 7% less than what it had been more than two years ago back in January 2020. Two years, rising prices, still less oil. Something beside the enthusiasm for Drill, Baby, Drill is clearly missing. The problem, as with so many things around the world’s economy, is the Fed but for vastly different reasons than you might think or have been told. Everyone says consumer prices and CPIs were caused by money printing when, in fact, the lack of money and global liquidity rather than anything else has prevented crude supply (above), thus created instead “inflation.” And what that further means is the Fed is now employing ridiculously absurd rate hikes if only to appear responsive to oil prices that its own past incompetence has contributed much if not most to; doing something that has no chance of fixing what by sheer ineptitude and dereliction, not excessive currency, it had a huge hand in creating. To understand what I mean, go back to 2014. Yes, “best jobs market in decades” but one that was immediately if not already undercut by a bevy of financial indications including UST curves or swap spreads (below) pointing toward a global mess, one created by lack of (euro)dollars rather than worldwide recovery led by QE succeeding in America. In addition to increasingly bearish (on money therefore economy) financial markets, the price of oil plunged. And then plunged some more. Finally collapsed. The very definition (not that you’ll hear this in the mainstream) of forced liquidations. A key reason why, especially in energy, was junk bonds and leveraged loans (along with other kinds of syndicated products). These were used as collateral to fund many an energy project before mid-2014, then were slammed right out the collateral stream creating the same kind of monetary toxicity (to a lesser degree) subprime mortgages had a little more than half a decade earlier. |

|

| The net result as it pertains to our crude story: a wave of defaults and bankruptcies across drillers, E&Ps, the whole oil patch.

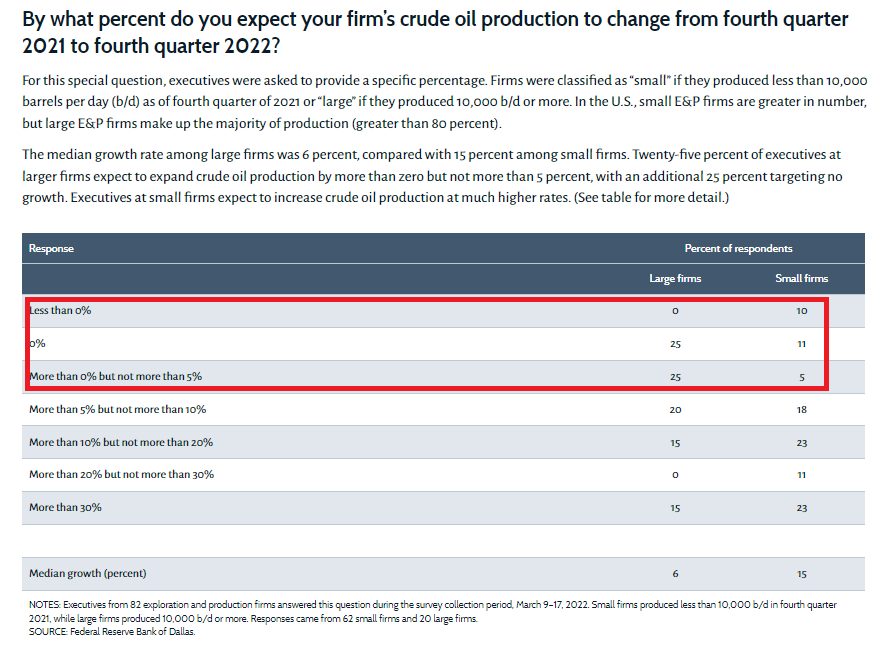

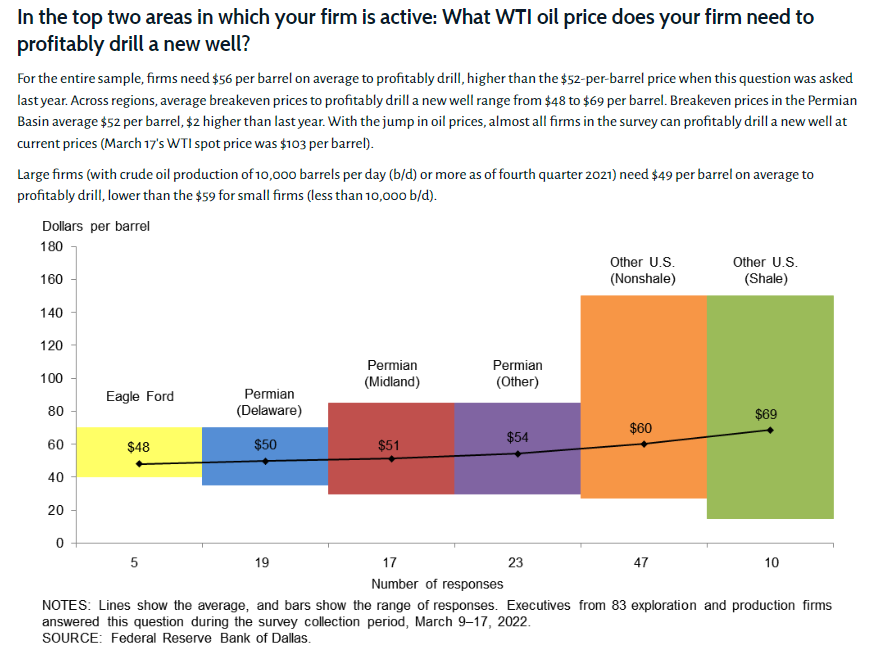

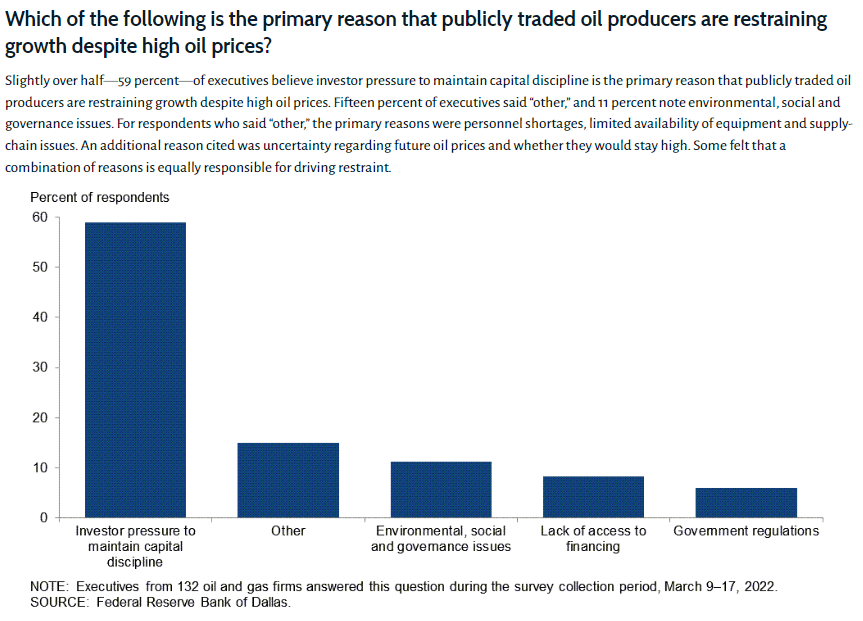

Whereas never really reported in the compliant media still seeking to extol the alleged virtues of QE as “liquidity”, you better believe investors remember what really happened if only because unlike the financial press or FOMC policymakers, they haven’t the same luxury of repeating failure. As if that wasn’t bad enough, what came next in the form of globally synchronized growth simply reinforced the mistakes; meaning, there was no 2017 recovery for 2018 to ascend into, therefore just a repeat of 2014-16 which by the end of ’18 left oil prices to strike another landmine if only to remind many of the same investors just how fleeting mainstream assurances of an always-upward macro case ever proves to be. False dawns, every single time. Once bitten, twice shy. By 2019, twice bitten… The Federal Reserve’s Dallas branch maintains a quarterly survey of oil producers from across the country, having years ago expanded upon an historical, regional examination begun for obvious reasons given how much oil there is around Texas and surrounding, and how important Texas oil is to American fortunes. Its latest released on March 23 was a real doozy. Before mid-March 2022, oil prices well above $100, having been as high as $125 thereabouts, and here’s what oil producers in the Dallas Fed’s coverage were thinking insofar as production this year might go: |

|

| Half of large producers, along with slightly more than a quarter of small producers, tell the Fed branch they’re expecting no more than a paltry 5% additional production. Add the other 20% in the next bucket, that’s 70% expecting maybe a 10% rise at most for this year, 2022.

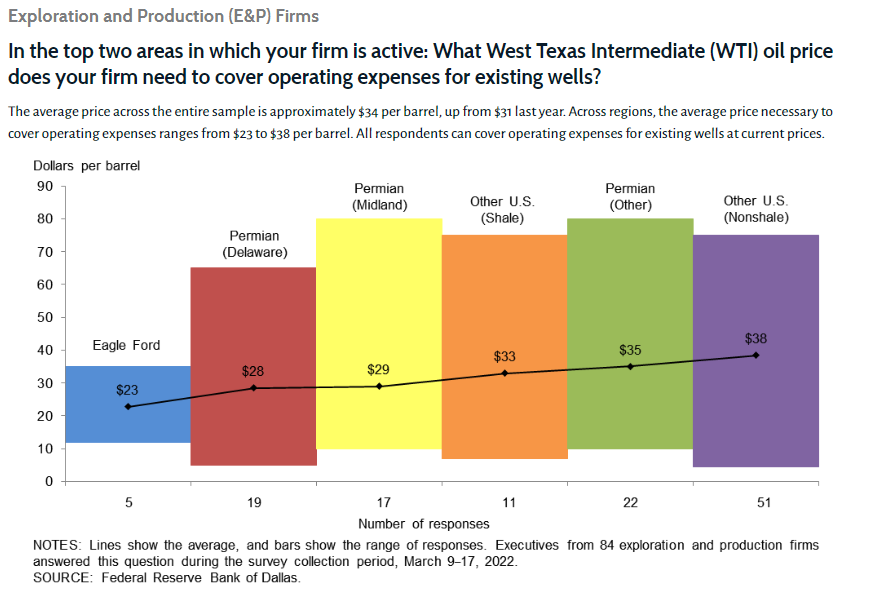

With oil in the triple-digits. According to the same survey, while every producer says current oil prices cover existing well operations, they might not necessarily cover new drilling. Anyone who has even briefly studied shale and fracking knows those are relatively more expensive techniques, even if quite effective. As services and materials costs rise along the 2021 “inflation” supply shock, uncertainty about future operations rises, too, and it’s not just new shale projects. |

|

| But that’s not even the biggest issue for energy firms, at least not in the Dallas data. Some have cited politics and regulations (one comment: “In the first quarter of 2021, I divested all properties in the state of Colorado due to the unbelievably hostile and increasingly aggressive regulatory environment driven by anti-fossil-fuel ideology. The administration has no clue about the oil-and-gas industry”), but that’s not really the obstacle, either.

By far, and it’s not close, the greatest constraint holding everything back – exploration, drilling, output, transportation, refining, lowering prices, taming the CPI – is twice-bitten investors. |

|

| Nearly two-thirds cite capital discipline: the widespread belief among bondholders and the like that they’ve seen this movie before, they know the Fed’s liquidity/money promises amount to zero, and that there is a high probability the monetary system then global economy turns yet again hanging especially junk bonds and syndicated loans out to dry.

Underpinning this skepticism is the implicit belief this “inflation” is another false dawn, if you could even call it as much. That oil prices even now over $100 aren’t likely to stay over $100. The undisciplined driller of years past would already be chasing these higher crude revenues, leading themselves and their investors off an awaiting, perhaps another inevitable cliff. No one believes the Fed’s garbage and this well-established disbelief is right now holding back badly needed output. Just like money dealers and collateral, for all the promises and glowing mainstream media projections we are stung by, and stuck with, harmful risk aversion in this crucial arena, too. The janitors didn’t clean this one up even a tiny bit. |

Congrats to Bernanke/Yellen/Powell, each had been the biggest contributors to the past year’s “inflation” and it had nothing whatsoever to do with “money printing.” On the contrary, because there never was any useful money printed, and exposed global markets like the global economy suffer repeatedly for the lack of it, not even the realization of $100 oil this year is bringing required supply back on line nor is it at all likely to.

Like so many current curves, it’s all upside down. The end of “inflation”, therefore, simply the next false dawn. Even the real money behind oil is waiting for it.

But, rate hikes and QT.

Full story here Are you the author? Previous post See more for Next postTags: bank reserves,Bonds,commodities,Crude Oil,currencies,economy,Featured,Federal Reserve/Monetary Policy,industrial production,Markets,newsletter,oil prices,oil production,QE,QT,rate hikes