Tag Archive: $CAD

FX Weekly Preview: Macro Considerations for the Capital Markets

The triumphalism that followed the fall of the Berlin Wall nearly three decades ago has evaporated. The Great Financial Crisis and inexorable widening of income and wealth inequalities within countries undermined claims of moral and economic superiority. Liberal democracies are fighting a rearguard action and the rise of illiberal regimes.

Read More »

Read More »

FX Daily, July 06: Dollar Slips After Tariffs and Before Jobs Data

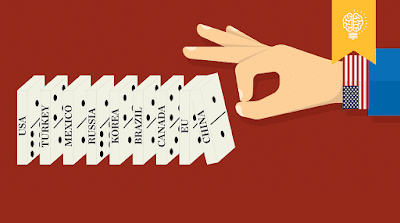

The first set of US tariffs aims specifically at China were implemented, and the retaliatory actions were also launched. The tariffs cover hundreds of goods, though the initial amount of trade covered is relatively small at $34 bln. Tariffs on another $16 bln are in the pipeline and could be put into effect in a few weeks. The US is threatening to ramp up its response by imposing a tariff on another $200 bln of Chinese goods, though the details...

Read More »

Read More »

FX Daily, July 03: Markets Trying to Stabilize

The global capital markets are trying to stabilize. US equities recovered from early losses yesterday but this was not enough to stop Asian equities from extending recent losses. The MSCI Asia Pacific Index slipped 0.2% for the sixth decline in the past seven sessions, However, several local markets, including China, Australia, and Korea advanced.

Read More »

Read More »

FX Daily, June 28: US Dollar Remains Firm, Sends Yuan, Rupee, Sterling and Kiwi to New 2018 Lows

The US dollar is consolidating its gains against most of the major currencies, but the underlying strength remains evident. Several major and emerging market currencies are at new lows for the year, including sterling and the New Zealand dollar, but also the yuan, rupee, and the rupiah.

Read More »

Read More »

FX Daily, June 27: Renminbi Slide Continues and Oil Extends Surge

The US dollar is mostly firmer today, though has slipped back below the JPY110 level, as lower yields and equities support the Japanese yen. The main story in the foreign exchange market today is the continued slide in the Chinese renminbi. The decline is the sharpest since the 2015 devaluation.

Read More »

Read More »

FX Daily, June 26: Trade Tensions and Approaching Quarter-End Cast Pall Over Markets

The global capital markets have stabilized today after yesterday's rout in equities, softer yields, and US dollar. The implementation of US tariffs on China and China's retaliatory tariffs on the US is still ten days off. The immediate focus is on actions expected to curb the technology transfer.

Read More »

Read More »

FX Daily, June 22: BOE Spurs Dollar Pullback

The Bank of England's hawkish hold yesterday, spurred by three dissents in favor of an immediate hike, changed the near-term dynamics in the foreign exchange market. Both the euro and sterling fell to new lows for the year before reversing higher. Yesterday's gains are being extended today.

Read More »

Read More »

FX Daily, June 20: Fragile Stability

The day began out with equity losses in Asia before a sharp recovery, perhaps initiated in China. The MSCI Asia Pacific Index was up a little more than 0.5%. The Shanghai Composite fell more than 1% before closing 0.25% better.

Read More »

Read More »

FX Daily, June 19: America First Clashes With Made in China 2025

The escalation of trade tensions between the world's two largest economies is scaring investors, who are liquidating equities and buying core bonds. The dollar and yen are the strongest of the major currencies. The Swiss franc is mostly steady as it too is benefiting from the unwinding of risk trades.

Read More »

Read More »

FX Daily, June 15: Dollar Slips While Escalating Trade Tensions may Roil Markets

The Dollar Index edged higher to its best level this year before turning down as market attention shifts from central banks to trade tensions. Reports confirm that the US will go ahead with the 25% tariff on $50 bln of Chinese goods and provide some specificity today. The final list is expected to be similar to the goods that had been identified in the preliminary list, with an emphasis on electronic goods, apparently on ideas that they may have...

Read More »

Read More »

Greenback Corrects Lower

The consensus narrative is that with rising inflation it is understandable that next week's meeting is live and that the confirmation of such has lifted the euro to ten-day highs, dragging the dollar broadly. However, to accept this is to accept the debasement of language. Until now, we dubbed central bank meeting that could result in action as "live." For example, given that the Fed has not changed interest rates since the hiking cycle began in...

Read More »

Read More »

FX Weekly Preview: Macro Matters Now, Just Not the Data

The main concerns of investors do not arise from the high-frequency data that are due in the coming days. Last week, the somewhat firmer than expected preliminary May CPI for the EMU failed to bolster the euro. The stronger than expected US jobs data, even if tipped by the President of the United States, and the pendulum of market sentiment swinging back in favor of two more Fed rate hikes this year did not trigger new dollar gains.

Read More »

Read More »

FX Daily, June 01: Ironic Twists to End the Tumultuous Week

The week is ending quite a bit different than it began. The main banking concern is not in Italy but in German, where shares in Deutsche Bank shares fell to a record low yesterday, and S&P Global cut its credit rating one step to BBB+ (third-lowest investment grade).

Read More »

Read More »

FX Daily, May 31: Don’t Confuse Calmer Markets with Resolution

The global capital markets that were in panic mode on Tuesday stabilized yesterday, and corrective forces have carried into today's activity. However, the underlying issues in Italy and Spain are hardly clarified in the past 48 hours. Moreover, the US push on trade is intensifying again.

Read More »

Read More »

FX Daily, May 17: US Rates Edge Higher, while Dollar Turns Mixed

The Britsh pound was a cent from yesterday's lows on a press report that claimed the UK cabinet had agreed on seeking to stay in the customs union with the EU beyond the two-year transition period. The report suggested that the UK wanted to still negotiate other trade deals, which would seem to be a Trojan Horse.

Read More »

Read More »

FX Daily, May 15: Firm US Rates Underpin Greenback

US 10-year rates are again probing the air above 3%, and this is encouraging a push back toward JPY110, with the euro slipping toward $1.19. Asian equities fell, with the MSCI Asia Pacific shedding 0.8%, the most in nearly a month, snapping a three-day advance. China and India were able to buck the regional move. China's economic data was mostly softer than expected and is consistent with a gradual turn in the cycle as the Lunar New effect fades.

Read More »

Read More »

FX Daily, May 14: US Dollar Slips in Quiet Turnover

The US dollar is sporting a softer profile against most of the major and emerging market currencies to start the new week. It already seemed to be tiring in the second half of last week. With today's mild losses, Dollar Index is off for a fourth consecutive session, the longest losing streak in over a month. The US and China appear to have taken measure to diffuse the trade tensions between the world's two largest economies.

Read More »

Read More »

FX Weekly Preview: Fed Can Look Through the Data Easier than the ECB and BOJ

Geopolitical issues will continue to bubble below the surface for the capital markets. The fallout from the reimposition of US sanctions on Iran has apparently helped lift oil prices in the face of the rising dollar, which often acts as a drag. In the coming days, the US will take the symbolic step of moving its embassy to Jerusalem.

Read More »

Read More »

FX Daily, May 11: Dollar Momentum Sapped, Near-Term Pullback Likely

The US dollar pulled back following yesterday's slightly softer than expected CPI report and this likely marks the beginning of a new phase, with the dollar moving lower. Investors have learned over the past two weeks that neither wages nor consumer prices are accelerating. There is little reason in the recent string of data or official comments to suggest a more hawkish path for monetary policy (e.g., four rate hikes this year).

Read More »

Read More »