Tag Archive: Brexit

FX Daily, August 29: Johnson Faces Legal Challenges and Conte may be Given an Extension

The capital markets are calm today, though there does seem to be some optimism creeping back into the market. The Chinese yuan strengthened, snapping a ten-day slide and Italian bank shares index has risen by more than 1% for the fourth consecutive session.

Read More »

Read More »

FX Daily, August 28: Optimism about Italy Creeps Back in but Sterling Heads the Opposite Way on Brexit Realities

The capital markets have turned quiet. There have been no more headline bombs about trade, and China set the dollar's reference rate much lower than projected. Asia Pacific equities were mixed. Hong Kong, China, India, and Singapore were on the downside, while Taiwan, Korea, and Australia rose.

Read More »

Read More »

FX Daily, August 23: Market has Second Thoughts on Magnitude of Fed Cuts Ahead of Powell

Powell speech at Jackson Hole stands before the weekend. Equities in Asia and Europe are finishing the week on a firm tone. Most markets in the Asia Pacific region closed higher today, and the MSCI Asia Pacific Index snapped a four-week slide. European bourses are edging higher, and the Dow Jones Stoxx 600 is poised to end its three-week air pocket.

Read More »

Read More »

FX Daily, August 21: European Stocks Snap Back, Market Hopeful Italian Election can be Delayed

The end of the US equity three-day advance yesterday weighed on Asia Pacific shares today. Most benchmarks fell. Better than expected trade data helped Thailand buck the trend. A firmer tone emerged in the European morning, and the Dow Jones Stoxx 600 has recouped yesterday's losses and more. It was led higher by consumer discretionary, energy, and industrials.

Read More »

Read More »

FX Weekly Preview: Macro Deterioration

The US-China tensions remain the dominant driver of investor risk appetites. President Trump has repeatedly accused China of manipulating its currency on twitter, and finally Treasury Secretary Mnuchiin acquiesced after China failed to prevent the dollar from rising above CNY7.0.

Read More »

Read More »

FX Weekly Preview: The Dog Days of August are Upon Us

The die is cast. To defend the uneven expansion and ward off disinflationary forces, monetary authorities will provide more accommodation. The Federal Reserve delivered its first rate cut in more than a decade and stopped unwinding its balance sheet two months earlier than it previously indicated (worth $100 bln of additional buying of Treasuries and Agencies).

Read More »

Read More »

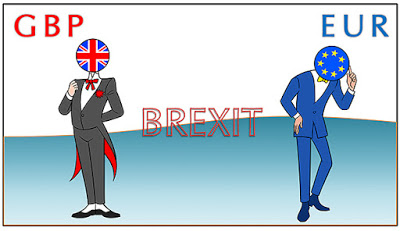

Brexit Update

The October 31 deadline for the UK to leave the EU is less than 100 days away. The new Prime Minister is beginning to convince others that that UK will, in fact, leave at the end of October. PredictIt.Org shows the odds of the UK leaving has risen to almost 50% from about a 33% chance a month ago. Here is a summary of where the situation stands and some key dates going forward.

Read More »

Read More »

FX Daily, August 2: End of Tariff Truce Trumps Jobs

Overview: The market was finding its sea legs after being hit with wave and counter-wave following the FOMC decision, and more importantly, Powell's attempt to give insight into the Fed's thinking. Trump's tweet than signaled an end to the tariff truce with a 10% levy on the $300 bln of imports from China that have not been subject to action previously.

Read More »

Read More »

FX Daily, July 30: Sterling Pounded

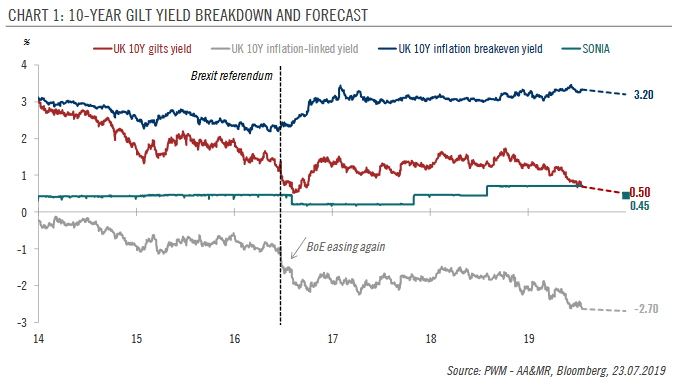

Overview: The prospect of a no-deal Brexit continues to pound sterling lower. A little more than two months ago, it was testing $1.32. Two weeks ago it was around $1.25. Today it traded near $1.2120 before stabilizing. On the other hand, the 10-year Gilt yield is below 65 bp, a new multiyear low, while the international-laden FTSE 100 is holding its own in the face of heavier equity prices in Europe.

Read More »

Read More »

FX Daily, July 29: Prospects of a No-Deal Brexit Weigh on Sterling

Unrest in Hong Kong and disappointing earnings reports from South Korea weighed on local equity markets, and the MSCI Asia Pacific Index fell for the third consecutive session. European equities are edging higher in tentative trading. The Dow Jones Stoxx 600 is firmer for the sixth session of the past seven. US shares are little changed after record-high closes before the weekend.

Read More »

Read More »

FX Weekly Preview: The FOMC and US Jobs Headline the Week Ahead

There is little doubt that the Federal Reserve will ease monetary policy at the conclusion of the FOMC meeting on July 31. We never thought the chances of a 50 bp move were anything but negligible, though even at this late stage, the market appears to be pricing in about a one-in-five chance.

Read More »

Read More »

FX Daily, July 26: Markets Consolidate as the Dollar Index Extends its Advance for the Sixth Consecutive Session

Investors are happy for the weekend. Between the ECB, Brexit, and next week's FOMC, BOJ, and BOE meetings, the markets are mostly in a consolidative mode ahead of the weekend. The first look at Q2 US GDP is the last important data point of the week, though it is unlikely to impact next week's Fed decision.

Read More »

Read More »

BREXIT UNCERTAINTY TO WEIGH ON YIELDS

UK sovereign bond (gilts) yields have fallen this year, with the 10-year yield dropping by 59 basis points (bps) to 0.69%1, in concert with other core sovereign bond yields. The Brexit saga, along with the global slowdown forcing many central banks to turn dovish, are the main factors behind this steep fall.

Read More »

Read More »

FX Daily, July 23: Debt Deal Help Lifts the Dollar

The gains in US equities and the apparent US budget agreement has underpinned equities today and the US dollar. Asia Pacific equities recouped yesterday's losses, and Europe's Dow Jones Stoxx is posting gains for the third consecutive session, helped by some earning beats, to probe two-week highs. US shares are firmer. Benchmark 10-year yields are mixed with the Asia Pacific softer and European firmer.

Read More »

Read More »

FX Daily, July 22: Greenback is Mostly Firmer to Start New Week, while the Euro is Pinned near $1.12

What promises to be an eventful two weeks has begun quietly. The ECB, Fed, BOJ, and BOE will meet over the next fortnight. The central banks of Turkey and Russia meet this week and are expected to cut rates. The UK will have a new Prime Minister.

Read More »

Read More »

FX Weekly Preview: Highlights in the Week Ahead

Three events that will capture the market's attention next week: The consequences of the Japanese election, the first look at US Q1 GDP, and the ECB meeting. The central banks of Turkey and Russia also meet. Both are expected to cut interest rates, following rate cuts in the middle of last week by South Korea, Indonesia, and South Africa.

Read More »

Read More »

FX Daily, July 18: Dollar on Back Foot as Equities Slide

Overview: Profit-taking continues to weigh on global equities earnings concerns saw the biggest drop in the S&P 500 in three weeks. The MSCI Asia Pacific Index fell for the fourth consecutive session. The Nikkei gapped lower for the second straight session and has now retraced half of the gains scored since early June. The Shanghai Composite is at its lowest level in a month.

Read More »

Read More »

FX Daily, July 16: Sterling Weakness Punctures Subdued Session

Overview: Summer in the northern hemisphere contributing to the subdued activity in the global capital markets. The MSCI Asia Pacific index stalled after a four-day advance, with Japanese, Chinese, and Australian equities offsetting gains in Taiwan, South Korea, and India. Europe's Dow Jones Stoxx 600 is flattish, struggling to extend its three-day rally.

Read More »

Read More »

FX Daily, June 20: Doves Rules the Roost Except in Oslo

Overview: The prospect of "lower for longer" continues to fuel the bond and stock rally. The initial US equity response to the Fed was positive but not strong and closed about 0.3% higher. Asia Pacific equities followed suit with mostly modest gains, except for China and Hong Kong, where gains of more than 1% were recorded.

Read More »

Read More »

FX Daily, June 19: Still Patient?

Overview: Risk-taking was bolstered by the dramatic shift in Draghi's rhetoric less than two weeks after the ECB meeting and a Trump's tweet announcing that there was going to be an "extended" meeting between him and Xi at the G20 meeting and that the respective staff would begin coordinating. It was later confirmed by the Chinese media.

Read More »

Read More »