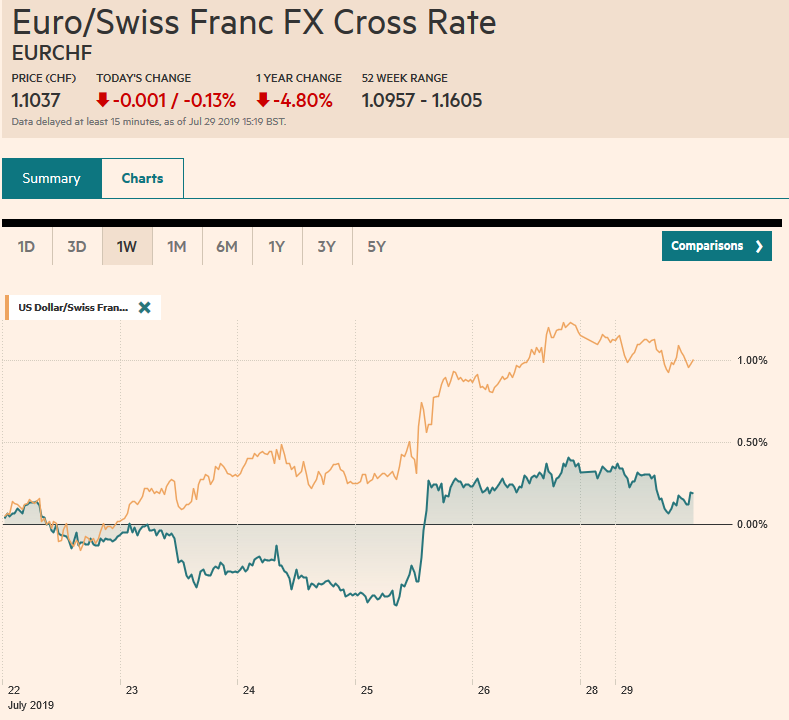

Swiss FrancThe Euro has fallen by 0.13% to 1.1037 |

EUR/CHF and USD/CHF, July 29(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Unrest in Hong Kong and disappointing earnings reports from South Korea weighed on local equity markets, and the MSCI Asia Pacific Index fell for the third consecutive session. European equities are edging higher in tentative trading. The Dow Jones Stoxx 600 is firmer for the sixth session of the past seven. US shares are little changed after record-high closes before the weekend. Benchmark 10-year bond yields are mostly one or two basis points lower. Sterling’s continued weakness in the face of perceptions that the risks of a no-deal Brexit are increasing is the main standout in the quiet start to the week in the foreign exchange market. The Turkish lira is firm with the dollar approaching the lower end of its recent range near TRY5.60. The South African rand is stabilizing after dropping around 3% in the past two sessions following Moody’s and Fitch expression of concern about the government’s bailout of Eskom. |

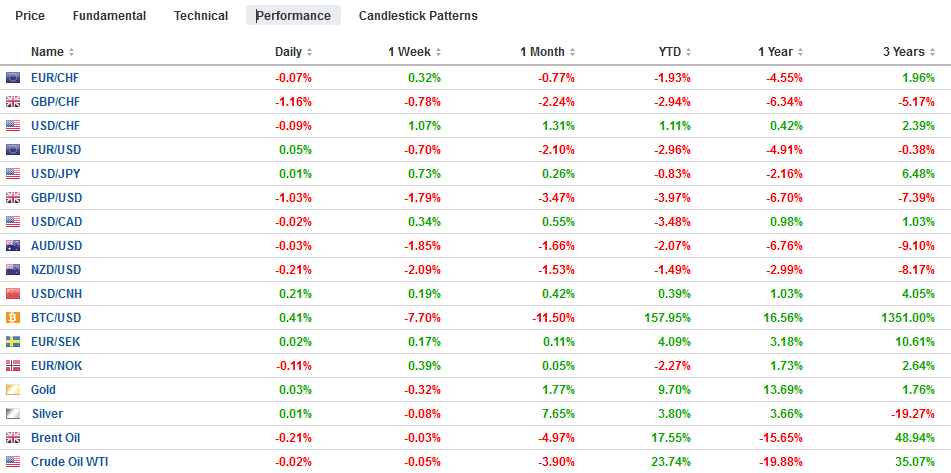

FX Performance, July 29 |

Asia Pacific

US-China face-to-face trade talks will resume tomorrow. Expectations are low for break-throughs any time soon. An extended tariff truce with some goodwill gestures, like China stepping up its purchases of some US agriculture. The US has yet to agree on waivers so American companies can sell product to Huawei. In fact, the US continues to seem determined to frustrate China on other fronts–like resisting China’s self-identification at the WTO that it is an emerging market, selling weapons to Taiwan, slapping anti-dumping duties a China’s structural steel, and sanctioning a Chinese company last week for shipping Iranian oil.

The Bank of Japan meets tomorrow. While it is not expected to take fresh initiatives, there is some speculation that Governor Kuroda could reinforce the forward guidance. We are skeptical of the impact, in any event. Two news items likely caught policymakers attention today. First, June retail sales held in a bit better than expected after an upwardly revised May report. Sales were flat in June though economists expected around a 0.3% decline (May revised to 0.4% from 0.3%). The year-over-year rate slowed to 0.5% from a revised 1.3% in May (from 1.2%). The sales tax will be hiked in October. Second, Japan’s Government Pension Investment Fund, one of the largest pension funds in the world, reportedly will increase hedge ratios of its substantial foreign bond investment holdings of US and European bonds. Reports indicate that only around 5% of the international bond portfolio (or JPY1.3 trillion) is hedged.

The US dollar began softer in Asia and steadily recovered. Initially, the dollar slipped to about JPY108.40 but by European morning had returned to unchanged levels around JPY108.70. The intraday technicals suggest today will not be the day that the dollar pushes through the important cap at JPY109.00, where an option for $610 mln is set to expire today. The Australian dollar is pinned near its lows, a hair above $0.6900. Resistance continues to move lower and is now seen in the $0.6910-$0.6920 area. A break could quickly see $0.6865 and then last month’s low just above $0.6830. After a few weeks of near flat-lining, the US dollar rose to three-week highs against the Chinese yuan (~CNY6.8955). It is the third consecutive session, the dollar has risen against the yuan and today’s 0.2% advance is the most since July 5.

Europe

The new UK government wants to show its determination to leave the EU without a deal in less than 100 days to bolster its negotiating position with the EU. It does not appear to be scaring European officials but is scaring investors who are leaving sterling. UK asset prices are faring better as the weaker pound buoys the international-heavy FTSE 100. The prospects of a hard exit bolster the likelihood of a monetary policy response (lower rates and possibly the resumption of QE). The CBI (Confederation of Business Industry) says the EU and the UK are not prepared for a no-deal departure. Johnson has a working majority of just two MPs, and it looks like that may narrow to one seat after the August 1 by-election in Brecon and Radnorshire (Wales), where the Lib-Dems are polling ahead.

The EU reportedly will limit five countries access to its financial markets shortly due to their failure to meet the “equivalence” standard, which is also a warning shot to the UK. Reports suggest that Argentina, Australia, Brazil, Canada, and Singapore will have their access to the UK financial markets curtailed.

Since being whipsawed by Draghi last week, the euro has chopped between $1.1100 and $1.1150. It is in the middle of that range as North American dealers return to their posts. There is an option at $1.11 for roughly 545 mln euros that expires today. The $1.11 level has been tested five or six times since the end of Q1. A break could spur a quick move toward the $1.1065 area, but the $1.10 level would be the next important target. On the upside, a move above the $1.1180-$1.1200 is needed to take the pressure off. Sterling is about two cents lower than it was a week ago. It is struggling to sustain even the most minor upticks but may have exhausted the selling interest for the moment near $1.2320. Immediate resistance is seen in the $1.2350-$1.2360 area. The euro is bouncing back against sterling after the pullback early last week. The nearly 1% gain in the euro over the last two sessions and today has lifted it again above GBP0.9000 and poised to challenge the GBP0.9050 high seen in the middle of July.

America

Ahead of the weekend, President Trump seemed to contradict his economic advisor Kudlow. Using a classic double negative, Trump was quoted saying,” I didn’t say I am not going to do something about the dollar.” Paradoxically, reporters seemed to get more out of it than market participants. The Dollar Index closed higher for the sixth consecutive session before the weekend. Other parts of the capital markets did not reflect perceptions of heightened currency risk for holding dollar-denominated assets. Yields eased, and the S&P 500 closed at record highs. Three-month implied euro vol continued to unwind the gains recorded in the run-up to the ECB meeting. Three-month implied yen declined five of the past six sessions.

The reason that Treasury intervention is remote is that there are formidable practical and operational difficulties, questionable odds of success, and grave risks. Operational challenges include getting the Federal Reserve to cooperate, and if did not, it would undermine the Treasury’s operation. What currency should the Treasury buy for the dollar’s it sells? Leaving aside the negative yields in Europe and Japan, a whisper that the ECB or BOJ are sterilizing the intervention also risk offsetting the impact. The US is one of the few nuclear-armed countries that does not rule out first use. In contrast, India is so determined to signal it will not use them first that it keeps the components separate. Trump is claiming the right to strike first in a real beggar-thy-neighbor currency war (different than pursuing a monetary policy aimed at the domestic economy, which many observers confused for a currency war). As a current account deficit country, which means that the US must import capital, the unforeseen and unintended consequences of unilateral intervention could work against its interests. And if that means higher interest rates, weaker equities, and a slower economy, it could become a factor in the 2020 election. But a successful intervention would not be much better.

The week’s economic calendar begins off slowly. Today’s reports include the Dallas Fed manufacturing index for July (expected -5 after -12) and Mexico’s June unemployment (expected to be little changed around 3.5%). Tomorrow’s US report of June consumption and income figures were already incorporated into last week’s estimate of Q2 GDP. The highlight of the week is the FOMC meeting, the jobs data, and around a third of the S&P 500 companies report earnings this week. Canada’s May monthly GDP report Wednesday may draw interest, and at the end of the week, it is expected to report that its merchandise trade balance slipped back into deficit in June after May’s surplus, the first since last July. Mexico reports Q2 GDP in the middle of the week, and the risk is that it contracted for the second consecutive quarter. Brazil’s central bank meets Wednesday as well and is expected to cut the Selic Rate 25 bp to 6.25%.

The US dollar tested CAD1.32 before the weekend before pulling back. We see the band of resistance extending toward CAD1.3220. The US dollar is consolidating and is finding initial support near CAD1.3150. The intraday technicals warn of the risk of a push higher in the North American morning. The US dollar is inside its pre-weekend range against the Mexican peso, which was inside the range from July 25. The MXN19.00-MXN19.20 band is expected to continue to confine the near-term price action.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,currency war,EUR/CHF,EUR/CHF and USD/CHF,newsletter,USD/CHF