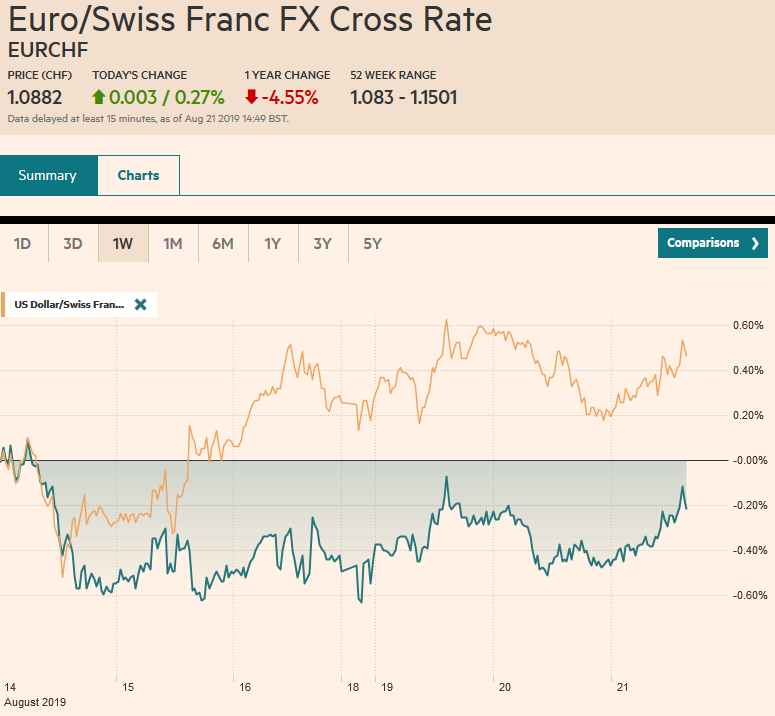

Swiss FrancThe Euro has risen by 0.27% to 1.0882 |

EUR/CHF and USD/CHF, August 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe end of the US equity three-day advance yesterday weighed on Asia Pacific shares today. Most benchmarks fell. Better than expected trade data helped Thailand buck the trend. A firmer tone emerged in the European morning, and the Dow Jones Stoxx 600 has recouped yesterday’s losses and more. It was led higher by consumer discretionary, energy, and industrials. US shares are also trading firmer today, and the S&P 500 is also retracing a good part of yesterday’s 0.8% decline. European bond yields are 2-3 bp firmer, though the possibility that an Italian election is delayed until after the 2020 budget is helping Italian bonds outperform. US Treasury yields are firm, but the 10-year is holding below the 1.60% level. Germany sold a zero-coupon 30-year bond today at a yield of minus 11 bp, though under-subscribed, leaving the Bundesbank to retain about 58% of the two billion euro offer. The dollar is mixed with the Scandis and Canadian dollar enjoying a little strength, but sterling and yen are about 0.2% heavier in quiet turnover. Among emerging markets, central European currencies are underperforming while the liquid and accessible currencies, like the South African rand, Russian rouble, Turkish lira, and Mexican peso are bid. Gold continues to straddle the $1500 area, and oil prices are steady. |

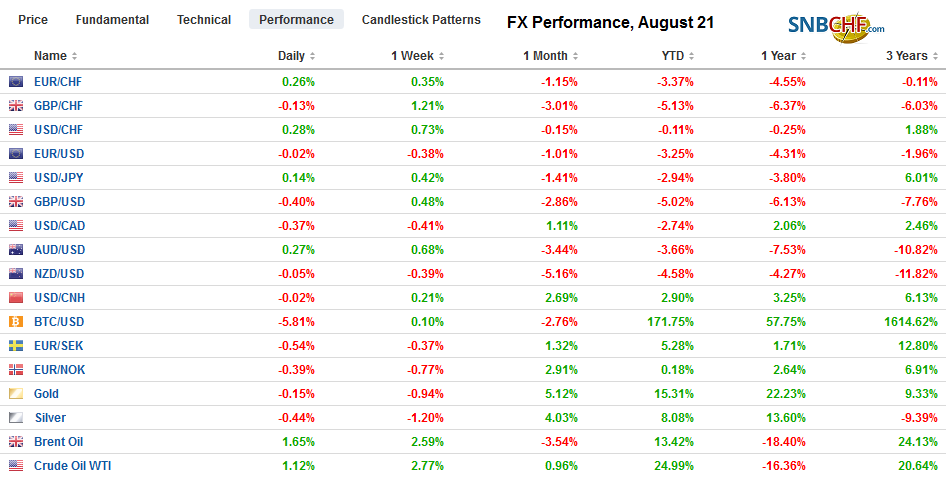

FX Performance, August 21 |

Asia Pacific

The PBOC set the reference rate for the dollar at CNY7.0433, which was a little weaker than the models implied. The offshore yuan (CNH) is firmer for the second session, while the onshore yuan (CNY) slipped lower, extending its decline for the fifth session. The gap between the two has practically closed.

The US Senate Majority Leader McConnell appears to be the most senior US official that has threatened to remove Hong Kong’s special status should the US judge that its autonomy has been eroded. Separately, reports confirm that a UK consulate staff person has been detained in Hong Kong. Meanwhile, Alibaba indicated it may delay its HK listing for a couple of months. Previously, it was going to be this month.

A mixed trade picture is emerging in Asia. Yesterday, Taiwan reported that export orders fell 3% in July, which was about half the pace forecast by the median economist in the Bloomberg survey. This compares with a 4.5% decline in June. Today, Thailand reported a nearly 4.3% rise in July exports, the most in five years. Economists expected a 2% decline. Imports rose 1.6% and had been projected to fall by 6%. However, South Korea‘s figures for the first 20 days in August are more troublesome. Exports fell 13.3% year-over-year, a slight improvement from the 13.8% decline in July. On the month, exports are off 12%. Semiconductor exports fell 30% year-over-year. Shipments to China were a fifth lower than a year ago and almost 9% lower to the US, and 13% to Japan. Imports were 2.4% lower year-over-year. In July imports were 10.3% below year-ago levels, while purchases from Japan were -8.3% and imports from the US were -3.6%.

The dollar is trading inside yesterday’s (~JPY106.15-JPY106.70) range. The $775 mln expiring option at JPY106.75 may discourage a breakout. Initial support now is seen near JPY106.45. The Australian dollar is also inside yesterday’s range and confined to about a 10-tick range on both sides of $0.6780. In fact, the Aussie has been trapped in the range set on August 14 of roughly $0.6735-$0.6810 for the fifth consecutive session. We lean toward an eventual upside break, which would be signaled by a move above $0.6820. On the other hand, the New Zealand dollar continues to leak lower, and without a recovery today, it is poised to record the lowest close since early 2016. There is a nearly NZD$300 mln option struck at $0.6400 that expires today and is very much in play.

Europe

Italian politics are in flux. The never-comfortable coalition of the Five Star Movement and the League has collapsed. League leader Salvini is pushing hard for elections. The idea is that the League’s support seemingly rise on its anti-immigration stance and the polls suggest Salvini could be the next prime minister, perhaps heading up a majority government. The idea, however, is encouraging the center-left PD to reconsider its hostility to an alliance with the Five Star Movement, which it previously rejected. The next step is for President Mattarella to formally grant former Prime Minister Conte a few days or so to see if another majority government from the existing parliament can be forged. The most pressing issue is the 2020 budget. A new government that could deliver this and, possibly political reform as well (e.g., reduce the number of deputies) and plan for elections late this year or early next year is among the favorite scenarios of investors.

Some 88k UK companies will automatically be enrolled in a key customs systems to help minimize the disruption of Brexit. Meanwhile, there is talk that Carney’s replacement at the helm of the Bank of England and the UK’s 2020 budget may be announced after the October 31 exit date. Prime Minister Johnson may push for former Chancellor of the Exchequer Osborne to replace Lagarde as Managing Director of the IMF at the weekend G7 meeting. Bulgarian economist and Chief Executive of the World Bank (since 2017) Georgieva-Kinova is regarded as the odds-on favorite.

Trump’s decision to cancel his trip to Denmark because of its refusal to consider selling Greenland to the US, which was not even formally proposed, has further surprised/shocked Europe and is likely to be an undercurrent at the weekend G7 meeting. Yesterday, Trump again threatened to levy tariffs on European autos. On the other hand, Trump’s suggestion that Russia is invited back to the G7 meetings (G8) after being dis-invited following its annexation of Crimea seemed to find a sympathetic ear in France’s Macron.

For a fourth session, the euro is going nowhere. It is in a $1.1065-$1.1115 range. The market seems reluctant to push it much one way or the other until at least tomorrow’s flash PMI report and, possibly, Powell’s speech at Jackson Hole ahead of the weekend. For a fourth session, sterling is being stymied by offers in the $1.2175 area. The pound closed North America yesterday near $1.2170, the second-highest close of so far in here in August. It has not closed above $1.22 since July 29.

America

President Trump boasts he is not ready to make a deal with China, but the US Secretary of State suggests that a deal is possible ahead of next year’s elections. Separately, despite pronouncement that the US economy is possibly in the best shape ever, the White House is reportedly contemplating a new fiscal stimulus. Among the items being bandied about is a payroll savings tax, like Obama implemented in 2011 and 2012. Also, an old favorite is being dusted off as well, and that is to index capital gains to inflation. Trump claims he could do the latter without congressional approval.

The economic calendar for North America ratchets up a notch today. Canada reports July CPI figures. A 0.2% increase in the headline would see the year-over-year pace slow to 1.7% from 2.0%. This may help fan the increasing speculation that the Bank of Canada will cut rates before the end of the year, despite its neutral stance. That said, the underlying rates of consumer inflation are expected to be steadier. Ahead of the weekend, Canada will report June retail sales. They are expected to have fallen for the second consecutive month. Mexico reports June retail sales today. A small increase is expected after a 0.7% rise in May. Disappointment will likely weigh on the peso more than a pleasant surprise would help it. The US reports existing home sales for July. A recovery is anticipated at a 1.7% decline in June. Last year, the US average pace was 5.34 mln home sales a month. The average in H1 19 has been 5.24 mln. It was at 5.27 mln in June and is expected to have improved to 5.39 mln, which would be the highest since February.

The FOMC minutes from last month’s meeting will be released today. At the end of July, when announcing the first rate cut in more than a decade, Powell framed it as a mid-course correction. Following the end of the second tariff truce, the market rejected the Fed’s framing. The implied yield of the January 2020 fed funds futures contract has fallen about 35 bp since the close shortly after the Fed delivered the cut. At 1.45%, it implies 67 bp in rate cuts this year. One way to see it is that the market has discounted two 25 bp rate cuts and it’s nearly split on a third cut. There has been little indication that the Fed’s view has changed about the mid-course correction. There have been a limited amount of public speeches, but neither Bullard nor Daly, who spoke in recent days hinted a revision of their view. Rosengren, one of the two dissents last month, still remains to be convinced. Three important data points have been plotted since the FOMC met: a solid, even if not spectacular July employment report, an acceleration in inflation (2.8% three-month annualized), and vigorous consumption (1% month-over-month increase in core retail sales).

The Canadian dollar is a little firmer today, but it does not appear to be going anywhere quickly. The US dollar’s upside is being blocked by offers around CAD1.3350, while enthusiasm for Loonie stalls near CAD1.3250. Initial support today is seen near CAD1.3280. The Mexican peso is also enjoying a slightly firmer tone today. It takes a move below MXN19.50 to boost the chances that a dollar high is in place.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,EUR/CHF,Federal Reserve,Italy,newsletter,USD/CHF