Found 1,867 search results for keyword: label

CEOs Profit as Workers Suffer from Pandemic, says Union

While the Covid-19 pandemic has caused existential hardship for many employees, CEOs and shareholders have “shamelessly helped themselves”, according to a union study. “The pay gap remains wide open at a very high level,” trade union Unia wrote in its annual pay gap studyExternal link published on Tuesday.

Read More »

Read More »

UBS Boss says Switzerland is Falling Behind on Structural Change

Swiss banks have some catching up to do when it comes to structural change and digitalisation, says Ralph Hamers, CEO of Swiss bank UBS. In his opinion structural change has taken place much faster in other countries and industries than in Switzerland.

Read More »

Read More »

Airbus Launches Counter-Offensive on Fighter Jet Contract

Ahead of the Swiss government’s decision on a major fighter jet contract, Airbus has made an appeal to the Swiss government to choose a European firm after leaked information from the government revealed US firm Lockheed Martin was out ahead of competitors.

Read More »

Read More »

Switzerland’s Battle of the Bees

The risk to bees through pesticides and the ensuing effects on the world’s food crops have been the source of much debate. But do Swiss measures to support the domestic honeybee disadvantage the equally important wild bee?

Read More »

Read More »

‘Switzerland can’t have its cake and eat it,’ says EU ambassador

After rejecting the framework agreement with the European Union last month, Switzerland must now choose the model for interacting with the bloc’s internal market, says the EU ambassador to Switzerland. In an interviewExternal link with Le Temps newspaper on Friday, Petros Mavromichalis warned that the status quo was not an option for the EU.

Read More »

Read More »

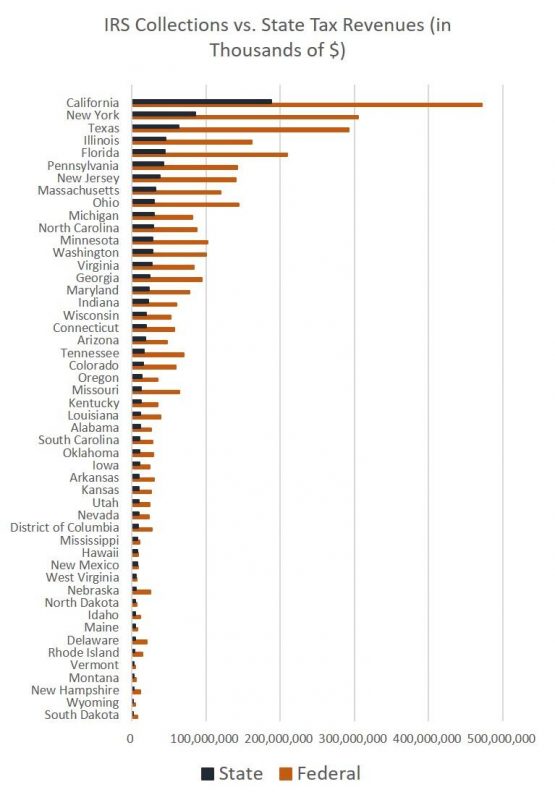

The Feds Collect Most of the Taxes in America—So They Have Most of the Power

In 2021, it's clear Americans now have thrown off any notions of subsidiarity and instead embraced the idea that the federal government should be called upon to fund pretty much anything and everything. From "stimulus checks" to "paycheck protection," it's assumed an entire national workforce can be propped up by federal spending.

Read More »

Read More »

Webkonferenz – 24.06.2021: Kapitalmarktausblick mit Dr. Jens Ehrhardt & Markus Koch

Wenn man wie Dr. Jens Ehrhardt über mehr als 50 Jahre Kapitalmarkterfahrung verfügt, so durchblickt man möglicherweise schneller die vordergründigen Ereignisse – etwa welchen Einfluss die Wiederkehr der Inflation auf die Märkte hat.

Denn in der Vermögensanlage kommt es vielmehr auf die langwelligen Muster und wesentlichen Faktoren an, die die Märkte bewegen. Zum Beispiel die vorhandene Liquidität an den Märkten oder der Gegensatz der Systeme....

Read More »

Read More »

How the Swiss-based WHO BioHub is preparing for future pandemics

The creation of a global repository in Switzerland to store, analyse and quickly share viruses and pathogens among laboratories around the world will better prepare us for the next pandemic, says a biologist working at the future BioHub site.

Read More »

Read More »

Steady increase of cross-border workers continued in 2020

The number of cross-border workers plying their trade in Switzerland has more than doubled since the mid-1990s. The rising trend continues, increasing by over 4% between 2019 and 2020. At the end of 2020, some 343,000 cross-border workers were employed in Switzerland, up from 329,000 in December 2019, the Federal Statistical Office (FSO) said on Thursday.

Read More »

Read More »

Swiss turning to new payment methods, but cash is still king

The use of debit cards continues to increase but cash remains the most popular payment method in Switzerland. A survey by the Swiss National Bank (SNB) found that 97% of respondents keep cash in their wallets or at home to cover day-to-day expenses, while 92% own a debit card and 78% hold a credit card, according to a press release External linkon Wednesday.

Read More »

Read More »

Covid-19 sent Swiss Energy Consumption Plummeting in 2020

The Swiss consumed almost 11% less energy last year due to the Covid-19 pandemic and warmer weather, according to the Federal Office of Energy. In total, Swiss residents used up 747,400 terajoules (TJ) of energy in 2020 – a fall of 10.6% compared to 2019 - the office said in a statementExternal link on Monday.

Read More »

Read More »

Swiss Cities Demand end to Opaque Cantonal Tax Competition

The proposed 15% minimum corporate tax rate is an opportunity for Switzerland to unite its tax code for the better, says an organization representing Swiss cities. City finance directors have criticized cantons for trying to plug expected tax gaps unilaterally, rather than find a common approach nationwide.

Read More »

Read More »

DJE-plusNews Juni 2021 mit Mario Küzel: Die globale Konjunktur läuft Weltweit weiter gut

In dem monatlich stattfindendem DJE-plusNews reflektiert Mario Künzel, Leiter Vertrieb Retail Business, die Marktgeschehnisse der vergangenen vier Kalenderwochen und gibt Ihnen einen Ausblick auf die kommenden Wochen.

#News #Aktien #Fonds #Investment #Märkte

Seit über vier Jahrzehnten setzt die DJE Kapital AG Maßstäbe in der Vermögensverwaltung und in Fonds.

Die DJE Kapital AG (DJE) ist seit 45 Jahren als unabhängige Vermögensverwaltung am...

Read More »

Read More »

Swiss economy on way back to normal, says top treasurer

Switzerland’s economy will be back to its pre-pandemic level as early as this year and does not need a stimulus package, says Sabine D'Amelio-Favez, director of the Federal Finance Administration. The Confederation has incurred debts of CHF30 billion ($33 billion) to stem the economic consequences of Covid-19, she said in an interview published on Saturday by newspapers of the CH Media group.

Read More »

Read More »

Credit Suisse carnage brings financial risk for banks into focus

Credit Suisse’s disastrous Greensill and Archegos investments have highlighted the destructive side of banking. Regulators and politicians are asking what the Swiss bank did wrong and what can be done to protect investors from future risk-assessment failures.

Read More »

Read More »

Switzerland commits CHF12 million to humanitarian aid in Venezuela

This year Switzerland will provide more than CHF12 million ($13 million) in humanitarian aid to Venezuela and the region, it said at the Donors’ Conference in Solidarity with Venezuelan Refugees and Migrants.

Read More »

Read More »

Podcast mit Hagen Ernst: Knappes Gut: Wohnimmobilien bleiben weiterhin sehr gefragt

Immobilien gelten in Deutschland als ein sicheres Investment. Trotz gestiegener Risiken wie Zinsen oder Regulierung bleiben Wohnimmobilien attraktiv – zudem locken hohe Abschläge zum inneren Wert bei Immobilienaktien. Doch gerade der Bereich Wohnimmobilien war zuletzt stark im Fokus der medialen und politischen Aufmerksamkeit. Welche Auswirkungen haben diese Entwicklungen auf den Anleger und wie steht es aktuell um Immobilienaktien? Zu Gast im...

Read More »

Read More »

Swiss Banks Boost Capital Bases Despite Coronavirus Crisis

Swiss banks have been able to strengthen their capital bases despite deteriorating economic conditions during the coronavirus pandemic, according to the Swiss National Bank (SNB). This applies to the two big banks, UBS and Credit Suisse, and also domestic banks.

Read More »

Read More »

Swiss among last to embrace wind and solar power

Switzerland is lagging behind most European countries when it comes to solar and wind power. In terms of per capita production, it ranks second to last in comparison with surrounding countries, according to the Swiss Energy Foundation (SES).

Read More »

Read More »

A plea to Swiss banks from the Russian Arctic

Swiss banks might not be the most obvious allies for indigenous communities struggling to survive in Russia’s Far North. But their financial clout could drive multinationals to change their business practices, argue those affected by a major environmental disaster last year.

Read More »

Read More »