Category Archive: 2) Swiss and European Macro

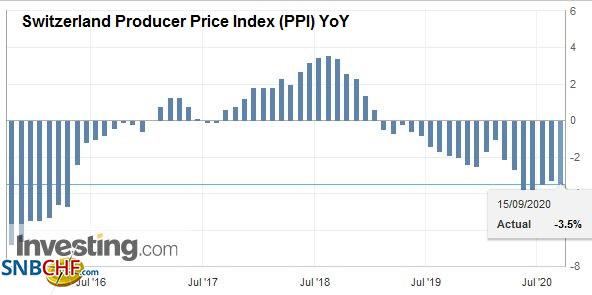

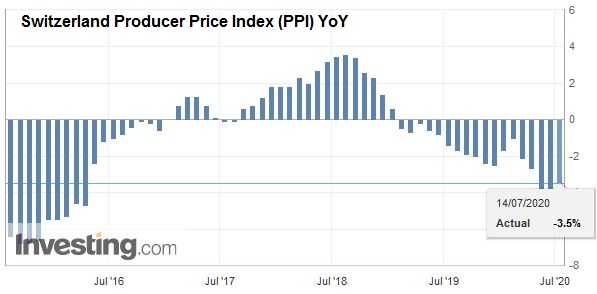

Swiss Producer and Import Price Index in August 2020: -3.5 percent YoY, -0.4 percent MoM

The Producer and Import Price Index fell in August 2020 by 0.4% compared with the previous month, reaching 97.9 points (December 2015 = 100). This decline was due in particular to lower prices for chemical and pharmaceutical products. Compared with August 2019, the price level of the whole range of domestic and imported products fell by 3.5%.

Read More »

Read More »

House View, September 2020

A surge in new covid-19 cases in a number of countries has interrupted progress towards normality, yet the effects of the virus are becoming more manageable and positive world H2 growth is achievable.

Read More »

Read More »

Weekly View – Election nerves increase

The sell-off in stocks last week showed a certain nervousness about the sharp run-up in tech stocks and the role of big option bets. Indeed, prices in some instances had risen too fast. But this was a technical correction. With the US tech titans generating free cash flow, we do not believe we are facing a repeat of the bursting of the dot-com bubble in 2000.

Read More »

Read More »

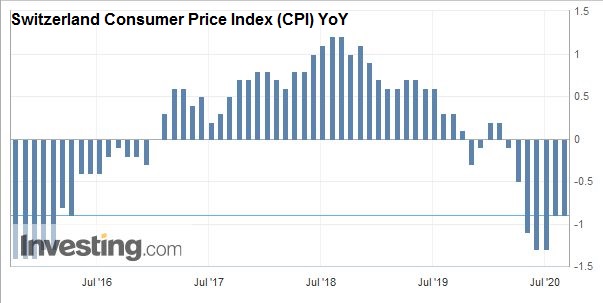

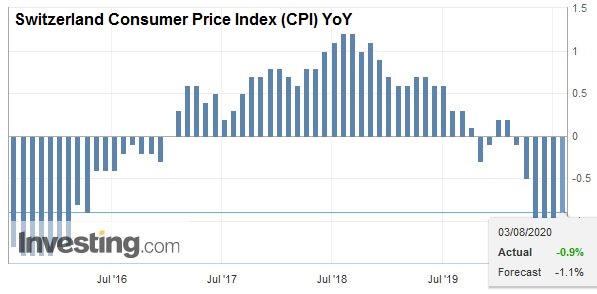

Swiss Consumer Price Index in August 2020: -0.9 percent YoY, 0.0 percent MoM

The consumer price index (CPI) remained stable in August 2020 compared with the previous month, reaching 101.2 points (December 2015 = 100). Inflation was –0.9% compared with the same month of the previous year.

Read More »

Read More »

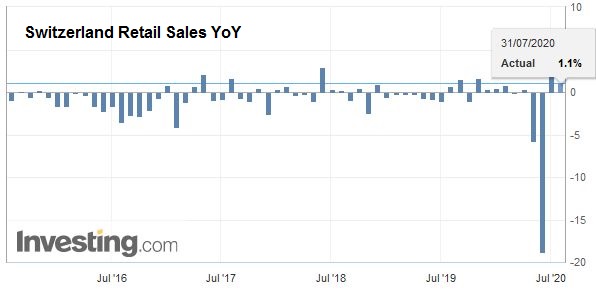

Swiss Retail Sales, July 2020: 3.4 percent Nominal and 4.1 percent Real

Turnover adjusted for sales days and holidays rose in the retail sector by 3.4% in nominal terms in July 2020 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.7% compared with the previous month.

Read More »

Read More »

Weekly View – The Last Samurai

The CIO office’s view of the week ahead.We are in the midst of a decisive elections season, from the surprise, poll-defying victory of the conservative coalition in Australia and Indian general elections last weekend to the European parliament elections in the week ahead.

Read More »

Read More »

Rise of 380 000 jobs in tertiary sector between 2011 and 2018

28.08.2020 - In 2018, almost 70 000 additional jobs were counted in Switzerland, bringing the total to more than 5.2 million. As in the previous years, the tertiary sector, which accounted for some 4 million jobs in 2018, contributed greatly to this increase with a +1.5% rise in employment.

Read More »

Read More »

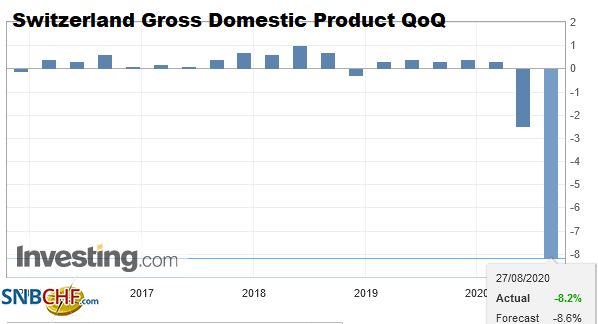

Switzerland GDP Q2 2020: -8.2 percent QoQ, -9.3 percent YoY

Switzerland’s GDP fell by –8.2 % in the 2nd quarter of 2020, after decreasing by –2.5 % (revised) in the previous quarter.* Domestic economic activity was severely restricted in the wake of the pandemic and the measures are taken to contain it. The global economy also plunged into a sharp recession. However, Switzerland’s GDP decline remained limited in an international comparison.

Read More »

Read More »

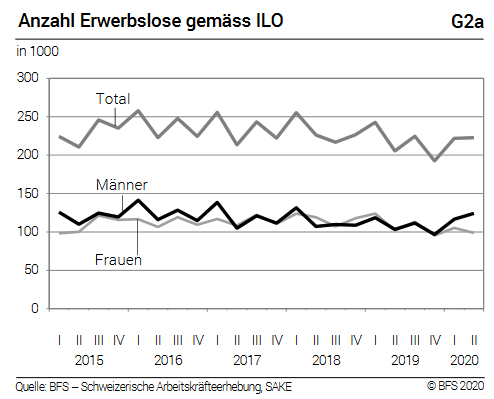

Swiss labor force survey in the 2nd quarter of 2020: labor supply

The number of employed persons in Switzerland fell by 1.6% (–82 000) between the 2nd quarter 2019 and the 2nd quarter 2020. Furthermore, the actual weekly hours per employed person declined by 9.5%.

Read More »

Read More »

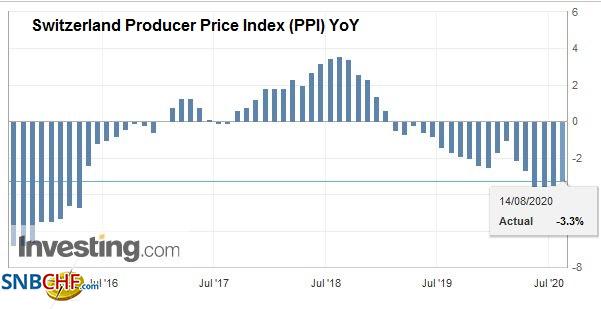

Swiss Producer and Import Price Index in July 2020: -3.3 percent YoY, +0.1 percent MoM

The Producer and Import Price Index rose in July 2020 by 0.1% compared with the previous month, reaching 98.3 points (December 2015 = 100). The rise is due in particular to higher prices for petroleum products. Compared with July 2019, the price level of the whole range of domestic and imported products fell by 3.3%.

Read More »

Read More »

House View, August 2020

We have revised up our euro area GDP forecast for 2020 to -8.5%, mainly due to improving data in Germany, which is better positioned to recover rapidly from the downturn than its European peers. Meanwhile, the US economy has shown signs of flatlining amid escalating covid-19 cases in the South. Consumer confidence has taken a hit, while weekly unemployment claims have been rising again.

Read More »

Read More »

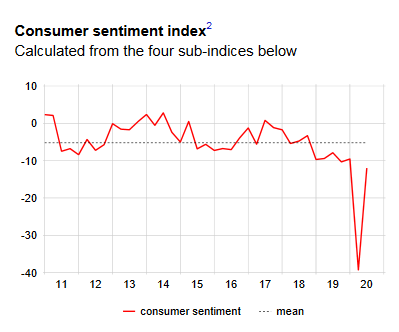

Swiss Consumer sentiment makes a strong recovery but remains below average

Consumer sentiment in Switzerland has largely recovered from its slump in April. Expectations regarding general economic development have improved, but those regarding the labour market remain very negative. Accordingly, respondents believe that now is not a good time to make major purchases.

Read More »

Read More »

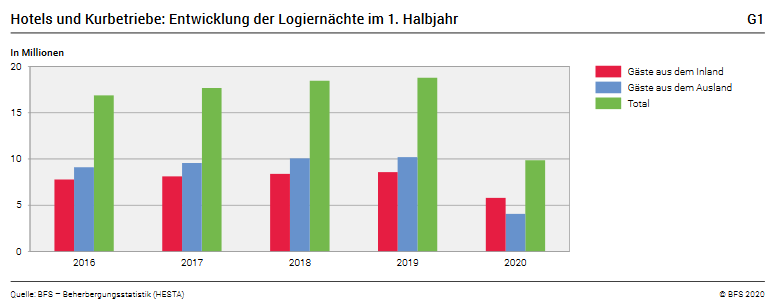

Record fall in overnight stays in first half of 2020

Record fall in overnight stays in first half of 2020The hotel sector registered 9.9 million overnight stays in Switzerland in the first half of 2020, representing a decline of 47.5% (– 8.9 million overnight stays) compared with the same period a year earlier. With a total of 4.1 million overnight stays, foreign demand dropped by 60.1% (– 6.1 million).

Read More »

Read More »

Horizon 2020: long-term investing in a world marked by pandemic

The sudden, violent recession triggered by this year’s covid-19 outbreak provides further impetus to pre-existing economic and market dynamics.

Read More »

Read More »

Swiss Consumer Price Index in July 2020: -0.9 percent YoY, -0.2 percent MoM

The consumer price index (CPI) fell by 0.2% in July 2020 compared with the previous month, reaching 101.2 points (December 2015 = 100). Inflation was –0.9% compared with the same month of the previ-ous year.

Read More »

Read More »

Swiss Retail Sales, June 2020: 0.4 percent Nominal and 1.1 percent Real

Turnover adjusted for sales days and holidays rose in the retail sector by 0.4% in nominal terms in June 2020 compared with the previous year. Seasonally adjusted, nominal turnover fell by 3.6% compared with the previous month.

Read More »

Read More »

Weekly view – The summer grind

All kinds of reasons can be advanced for the tit-for-tat closure of the Chinese consulate in Houston and its US equivalent in Chengdu. These range from a dispute over quarantine requirements for US diplomats returning to China to an attempt by the Trump Administration to distract from troubling virus news and a real threat to American intellectual property and privacy.

Read More »

Read More »

Weekly view – Fog warning

Coronavirus cases in the US are rising and high frequency data in the US such as retail foot traffic and employee working hours have flatlined. Meanwhile, in Q2 results, USD36 bn in trading and fixed-income revenues managed to make up for higher loan provisions for US banks.

Read More »

Read More »

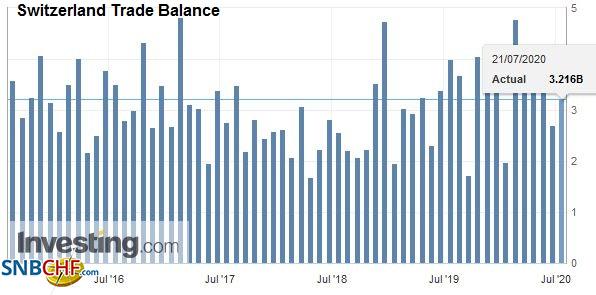

Swiss Trade Balance Q2 2020: historic decline in exports and imports

Swiss foreign trade recorded a record decline in the second quarter of 2020. In seasonally adjusted terms, exports plunged by 11.5% compared to the previous quarter and imports even by 16.0%. This result stems from the traffic collapse recorded in April in the wake of the coronavirus pandemic, with May and June having regained some color. The trade balance closed with a record surplus of 9.6 billion francs.

Read More »

Read More »

Swiss Producer and Import Price Index in June 2020: -3.5 percent YoY, +0.5 percent MoM

14.07.2020 - The Producer and Import Price Index rose in June 2020 by 0.5% compared with the previous month, reaching 98.1 points (December 2015 = 100). The rise is due in particular to higher prices for petroleum products as well as petroleum and natural gas. Compared with June 2019, the price level of the whole range of domestic and imported products fell by 3.5%.

Read More »

Read More »