Category Archive: 2) Swiss and European Macro

Price indices’ upgrade includes addition of an official residential property price index

From 2021, the price indices published by the Federal Statistical Office (FSO) will be armed with an updated methodology that reflects market changes as closely as possible. Furthermore, a new price index will be added to the existing set, measuring residential property price change, which will be published on a quarterly basis.

Read More »

Read More »

Employment in Switzerland continued to fall in 3rd quarter

26.11.2020 - In the 3rd quarter 2020, total employment (number of jobs) fell by 0.4% in comparison with the same quarter a year earlier (+0.5% with previous quarter). In full-time equivalents, employment in the same period declined by 0.1%. The Swiss economy counted 11 900 fewer vacancies than in the corresponding quarter of the previous year (–15.1%) with the employment outlook indicator also indicating a downward trend (-2.3%).

Read More »

Read More »

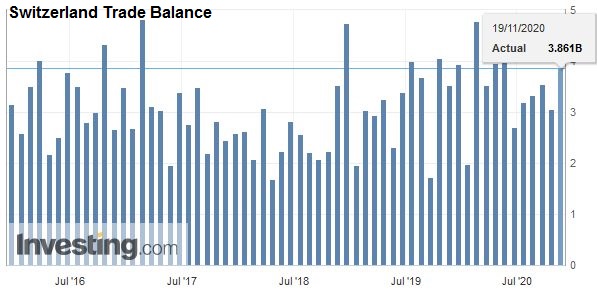

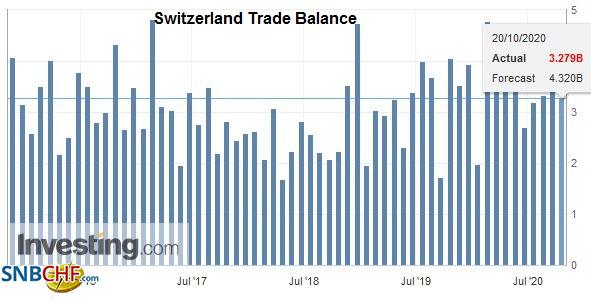

Swiss Trade Balance October 2020: foreign trade falters

In October 2020, Swiss foreign trade took off. In seasonally adjusted terms, exports stagnated (-0.4%) while imports fell 3.3%. The slowdown recorded since this summer in both directions of traffic has thus been confirmed. The trade balance closed with a surplus of 2.9 billion francs.

Read More »

Read More »

House View, November 2020

The upsurge in covid-19 cases will likely hurt global economic prospects in the current quarter. With a Democrat 'blue wave' failing materialise in the US elections, hopes of a substantial spending bill have faded and there is risk that US household incomes suffer as existing support measures fade. In the meantime, covid-19 infections continue surge in the US.

Read More »

Read More »

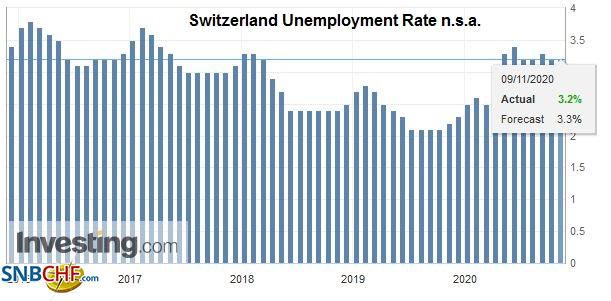

Switzerland Unemployment in October 2020: remained at 3.2percent, seasonally adjusted fallen to 3.3percent

Registered unemployment in October 2020 - According to surveys by the State Secretariat for Economic Affairs (SECO), 149,118 unemployed people were registered with the regional employment centers (RAV) at the end of October 2020, 558 more than in the previous month. The unemployment rate remained at 3.2% in the month under review. Compared to the same month last year, unemployment increased by 47,434 people (+ 46.6%).

Read More »

Read More »

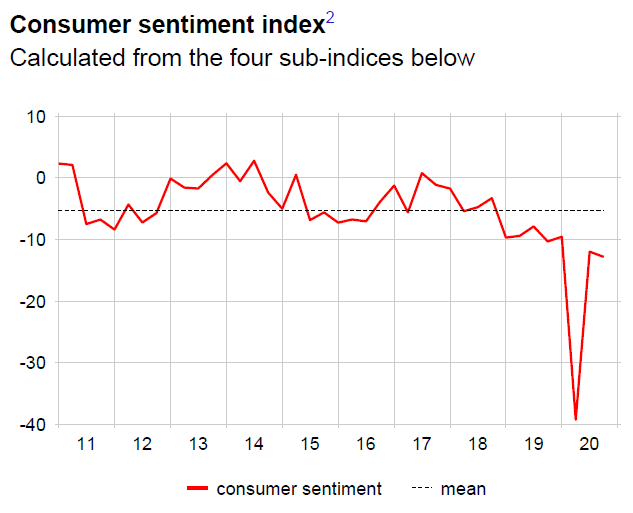

Swiss Consumer sentiment: No further recovery of consumer sentiment

Consumer sentiment in Switzerland has largely been stagnating since the summer. All sub-indices used for the calculation are still below their long-term average and none have improved significantly compared to this summer’s survey. Economic development and the situation on the labour market are seen as unfavourable.

Read More »

Read More »

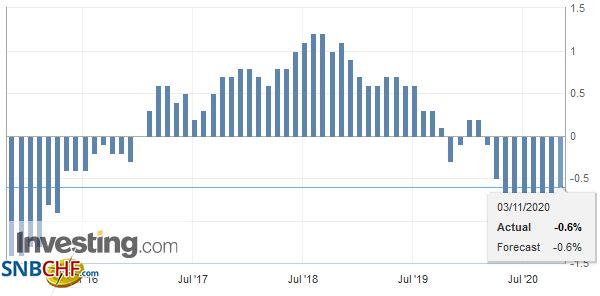

Swiss Consumer Price Index in October 2020: -0.6 percent YoY, 0.0 percent MoM

The consumer price index (CPI) remained stable in October 2020 compared with the previous month, remaining at 101.2 points (December 2015 = 100). Inflation was –0.6% compared with the same month of the previous year.

Read More »

Read More »

Swiss Retail Sales, September 2020: 0.3 percent Nominal and 0.3 percent Real

30.10.2020 - Turnover adjusted for sales days and holidays rose in the retail sector by 0.3% in nominal terms in September 2020 compared with the previous year. Seasonally adjusted, nominal turnover fell by 3.6% compared with the previous month.

Read More »

Read More »

Weekly View – A sure thing

Signs from last week’s SURE programme to finance partial unemployment schemes are highly encouraging for the EU’s plans for recovery fund issuance which could start, we believe, in mid-2021. Last week’s SURE issue was close to 14 times oversubscribed at a rate lower than that for French government bonds of comparable duration.

Read More »

Read More »

World Data Forum: strong international cooperation for quality data

22.10.2020 - The United Nations World Data Forum took place from 19 to 21 October 2020 in digital format due to COVID-19. The event brought together several thousand experts to find innovative solutions in order to meet the need for better quality data to implement the 2030 Agenda and to control the pandemic.

Read More »

Read More »

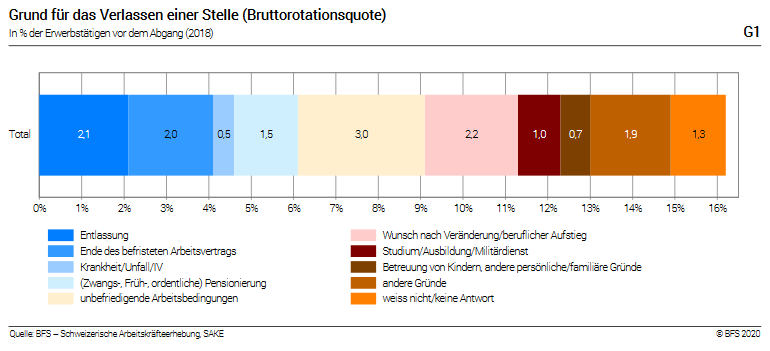

Occupational mobility: nearly 20 percent of employed persons left their job between 2018 and 2019

22.10.2020 - In Switzerland, 19.2% of people who pursued a professional activity left their job between 2018 and 2019. Mobility is particularly strong among young people, people with a fixed-term contract or working in the hotel and restaurant sector.

Read More »

Read More »

Swiss Trade Balance Q3 2020: foreign trade regains color

After its historic decline in the second quarter, Swiss foreign trade showed a clear recovery in the third quarter of 2020. In seasonally adjusted terms, exports swelled by 6.5% and imports by 11.5%. The two traffic departments, however, remained well below their record level for the second quarter of 2019. The trade balance closed with a surplus of 8.2 billion francs.

Read More »

Read More »

Weekly View – Biden time for markets

Donald Trump’s poll numbers were looking increasingly unhealthy at the time of writing, but at least the cocktail of drugs administered to the coronavirus-stricken President appears to have worked.

Read More »

Read More »

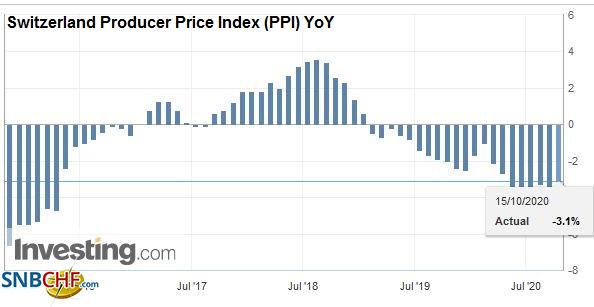

Swiss Producer and Import Price Index in September 2020: -3.1 percent YoY, +0.1 percent MoM

The Producer and Import Price Index rose in September 2020 by 0.1% compared with the previous month, reaching 98.0 points (December 2015 = 100). The rise is due in particular to higher prices for scrap as well as for basic metals and semi-finished metal products.

Read More »

Read More »

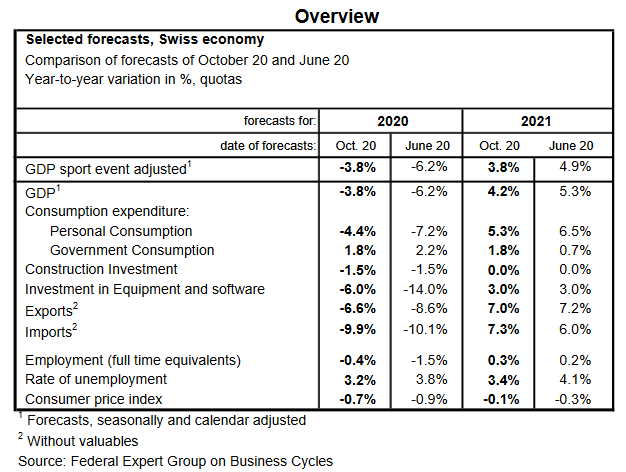

Forecast: 2020 economic slump less serious than feared

The Expert Group is expecting GDP adjusted for sporting events to fall by 3.8 % in 2020 and unemployment to average 3.2 % over the year as a whole. Prospects for 2020 are therefore less negative than feared in the middle of the year. The momentum is likely to weaken as time goes on.

Read More »

Read More »

House View, October 2020

Rising coronavirus cases accompanied by flagging recovery momentum and a fractious run-up to the US elections make prospects for equities highly reliant on 3Q results and further policy stimulus. Against this background we have downgraded our stance on euro area equities from neutral to underweight, following a similar downgrade for US equities in August.

Read More »

Read More »

Swiss Retail Sales, August 2020: 1.6 percent Nominal and 2.5 percent Real

Turnover adjusted for sales days and holidays rose in the retail sector by 1.6% in nominal terms in August 2020 compared with the previous year. Seasonally adjusted, nominal turnover fell by 2.1% compared with the previous month.

Read More »

Read More »

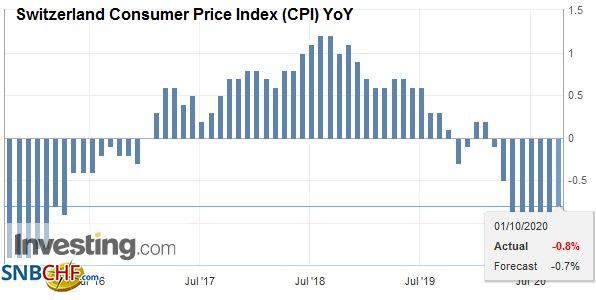

Swiss Consumer Price Index in September 2020: -0.8 percent YoY, 0.0 percent MoM

The consumer price index (CPI) remained stable in September 2020 compared with the previous month, reaching 101.2 points (December 2015 = 100). Inflation was –0.8% compared with the same month of the previous year.

Read More »

Read More »

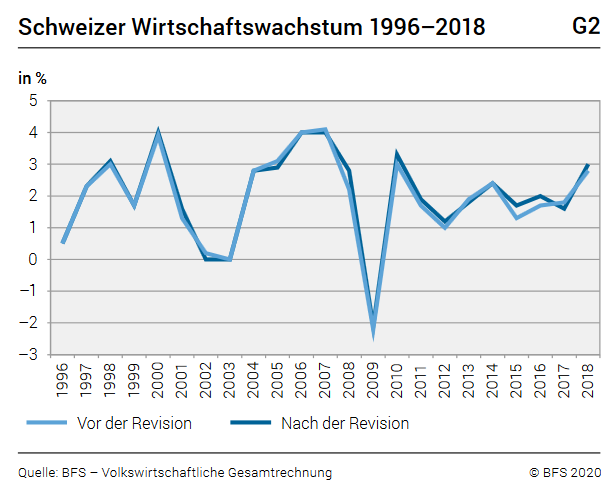

GDP level corrected from 2.8 percent to 3.6 percent between 1995 and 2017 following revision of the national accounts

The results of the national accounts published by the Federal Statistical Office (FSO) have been revised upwards. New data series are available for the period 1995 to 2019. This revision was carried out in collaboration with the sector responsible for quarterly estimates at SECO, provides methodological improvements and takes into consideration new data.

Read More »

Read More »

Weekly View – No breakfast at Tiffany’s

The impact of political tensions on business is ever more apparent: LVMH of France will not, after all, proceed with the purchase of Tiffany of the US. If, as seems likely, the hand of the French government was involved, this is solid evidence that political sensitivities are increasingly influencing cross-border deals – something that is likely to remain the case just as M&A in general has been declining.

Read More »

Read More »