Category Archive: 1) SNB and CHF

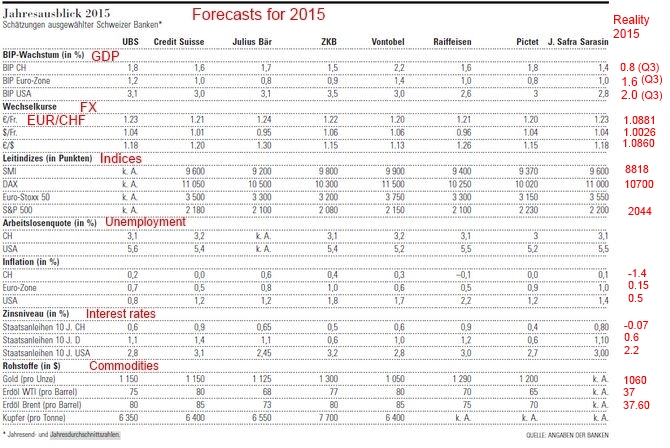

Economic Forecasts for 2015: Swiss Banks were too Optimistic

Our analysis of the forecasts of economic data for 2015 shows that the Swiss banks were too optimistic for most data. US growth, the oil price, inflation and interest rates are far lower than expected. The errors for stock indices were smaller.

Read More »

Read More »

The year explained: Our ten most popular explainers from 2015

EVERY weekday The Economist explains a new subject, topical or timeless, profound or peculiar. As the end of the year approaches, we look back at the explanations that have proved most popular with readers during 2015. (Normal service will resume on January 4th.)

Read More »

Read More »

Monetary assessment meeting Swiss National Bank

Monetary assessment meeting Swiss National Bank: My real-time tweets contain the main important points of the SNB meeting from the view of investors or FX traders.

Read More »

Read More »

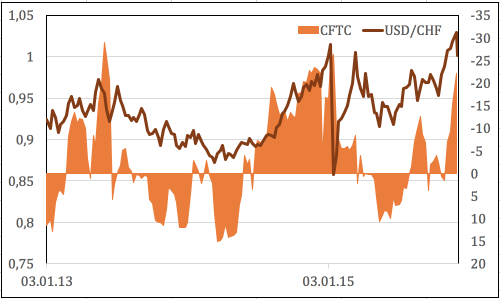

Will The Franc Follow In The Euro’s Footsteps?

The SNB's expected December 10 rate cuts have already been priced in to the Swiss Franc.

The central bank's failure to do more than the market expected resulted in a stronger CHF.

Growing uncertainty over the Fed's 2016 monetary policy is a bullish factor for the franc.

Read More »

Read More »

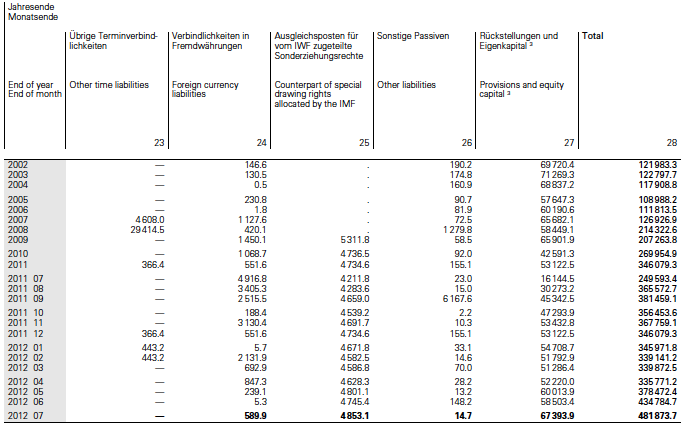

SNB’s history of balance sheet and Monthly bulletin

The SNB monthly bulletins contain all important data of the SNB and the Swiss economy as of the latest quarter.

Read More »

Read More »

Que dire des scenarios catastrophes FINMA versus Caisses de pensions ?

Think Tank 2015: Le Think Tank Cronos (laboratoire d’idées à but non lucratif) a été créé en 2011 pour susciter échanges et réflexions sur une étape autant élémentaire que fragile du processus d’investissement d’une caisse de pensions: la détermination de sa capacité à prendre des risques.

Read More »

Read More »

Dollar Recoups January Loss Against the Swiss Franc

The US dollar recorded its high for the year against the Swiss franc on January 14 near CHF1.0240. It closed that day a little below CHF1.0190. The next day the Swiss National Bank surprised the world by lifting its cap against the euro. The ...

Read More »

Read More »

FINMA и FinTech

Как Служба по контролю за финансовыми рынками Швейцарии относится к финансово-технологическим компаниям? Клод Жентиль, BrainServe Ltd. Вы можете посмотреть это видео и полный видео-архив на нашей Dukascopy TV странице: http://www.dukascopy.com/tv/ru/#166391 Watch Dukascopy TV in your language: https://www.youtube.com/user/dukascopytv 用您的语言观看杜高斯贝电视: http://www.youtube.com/user/dukascopytvchinese Miren Dukascopy TV en su idioma:...

Read More »

Read More »

FINMA & FinTech

Wie positioniert sich FINMA bezüglich FinTech? Claude Gentile, BrainServe Ltd Sie können dieses Video und das gesamte Video Archive auf der Dukascopy TV Seite ansehen: http://www.dukascopy.com/tv/de/#166391 Watch Dukascopy TV in your language: https://www.youtube.com/user/dukascopytv Смотрите Dukascopy TV на вашем языке: http://www.youtube.com/user/dukascopytvrussian 用您的语言观看杜高斯贝电视: http://www.youtube.com/user/dukascopytvchinese Miren Dukascopy TV...

Read More »

Read More »

Thomas Jordan – SNB-Präsident – Starker Franken und die Geldpolitik der SNB

Prof. Dr. Thomas Jordan die Fäden unserer Geldpolitik fest in seiner Hand. Die Aufhebung des Mindestkurses zum Euro hat er als unumgänglich bezeichnet. Dass sich damit gewisse Engpässe für die Schweizer Wirtschaft – zumindest vorübergehend – ergeben haben, bestreitet er nicht, hält diesen Umstand aber in Anbetracht «der Kosten zur Verteidigung der Untergrenze, die in …

Read More »

Read More »

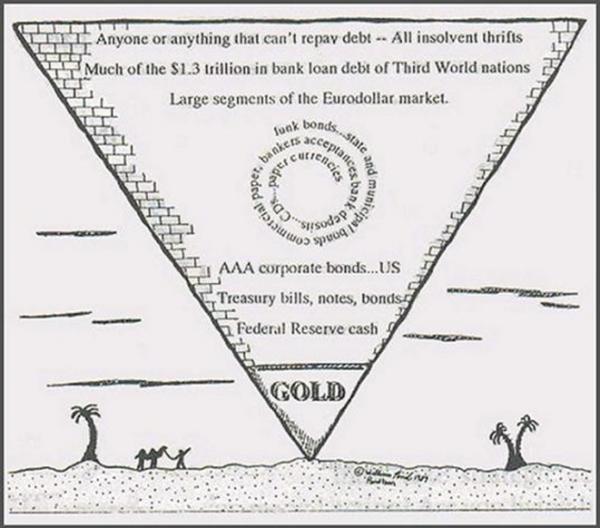

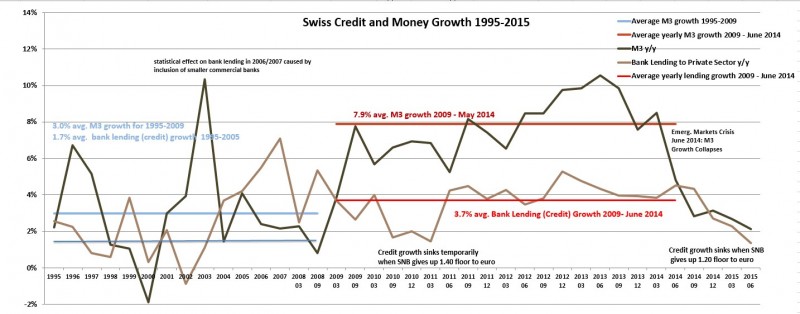

The 2015 Update: Risks on the Rising SNB Money Supply

We explain the risks on the rising money supply in Switzerland. We distinguish between broad money supply (M1-M3) and narrow money supply (M0). Both are rising quickly.

Read More »

Read More »

Jordan’s “Does the SNB need equity?”, an assault on the Swiss constitution?

Marc Meyer argues that the Swiss National Bank must build up reserves, but this does not mean "foreign exchange reserves", but "Swiss Franc reserves". According to the constitution these reserves are owners' equity denominated in Swiss Franc and some gold. Thomas Jordan famous paper "Does the SNB need equity?" tries to overturn the constitution suggesting that the constitution accepts FX investments as "reserves".

Russia builds up foreign...

Read More »

Read More »