Category Archive: 1) SNB and CHF

Swiss Perfectionism

In Der Bund, Adrian Sulc comments on the Swiss National Bank’s perfectionism. Keine andere Schweizer Organisation kommuniziert so professionell wie die SNB, keine andere Organisation kann so gut dichthalten.

Perfectionism is costly. Der Personalbestand ist in den letzten fünf Jahren um 18 Prozent auf 795 Vollzeitstellen gestiegen. … Die durchschnittlichen Lohnkosten pro Mitarbeiter betragen mittlerweile 155 000 Franken pro Jahr. Dies weil gemäss...

Read More »

Read More »

Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm.

Read More »

Read More »

News conference Swiss National Bank, Thomas Jordan

It is a pleasure for me to welcome you to the Swiss National Bank’s news conference. I will begin by explaining our monetary policy decision and our assessment of the economic situation. I will then hand over to Fritz Zurbrügg, who will speak about current developments in the area of financial stability. After that, Andréa Maechler will review the situation on the financial markets and the progress in reference interest rate reform. Finally, we...

Read More »

Read More »

SNB Monetary Assessment Dec 2017, Introduction

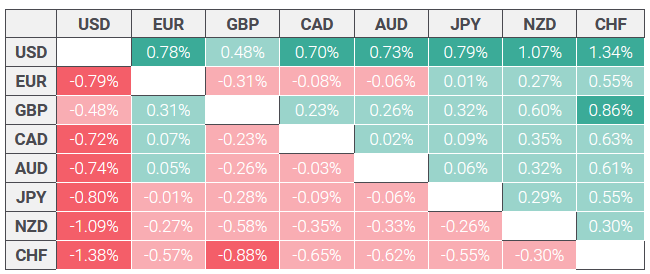

The monetary policy pursued by the large central banks was once again the focus of attention for the financial markets in the second half of the year. Given moderate inflation growth, financial market participants are expecting only a very gradual normalisation of monetary policy across the world. Against this backdrop, government bond yields have remained persistently low. Muted expectations regarding a move away from expansionary monetary policy,...

Read More »

Read More »

News conference Swiss National Bank 2017, Fritz Zurbrügg

In my remarks today, I would like to address some of the developments currently taking place in the field of financial stability. I shall look at the big banks first before turning to the domestically focused banks. I will conclude with a few words on the new banknote series.

Read More »

Read More »

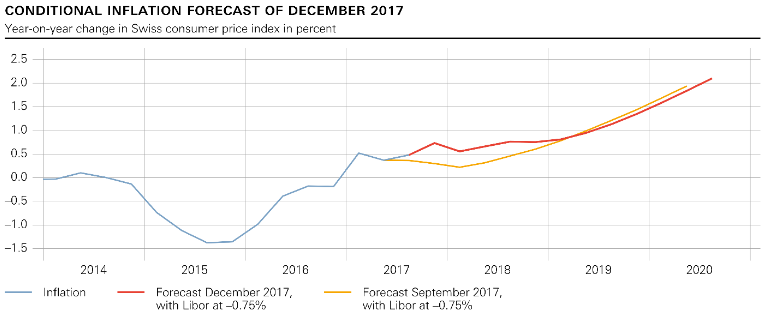

SNB Monetary policy assessment of 14 December 2017

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

The Latte Index: Using The Impartial Bean To Value Currencies

Like any other market, there are many opinions on what a currency ought to be worth relative to others. With certain currencies, that spectrum of opinions is fairly narrow. As an example, for the world’s most traded currency – the U.S. dollar – the majority of opinions currently fall in a range from the dollar being 2% to 11% overvalued, according to organizations such as the Council of Foreign Relations, the Bank of International Settlements, the...

Read More »

Read More »

Comment les cédules hypothécaires suisses alimentent le marché européen des produits dérivés

Beaucoup d’emprunteurs ne se rendent pas compte qu’en concluant le contrat, ils acceptent que leur hypothèque soit transmise à des tiers. […] Les clauses de transmission de l’hypothèque à des tiers sont pratique courante, comme il ressort de nos prises de renseignement auprès [d’UBS,] Credit Suisse, Banque cantonale de Zurich et Raiffeisen.

Read More »

Read More »

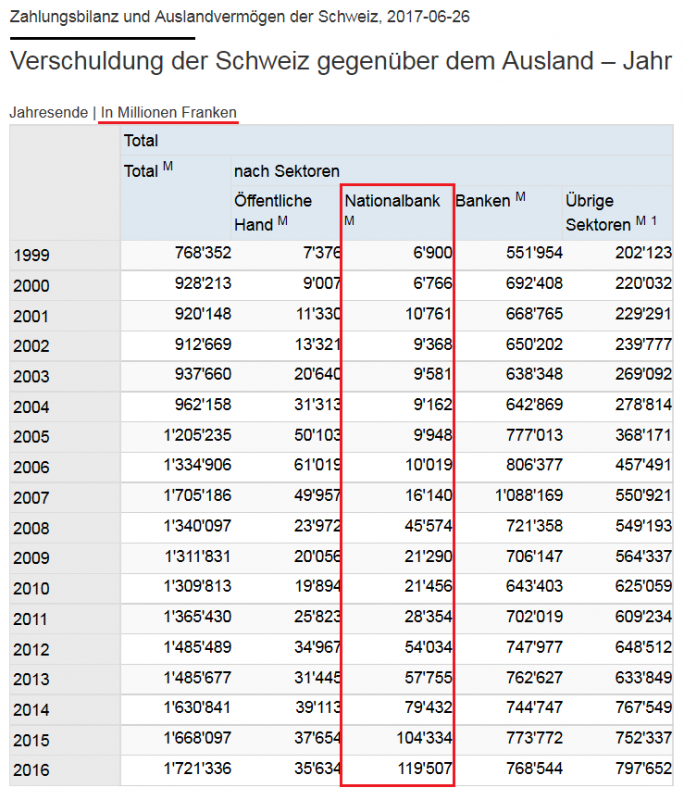

Hochriskante SNB-Verschuldung: von Herrn Jordan selbst bestätigt!

Wer ist sich in unserem Land bewusst, dass Ende 2016, die Gesamtverschuldung der Schweiz gegenüber dem Ausland den imposanten Betrag von 1‘721 Milliarden (!) Franken erreichte? Diese, auf dem Datenportal der SNB für alle zugängliche Info, darf mit einer weiteren bemerkenswerten Beobachtung vervollständigt werden.

Read More »

Read More »

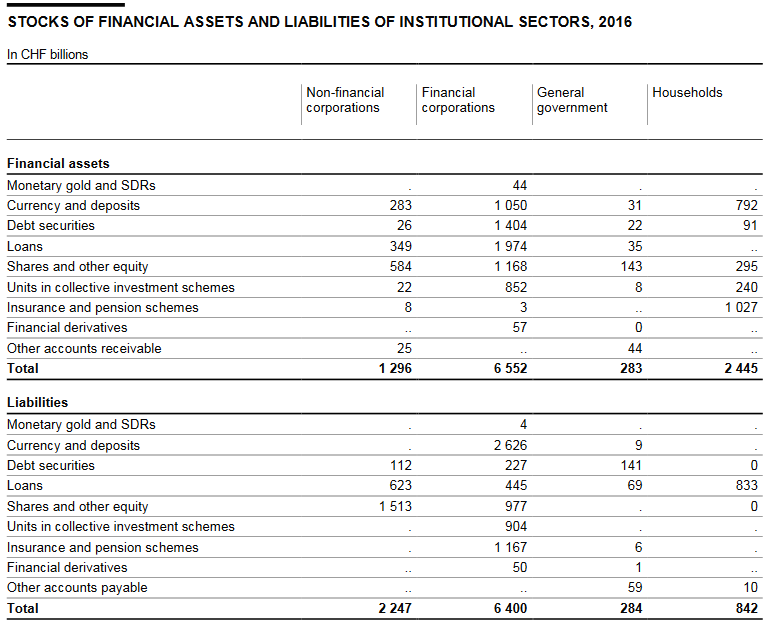

Swiss Financial Accounts, 2016 edition

Financial assets and liabilities of the institutional sectors The financial accounts form part of Switzerland’s system of national accounts. They show the financial assets and liabilities of the economy’s institutional sectors, which are non-financial and financial corporations, general government and households. The major developments in the financial accounts are outlined below.

Read More »

Read More »

Bitcoin – Die Tulpenknolle des Computerzeitalters

Von 10 auf 100 auf 1’000 auf 10’000 Dollar. Das ist die Kursentwicklung von Bitcoins in den wenigen Jahren seit ihrem Bestehen bis gestern früh. Der Vergleich mit der Tulpenmanie in der Hochblüte Hollands ist nicht mehr fern. Der Preis einer kostbaren Tulpenzwiebel stieg im 17. Jahrhundert in Holland auf das über 60-fache eines durchschnittlichen damaligen Jahressalärs.

Read More »

Read More »

Un algorithme du Credit Suisse avait pour but de gagner de l’argent au détriment de ses clients

Le grand déballage des « arrières cuisines » des marchés des changes et de leurs dérives se poursuit sur tous les continents . Les petits arrangements entre traders sur un des marchés les moins régulés, ne sont plus tolérés. Dernier exemple en date aux Etats-Unis, la banque Credit Suisse a reçu une amende de 135 millions de dollars pour la violation de certaines règles (partage d’informations des clients, manipulations de...

Read More »

Read More »

SNB: It’s A Bonfire Of The Absurdities

This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my head now and then to “WTF” moments several times a week.

Read More »

Read More »

La politique monétaire de la BNS rejaillit sur le système bancaire suisse. Le cas de la BCV.

Les « opérations de refinancement » de la BNS peuvent-elles exposer l’ensemble du système bancaire suisse aux aléas de la finance spéculative européenne ? Les too-big-to-fail sont-elles les seules concernées ? Eh bien non. Certaines déclarations du directeur de la Banque cantonale vaudoise (BCV*) nous ont incité à nous pencher sur les comptes de cet établissement de taille moyenne.

Read More »

Read More »

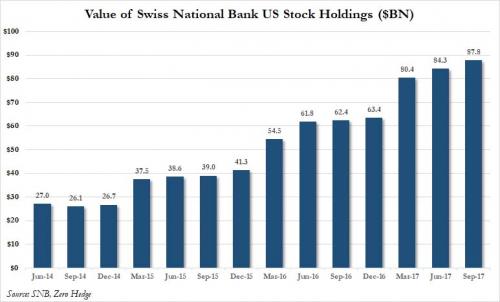

The Swiss National Bank Now Owns A Record $88 Billion In US Stocks

In the third quarter of 2017, one in which the global economy was supposedly undergoing an unprecedented "coordinated growth spurt", and in which central banks were preparing to unveil their QE tapering intentions, in the case of the ECB, or raising rates outright, at the Fed, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using "money" freshly printed out of thin...

Read More »

Read More »

La stratégie de la BNS pénalise toujours le pays et la population

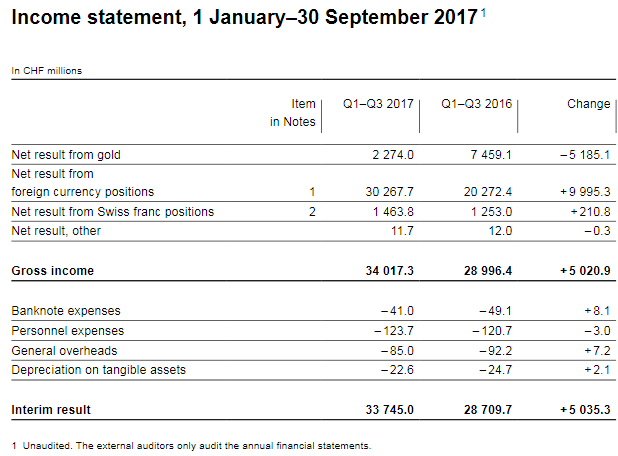

33,7 milliards de francs suisses. Voici le montant du bénéfice, réalisé par la BNS à fin septembre, dont se félicitent nos médias. Le problème est qu’un chiffre sorti de son contexte ne sert à rien. Si votre patron vous augmente de 100 et qu’en parallèle, votre loyer augmente de 200, à la fin de l’année vous êtes en déficit de 100 n’est-ce pas? Dans un ménage, une entreprise ou un Etat, il convient de garder une vision globale.

Read More »

Read More »

The good years have started, increasing SNB Profits

The Swiss National Bank (SNB) reports a profit of CHF 33.7 billion for the first three quarters of 2017. But in 2017, the picture is changed. Assuming a "biblical" cycle of seven good years and seven bad years, the SNB could now increase profits every year - thanks to a weaker franc and the seven good years.

Read More »

Read More »

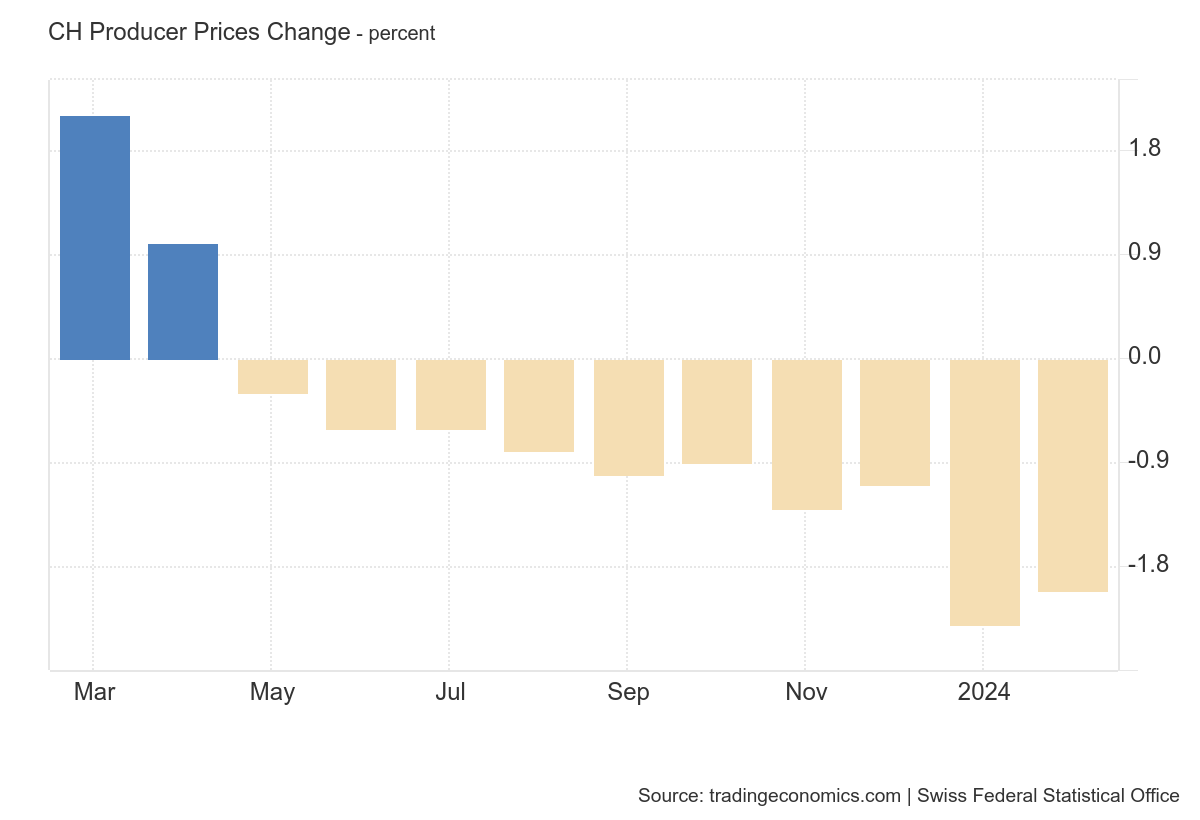

Swiss industry has learned to live with strong franc

The recent appreciation of the Swiss franc has sent shockwaves through Swiss firms, resulting in job losses and lower research budgets. But viewed long-term, Switzerland’s export-driven economy has adapted remarkably well to a strong currency.

Read More »

Read More »

10 Franc Note: Banknote App Updated

The Swiss National Bank (SNB) is releasing an updated version of ‘Swiss Banknotes’, an app for mobile devices designed to help the public familiarise themselves with the new banknotes.The popular app, which has been downloaded over 70,000 times, now also showcases the new 10-franc note. It can be downloaded free of charge from the Apple (itunes.apple.com) and Google Play (play.google.com) app stores.

Read More »

Read More »

The new 10 Swiss franc note hand mystery

The third in a series of gorgeous new Swiss franc bank notes will be released by the Swiss National Bank (SNB) on October 18th. The 10-franc note keeps its yellow colour, but most everything else in the design and construction is different. What’s most remarkable about the new bank note? Not the 40 centimes or so it takes to make each note, nor that each note is projected to last only about a year. Not the sophisticated security measures, including...

Read More »

Read More »

-638453232816314704.png)