Category Archive: 1.) CHF

Dollar Recoups January Loss Against the Swiss Franc

The US dollar recorded its high for the year against the Swiss franc on January 14 near CHF1.0240. It closed that day a little below CHF1.0190. The next day the Swiss National Bank surprised the world by lifting its cap against the euro. The ...

Read More »

Read More »

Julius Bär’s Acket Talking Nonsense: Too Much Transparency on SNB Sight Deposits?

Julius Baer's Chief Economist Janwillem Acket argues that by publishing weekly sight deposits, the SNB is telling the market too much. George Dorgan responds that this hiding of economic data will need to happen also in trade data, in GDP data and even in the disclosure of Swiss company results. For Adam Button, this contradicts the people's desire of transparency.

Read More »

Read More »

Tristan Fletcher and Izabella Kaminska – artificial intelligence in financial markets

Tristan Fletcher and Izabella Kaminska speaking at Playfair Capital’s Machine Intelligence 2015 event in London. Tristan Fletcher heads up the machine learning team at Thought Machine – a startup revolutionizing personal finance with AI. He’s an expert in applying state of the art machine learning techniques in the practical domain: from algorithmic trading, portfolio management, …

Read More »

Read More »

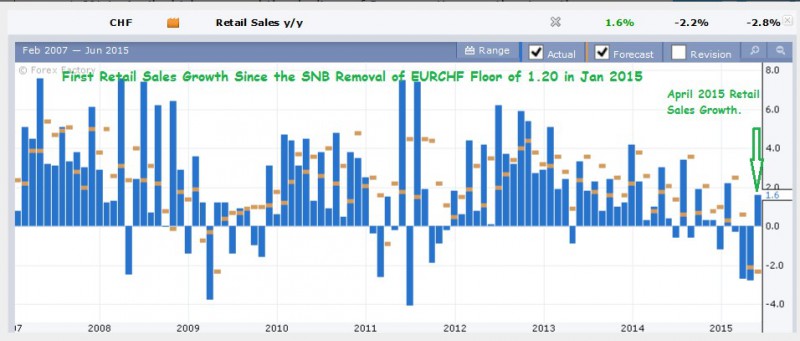

Impressive Swiss Recovery After SNB Peg Removal

Retail data shows that the SNB peg removal in January 2015 as early as April 2015 with minimal adverse impact on the economy.

Trade surplus showed that Switzerland had fully recovered its lost trade surplus in May and expectations crossed an important threshold into positive territory in June.

CHF strengthened since May end, as the market caught wind of the Swiss recovery, and the Grexit would further strengthen the CHF if it were to occur.

Read More »

Read More »

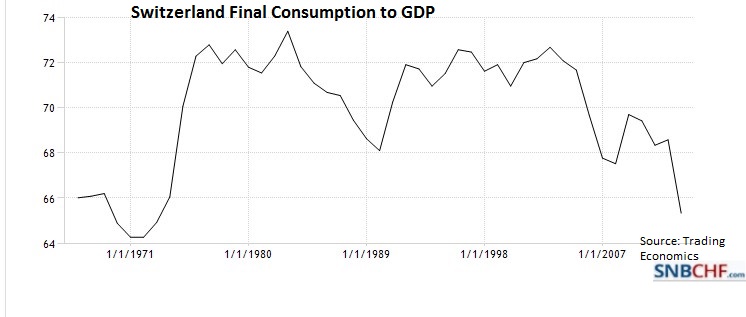

Q1/2015: Swiss Real GDP Rises by 15 percent … in Euro Terms

George Dorgan shows that Gross Domestic Product (GDP) is a measurement in the local currency. Effectively, Swiss real GDP rose by 15% in Euro terms, but fell slightly in CHF. He also emphasizes that Switzerland needs a big rebalancing of its economy, away from exports towards consumption. The Swiss National Bank was right to remove the euro peg. The move towards consumption is only possible when the Swiss franc is stronger because consumers will...

Read More »

Read More »

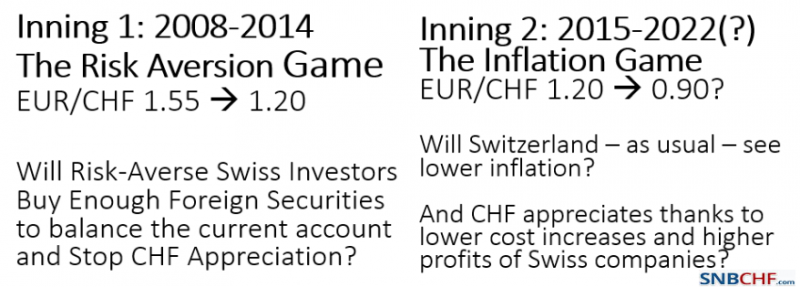

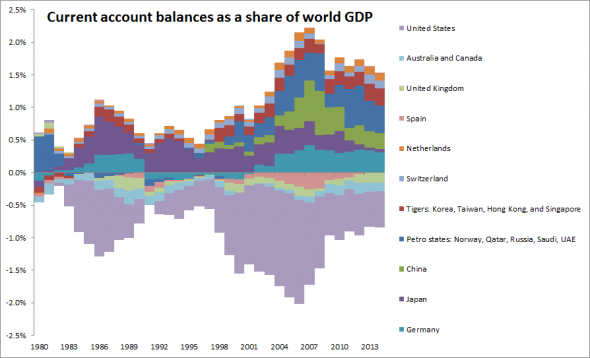

The two phases of CHF appreciation… and what is in between

We show the two phases or "two innings" of Swiss franc appreciation: The risk aversion phase and the high inflation phase.

With the weakening of emerging markets and the strengthening of the United States in 2013/2014, the Swiss National Bank (SNB) had won the first battle in the war against financial market, the "risk aversion game", the first inning in two-part match. Risk aversion is lower because the United States recovered with weaker oil...

Read More »

Read More »

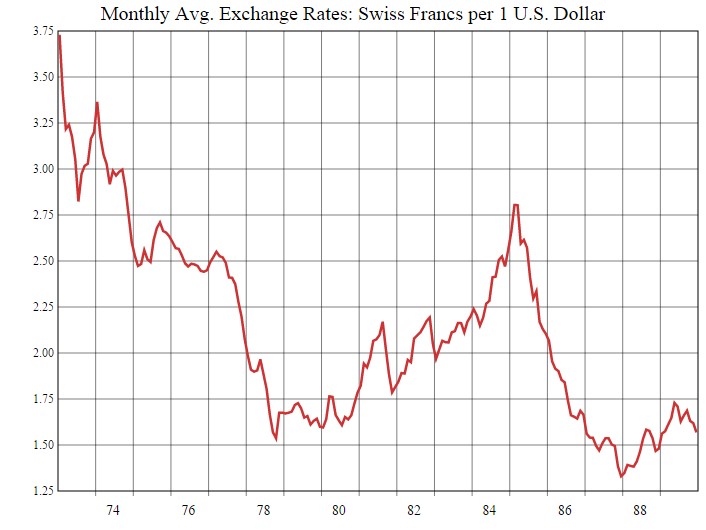

Swiss Franc History: The Gold Standard and Bretton Woods

In this post we will show the history of the Swiss Franc until 1971, a monetary era driven by the gold standard and the Bretton Woods period, both periods with nearly fixed exchange rates.

Read More »

Read More »

Ex-Post FX Evaluation: Is the Swiss Capital Account Able to Neutralise the Persistent Current Account Surpluses?

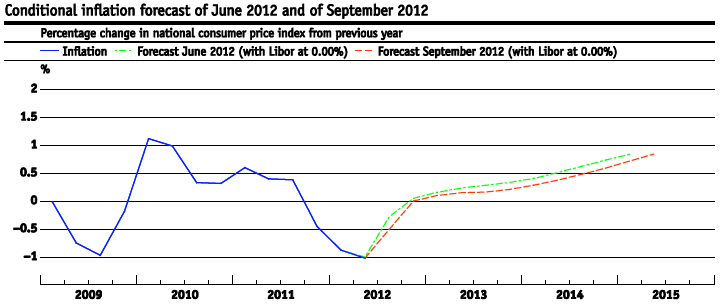

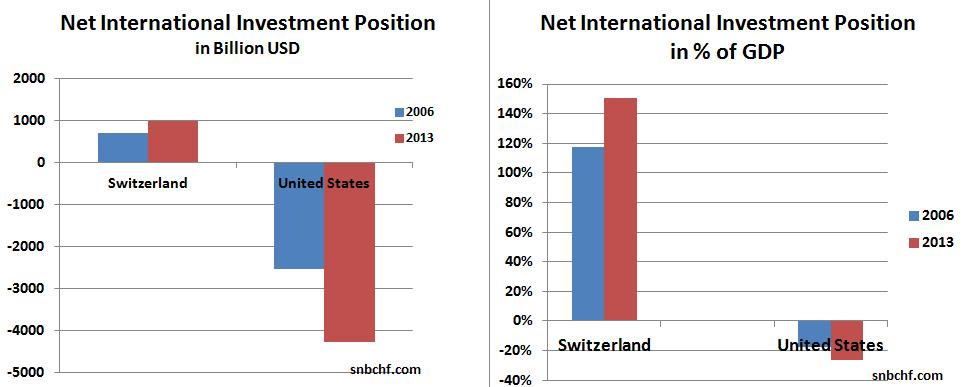

(post written originally in March 2013)

We reckon that the Swiss National Bank (SNB) will have issues maintaining the EUR/CHF floor in the longer term, because the expected yields on Swiss investments abroad will not be sufficiently higher than the yield on investments in Switzerland. Because of this insufficient risk-reward relationship, outflows in the capital account of the Swiss balance of payments will not cover the persistent Swiss current...

Read More »

Read More »

Is the Swiss Franc Really so Expensive or is Swiss Consumption anemic?

One of the most predictable consequences of the Swiss National Bank’s decision to stop suppressing the exchange rate between the franc and the euro was the whinging of Swiss exporters. That doesn’t mean the policy change was an error. If anything, it may help rebalance the Swiss economy away from its excessive dependence on exports towards greater levels of domestic consumption.

Read More »

Read More »

Colin Lloyd on the end of the EUR CHF peg

Colin Llyod gives a detailed explanation of the end of the EUR/CHF peg on Seeking Alpha. Most extracts come from George Dorgan, on snbchf.com

Read More »

Read More »

Why did the Swiss franc spike? Lack of Capital Outflows

There is a straightforward answer to the question in the headline: more money has been trying to get into Switzerland than get out, which didn’t affect the exchange rate as long as the Swiss National Bank bought foreign currency. As soon as they stop...

Read More »

Read More »

End of Peg Buiter Critique

In a Citi research note, Willem Buiter discusses the SNB’s decision to discontinue the exchange rate floor of the Swiss Franc vis-a-vis the Euro. His main points are: Buiter refers to his earlier work on removing the lower bound on nominal interest r...

Read More »

Read More »