Category Archive: 7) Markets

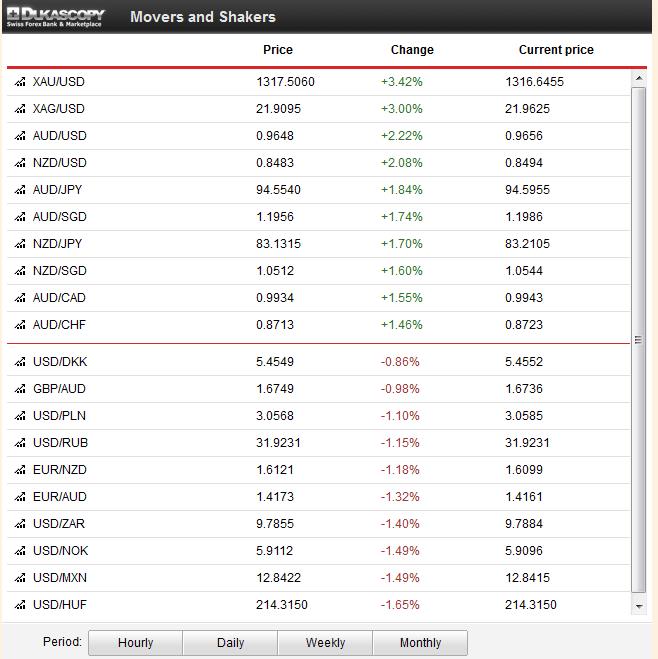

Fundamentals, FX, Gold and CHF: Week October 21 to 25

Major Fundamental Events The week contained a lot of important fundamental events, in particular Non-Farm Payrolls and preliminary “flash” PMI readings. Highest importance for FX rates Non-Farm Payrolls (NFPs) weakened to 148K, private NFPs to 126K, both against 180K expected. Especially the private NFPs were disappointing. The decrease in the unemployment rate from 7.3% …

Read More »

Read More »

Week October 14 to 18, A Close Look at China’s Fundamental Data

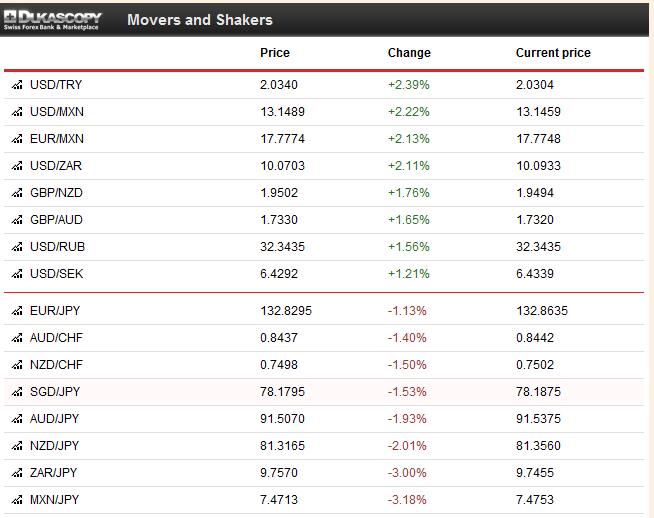

Weekly Overview of FX Rates Movements The week was driven by the following factors: Solid Chinese economic data including a 7.8% rise in GDP. The end of the debt ceiling debate, at least for now. The expectation by the Fed member Evans that the government shutdown has delayed Fed tapering. San Francisco Fed’s Williams …

Read More »

Read More »

Fundamentals, Gold and FX Movements, Week October 7 to Oct. 12

Our weekly summary of fundamental news on FX that aims to explains price movements, with particular emphasis on the possibly biggest mysteries: the gold price (GLD) and the Swiss franc (FXF) . Weekly Overview Hopes on a compromise between Obama and republicans on the U.S. debt ceiling and high U.S. initial unemployment claims sustained …

Read More »

Read More »

Fundamentals, Gold and FX Movements, Week September 30 to October 4

Our weekly summary of fundamental news on FX that aims to explains price movements, with particular emphasis on the possibly biggest mysteries: the gold price (GLD) and the Swiss franc (FXF) . The clear winner of the week was the Aussie, supported by a positive PMI and positive news from the RBA. In the previous …

Read More »

Read More »

Fundamentals and FX Movements, Week September 23 to September 27

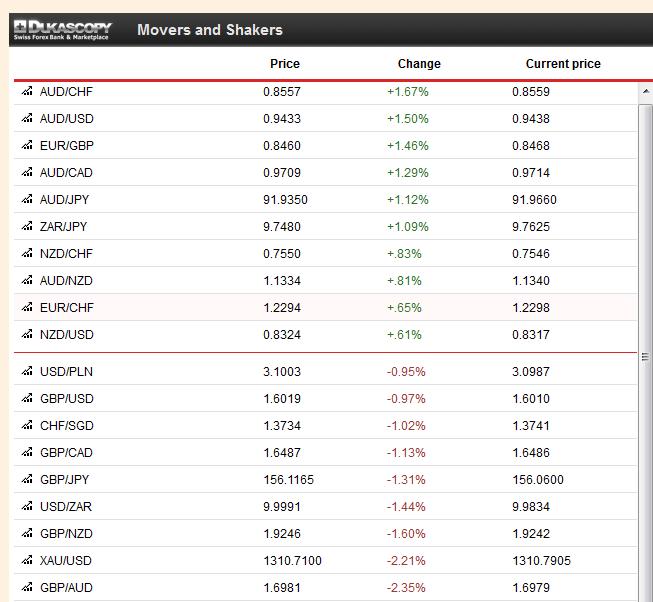

Weekly summary of fundamental news on FX with a focus on CHF and gold price movements. Weekly price movements The U.S. budget discussion and rather bad U.S. fundamental data made JPY and CHF the winners of the week. After weeks of improvements, the currencies of the Emerging Markets and carry trade currencies, like NZD, AUD …

Read More »

Read More »

Fundamentals and FX Movements, Week September 16 to September 20

Weekly summary of fundamental news with a focus on CHF and gold price movements. Friday, September 20:The St. Louis Fed president James Bullard explained that the Fed was close to tapering 10 bln. $ and that markets overreacted after the FOMC with their strong performance. As a consequence the S&P500 inched down by 0.6% while …

Read More »

Read More »

Fundamentals and FX Movements, Week September 9 to Sept. 13

The weekly summary of global fundamental news with focus on CHF and gold price movements. Friday, September 13:The leading news came from U.S. retail sales and the Michigan consumer sentiment. Retail sales were up +0.2% instead of 0.5% expected, sales excluding autos and gas +0.1% (vs +0.3% exp.) The Michigan consumer sentiment disappointed at 76.8 …

Read More »

Read More »

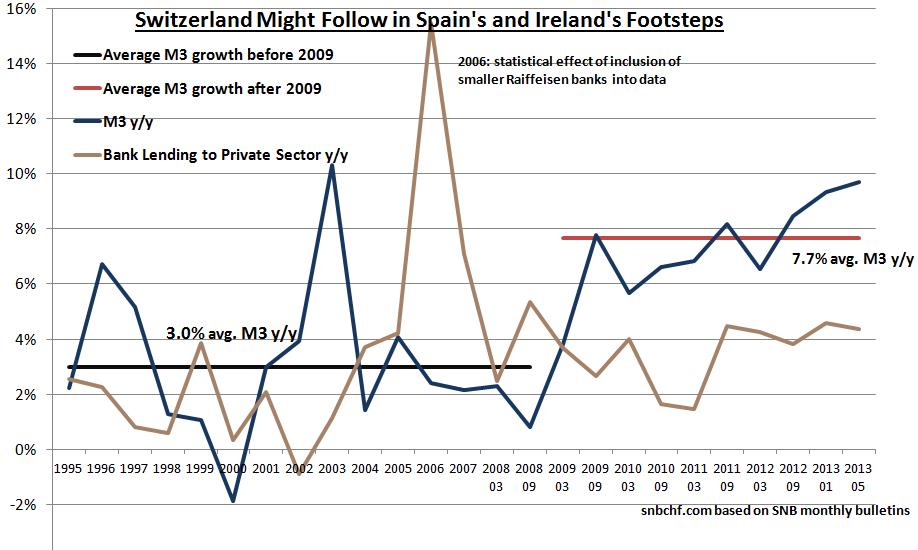

Excessive Money Supply: Switzerland Could Follow in Spain’s and Ireland’s Footsteps

In the Euro zone bank lending is contracting, M3 is rising very slowly. As opposed to that, Swiss bank lending is currently rising by 4.4% per year, M3 is increasing by 10% per year.

Read More »

Read More »

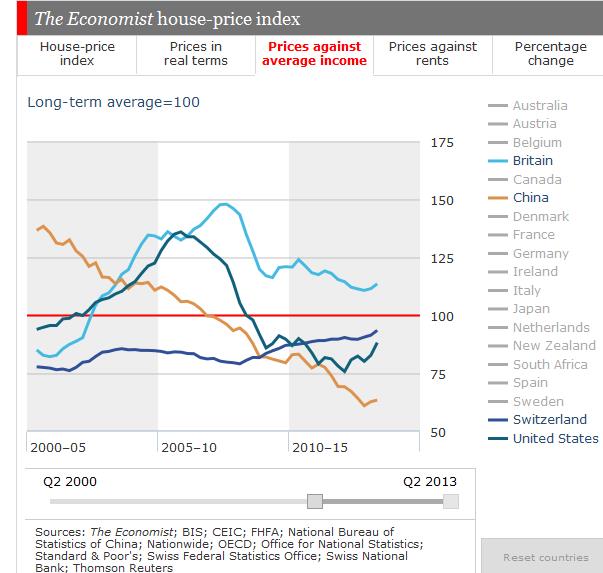

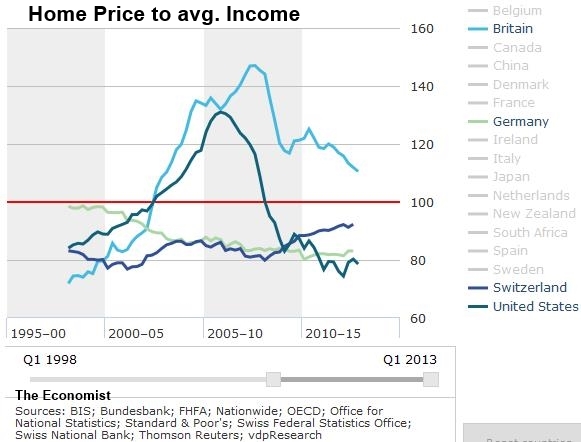

Swiss home price to income ratio small in historic and global comparison

Based on four different data source, we find out that Swiss home price to income ratio is small in global comparison. Therefore we wonder why the SNB must contain home price rises, but the Fed must artificially increase them.

Read More »

Read More »

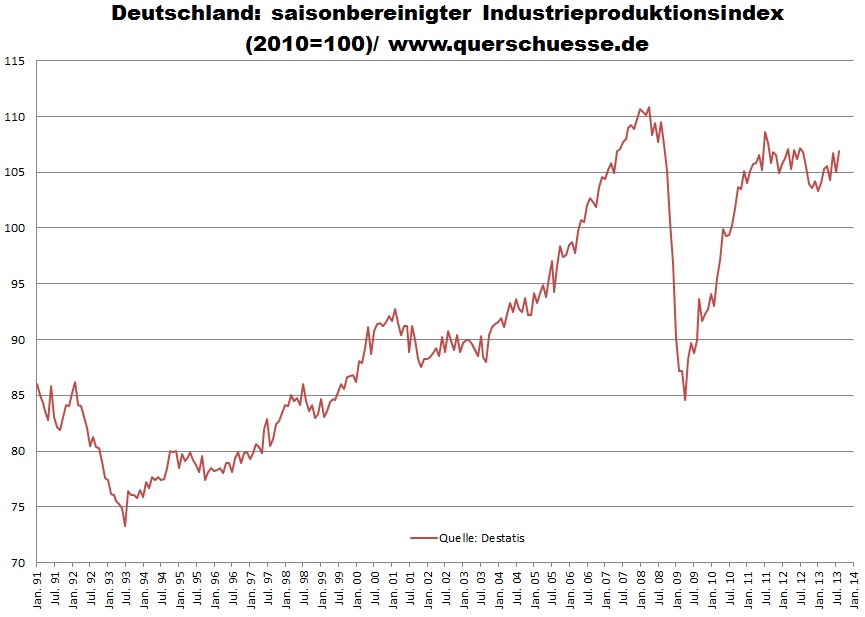

High German Pay Rises: The End of the German Bunds Bubble

Yesterday’s German CPI has given a first insights of what is coming these years: German inflation. For years excessive risk averseness put pressure on German yields. Most recently, energy prices helped to push down inflation and on German yields possibly for a last time. But many ignore that the main reason for inflation are rising …

Read More »

Read More »

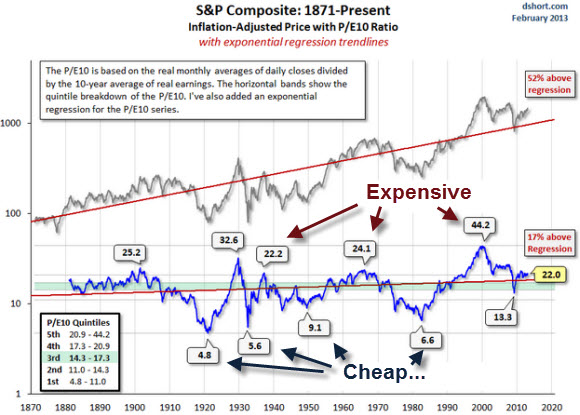

Performance of global stock markets compared

A list of relevant graphs for the long-term price earnings rations and different stock market returns over the last 2 years. Moreover we show the return of the S&P 500 for each of the year.

Read More »

Read More »

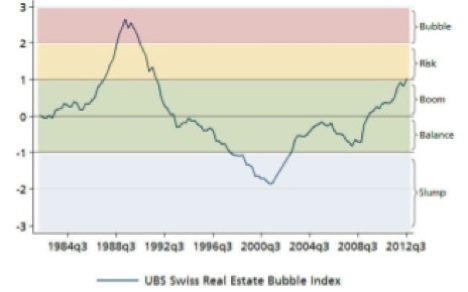

Swiss Public Discussion Switched from Floor to Housing Bubble

Why there is no real estate bubble in Switzerland yet and why the SNB will help to create one With the current recovery in the United States the discussion in Switzerland switched from a discussion about the EUR/CHF floor to the Swiss real estate boom, the so-called “housing bubble”. It seems that the Swiss …

Read More »

Read More »

2012 Posts on Markets

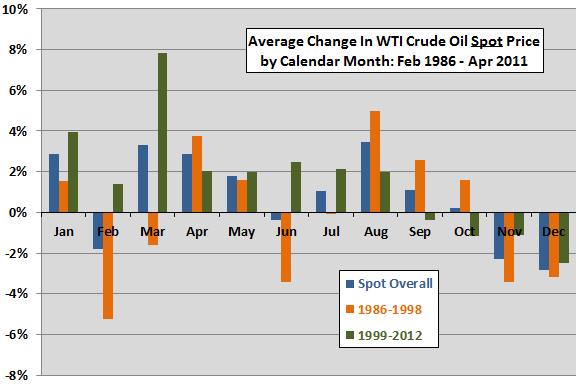

Seasonal Factors on Oil

Evidence from simple tests supports perhaps some belief that crude oil tends to have strong and weak months of the year, Q4 is often the weakest quarter and Q1 and Q2 the best.

Read More »

Read More »

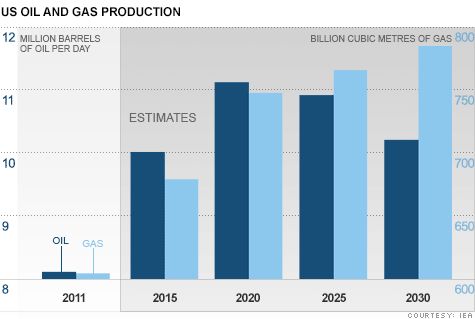

Before getting too excited about the IEA’s forecast of US oil production leadership…

Saxo Bank, recently called for quitting long Gold and "being scared" trades.

For them shale gas & oil is the game changer for the United States. It should make the US the leader for global growth in the next years. The International Energy Association (IEA) declared that the US would be energy-independent by 2030.

Today a nice article...

Read More »

Read More »