Read the full list of reasons why the Swiss real estate boom should continue for another decade here in a virtual discussion with Jesse Colombo, one of the few analysts that foresaw the financial crisis. We also explain why the recent referendum on mass immigration has changed nothing.

The most important reason for a continuation of the boom are relatively weak Swiss home price to income ratios in a historical perspective. It implies that Swiss home prices are not overvalued, at least when compared to other countries.

Swiss home prices are not overvalued compared to other countries

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

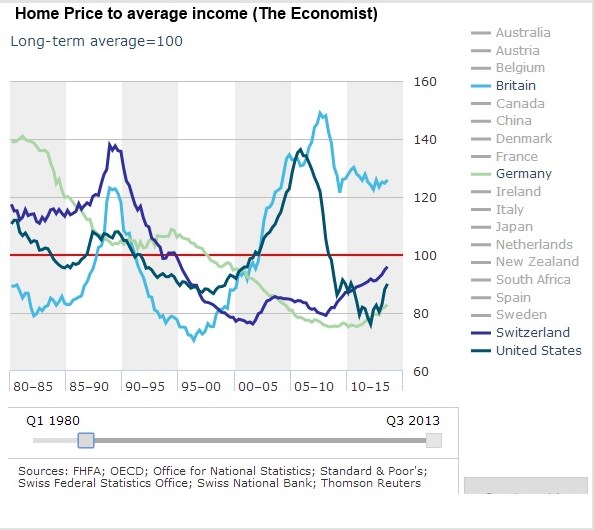

Data source 1: The EconomistThe Economist indicates that in the last 20 years and despite the sub prime crisis, U.S. and UK home prices have risen more strongly than the Swiss ones, while Germany remains at the bottom. The U.S. data is from Q4/2012, recent rises are not shown yet.

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Economist: Home Price to average incomeIn the more relevant home price to income index, the Swiss overtook the United States during the financial crisis. The Swiss home price to income index is now at 92, under the global long-time average of 100. The one for the US is at 78, the German one is 83 and the British still around 110. The price to income value for the American 10-city index, however, is already at 101 and the 20-city index is at 86.7 (see US prices on The Economist). Home prices for British and US 10-city inhabitants have risen more quickly than income. Since the German housing boom in the 1970s and early 80s and the Swiss housing boom in the early 1990s, homes in these two countries have became far cheaper in comparison to people’s salary. |

Home Price to average Income Q3 2013 Home Price to average Income, Source The Economist Q3 2013 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

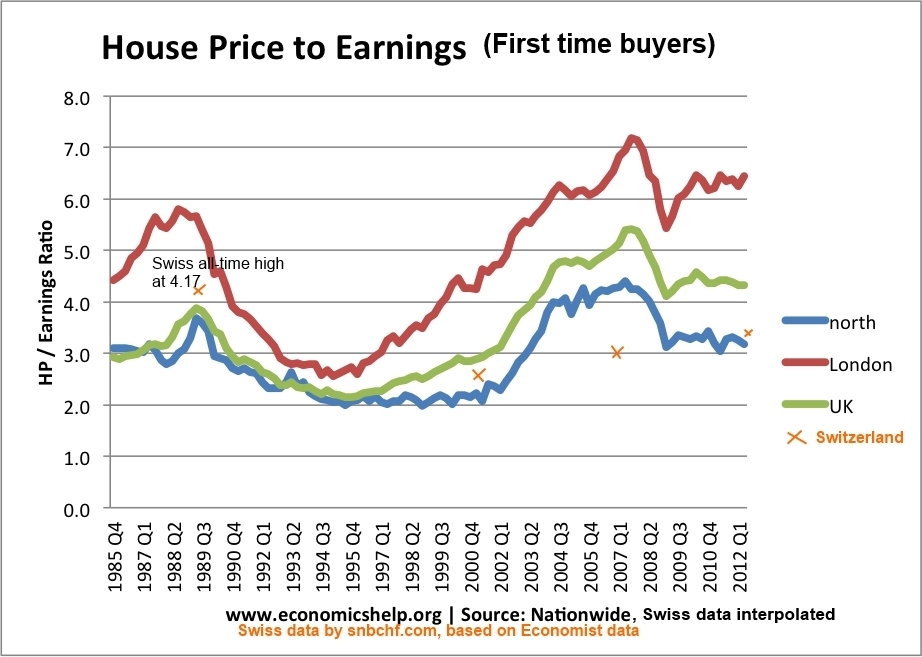

Data Source 2: An interpolation for home price to income ratio based on UK data

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Data source 3: NumbeoInstead of an interpolation, we now obtained real data for home price to income ratios from Numbeo: Effectively the UK median value is 5.90, a value considerably higher than 4.3, the value for the first-time buyers. The Swiss median value according to Numbeo is 5.68. Our previous interpolation placed the value for first-time buyers at 3.5. London exhibits a considerably higher average value with 15.31 compared to 6.3 for first-time-buyers. In Zurich shows an average price to income ratio of 7.94. |

Numbeo data as of Q4 2013

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Data source 4: Offered Prices in Switzerland: HomegateA quick double check via this Homegate query for Bern (equal to the median according to Numbeo) gave an average offered price of 765000 for flats between 3.5 and 4.5 rooms. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

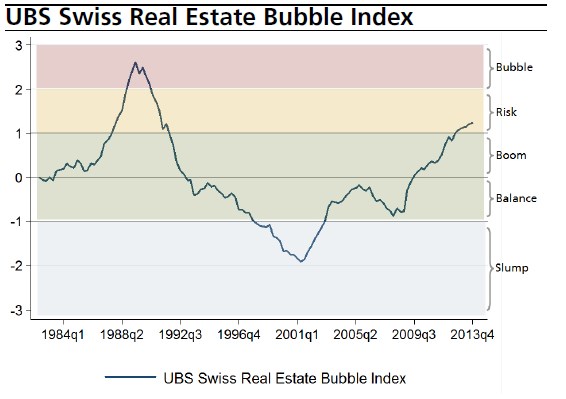

Data source 5: UBS Real Estate Bubble Indexsource UBS Our data is confirmed by the UBS Real Estate bubble index, which shows the peak in 1989 of an index value of 2.5, while currently we are just at 1.2.

Our insights are the following: |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Low interest rates, a new phenomenon for Brits and AmericansThe major reason for rising British and American home prices is the relatively new phenomenon that they are to able to finance at cheap rates. Swiss or Germans have relatively low mortgage rates for more than three decades (with an exception in the late 1990s). The main driver of low rates in the UK and the U.S. are, bizarrely, stagnating salaries while until the 1990s salaries rose quite quickly. Needless to say that higher remaining income after housing/credit expenses leaves room for higher spending or savings in other form of assets.

|

Swiss home prices are cheap compared to the UK, in particular in a historic viewHigh British prices are often explained by the limited supply, while countries like Ireland, Spain or the U.S. had oversupply. High immigration into Switzerland and limited space availability should push Swiss home prices upwards. But relative to income, Swiss home prices are far cheaper than in the UK. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Low housing costs leave room for more spending and savingsThe weak Swiss home price to income ratio and lower mortgage rates imply that the percentage of income dedicated to housing is lower than in the UK or the U.S, even more when compared to Italy and France. This leaves more room for spending and savings. The Swiss are able to diversify savings into other asset classes. Stock owners of Swiss multinationals, for example, were able to participate in the strong growth of the Emerging Markets. Given that since the financial crisis Swiss investors have acquired a strong home-bias, consumer spending and high savings should further sustain the prices of Swiss stocks and real estate. |

The SNB tries to limit home prices at levels where other central banks push them upwardsSwiss home price to income ratios are smaller than in the UK. They are comparable to the US 10-city or 20-city index. Prices in the only Swiss region with price excesses, Geneva, are still lower than in London. At these levels, the Fed and the BoE want to sustain home prices, they apply quantitative easing: the Fed even purchases asset-backed securities. The Swiss, however, do the opposite. They apply macro-prudential measures in the hope of limiting risks and quick home price increases. With the counter-cyclical capital buffer, they have obliged banks to provide 1% more equity, possibly more in the future. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

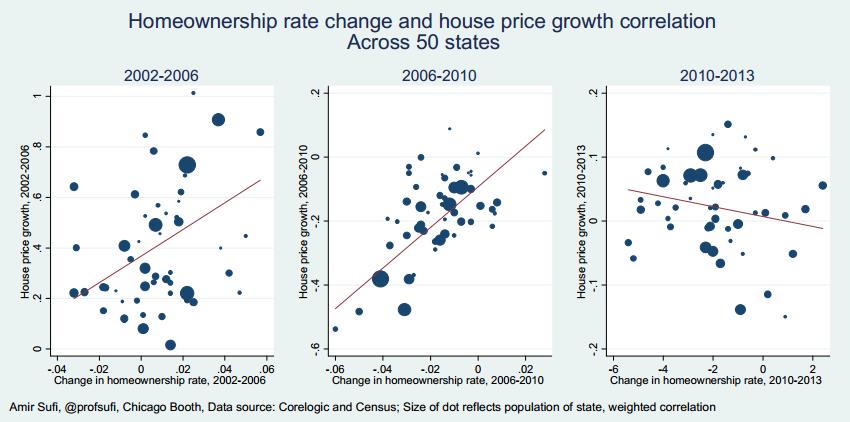

Investors, not Home Owners Drive U.S. Real Estate PricesIn the U.S. investors drive home prices upwards, in Switzerland more and more home owners Amir Sufi of the Chicago Booth University, has recently proven that the rise of U.S. home prices is driven mostlyThe objective of these investors is clear: U.S. home prices are still relatively cheap against rents, at 91%. Future rental income on the property – potentially leveraged by cheap credit – will help to reimburse the investment. In 2010, private real-estate funds tried to apply the same principle in Germany. Except for some increases in major cities, the relatively weak German home prices have not taken off yet. Both the German price to rent ratio and price to income ratio remain at 83%. German home prices increased by 8% since 2008; this is far less than the 12% rise of the 20 city index in a single year. |

Investors, not Home Owners Drive U.S. Real Estate Prices (source) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Home Owners Drive U.S. Real Estate PricesSwitzerland, however, rising real estate prices are driven more by home owners. The number of owners has risen from 31% in 1990 to 36.8% in 2010. Still Switzerland has a relatively high share of institutional investors in real estate. |

Construction qualityIn Switzerland prefab houses or similar are rarely used. Quality of the construction is very important.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

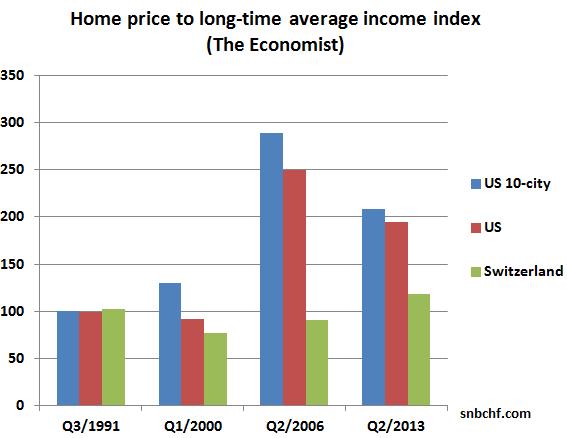

ConclusionThe Swiss need to pay 18% more for a home than in 1991, when comparing the home price with income. 1991 was the height of the Swiss real estate bubble. Between 1991 and 2002, the bubble collapsed and a home became far cheaper compared to income. In the United States, housing was fairly cheap in 1991 compared to income. The share (or multiple) of income needed to pay for a U.S. home nearly tripled until 2006. With recent Fed purchases of mortgage-backed securities and investor appetite for US real estate, this ratio has recently risen again to around 200%, after falling to levels of 169% in early 2012. Hence as for Affordability: if an American had to pay 20% of his salary for mortgage and housing costs in 1991, this value has risen to 40% in 2013. If in Switzerland the affordability ratio was 20% in 1991, it has risen to 23.6% today. The conclusion is obvious: the Fed is trying to sustain prices because this may help some owners that are “under-water”, while the SNB aims to avoid the situation where owners have similar issues with their mortgage. Swiss real estate remains relatively cheap compared to American or British prices and compared to incomes; therefore, it remains interesting for international investors. A rate hike by the Fed or the Bank of England, even the recent increase in 30 year US mortgage rates, could harm home prices. The consequence is that the SNB will need to follow other central banks and will maintain rates close to zero for another five years or even a decade; more central bank fuel for the Swiss real estate bubble. |

Home price to average income, data source The Economist |

Reason enough to believe that the Swiss real estate boom will continue for another decade.

Read also:

The Swiss housing bubble should continue for another decade

The French Housing Bubble finally Bursting: French and German Flat Prices Compared

See more for

2 comments

David

2014-05-18 at 20:26 (UTC 2) Link to this comment

I would be very careful with the source of information. It doesn’t seem to be too realistic. E.g.: House Prices/Earnings ratio. Considering a median price of about 800’000 CHF, and a ratio of 3 would result in a median income of about 267’000 for a household.

I would say the ratio is somewhere between 8 and 15 depending of location. Which put some locations in Switzerland out of the map.

Another example: UBS real estate index. So, UBS selling credits says “almost bubble”. It should show again out of the map, they need to rescale the map for this. If would we have an environment without price increase UBS would say “slump”.

Otherwise, nice article summing up how we can determine if it’s a bubble or not.

George Dorgan

2014-05-20 at 08:18 (UTC 2) Link to this comment

Thanks, I made the comparisons more explicit, in particular between data source 2 and 3. First-time buyers buy at a smaller price to income ratio compared to others.

800000 for first-time buyers might be realistic in Zurich, but not outside the city, the place where many young first-time buyers reside.

I added a look at offered prices in the median city Bern (according to Numbeo).