Why there is no real estate bubble in Switzerland yet and why the SNB will help to create one

With the current recovery in the United States the discussion in Switzerland switched from a discussion about the EUR/CHF floor to the Swiss real estate boom, the so-called “housing bubble”.

It seems that the Swiss public opinion is far more sensitive to the dilemma of central bankers than the SNB itself is:

The policy dilemma is whether to keep rates low and risk a balance sheet recession/depression down the road because domestic households did not heed the central bank advice to be prudent in taking on debt and buying assets when real interest rates were low or negative, or take the consequences of tightening and watching your currency strengthen…..

Compounding their dilemma is that asset price bubbles are fun while they last, and it is hard to know when domestic asset markets are so far out of line with fundamentals that the risk of a crash is real.

Fritz Zurbrügg, the newest member of the SNB board, was interviewed on Swiss television. Even if Zurbrügg is responsible for the surveillance of the EUR/CHF floor, most parts of the interview concentrated on the Swiss housing boom and the potential introduction of a counter-cyclical capital buffer (CCB), with which Swiss banks must reserve additional capital for the case of a real estate bust. Since the SNB cannot change interest rates, this buffer replaces a rate hike, the traditional measure of monetary policy against overheating and inflation.

As we demanded two months ago, mainstream financial papers now want the SNB to implement the CCB. See Finanz und Wirtschaft‘s editor in chief Mark Dittli, who compares Switzerland’s real estate boom to the Irish and Spanish bubbles. He says explicitly:

Some people claim, an asset bubble can be known only after it bursts. This is nonsense. …

Government debt in the amount of 30% of gross domestic product, a budget deficit of well under 1%: Switzerland is great. An island of financial virtue ……

Wrong. The above benchmarks are not based on today’s Switzerland, but on two European countries in 2007: Ireland and Spain.See more on Dittli’s commentary

Still we are not sure if the Swiss housing boom is really that big, as the following charts show:

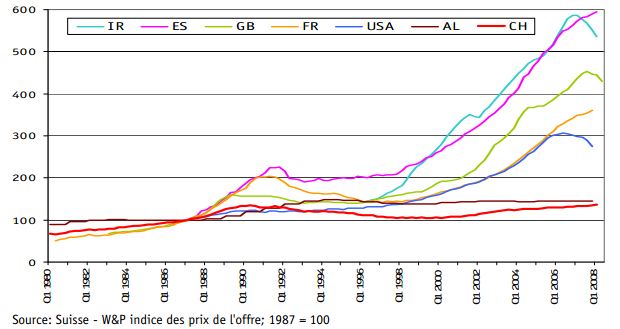

From 1992 to 2008 prices in Ireland and Spain tripled, whereas they improved by 500% since 1988. The change for the UK since 1988 was equally 350%, for France 250%, whereas they only rose by 45% in Switzerland until 2008. After a housing bust in the 1990s, Swiss prices were up only 20% the period between 1988 and 2002.

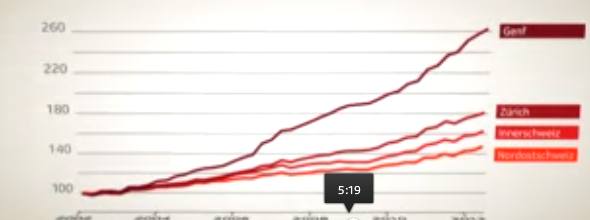

Between 2002 and today many Swiss home prices have appreciated up to 160% in some regions (e.g. Geneva), the average increase for houses is 43% and for condos by 73%. These values might seem quite high, but they are far lower than the ones in the bubbles until 2008 above.

Swiss real estate boom since 2002: Prices in Geneva, Zurich, Central Switzerland and Eastern Switzerland

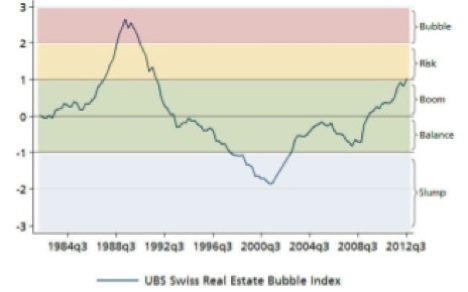

Both, the UBS real-estate risk index and the Economist comparison show that Swiss prices can still appreciate, the bubble (“Blase”) is still far away. Real estate markets in Europe, now even France, are under big pressure. Many emerging markets like China or Brazil have slowed down.

Investors’ money does not know where to go any more given that central banks do not stop printing. So these funds created a government bond bubble and in their most desperate move they returned to the United States, where despite foreclosures and oversupply, prices are moving upwards – the Economist undervaluation above is not the whole story. And money will certainly continue to pour into the biggest safe-havens in Europe, to Germany and Switzerland, countries with undervalued home prices without oversupply.

Most of the well-qualified personnel with perfect credit records and suitability who came to Switzerland after the Swiss-European bilateral agreements, do not posses a Swiss home yet. There is a lot of room and a lot of scared foreign funds available for the Swiss real estate to appreciate. Recent history shows that Swiss banks have no issue in raising equity with some state funds from Arabia, Singapore or maybe soon Norway that sees a far bigger housing bubble than Switzerland.

So forget the counter-cyclical capital buffer. The only method to really prevent a Swiss bubble is hiking rates: a 3% or 4% CHF Libor would be perfect and adequate when compared to money supply, credit and GDP growth in a historical perspective.

Unfortunately this will require that the EUR/CHF exchange rate sinks far under parity.

Consequently, Swiss real estate remains a safe and profitable place for another ten years. But foreign investors should hurry up: the SNB still pays a 20% FX welcome bonus against the fair value of EUR/CHF of 1.00 for the year 2018. How long they will pay this bonus, Mr Zurbrügg did not want to tell during the interview.

Are you the author? Previous post See more for

Tags: Asset Price Bubble,home prices,housing bubble,Ireland,Spain,Swiss economy,Swiss Franc Overvaluation,Swiss National Bank,Swiss real estate,Switzerland