Category Archive: 7) Markets

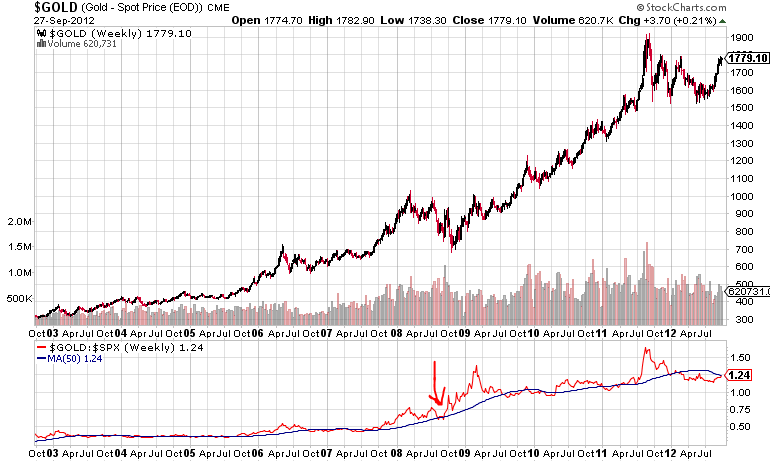

Marc Faber: Assets are overpriced, we short metals and Brent now

As we predicted on October 5 or one day later on DailyFX, metals have started their descent, silver lost one dollar, from levels around 35$ last week to 34$ now. Marc Faber joins our view and says that asset prices are quite vulnerable. “I’m not 100% in cash, for the simple reason that I could … Continue reading »

Read More »

Read More »

Marc Faber argues against Jim Rogers

The most famous investors Marc Faber and Jim Rogers were in a common interview on CNBC. Marc Faber is of our position, whereas Jim Rogers is still bullish on commodities. Marc points out that China’s bench mark stock index the Shanghai Stock Exchange Composite Index was at 6100 in 2007 even as it … Continue reading...

Read More »

Read More »

Are German Bunds finally heading for the big slide ?

Citibank judges that the Swiss National Bank (SNB) does not need a peg anymore. The EUR/CHF exchange rate would be now over 1.20 even if exposed to the free market. Yesterday we showed that the upward move in the EUR/CHF is just the behavior of some euphoric Forex traders. In the meantime we see a completely … Continue reading »

Read More »

Read More »

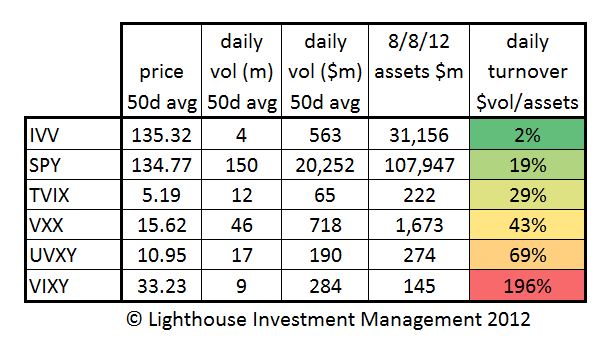

Volatility ETFs’ crazy churn

Two volatility ETFs (VXX and UVXY) are having almost half of the trading volume in the world’s largest ETF (SPY). How come? First, the facts: SPY is heavily traded (19% of assets daily turnover) compared to IVV (also referring to the S&P 500). But then come the volatility ETFs. Tiny VIXY (assets $145m) … Continue reading...

Read More »

Read More »

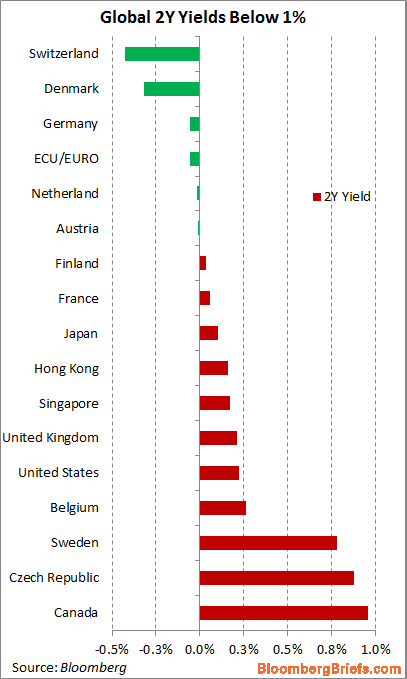

German Schatz turns negative again

After the first time End May, the German Schatz turns negative:

German June 2014 Schatz Average Yield -0.06% vs 0.10% on June 20

Swiss Eidgenossen 2yrs still at -0.4%

Read More »

Read More »

Die Wirtschaftskommission hat den Goldfranken abgelehnt, jetzt kommt die Volksinitiative

Zwei Initiativen für Kleinanleger um das Geld/Gold vor den Mächtigen zu retten Der Ökonom Detlev Schlichter der “Österreichischen Schule” hat einen Vortrag beim “Verein Goldfranken” gehalten. Hier der äquivalente Vortrag auf Englisch beim Adam-Smith-Institut in den USA. Die Kritik an der Boom und Bust Politik der Nationalbanken.

Read More »

Read More »

Spread Swiss Eidgenossen vs. German Bund to see further gains

The spread between the Swiss government Eidgenossen bond against the Germany 10yrs. Bund will see further gain in the future, after the Euro summit opened the door for ESM direct financing of banks. Differences between EFSF and ESM explained

Read More »

Read More »

The other risk for the SNB: Will German Bund yields double ?

In the latest post we started discussing the implications of a German euro exit for the Swiss National Bank, this time we will look on another risk: The rising German Bund yields.

Read More »

Read More »

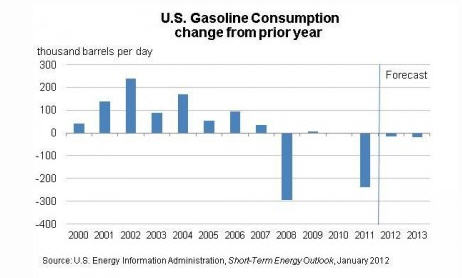

Oil price increases in 2012 and why they are not real

Oil prices Oil prices will rise quickly this year along with the recovery, the Iran issues and last but not least driven by investor demands of yield, implemented in the HFT algos. Interestingly the Iran issues already existed in December, but oil prices were falling, at that moment investors did not believe in a global recovery yet, …

Read More »

Read More »