Category Archive: 7) Markets

Is the Safe-Haven Government Bond Bubble Finally Bursting?

The Safe-haven government bond bubble did not pop, but Italy or Spain have become low yielders as well

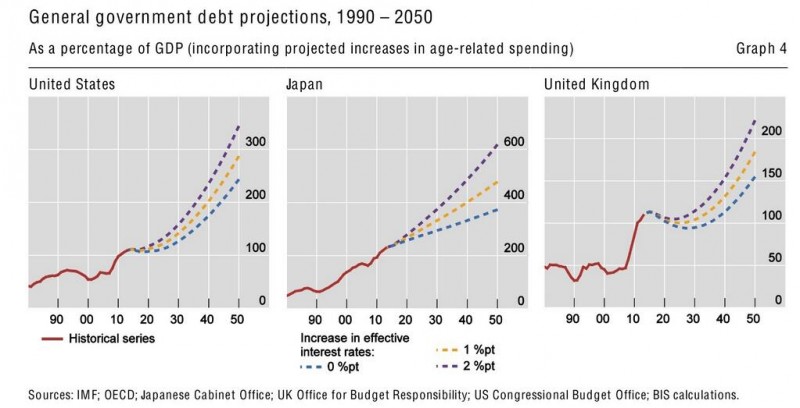

Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century?

Read More »

Read More »

9) Markets

We are currently looking for an curator of this category. The aim is explain how to obtain sustainably nice returns on stocks and bonds. The focus here should be also on global macro. Sustainability is key: "buy today and sell far in the future", for example when you get retired. Publicity for own books or publication is allowed.

Read More »

Read More »

Dividend Yield Comparison SMI, DAX and Dow Jones

The following table compares the dividend yields for blue chips in the SMI, DAX and Dow Jones.

Read More »

Read More »

2014 Posts on Markets

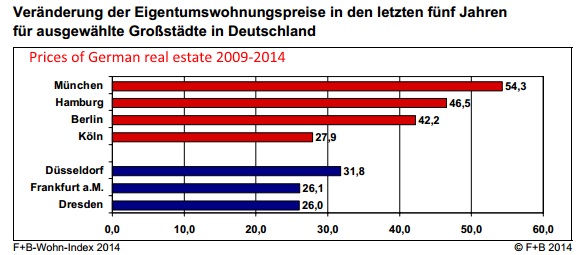

German Home Prices Quickly Narrowing Gap against France – 2014 Update

European national central banks released European household wealth reports in Spring 2013. According to that data, "median" German households were far poorer than many of their European counterparts. Based on 2012/2013 data we compared apartment prices and discovered that French prices were strongly overvalued or German ones undervalued.

We wanted to know if this is still the case in 2014 and integrated our 2012/2013 data with the one of 2014. We...

Read More »

Read More »

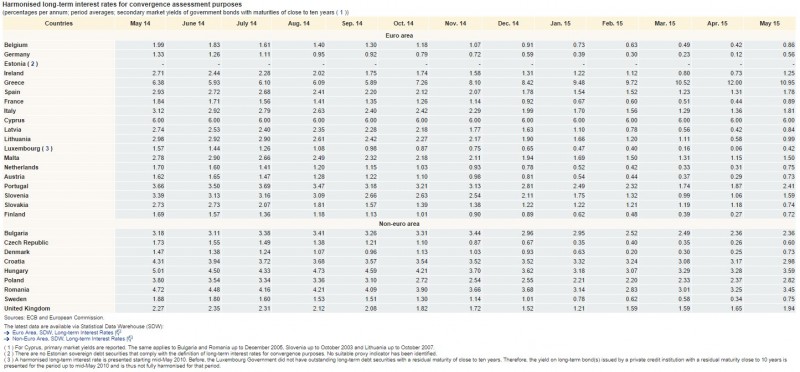

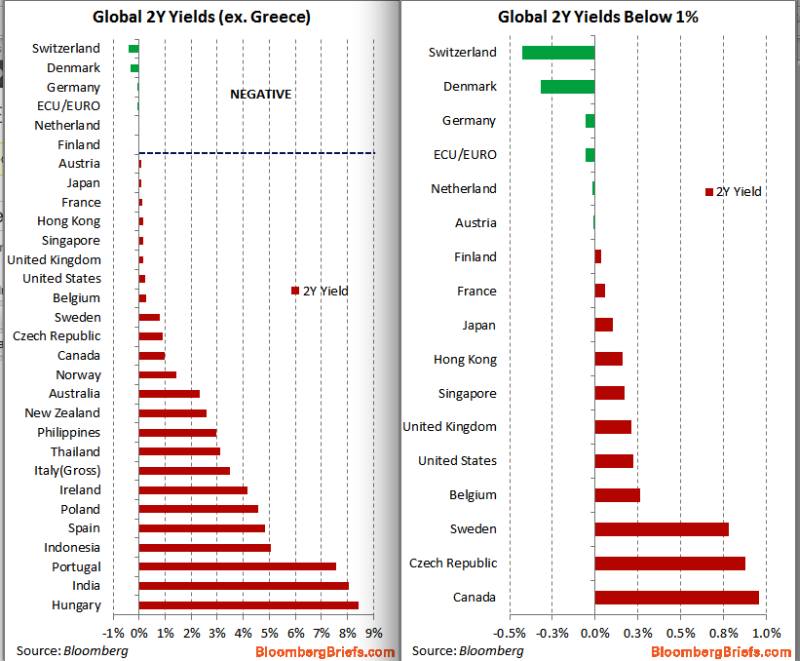

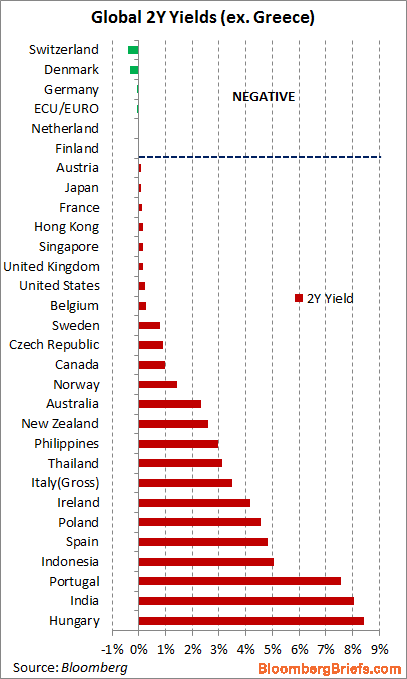

Negative and Close to Zero Yields of Government Bonds and the Reasons

We judge that negative or close to zero yielding government bonds reflect three points: Risk off environment, long-run currency gains on currency with low inflation, insufficient supply of government bonds for bank refinancing purposes.

Read More »

Read More »

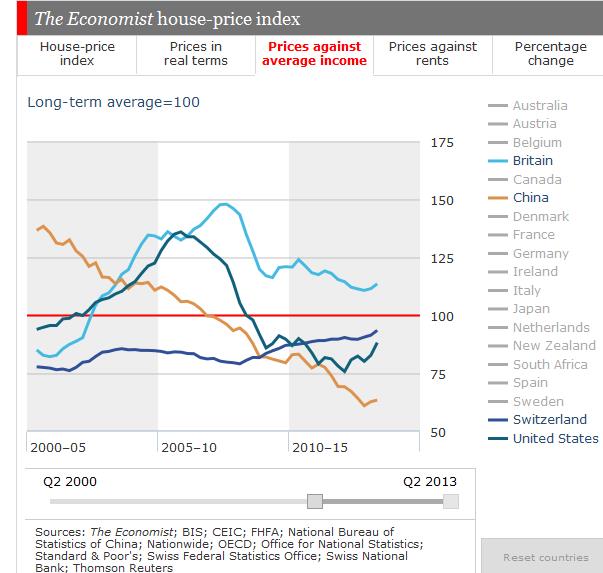

Swiss Housing Bubble: Thirteen Reasons Why It Will Continue for another Decade

The Bubble Bubble is produced by economic analyst and Forbes columnist Jesse Colombo, who was called one of the "Ten People Who Predicted the Financial Meltdown" in 2008 by the London Times.

Read More »

Read More »

What Drives Government Bond Yields, Part2: Emerging Markets and Recent Discussions

Two additional criteria important for Emerging Markets: High foreign debt, a weak net investment position and a current account deficit increases government bond yields.

Read More »

Read More »

Pros and Cons of the Swiss Countercyclical Capital Buffer

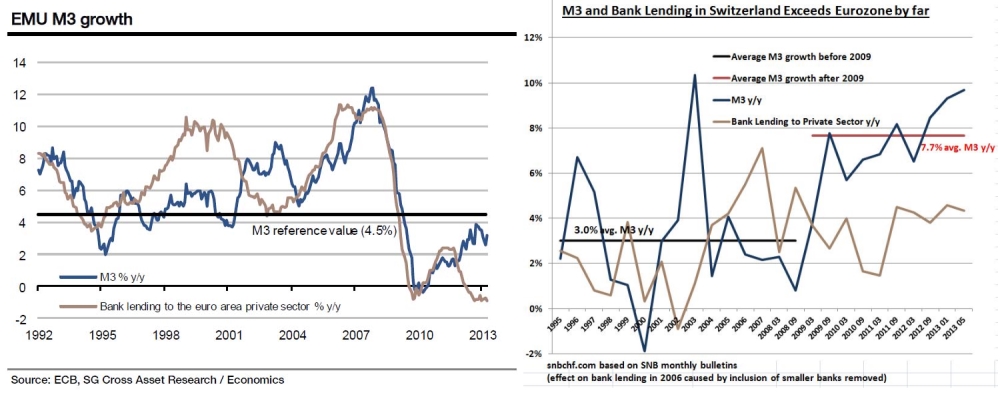

Switzerland is currently living in a big real estate boom. The bubble bursting would imply that banks' collateral in the form of real estate falls in value. Therefore the banks' assets might fall because many home buyers might not be able to repay their mortgage. If a real estate bubble pops, then banks should be better capitalized to absorb such a shock. Therefore the Swiss National Bank introduced macro-prudential measures, like the so-called...

Read More »

Read More »

2013 Posts on Markets

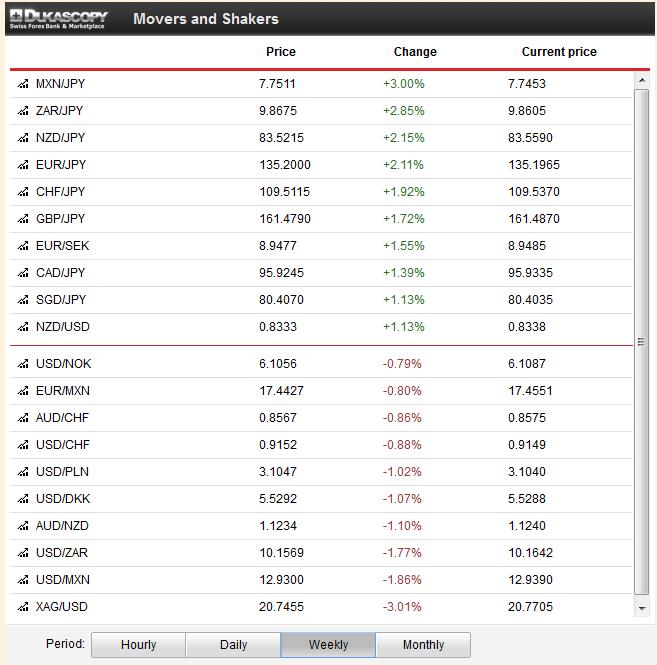

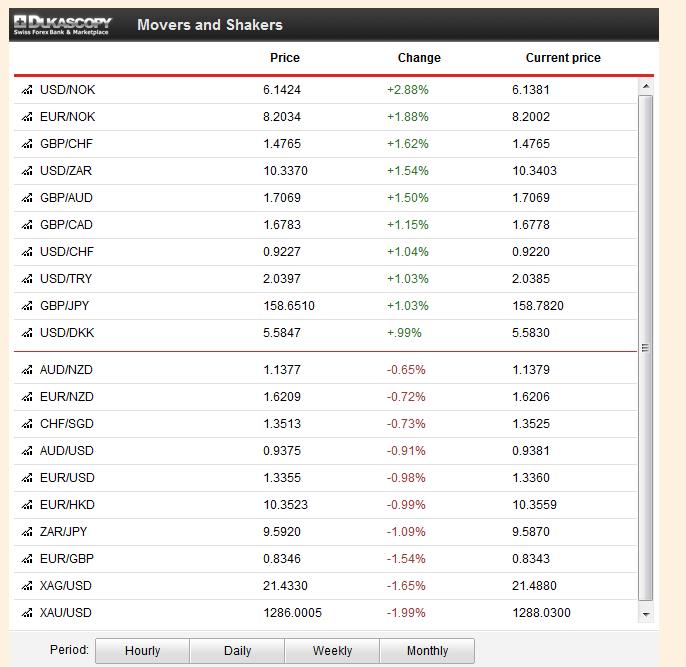

Fundamentals,FX,Gold and CHF:Week November 18 to November 22

Fundamentals with highest importance: The HSBC Flash Purchasing Manager Index (PMI) for China weakened from 50.8 to 50.4. In particular, new export orders, output prices and employment started to decrease again, while output increased. The preliminary Markit manufacturing PMI for the United States edged up to 54.3 (vs. 52.3 expected), a 9-month high after the …

Read More »

Read More »

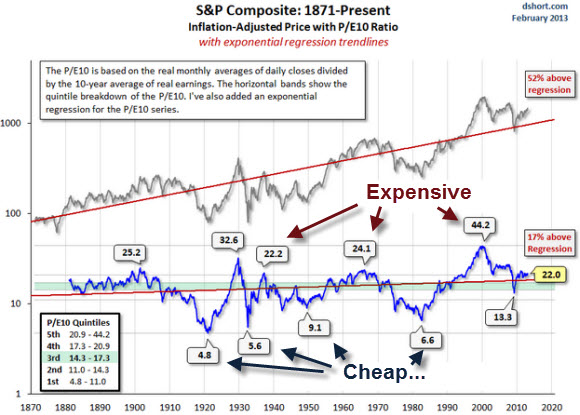

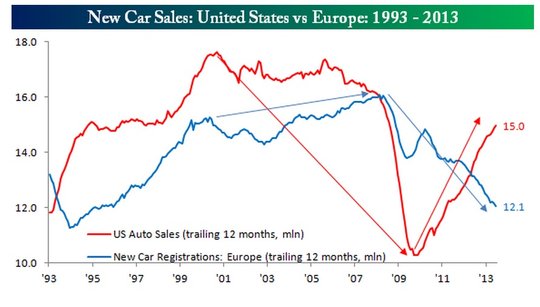

Rising Profits as Reason for the Stock Market Rally?

A list of relevant graphs for long-term price earnings ratios and the rising company profits in the last years.

Read More »

Read More »

Fundamentals,FX,Gold and CHF:Week November 11 to November 15

Fundamentals with highest importance: In Janet Yellen’s hearing at the Senate Banking Commission, the future Fed chair emphasized the need to provide support to the economic recovery and to overcome low inflation. Her speech supported equities, gold and US Treasuries. GDP in the Euro zone rose by 0.1% QoQ in line with expectations, but less …

Read More »

Read More »

Fundamentals,FX,Gold and CHF: Week November 4 to November 8

Fundamentals with highest importance: The U.S. GDP release for Q3, showed that despite the recent U.S. critique with Germany, the Americans are trying to follow the successful Germans: for the first time since Q1/2012 and Q2/2011 exports rose more than imports. GDP was up 2.8%, but not driven by consumption, it was mostly helped by …

Read More »

Read More »

Fundamentals, FX, Gold and CHF: Week October 21 to 25

Major Fundamental Events The week contained a lot of important fundamental events, in particular Non-Farm Payrolls and preliminary “flash” PMI readings. Highest importance for FX rates Non-Farm Payrolls (NFPs) weakened to 148K, private NFPs to 126K, both against 180K expected. Especially the private NFPs were disappointing. The decrease in the unemployment rate from 7.3% …

Read More »

Read More »

Week October 14 to 18, A Close Look at China’s Fundamental Data

Weekly Overview of FX Rates Movements The week was driven by the following factors: Solid Chinese economic data including a 7.8% rise in GDP. The end of the debt ceiling debate, at least for now. The expectation by the Fed member Evans that the government shutdown has delayed Fed tapering. San Francisco Fed’s Williams …

Read More »

Read More »

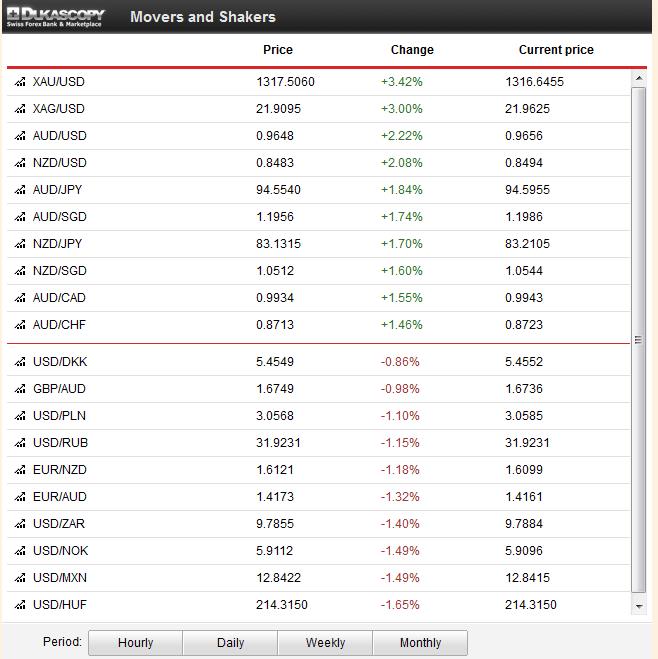

Fundamentals, Gold and FX Movements, Week October 7 to Oct. 12

Our weekly summary of fundamental news on FX that aims to explains price movements, with particular emphasis on the possibly biggest mysteries: the gold price (GLD) and the Swiss franc (FXF) . Weekly Overview Hopes on a compromise between Obama and republicans on the U.S. debt ceiling and high U.S. initial unemployment claims sustained …

Read More »

Read More »