Category Archive: 7) Markets

US Stock Market: Happy Days Are Here Again? Not so Fast…

Obviously, assorted crash analogs have by now gone out of the window – we already noted that the market was late if it was to continue to mimic them, as the decline would have had to accelerate in the last week of March to remain in compliance with the “official time table”. Of course crashes are always very low probability events – but there are occasions when they have a higher probability than otherwise, and we will certainly point those out...

Read More »

Read More »

US Stock Market – How Bad Can It Get?

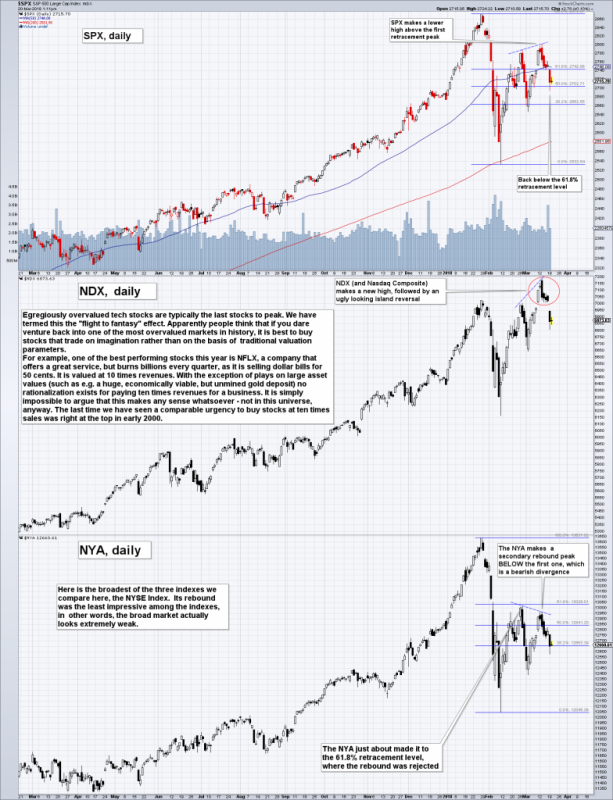

In view of the fact that the stock market action has gotten a bit out of hand again this week, we are providing a brief update of charts we have discussed in these pages over the past few weeks (see e.g. “The Flight to Fantasy”). We are doing this mainly because the probability that a low probability event will actually happen has increased somewhat in recent days.

Read More »

Read More »

US Stock Market – The Flight to Fantasy

The chart formation built in the course of the early February sell-off and subsequent rebound continues to look ominous, so we are closely watching the proceedings. There are now numerous new divergences in place that clearly represent a major warning signal for the stock market. For example, here is a chart comparing the SPX to the NDX (Nasdaq 100 Index) and the broad-based NYA (NYSE Composite Index).

Read More »

Read More »

Stock and Bond Markets – The Augustine of Hippo Plea

Most fund managers are in an unenviable situation nowadays (particularly if they have a long only mandate). On the one hand, they would love to get an opportunity to buy assets at reasonable prices. On the other hand, should asset prices actually return to levels that could be remotely termed “reasonable”, they would be saddled with staggering losses from their existing exposure. Or more precisely: their investors would be saddled with staggering...

Read More »

Read More »

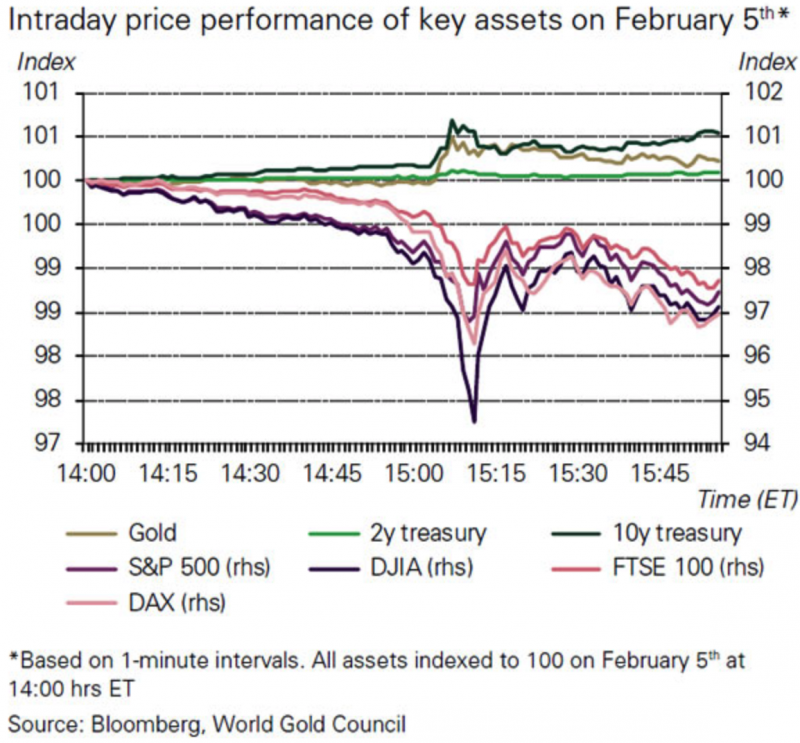

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk. Recent stock market selloff showed gold can deliver returns and reduce portfolio risk. Gold’s performance during stock market selloff was consistent with historical behaviour. Gold up nearly 10% in last year but performance during recent selloff was short-lived. The stronger the market pullback, the stronger gold’s rally. WGC: ‘a good time for investors to consider including or adding gold...

Read More »

Read More »

Market Efficiency? The Euro is Looking Forward to the Weekend!

As I have shown in previous issues of Seasonal Insights, various financial instruments are demonstrating peculiar behavior in the course of the week: the S&P 500 Index is typically strong on Tuesdays, Gold on Fridays and Bitcoin on Tuesdays (similar to the S&P 500 Index). Several readers have inquired whether currencies exhibit such patterns as well. Are these extremely large markets also home to such statistical anomalies, or is market efficiency...

Read More »

Read More »

Seasonality of Individual Stocks – an Update

Readers are very likely aware of the “Halloween effect” or the Santa Claus rally. The former term refers to the fact that stocks on average tend to perform significantly worse in the summer months than in the winter months, the latter term describes the typically very strong advance in stocks just before the turn of the year. Both phenomena apply to the broad stock market, this is to say, to benchmark indexes such as the S&P 500 or the DJIA.

Read More »

Read More »

Great Graphic: Stocks and Bonds

The relationship between stocks and bonds does not appear to have changed much. It is difficult to eyeball correlations. Question the meaning of a chart that has two time series and two scales and.

Read More »

Read More »

US Stocks – Minor Dip With Potential, Much Consternation

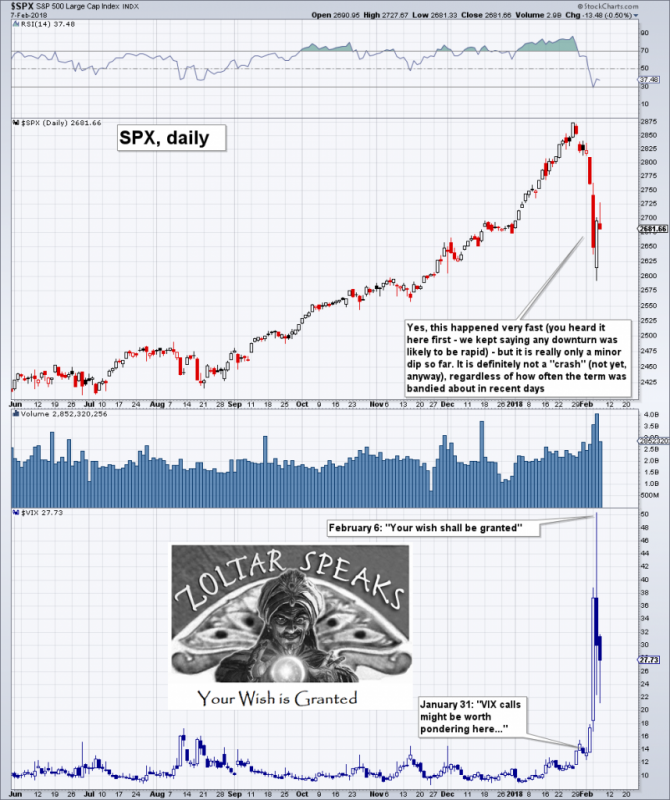

On January 31 we wrote about the unprecedented levels – for a stock market index that is – the weekly and monthly RSI of the DJIA had reached (see: “Too Much Bubble Love, Likely to Bring Regret” for the astonishing details – provided you still have some capacity for stock market-related astonishment). We will take the opportunity to toot our horn by reminding readers that we highlighted VIX calls of all things as a worthwhile tail risk play....

Read More »

Read More »

How to Buy Low When Everyone Else is Buying High

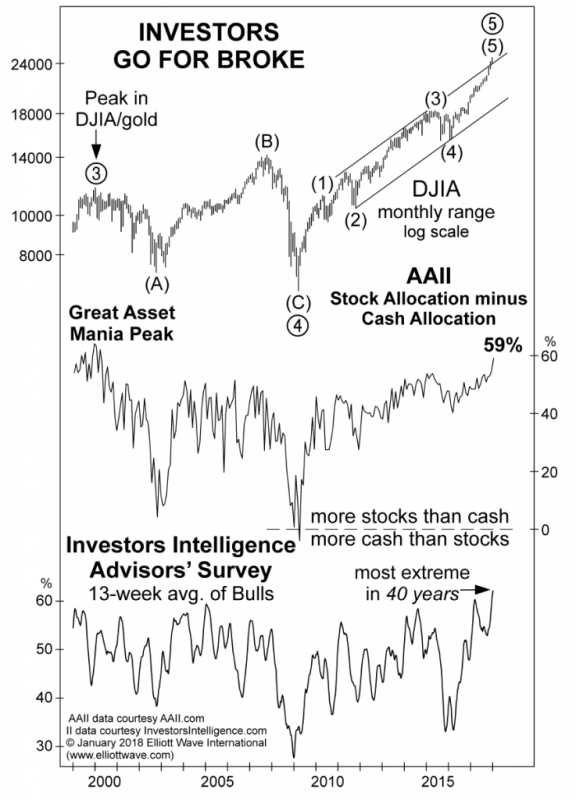

The common thread running through the collective minds of present U.S. stock market investors goes something like this: A great crash is coming. But first there will be an epic run-up climaxing with a massive parabolic blow off top. Hence, to capitalize on the final blow off, investors must let their stock market holdings ride until the precise moment the market peaks – and not a moment more. That’s when investors should sell their stocks and go to...

Read More »

Read More »

Is This The Greatest Stock Market Bubble In History? Goldnomics Podcast

GoldNomics Podcast (Episode 2) Is This The Greatest Stock Market Bubble In History? In our second GoldNomics podcast, we take a look at one of the important financial questions of our day – is this the greatest stock market bubble in history? Listen on iTunes, SoundCloud and Blubrry. Watch on YouTube below

Read More »

Read More »

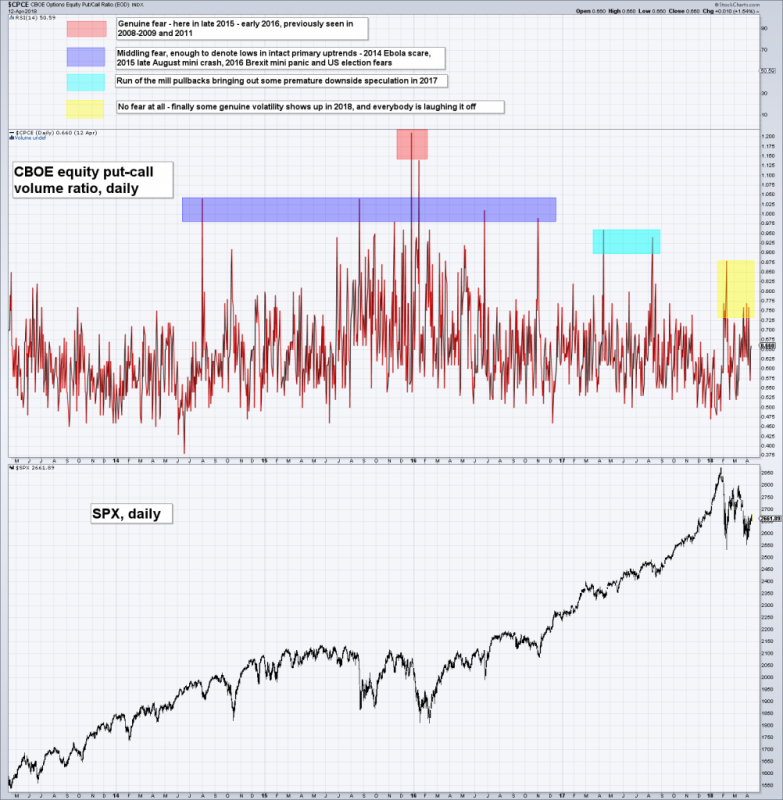

Punch-Drunk Investors & Extinct Bears, Part 1

We didn’t really plan on writing about investor sentiment again so soon, but last week a few articles in the financial press caught our eye and after reviewing the data, we thought it would be a good idea to post a brief update. When positioning and sentiment reach levels that were never seen before after the market has gone through a blow-off move for more than a year, it may well be that it means something for once.

Read More »

Read More »

2018: The Weakest Year in the Presidential Election Cycle Has Begun

Our readers are probably aware of the influence the US election cycle has on the stock market. After Donald Trump was elected president, a particularly strong rally in stock prices ensued. Contrary to what many market participants seem to believe, trends in the stock market depend only to a negligible extent on whether a Republican or a Democrat wins the presidency.

Read More »

Read More »

Oil Supply Globally: Market Price Compared to Production Costs

Mainstream media often speaks of the great shale gas/oil revolution and how it makes the United States more productive and a net exporter of oil. We wanted to go into more details,we compare oil production costs for US shale and global oil producers. As reason for the cheap oil we see the combination of two effects:

Demand: Cheap US money supported a Chinese investment boom in factories and housing until 2012. The over-investment phase is...

Read More »

Read More »

Credit Risk and Capital Charges

Collateralisation reduces the credit risk on repo, which in turn can reduce the capital charge that regulators impose on lending cash. However, collateral has operational and legal risks, which means that, notwithstanding the comfort given by collateral, the primary concern in a repo should always be the creditworthiness of the counterparty. This is one of the lessons of the current market crisis.

Read More »

Read More »

John Henry Smith, the Grail: Abnormally High Returns

John Henry Smith of Grail Securities (Switzerland) specializes in the U.S. stock market. He offers a unique and powerful advisory service to private investors, institutional investors, and asset managers, who are seeking to consistently beat the market.

Read More »

Read More »

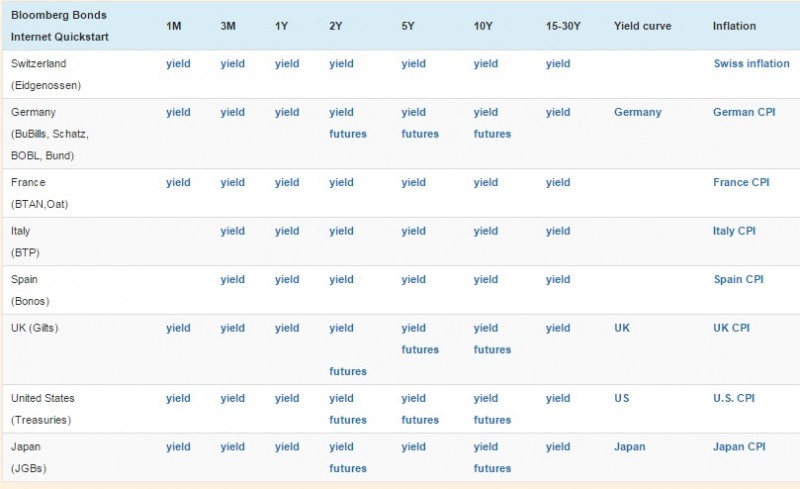

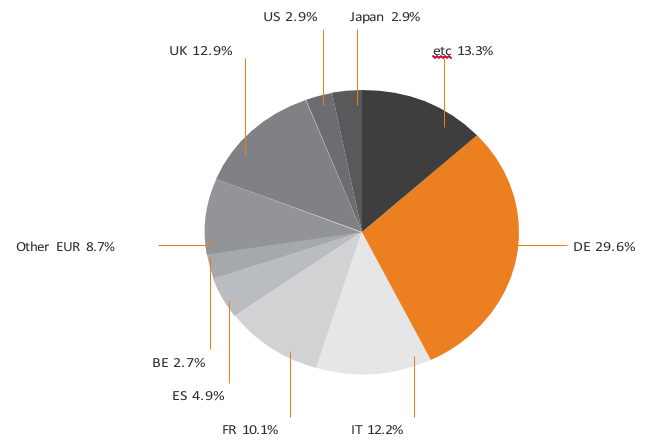

What Drives Government Bond Yields?

For us the five major drivers of government bond yields are:

Inflation expectations and inflation: The by far most important criterion. High inflation expectations must be compensated via higher bond yields. The main driver behind inflation expectations is the wage development, this is the form of inflation that typically persists. Price inflation follows inflation expectations with a certain lag.

Wealth: The higher the wealth of a country, the...

Read More »

Read More »