Category Archive: 7) Markets

A Global Dearth of Liquidity

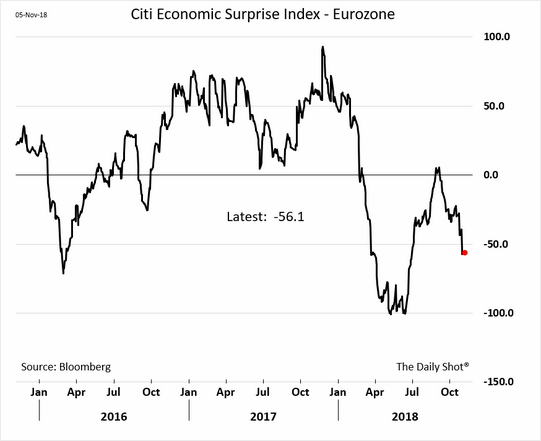

Worldwide Liquidity Drought – Money Supply Growth Slows Everywhere

This is a brief update on money supply growth trends in the most important currency areas outside the US (namely the euro area, Japan and China) as announced in in our recent update on US money supply growth (see “Federal Punch Bowl Removal Agency” for the details).

Nobody likes a drought. This collage illustrates why.

The liquidity drought is not confined to the US – it...

Read More »

Read More »

Swiss stock exchange could lose EU access in January

An EU Commission document has revealed that, for now, not enough progress on the Swiss-EU framework agreement has been made to renew the ‘financial equivalency’ status of the Swiss stock exchange in Europe.

Read More »

Read More »

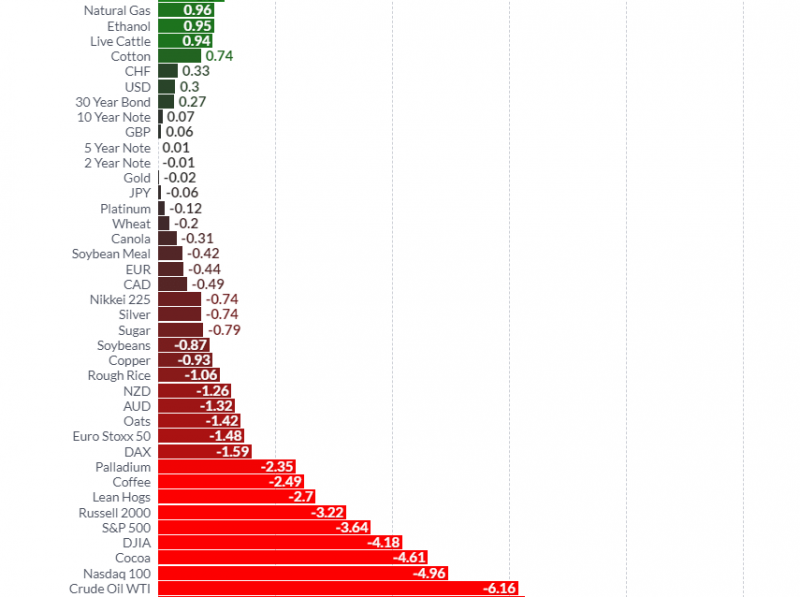

Gold and Silver Hold Firm as Stocks and Oil Lower in to US Holiday Weekend

Key Gold and Precious Metals News, Commentary and Charts This Week. Gold and silver traded sideways this week as we saw stock markets take some heat and undo most of the recent recovery from the October sell off. Oil has sold off and is now at levels that we haven’t seen since 2017.

Read More »

Read More »

The Intolerable Scourge of Fake Capitalism

All is now bustle and hubbub in the late months of the year. This goes for the stock market too. If you recall, on September 22nd the S&P 500 hit an all-time high of 2,940. This was nearly 100 points above the prior high of 2,847, which was notched on January 26th. For a brief moment, it appeared the stock market had resumed its near decade long upward trend.

Read More »

Read More »

Pushing Past the Breaking Point

Schemes and Shams. Man’s willful determination to resist the natural order are in vain. Still, he pushes onward, always grasping for the big breakthrough. The allure of something for nothing is too enticing to pass up.

Read More »

Read More »

Eastern Monetary Drought

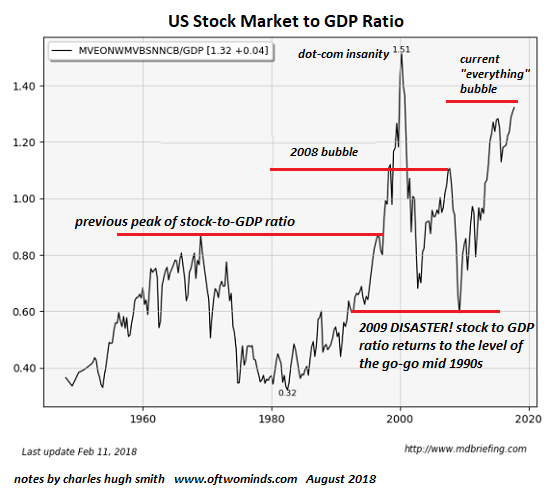

Looking back at the past decade, it would be easy to conclude that central planners have good reason to be smug. After all, the Earth is still turning. The “GFC” did not sink us, instead we were promptly gifted the biggest bubble of all time – in everything, to boot. We like to refer to it as the GBEB (“Great Bernanke Echo Bubble”) in order to make sure its chief architect is not forgotten.

Read More »

Read More »

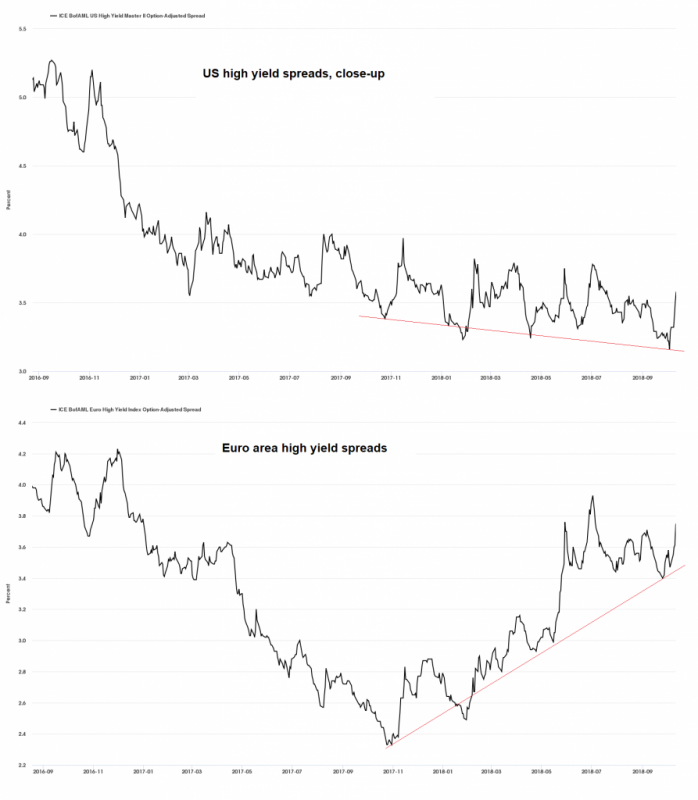

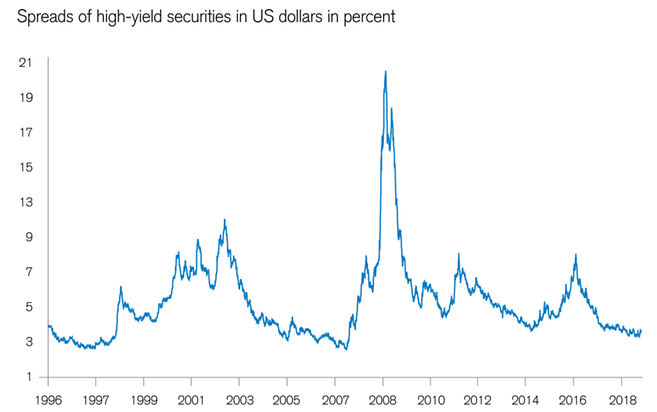

Are Credit Spreads Still a Leading Indicator for the Stock Market?

Seemingly out of the blue, equities suffered a few bad hair days recently. As regular readers know, we have long argued that one should expect corrections in the form of mini-crashes to strike with very little advance warning, due to issues related to market structure and the unique post “QE” environment.

Read More »

Read More »

Special Edition: Markets Under Pressure (VIDEO)

What does Alhambra Investments think about the 1300 point drop in the Dow Jones Average this week? Alhambra CEO Joe Calhoun has some thoughts.

Read More »

Read More »

US Stocks and Bonds Get Clocked in Tandem

At the time of writing, the stock market is recovering from a fairly steep (by recent standards) intraday sell-off. We have no idea where it will close, but we would argue that even a recovery into the close won’t alter the status of today’s action – it is a typical warning shot. Here is what makes the sell-off unique:

Read More »

Read More »

Video with Michael Strobaek: Discussing economic growth and investment strategies

What shape are the markets in right now? This month, Credit Suisse Global CIO Michael Strobaek discusses growth in the global and Swiss economies and explains the right investment strategies during the growth phase.

Read More »

Read More »

Stimmen vom Immopreneur Kongress 2017 – Waldemar Merkel

Sichere dir jetzt dein Ticket für den nächsten Immopreneur Kongress 2019: http://bit.ly/IPK19YT

Immopreneur.de:

▶ http://immopreneur.de

Immopreneur.de Blog:

▶ http://immopreneur.de/blog/

Immopreneur Instagram:

▶ https://www.instagram.com/immopreneur.de/

--------------------------------------

Bestelle Dir hier das neue Buch DAS SYSTEM IMMOBILIE (fast) kostenlos!

▶ http://bit.ly/DasSystemImmobilieYT

--------------------------------------...

Read More »

Read More »

Four trouble spots. Four pleasant surprises.

August looks back on positive economic and market developments. In retrospect, the first half of the year was soothed by many pleasant surprises, including much-discussed trouble spots that never flared. Read about four perceived market crises.

Read More »

Read More »

Stimmen vom Immopreneur Kongress 2017 – Julien Backhaus

Sichere dir jetzt dein Ticket für den nächsten Immopreneur Kongress 2019: http://bit.ly/IPK19YT

Immopreneur.de:

▶ http://immopreneur.de

Immopreneur.de Blog:

▶ http://immopreneur.de/blog/

Immopreneur Instagram:

▶ https://www.instagram.com/immopreneur.de/

--------------------------------------

Bestelle Dir hier das neue Buch DAS SYSTEM IMMOBILIE (fast) kostenlos!

▶ http://bit.ly/DasSystemImmobilieYT

--------------------------------------...

Read More »

Read More »

Immopreneur Kongress 2018 – Die Pflichtveranstaltung für innovative Immobilien-Investoren

Sichere dir jetzt dein Ticket für den nächsten Immopreneur Kongress 2019: http://bit.ly/IPK19YT

Immopreneur.de:

▶ http://immopreneur.de

Immopreneur.de Blog:

▶ http://immopreneur.de/blog/

Immopreneur Instagram:

▶ https://www.instagram.com/immopreneur.de/

--------------------------------------

Bestelle Dir hier das neue Buch DAS SYSTEM IMMOBILIE (fast) kostenlos!

▶ http://bit.ly/DasSystemImmobilieYT

--------------------------------------

Du...

Read More »

Read More »

Digging into Wealth and Income Inequality

The assets of U.S. households recently topped $100 trillion, yet another sign that everything is going swimmingly in the U.S. economy. Let's take a look at the Federal Reserve's Household Balance Sheet, which lists the assets and liabilities of all U.S. households in very big buckets (real estate: $25 trillion). (For reasons unknown, the Fed lumps non-profit assets and liabilities with households, but these modest sums are easily subtracted.)

Read More »

Read More »

Die richtige Unternehmensgesellschaft für Immobilieninvestments | Achim Zimmermann

Unternehmensgesellschaft für Immobilieninvestments - - sichere dir jetzt dein Ticket für den nächsten Immopreneur Kongress 2019: http://bit.ly/IPK19YT

Welche Unternehmensgesellschaft ist die sinnvollste für mich als Immobilieninvestor? Diese Frage stellen sich viele Investoren, denn die falsche Wahl kann viel Geld und viele Nerven kosten.

Achim Zimmermann erklärt dir in diesem Video, worauf du dabei achten solltest.

Jetzt für die Immopreneur...

Read More »

Read More »

Steuern sparen Immobilien – Wie du als Immobilieninvestor deinen Steuersatz senkst | Johann Köber

Steuern sparen Immobilien - sichere dir jetzt dein Ticket für den nächsten Immopreneur Kongress 2019: http://bit.ly/IPK19YT

Eine der besten Möglichkeiten, um deinen Gewinn als Immobilieninvestor zu erhöhen, ist Möglichkeiten zu finden, wie du deinen Steuersatz senkst.

In diesem Video zeigt dir Johann Köber, wie du es schaffst, durch Immobilien Steuern zu sparen.

Jetzt für die Immopreneur Masterclass mit Thomas Knedel bewerben:

▶▶▶...

Read More »

Read More »

KEIN RISIKO als Immobilieninvestor mit der richtigen Unternehmensform | Achim Zimmermann

Richtige Unternehmensform - sichere dir jetzt dein Ticket für den nächsten Immopreneur Kongress 2019: http://bit.ly/IPK19YT

Ist es möglich das Risiko als Immobilieninvestor komplett zu minimieren? Wenn du die richtigen Wege kennst, dann ist das möglich. Achim Zimmermann zeigt dir in diesem Video, wie das geht.

Dr. Achim Zimmermann: https://achim-zimmermann.de/intelligenter-immobilieneinkauf/

Jetzt für die Immopreneur Masterclass mit Thomas...

Read More »

Read More »

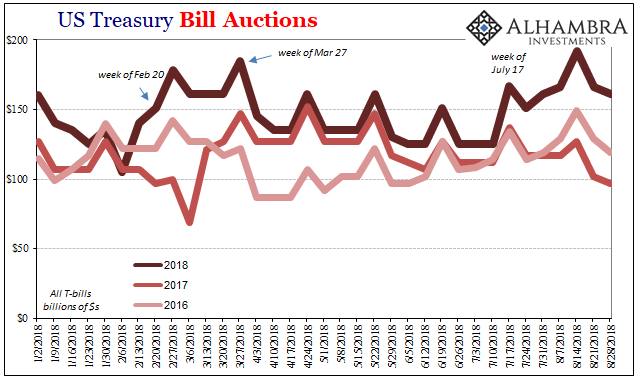

Anticipating How Welcome This Second Deluge Will Be

Effective federal funds (EFF) was 1.92% again yesterday. That’s now eight in a row just 3 bps underneath the “technically adjusted” IOER. If indeed the FOMC has to make another one to this tortured tool we know already who will be blamed for it.

Read More »

Read More »

Günstig Land kaufen – Wie du profitabel kleine Grundstücke kaufst – mit Jack Bosch

Land kaufen - Dein kostenloses Immopreneur Starterpaket für Immobilieninvesotren: http://bit.ly/immobilienstarter

Im heutigen Interview habe ich Jack Bosch zu Gast. Wir sprechen darüber, wie du es schaffst mit einfach Methoden Land zu kaufen und so hohe Profite mitzunehmen.

Jack ist Experte für Land flipping und hat sich in den letzten Jahren ein starkes Immobilienportfolio in den USA aufgebaut. Zusätzlich ist er als Coach tätig und hilft...

Read More »

Read More »