Category Archive: 7) Markets

The Golden Autumn Season – One of the Most Reliable Seasonal Patterns Begins

The Strongest Seasonal Stock Market Trend. Readers may already have guessed: when the vibrant colors of the autumn leaves are revealed in all their splendor, the strongest seasonal period of the year begins in the stock market – namely the year-end rally. Stocks typically rise in this time period. However, there are questions, such as: how often does a rally take place, how strong is it, and when is the best time for investors to enter the market?

Read More »

Read More »

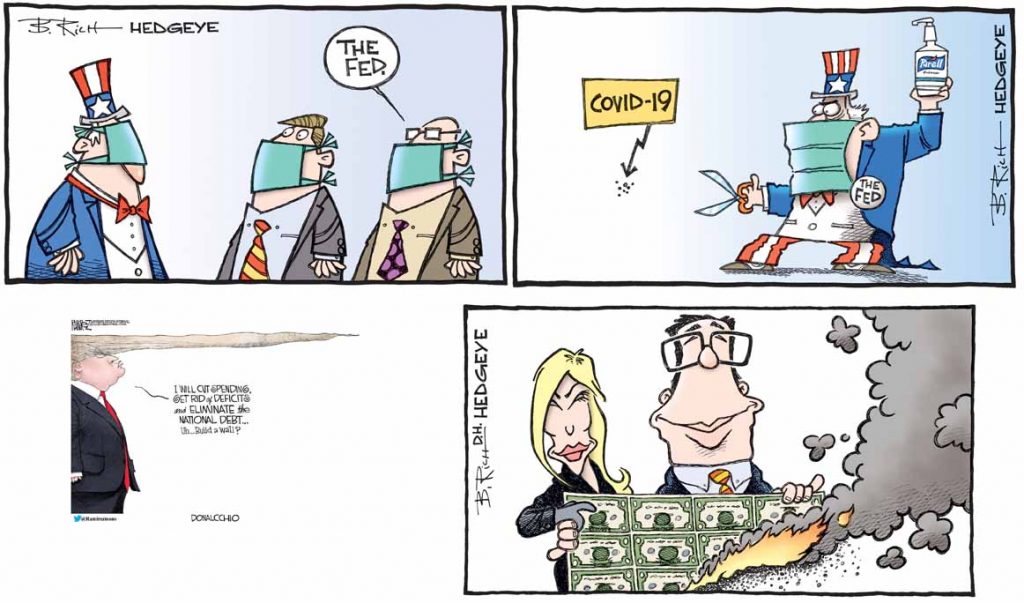

America’s Road Map to $40 Trillion National Debt by 2028

Planning on Your Behalf. Watch out! At this very moment, professional economists of all stripes are making plans on your behalf. They are dreaming and scheming new and innovative ways to spend your money long before you have earned it. While you are busy at the gristmill, grinding away for clients and customers, claims are being laid upon your life.

Read More »

Read More »

Tidbits Of Further Warnings: Houston, We (Still) Have A (Repo) Problem

Despite the name, the Fed doesn’t actually intervene in the US$ repo market. I know they called them overnight repo operations, but that’s only because they mimic repo transactions not because the central bank is conducting them in that specific place. What really happened was FRBNY allotting bank reserves (in exchange for UST, MBS, and agency collateral) only to the 24 primary dealers.

Read More »

Read More »

Head Faking In The Empty Zoo: Powell Expands The Balance Sheet (Again)

They remain just as confused as Richard Fisher once was. Back in ’13 while QE3 was still relatively young and QE4 (yes, there were four) practically brand new, the former President of the Dallas Fed worried all those bank reserves had amounted to nothing more than a monetary head fake. In 2011, Ben Bernanke had admitted basically the same thing.

Read More »

Read More »

Money Markets: Sizing Up the Cavalry

There’s been an unusual level of honesty coming out of Liberty Street of late. Not total honesty but certainly more than the usual nothing denials and dismissals. If you don’t immediately recognize the reference, that’s the street in NYC where FRBNY and its Open Market Desk resides. What is supposed to be the moneyed centered of the universe. After all, as Ben Bernanke famously threatened in November 2002, that’s the printing press.

Read More »

Read More »

More Than A Decade Too Late: FRBNY Now Wants To Know, Where Were The Dealers?

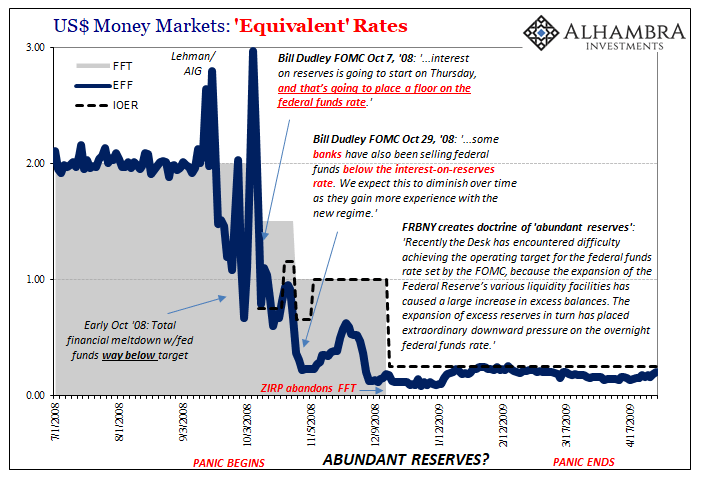

I’ve said it all along; focusing in on bank reserves would leave you dazed and confused. It’s just not how the system works. After all, as I pointed out again not long ago, “our” glorious central bank had the audacity to claim that there were “abundant” reserves during the worst financial panic in four generations. “Somehow” despite that, it was a Global Financial Crisis that lived up to its name – global.

Read More »

Read More »

What’s The Verdict On This Week?

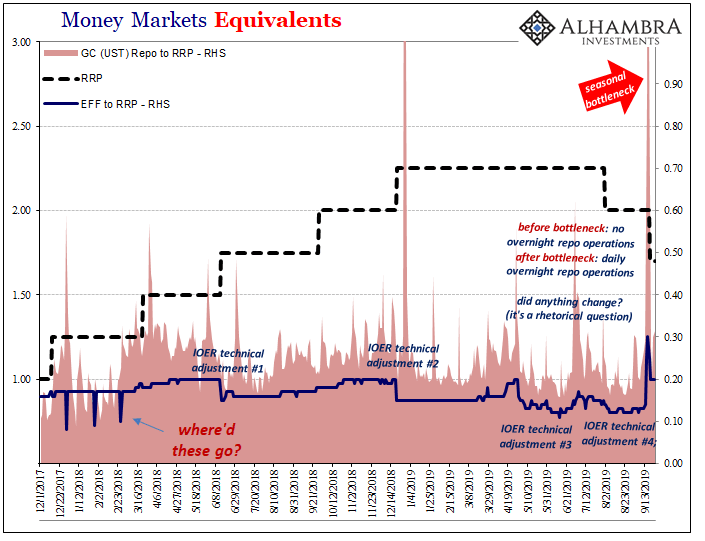

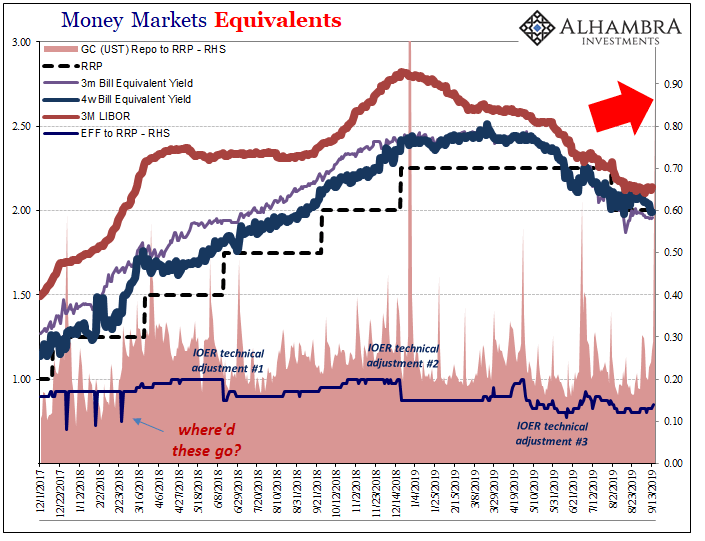

Jay Powell’s disastrous week is coming to a close, not yet his long nightmare. He has been battling fed funds (meaning repo) for his entire tenure dating back to February 2018. This week wasn’t the conclusion to the contest, just the latest and biggest round of it.

Read More »

Read More »

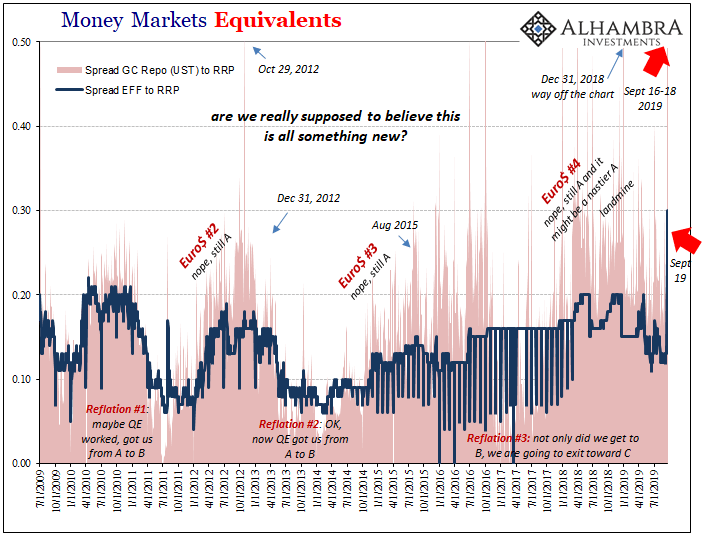

Stuck at A: Repo Chaos Isn’t Something New, It’s The Same Baseline

Finally, finally the global bond market stopped going in a straight line. I write often how nothing ever does, but for almost three-quarters of a year the guts of the financial system seemed highly motivated to prove me wrong. Yields plummeted and eurodollar futures prices soared. It is only over the past few weeks that rates have backed up in what has been the first real selloff since last year.

Read More »

Read More »

Scientific Long-Term Study Confirms: Seasonality is the Best Investment Strategy!

A Pleasant Surprise. You can probably imagine that I am convinced of the merits of seasonality. However, even I was surprised that an investment strategy based on seasonality is apparently leaving numerous far more popular strategies in the dust. And yet, this is exactly what a recent comprehensive scientific study asserts – a study that probably considers a longer time span than most: it examines up to 217 years of market history!

Read More »

Read More »

How To Properly Address The Unusual Window Dressing

Unable to tackle effective monetary requirements, bank regulators around the world turned to “macroprudential” approaches in the wake of the Global Financial Crisis. It was mostly public relations, a way to assure the public that 2008 would never be repeated. A whole set of new rules was instituted which everyone was told would reign in the worst abuses.

Read More »

Read More »

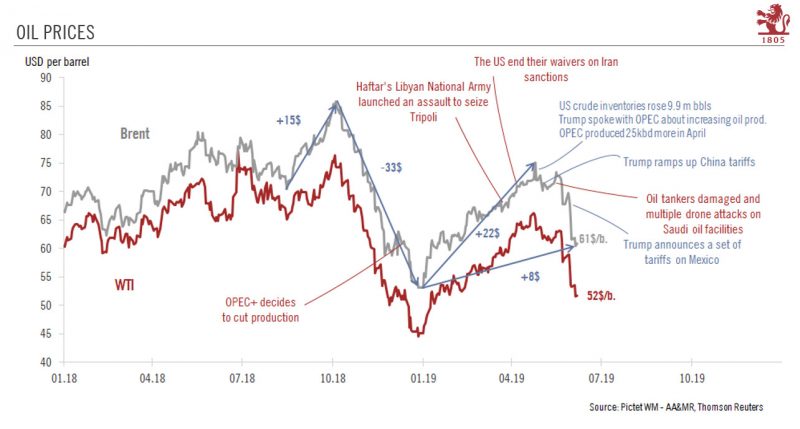

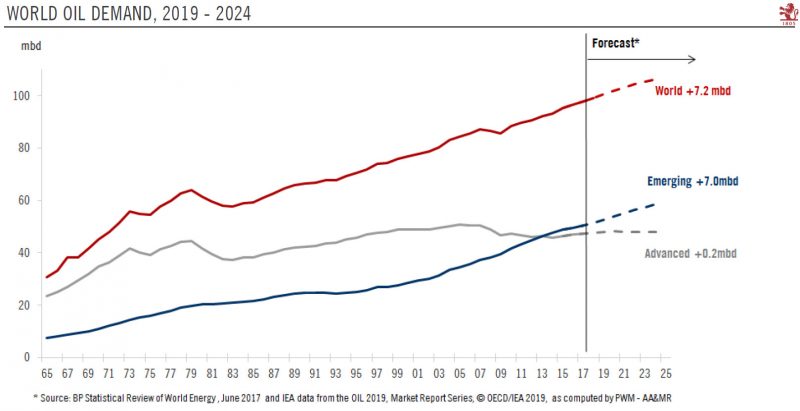

Oil prices are reeling

The escalation in trade tensions, the dimming of global growth prospects and a surge in US export capacity have pushed us to lower our oil forecasts.The recent plunge in prices suggests that oil is acting like a leading indicator of global economic growth, reflecting investors’ concerns that lasting trade disputes will dent future growth and risk pushing the world economy into recession.

Read More »

Read More »

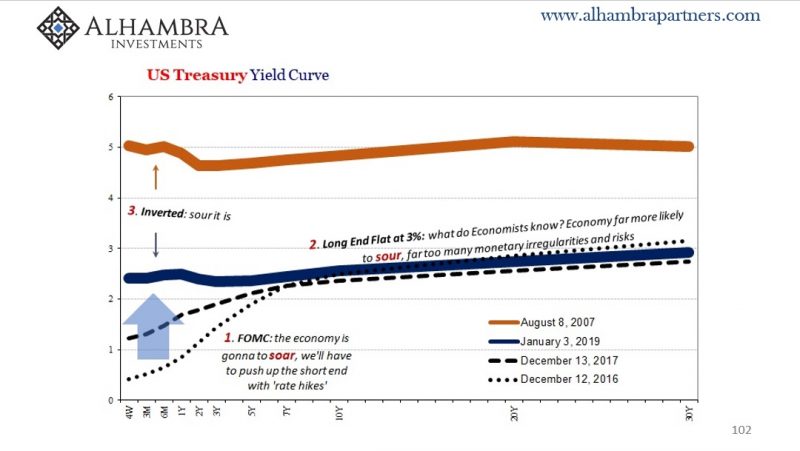

What Kind Of Risks/Mess Are We Looking At?

The fact that the mainstream isn’t taking this all very seriously isn’t anything new. But how serious are things really? That’s pretty much the only question anyone should be asking. What are the curves telling us about what’s now just over the horizon?

Read More »

Read More »

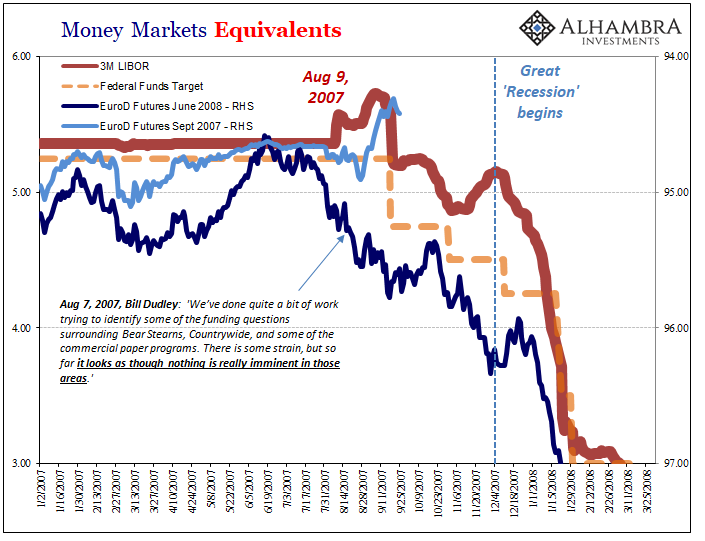

The Transitory Story, I Repeat, The Transitory Story

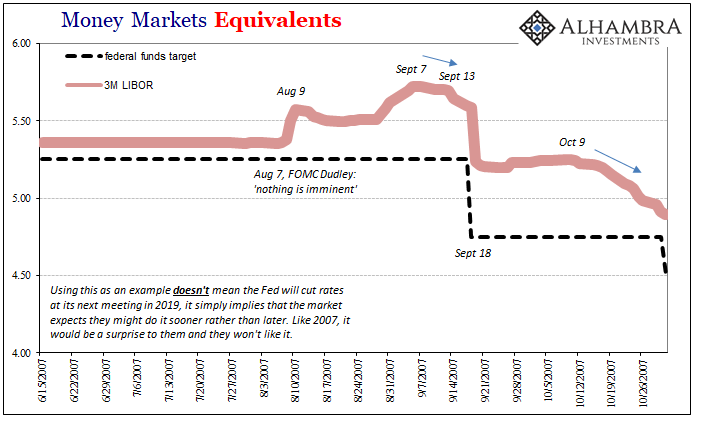

Understand what the word “transitory” truly means in this context. It is no different than Ben Bernanke saying, essentially, subprime is contained. To the Fed Chairman in early 2007, this one little corner of the mortgage market in an otherwise booming economy was a transitory blip that booming economy would easily withstand.

Just eight days before Bernanke would testify confidently before Congress, the FOMC had met to discuss their lying eyes....

Read More »

Read More »

Oil prices supported by OPEC+ cuts…before market risks being flooded again

Increased US export capacity would probably force OPEC+ to change its current tactics.After last year’s collapse, oil prices have found support since the beginning of this year for several reasons. At this stage, the main question is whether the recent surge in prices is sustainable or whether we will see renewed oil price volatility, with the possibility of a repeat of 2018.

Read More »

Read More »

Phugoid Dollar Funding

On August 12, 1985, Japan Airways flight 123 left Tokyo’s Haneda Airport on its way to a scheduled arrival in Osaka. Twelve minutes into the flight, the aircraft, a Boeing 747, suffered catastrophic failure when an aft pressure bulkhead burst.

Read More »

Read More »

The Real End of the Bond Market

These things are actually quite related, though I understand how it might not appear to be that way at first. As noted earlier today, the Fed (yet again) proves it has no idea how global money markets work. They can’t even get federal funds right after two technical adjustments to IOER (the joke).

Read More »

Read More »

Bitcoin Bottom Building

Defending 3,800 and a Swing Trade Play. For one week, bulls have been defending the 3,800 USD value area with success. But on March 4th they had to give way to the constant pressure. Prices fell quickly to the 3,700 USD level. These extended times of range bound trading are typical for Bitcoin Bottom Building in sideways ranges.

Read More »

Read More »

FOMC Minutes: The New Narrative Takes Shape

Nothing the Fed did today, or has done up to today, has changed the curves. Eurodollar futures and UST’s, they are both still inverted. The former sharply inverted. The only thing that has changed since early January is the narrative – and not in a charitable way. It is treated as a positive when it is a pretty visible signal about deteriorating circumstances.

Read More »

Read More »

LIBOR Was Expected To Drop. It Dropped. What Might This Mean?

Everyone hates LIBOR, until it does something interesting. It used to be the most boring interest rate in the world. When it was that, it was also the most important. Though it followed along federal funds this was only because of the arb between onshore (NYC) and offshore (mainly London, sometimes Caymans) conducted by banks between themselves and their subs (whichever was located where).

Read More »

Read More »

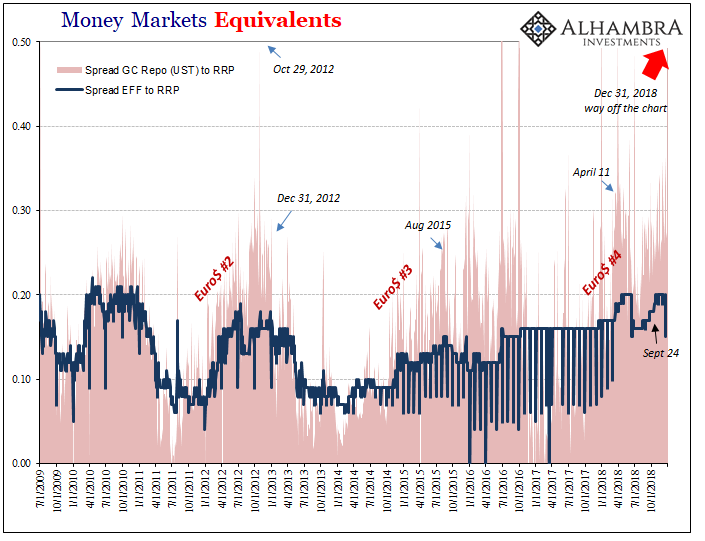

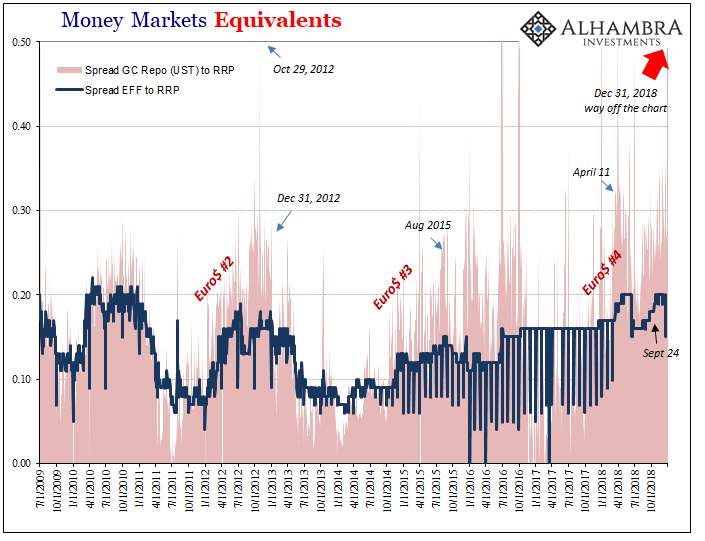

Insane Repo Reminds Us

It was only near the quarter end, that’s what made it so unnerving. We may have become used to these calendar bottlenecks over the years, but they still remind us what they are. Late October 2012 was a little different, though. On October 29, the GC repo rate for UST collateral (DTCC) surged to 52.6 bps. The money market floor, so to speak, was zero at the time and IOER (the joke) 25 bps. We also have to keep in mind the circumstances of that...

Read More »

Read More »