Category Archive: 6a) Gold & Monetary Metals

Why Governments Will Not Ban Bitcoin

Those who see governments banning ownership of bitcoin are ignoring the political power and influence of those who are snapping up most of the bitcoin. To really understand an asset, we have to examine not just the asset itself but who owns it, and who can afford to own it. These attributes will illuminate the political and financial power wielded by the owners of the asset class.

Read More »

Read More »

Learn Why Axel Merk Sees Problems Ahead for the Dollar…

Read the full transcript here: https://goo.gl/D3sbKU Listen to a previous interview with Axel Merk here: https://www.moneymetals.com/podcasts/2017/07/14/diversify-with-gold-and-cash-001114 Axel Merk of Merk Investments and the Merk Funds describes why he believes the “buy the dip” mentality has overtaken mainstream financial advisors, warns about the danger of buying into conventional wisdom and also chimes in on gold and …

Read More »

Read More »

Russia Buys 34 Tonnes Of Gold In September

Russia adds 1.1 million ounces to reserves in ongoing diversification from USD. 34 ton addition brings Russia’s Central Bank holdings to 1,779t; 6th highest. Russia’s gold reserves are at highest point in Putin’s 17-year reign. Russia’s central bank will buy gold for its reserves on the Moscow Exchange.

Read More »

Read More »

MARC FABER – The economic collapse of the Amerigeddon actually Happened in the summer we passed

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / AGENDA 21 / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2017

Read More »

Read More »

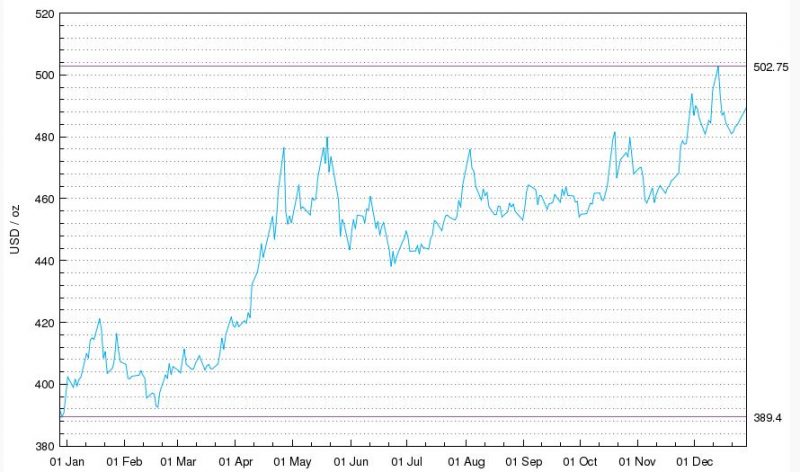

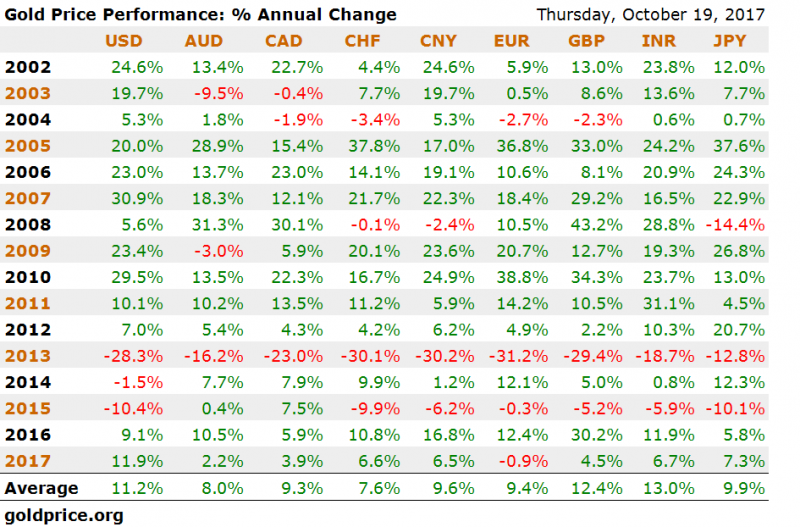

Next Wall Street Crash Looms? Lessons On Anniversary Of 1987 Crash

Next Wall Street Crash looms? Lessons on anniversary of crash. 30 years since stock market ‘Black Monday’ crash of 1987. Dow Jones Industrial Average fell 22.6% on October 19, 1987. S&P 500, FTSE and DAX fell 20%, 11% & 9% respectively. Gold rose 24.5% in 1987 (see chart), acting as safe haven. Prior to crash, stocks hit successive record highs despite imbalances. Imbalances that lead to 1987 crash are much worse today

Read More »

Read More »

Marc Faber: Every Market In Asia Has Outperformed The United States!

Subscribe to our Free Financial Newsletter: Crush The Street Marc Faber shares his thought provoking insights with us regarding freedom of the press the economy and also Blockchain technology. Other important subjects discussed is the Central Banker’s control over the economy and President Trump. TOPICS IN THIS INTERVIEW: 00:50 Lack of freedom of the press …

Read More »

Read More »

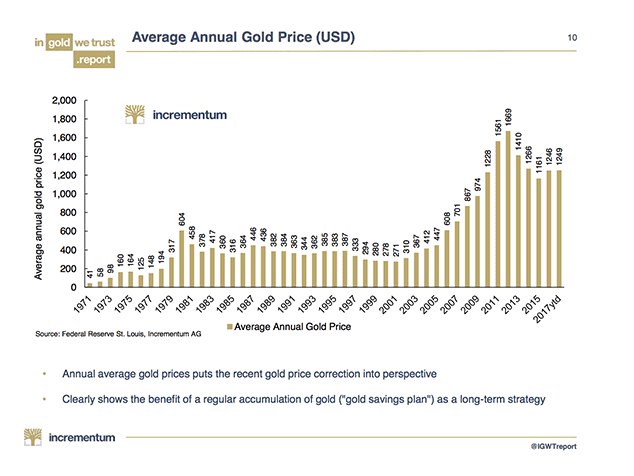

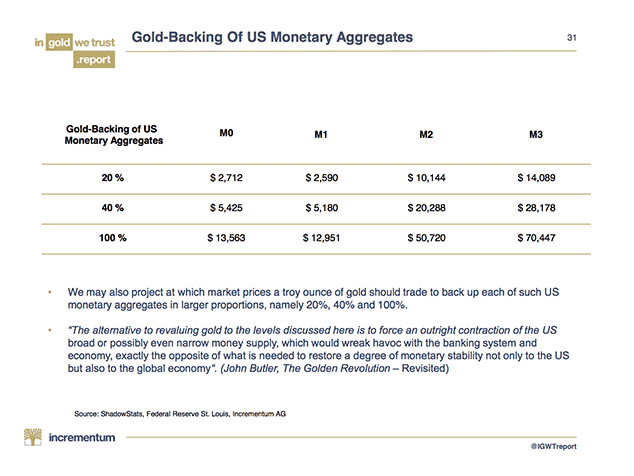

Key Charts: Gold is Cheap and US Recession May Be Closer Than Think

Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances. There’s so much to look at and consider. It’s a sort of digital equivalent of a coffee-table book.

Read More »

Read More »

Sprott Money News Ask the Expert October 2017 – Jim Rickards

Author and analyst Jim Rickards joins us to discuss Fed policy, the gold price and the possibility of renewed war on the Korean Peninsula.

Read More »

Read More »

Gold Up 74percent and One Of Top Performing Assets Since Last Market Peak 10 Years Ago

10 year anniversary of pre-Global Financial Crisis market peak in S&P 500 on October 9th. Gold up 74% since the last market peak a decade ago; 11% pa in USD, 9.4% pa in EUR and 12.4% pa in GBP. Precious metal has climbed $736/oz on Oct 9th 2007 to $1278.75 ten-years later. S&P 500’s 102% climb is thanks to asset-pumping policies by central banks, rather than value. Gold’s performance is slowly forcing mainstream to re-consider gold.

Read More »

Read More »

How Gold Bullion Protects From Conflict And War

What Steel’s study shows is that, as with any monetary force, it is how it is managed rather than what it is that carries responsibility for conflicts and the resulting financial situation. Steel’s work also demonstrates the strength and protection access to gold will give a country or army during times of conflict.

Read More »

Read More »

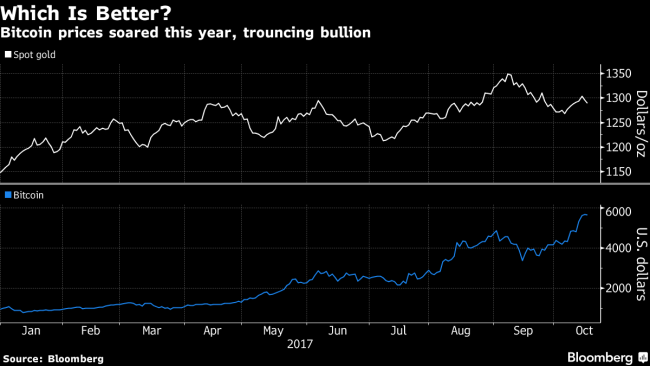

Frank Holmes Exclusive: Bitcoin Needs Electricity, Gold CONDUCTS Electricity

Tell us what you think about crypto-currencies ⇨ https://goo.gl/5npcp2 Frank Holmes of U.S. Global Investors joins Money Metals Exchange to share his comments on the main difference between gold and crypto-currencies, the fallout that will likely occur in the financial markets if Congress and the President can’t push through some much-needed deregulation and tax cuts, …

Read More »

Read More »

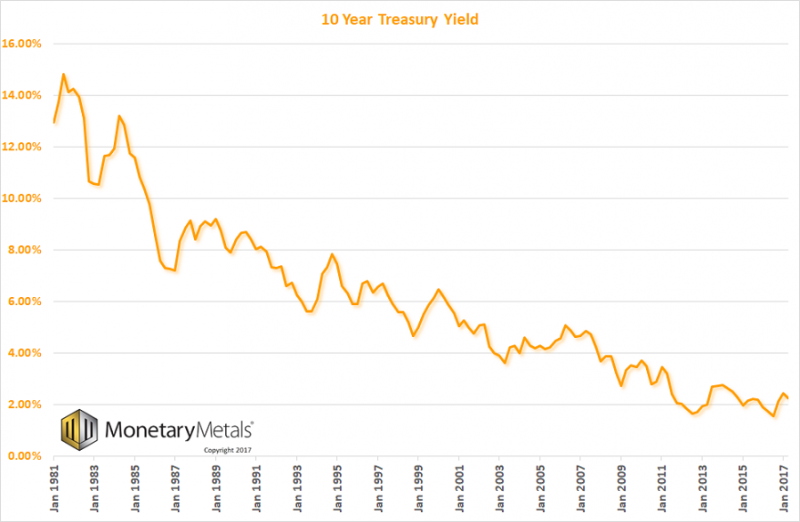

Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Authored by Kevin Muir via The Macro Tourist blog, Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility.

Read More »

Read More »

Marc Faber: US election, China, Russia, economy, gold, silver and 2017

Marc Faber is an investment advisor, fund manager, media commentator and author, as well as a seasoned public speaker. Described as ‘something of an icon’ by the Financial Times and ‘the region’s (Asia’s) most notorious bear’ by The Wall Street Journal, Dr Faber’s contrarian investment approach and monthly Gloom Boom and Doom Report are familiar …

Read More »

Read More »

Marc Faber Responds to Racism Allegations

Subscribe to our Free Financial Newsletter: http://FutureMoneyTrends.com Get more info at: Marc Faber on Yields, Stocks, Cash, and The Fallout of his Recent Comments Marc Faber is our special Guest in today’s interview, we go political and look at what progress the Trump Administration has made while also looking at why we haven’t yet seen …

Read More »

Read More »

Silver Bullion Prices Set to Soar

Gold prices have far outpaced gains in silver so far this year, but silver will emerge as the winner for the second year in a row. With a per-ounce price of $17.41 for silver futures as of Friday, analysts say the white metal is poised for a big climb, particularly as the gold-to-silver ratio stands well above historical averages.

Read More »

Read More »