Category Archive: 6a) Gold & Monetary Metals

Gold Season – Is This It?

Gold prices have a certain seasonality to them. Typically gold prices tend to bottom in July and August and then rally in to the end of the year. According to Carley Garner of DeCarlyTrading.com this is driven by a number of underlying factors. However as of yet we haven’t seen gold turn up again and … Continue reading »

Read More »

Read More »

Sprott Money News Weekly Wrap-Up 8 17 18

Eric Sprott discusses the difficult week for the precious metals and mining shares but also looks ahead to where prices are likely headed from here.

Read More »

Read More »

Jim Rogers on Gold, Silver & Surviving the Coming Crash – Goldnomics Episode 7

Talking about gold, silver and surviving the next financial crash, Jim Rogers, legendary investor and “Adventure Capitalist” speaks with Mark O’Byrne GoldCore’s Director of Research in Episode 7 of the Goldnomics Podcast. Are the actions of the US administration making China great again? What currency is going to challenge the US dollar as the global …

Read More »

Read More »

MARC FABER: Make Bear Market Preparations – DELUGE AHEAD!

Tom Beck’s Top Blockchain / Artificial Intelligence Available AT: LP(S) – My Picks Shelter your Portfolio from the Bonds COLLAPSE: http://www.PortfolioWealthGlobal.com/Bonds Get Immediate Access to our Exclusive Report on the Coming STOCK MARKET CRASH: http://www.portfoliowealthglobal.com/crash/ Download Our Top 5 Cryptocurrencies for 2018 AT: http://www.portfoliowealthglobal.com/top5/ The Gold Bull Market is Weeks Away From Hitting...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 8.10.18

Hear Eric Sprott discuss the global economy, the stress in the emerging markets and the latest updates for the precious metals.

Read More »

Read More »

John Vallis #3: Economic Boom or Doom? – Dr. Marc Faber

I was recently in Chiang Mai and connected with world-renowed economist, Dr. Marc Faber. Dr. Faber is a Swiss-born Phd in economics, and is the editor and publisher of the ‘Gloom, Boom and Doom Report’. He is regularly invited on mainstream financial news media to provide his views on various aspects of the global economy …

Read More »

Read More »

Jim Rogers US Dollar Safe Haven Status Under Threat

Another clip from our upcoming Episode of the Goldnomics Podcast with the legendary investor and adventure capitalist Jim Rogers. Jim is an American businessman, investor, traveler, financial commentator and author. He is the Chairman of Rogers Holdings and Beeland Interests, Inc. He was the co-founder of the Quantum Fund and creator of the Rogers International …

Read More »

Read More »

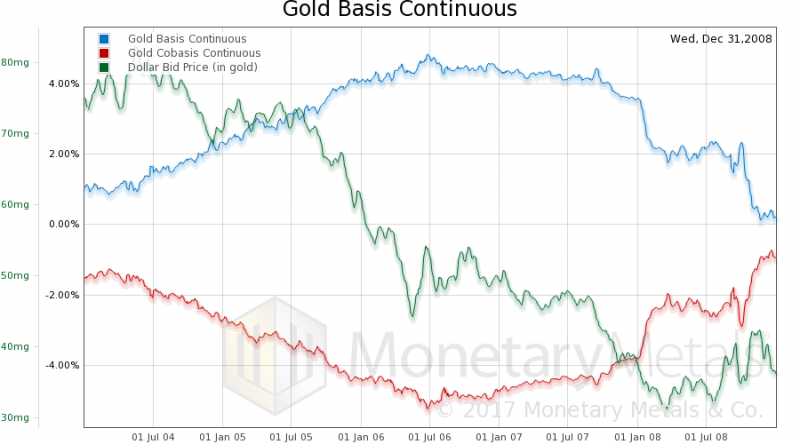

Gold—Even at its Lowest Levels in 2018—is Behaving Just as Prescribed

Gold’s sharp decline over the past month serves as little surprise to the investors who want the asset to perform in just this fashion—that is, as an alternative to assets perceived as risky, like stocks. They’re betting that the opposite will be true as well, that gold will resume its role as protector and diversifier, even inflation hedge, when what they see as bloated price-to-earnings ratios, heavy debt-to-GDP ratios among major economies and...

Read More »

Read More »

Jim Rogers – Making China Great Again!

We are delighted to announce a very special guest for our next episode of the Goldnomics Podcast, due for release later this week. We recently had the opportunity to speak with the legendary investor and adventure capitalist Jim Rogers. Jim is an American businessman, investor, traveler, financial commentator and author. He is the Chairman of …

Read More »

Read More »

Gold to Enter New Bull Market – Charles Nenner

Gold to Enter New Bull Market – Charles Nenner. “Gold is going to enter a new bull market”. “The first cycle will bottom after the summer”. “$1,212 per ounce is our downside target”. “It’s going to top $2,500 per ounce . . . in about two years or so”. “Gold is in a bull market even though it came down from $1,900 per ounce”

Read More »

Read More »

Sprott Money News Weekly Wrap-Up 8.3.18

Eric Sprott discusses the latest US jobs report and economic data as well as the precious metals and mining shares.

Read More »

Read More »

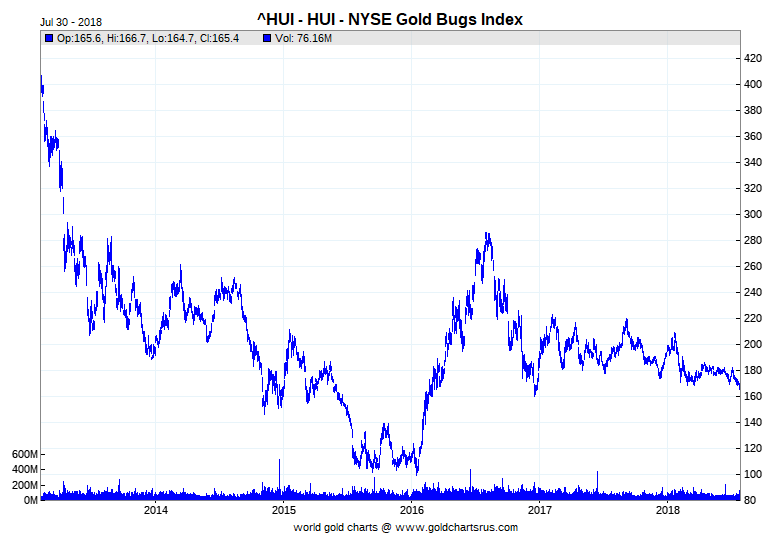

Spotlight on the HUI and XAU Gold Stock Indexes

Probably the two best known gold mining stock indexes in the world’s financial markets are the HUI and the XAU. HUI is the ticker symbol for the NYSE Arca Gold BUGS Index. XAU is the ticker symbol for the Philadelphia Gold and Silver Index. Both of these monikers make an appearance on many gold related websites and many general financial market websites as well, so its worth knowing briefly what these indexes are and what they represent.

Read More »

Read More »

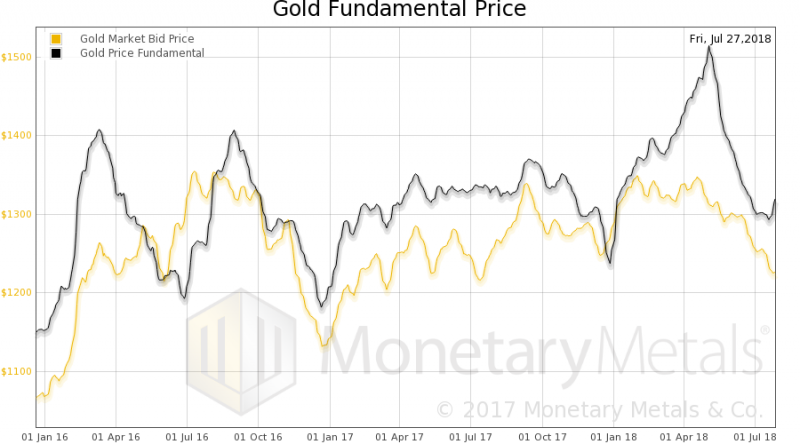

A Dire Warning, Report 29 July 2018

Let’s return to our ongoing series on the destruction of capital, and how to identify the signs. Steve Saville posted a thoughtful article this week entitled The “Productivity of Debt” Myth. His article provides a good opportunity to add some additional thoughts. We have written quite a lot on this topic. Indeed, we have a landing page for marginal productivity of debt (MPoD) with four articles so far.

Read More »

Read More »