Category Archive: 6a) Gold & Monetary Metals

Sprott Money News Ask the Expert October 2018 – Marin Katusa

Marin Katusa of Katusa Research joins us to answer questions on the economy, gold prices and the precious metals mining sector.

Read More »

Read More »

Direct Access Gold Podcast Special – The Safest Way To Own Gold

Direct Access Gold – The Safest Way to Own Gold Globally Do you own gold in the safest way possible? GoldCore has launched a service that is being considered as a game-changer when it comes to the level of safety, security and access that precious metals investors have when it comes to their gold. It …

Read More »

Read More »

We’ve Got A Special Announcement Coming This Thursday

This Thursday we are going to have a very special announcement about a new service that we are launching. This service is going to be a first for the precious metals industry and frankly we think that is going to be a game changer! We can’t say anything about it until its official launch but … Continue reading...

Read More »

Read More »

Marc Faber of Gloom, Boom & Doom Report speaks to ET Now

Marc Faber, editor and publisher of ‘The Gloom, Boom & Doom Report’, who in an interview to ET Now earlier this year had projected a 20 per cent drop in Sensex to a sub-30,000 level, now says the rupee could hit 100 a dollar mark in the next few years. India’s fiscal position is not … Continue...

Read More »

Read More »

Gold’s Best Day In 2 Years Sees 2.5 Percent Gain As Global Stocks Sell Off – This Week’s Golden Nuggets

Gold’s Best Day In 2 Years Sees 2.5 Percent Gain As Global Stocks Sell Off – This Week’s Golden Nuggets. News, Commentary, Charts and Videos You May Have Missed. Here is our Friday digest of the important news, commentary, charts and videos we were informed by this week. Market jitters and volatility have returned this week and the sell-off in US government bonds led to sharp falls on Wall Street centered on the very overvalued tech sector and the...

Read More »

Read More »

Stephen Leeb Predicts 3-Digit Silver and 5 Digit Gold?! (Bombshell Guest)

Read full transcript here: https://www.moneymetals.com/podcasts/2018/10/12/trump-bashes-crazy-fed-001632 Check Gold & Silver Prices: https://www.moneymetals.com/precious-metals-charts Dr. Stephen Leeb of Leeb Capital Management weighs in on what he believes will be a major fly in the ointment for the U.S. when it comes to the trade war with China and also tells us if he’s still holding onto the thought …

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 10.12.18

Eric Sprott discusses the falling U.S. stock market, the rising gold price and his recent trip to visit mining sites in Australia.

Read More »

Read More »

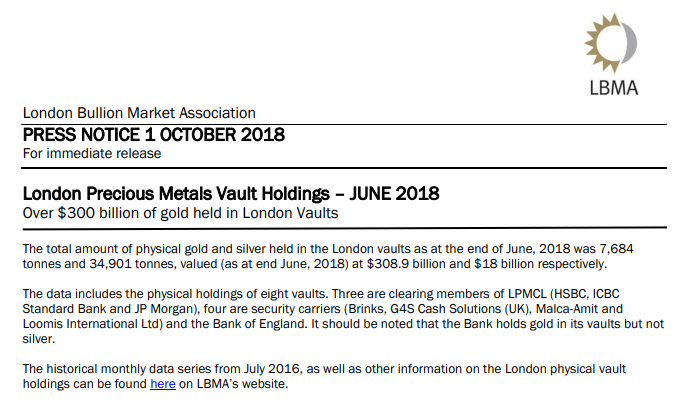

Perth Mint’s Gold and Silver Bullion Coin Sales Soar In September

Sales of gold products by the Perth Mint surged in September to their highest since January 2017, while silver sales more than doubled from August to mark an over two-year peak, boosted by lower bullion prices, the mint said on Wednesday.

Read More »

Read More »

Are Global Property Bubbles Starting to Burst?

Are Global Property Bubbles Starting To Burst? – London, Dublin, Sydney, Vancouver and Hong Kong property prices fall as global risks increase… – Property bubbles in many cities internationally according to The Economist, UBS and others https://www.bloomberg.com/news/articles/2018-09-28/the-cities-around-the-world-most-at-risk-of-property-bubbles – UBS found that six of the world’s largest cities are now subject to a...

Read More »

Read More »

Sprott Money News Weekly Wrap -up 9.28.18

Eric Sprott gives his thoughts on the recent price action in the precious metals. He also provides a thorough update on some of his favorite mining shares.

Read More »

Read More »