Category Archive: 6a) Gold & Monetary Metals

Government Will Remain Divided, But Uncertainty Remains

As President Donald Trump continues to insist that he will be the winner of the election after all the legitimate votes are counted and the illegitimate ones thrown out, at least one publication has declared a different winner. Not Joe Biden, but Federal Reserve chairman Jerome Powell.

Read the full transcript here: https://www.moneymetals.com/podcasts/2020/11/06/is-fed-chairman-powell-the-true-election-winner-002157

Do you own precious metals...

Read More »

Read More »

Marc Faber: US Wahl, Demokratie und ist die Bekanntgabe des Impfstoffes nach den Wahlen Zufall?

Ehrengast Dr. Marc Faber spricht im traditionellen Marktgespräch mit Robert Rother und Rainer Hahn über die US-Wahlen sowie den Auswirkungen.

Read More »

Read More »

Marc Faber Interview & Eine von der Mafia regierte Welt im tiefgreifenden Wandel, Gold bleibt

Das Finanzsystem ist mehr als angeschlagen und C19 wird zum globalen Umbau genutzt. China steht augenscheinlich wieder besser da, aber aufgrund drastischer Maßnahmen und noch mehr Begrenzungen der Bürgerrechte. Ein Vorbild für den Westen? Die Handlungen immer totalitärer agierender Regierenden deuten in diese Richtung.

Read More »

Read More »

? MAX OTTE: FINANZIELLE ATOMBOMBE GEHT HOCH! – MAX OTTE ÜBER AKTIEN KAUFEN, ETFS & TRADING STRATEGIE

? Quelle + Interviews auf EingeSCHENKT.tv: https://bit.ly/3myQRwY

? Unterstütze EingeSCHENKT.tv: https://eingeschenkt.tv/

? WIE DENKST DU ÜBER DAS THEMA? - SCHREIB UNS DEINEN KOMMENTAR ?

---------------------------

DAS WICHTIGSTE ZUERST:

Wir freuen uns sehr, wenn du ebenfalls deine Meinung, Handlungsempfehlungen oder deine eigenen Prognosen in den Kommentaren postest. Das würde uns und der Community sehr viel bedeuten.

Ebenfalls kannst du die...

Read More »

Read More »

? MAX OTTE: SCHLUSS DAMIT! – DAS KANN DOCH NICHT WAHR SEIN – WARUM WIRD NICHT ORDENTLICH GEPRÜFT?!

? Werde TEIL unserer Community: https://bit.ly/2ZFTlRl ?

? FREI DENKEN - Alle Sendungen: https://bit.ly/3iJn972 ?

? WIE DENKST DU ÜBER DAS THEMA? - SCHREIB UNS DEINEN KOMMENTAR ?

---------------------------

DAS WICHTIGSTE ZUERST:

Wir freuen uns sehr, wenn du ebenfalls deine Meinung, Handlungsempfehlungen oder deine eigenen Prognosen in den Kommentaren postest. Das würde uns und der Community sehr viel bedeuten.

Ebenfalls kannst du die...

Read More »

Read More »

AKTUELL SEHR ARMES EUROPA! – WARUM MAX OTTE MIT DEM HEUTIGEN EUROPA PROBLEME HAT…

Wir freuen uns sehr, wenn du ebenfalls deine Meinung, Handlungsempfehlungen oder deine eigenen Prognosen in den Kommentaren postest. Das würde uns und der Community sehr viel bedeuten.

Read More »

Read More »

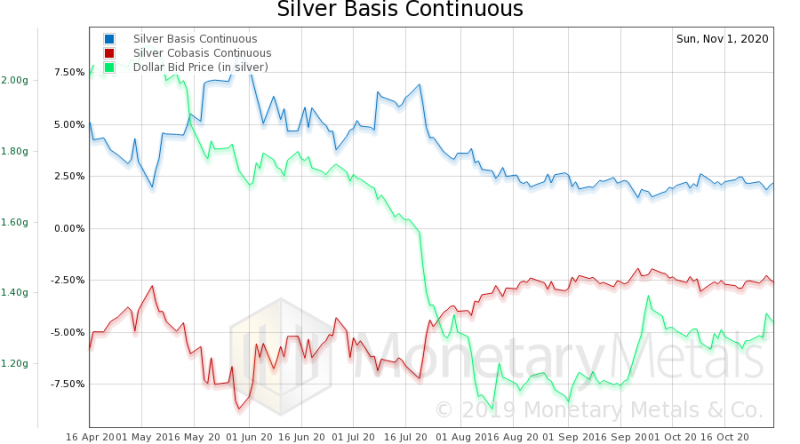

Gold and Silver to Explode Higher Regardless of the US Election Result?

Today we are taking our weekly look at the charts for gold and silver. After what has been the most unusual campaign season for both candidates, election day has finally arrived. Regardless of your political persuasions, both gold and silver look to be setting up for an explosive move higher.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 11.06.20

Bob Thompson of Raymond James in Vancouver sits in for Eric this week and provides commentary regarding the U.S. election, The Fed, the precious metals and the mining shares.

Visit our website https://www.sprottmoney.com for more news.

You can submit your questions to [email protected]

Read More »

Read More »

Why High Net Worth Investors are Opting for Physical Gold Vs ETFs, Digital Gold & Crypto-Currencies

As we continue to await the official result of the US Election, in the short-term financial markets remain volatile.

Read More »

Read More »

Ökonom Max Otte zur US Wahl Es ist den Amerikanern ziemlich egal, was in Deutschland läuft

Auch einen Tag nach der Präsidentschaftswahl in den USA dauert die Auszählung der Stimmen in einigen US-Staaten noch immer an, der Gewinner bleibt ungewiss. Die Wahl droht zu einer Hängepartie zu werden, die die Weltmärkte und Börsen verunsichert. Über die Spaltung der US-amerikanischen Gesellschaft sowie die möglichen Auswirkungen der Wahl auf die deutsche Wirtschaft hat RT Deutsch mit dem Ökonomen und Privatinvestor Max Otte gesprochen.Mehr auf...

Read More »

Read More »

Submit Questions for Alasdair Macleod on Liberty and Finance!

The Information presented in Liberty and Finance is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose.

Read More »

Read More »

Ökonom Max Otte zur US-Wahl: Es ist den Amerikanern ziemlich egal, was in Deutschland läuft

Auch einen Tag nach der Präsidentschaftswahl in den USA dauert die Auszählung der Stimmen in einigen US-Staaten noch immer an, der Gewinner bleibt ungewiss. Die Wahl droht zu einer Hängepartie zu werden, die die Weltmärkte und Börsen verunsichert. Über die Spaltung der US-amerikanischen Gesellschaft sowie die möglichen Auswirkungen der Wahl auf die deutsche Wirtschaft hat RT Deutsch mit dem Ökonomen und Privatinvestor Max Otte gesprochen.Mehr auf...

Read More »

Read More »

Alasdair Macleod-Preparing for a Monetary Reset

Alasdair Macleod explains why he believes the destruction of dollar and euro are inevitable and how we common citizens can best prepare for a New World Order.

Read More »

Read More »

WAHL IN DEN USA – Max Otte erklärt die Hängepartie

#USA #Wahl #MaxOtte #Trump #Biden #NewYork #SupremeCourt #Klage

Unterstützen Sie unsere Arbeit. Abonnieren Sie unser Politikmagazin "PI Politik-Spezial" in 3 Variationen Standard-Abo 69 Euro = für alle Ausgaben pro Jahr Förder-Abo 99 Euro = alle PDF-Ausgaben plus frühe Einladungen und bevorzugte Reservierungen für unsere Veranstaltungen Ermäßigtes Abo 29 Euro für diejenigen, die sich das Standard-Abo aus finanziellen Gründen nicht leisten...

Read More »

Read More »

A New World Monetary Order Is Coming

The global coronavirus pandemic has accelerated several troubling trends already in force. Among them are exponential debt growth, rising dependency on government, and scaled-up central bank interventions into markets and the economy.

Central bankers now appear poised to embark on their biggest power play ever.

Read More »

Read More »

MAX OTTE – Wenn Trump gewinnt, wird es hässlich

#USA #Wahl #Trump #Biden #NewYork #Delegierte

Unterstützen Sie unsere Arbeit. Abonnieren Sie unser Politikmagazin "PI Politik-Spezial" in 3 Variationen Standard-Abo 69 Euro = für alle Ausgaben pro Jahr Förder-Abo 99 Euro = alle PDF-Ausgaben plus frühe Einladungen und bevorzugte Reservierungen für unsere Veranstaltungen Ermäßigtes Abo 29 Euro für diejenigen, die sich das Standard-Abo aus finanziellen Gründen nicht leisten können...

Read More »

Read More »

Max Otte Vermögensbildungsfonds: Einer der besten Mischfonds seit dem Corona-Tief!

Abonnieren Sie unseren Fonds-Newsletter und erhalten Sie monatlich unsere Marktkommentare! ? https://www.max-otte-fonds.de/

Read More »

Read More »