Category Archive: 6a) Gold & Monetary Metals

Sprott Money News Weekly Wrap-up – 11.16.18

Eric Sprott discusses this week’s rally in precious metal prices and looks ahead to the remainder of the year.

Read More »

Read More »

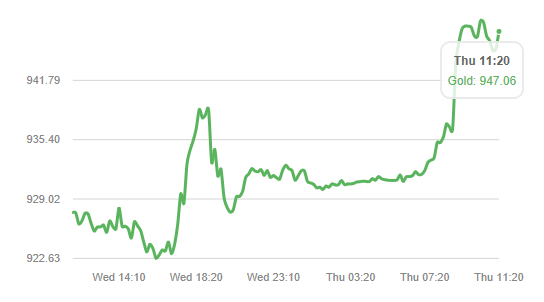

Pound Falls 2.5 percent Against Gold as UK Government in Turmoil Over Brexit

The pound plunged against the euro, the dollar, gold and all leading currencies today as Theresa May’s UK government appeared vulnerable to collapsing and political turmoil risked creating a hard Brexit. The pound has fallen 2.6% against gold in less than twenty four hours seeing gold rise from £923 to £947 per ounce in sterling terms.

Read More »

Read More »

Sprott Money News Ask the Expert November 2018 – David Morgan

Precious metals expert David Morgan fields multiple questions pertaining to silver, gold and the global markets.

Read More »

Read More »

Secure Storage Ireland – Store Gold In The Safest Vaults In Ireland – Goldnomics Podcast Special

Do you wish to store gold in Ireland a highly liquid way in ultra secure, specialist gold vaults? We are delighted to announce that Irish, UK and international investors can for the first time store gold in professionally managed, secure, institutional grade vaults in Ireland. Store Gold In The Safest Vaults In Ireland GoldCore Secure …

Read More »

Read More »

Silver & Gold Price Update – Nov 9 2018 + JP Morgan Silver Manipulation

Check Gold & Silver Prices: https://www.moneymetals.com/precious-metals-charts Stocks got a big lift Wednesday as investors seemed content with Republicans keeping the Senate but losing the House. Precious metals markets, meanwhile, softened. Selling hit gold and silver on Thursday as the Federal Reserve issued a fairly hawkish policy statement, and that softening in the precious metals has …

Read More »

Read More »

Sprott Money News Weekly Wrap-Up 11 9 18

Eric Sprott discusses the week in precious metals including the charges against JP Morgan traders as well as the request by Venezuela to repatriate their gold from London.

Read More »

Read More »

American Elections Farce as Politicians Ignore the Looming $121.7 Trillion Debt Crisis

AMERICAN ELECTIONS FARCE – IN TODAY’S VIDEO UPDATE WE LOOK AT YET ANOTHER ‘PUNCH & JUDY’ ELECTION WHICH ONCE AGAIN IGNORED THE ELEPHANT IN THE ROOM – THE INEVITABLE U.S. $121.7 TRILLION DEBT CRISIS AND THE GLOBAL $250 TRILLION DEBT CRISIS We briefly look at the outcome of the elections, how markets have reacted in …

Read More »

Read More »

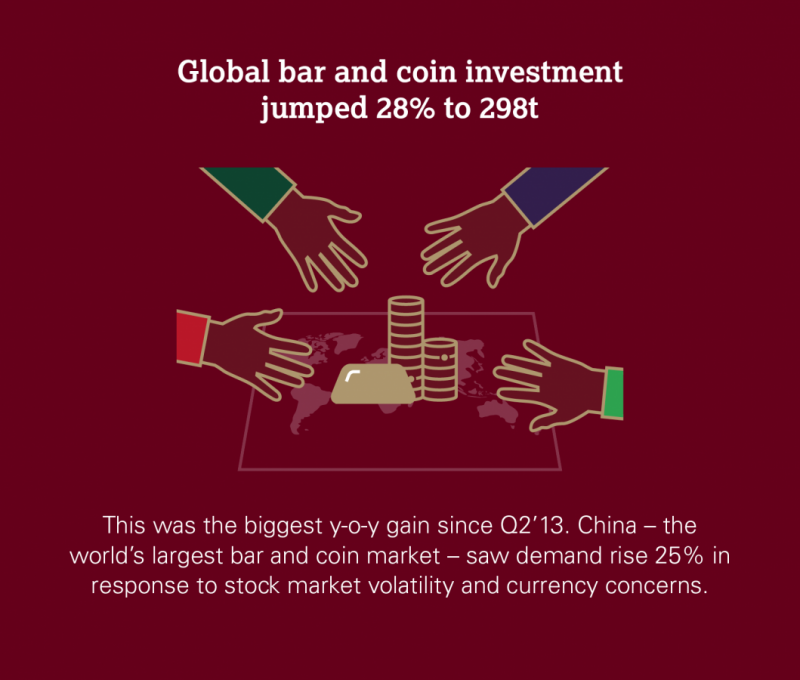

Gold ETFs See Strong Demand In Volatile October After Robust Global Gold Demand In Q3

Gold ETFs saw inflows in volatile October as investors again hedged risk. Gold ETFs see demand of 16.5 tonnes(t) in October to total of 2,346t, the equivalent of US$1B in inflows. Global gold demand was robust in Q3 – demand of 964.3 tonnes – plus 6.2t yoy.

Read More »

Read More »

Bron Suchecki

Bron Suchecki, Precious Metals Consultant, Suchecki Consulting presenting at the 2018 Precious Metals Investment Symposium in Perth.

Read More »

Read More »

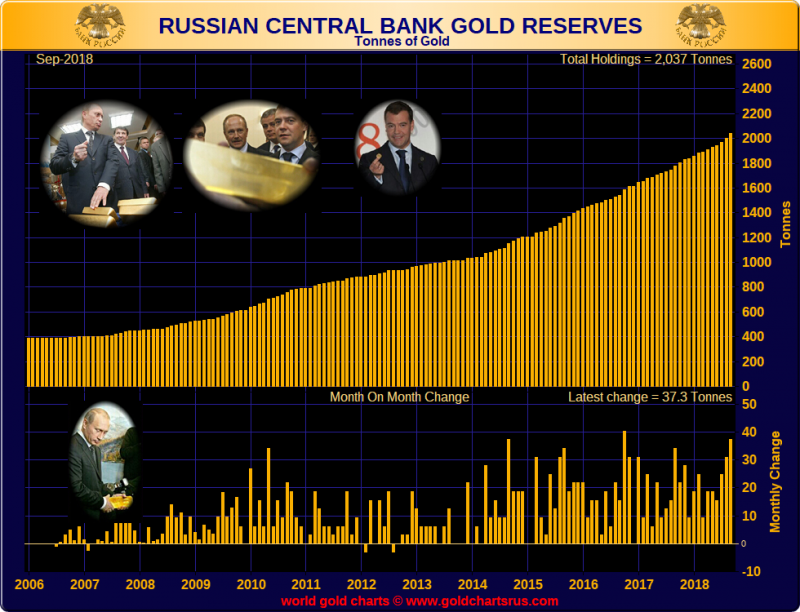

Does the recent spate of Central Bank gold buying impact demand and price?

There has been a lot of media coverage recently about the re-emergence of central bank gold buying and the overall larger quantity of gold than central banks as a group have been buying recently compared to previous years. For example, according to the World Gold Council’s Gold Demand Trends for Q3 2018, net purchases of gold by central banks in the third quarter of this year were 22% higher than Q3 2017, and the highest quarterly level since Q4 of...

Read More »

Read More »

Sprott Money News 11 2 18

Hear Eric Sprott discuss the week that was in precious metals and then look ahead at what’s to come.

Read More »

Read More »

Alarm Bells Ring and Gold Rises In October As Stocks and Property Fall Globally

In our latest video update, we consider the performance of markets in a volatile October. Stock markets globally fell sharply while gold acted as a hedge in all currencies, rising 1.7% in dollars, 4.4% in euro terms and 4.2% in sterling terms. Many political, economic and financial risks have been ‘bubbling’ away under the surface …

Read More »

Read More »

Gold Analysts At LBMA See 25percent Return To $1,532/oz In 12 months

The price of gold is expected to rise to $1,532 an ounce by October next year, delegates to the London Bullion Market Association’s (LBMA) annual gathering predicted on Tuesday. A poll of delegates at the LBMA conference in Boston also predicted higher prices in a year’s time for silver, platinum and palladium.

Read More »

Read More »

Smart Valor tackles cryptocurrency volatility problem

Cryptoasset trading platform Smart Valor plans to launch a new cryptocurrency pegged to the Swiss franc. The CHFt coin will join a growing list of so-called ‘stable coins’ designed to dampen the huge price swings of cryptocurrencies, such as bitcoin, which limits their everyday use. Smart Valor said on Monday that it is in talks with Swiss banks and cryptocurrency exchanges to issue CHFt.

Read More »

Read More »

Sprott Money News Weekly Wrap-Up 10 26 18

Legendary investor Eric Sprott discusses the recent moves in the stock market as well as gold and silver.

Read More »

Read More »

Gold Outperforming Many Other Assets | Marc Faber

https://sdbullion.com http://www.silverdoctors.com/precious-metals-market-podcast/ Everyone wants to know whether this stock market sell-off is a buying opportunity or the first move in a long-term downtrend. Swiss investor Marc Faber joins Silver Doctors with a word of caution. Faber doubts the majority of stocks will make new highs. In the next two years, many investors will not make …

Read More »

Read More »