Category Archive: 5) Global Macro

A Perfect Example of the Euro$ Squeeze

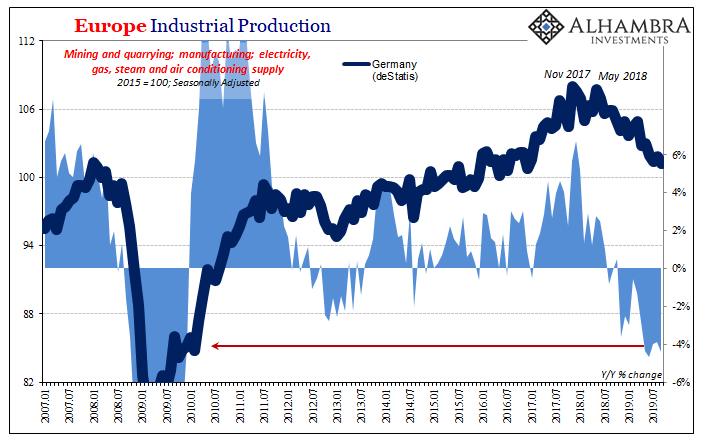

Germany’s vast industrial sector continued in the tank in September. According to new estimates from deStatis, that country’s government agency responsible for maintaining economic data, Industrial Production dropped by another 4% year-over-year during the month of September 2019. It was the fifth consecutive monthly decline at around that alarming rate.

Read More »

Read More »

How to be an activist | The Economist

From climate strikes to Extinction Rebellion, activism is gaining momentum around the world. At The Economist’s Open Future Forum we spoke to three campaigners with different takes on how to be an activist today. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Activism today can take many different forms. Sokeel Park works with …

Read More »

Read More »

Still Stuck In Between

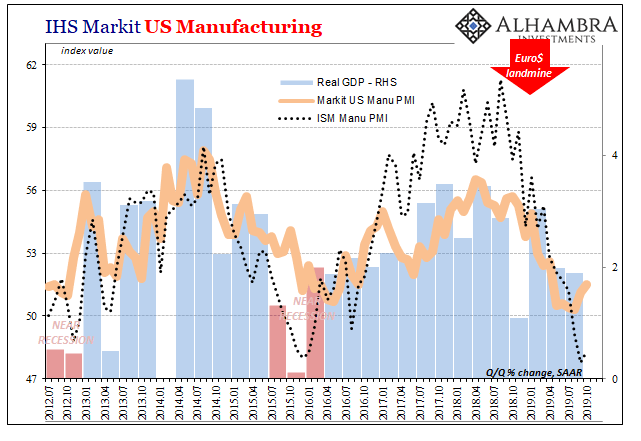

There wasn’t much by way of the ISM’s Manufacturing PMI to allay fears of recession. Much like the payroll numbers, an uncolored analysis of them, anyway, there was far more bad than good. For the month of October 2019, the index rose slightly from September’s decade low. At 48.3, it was up just half a point last month from the month prior

Read More »

Read More »

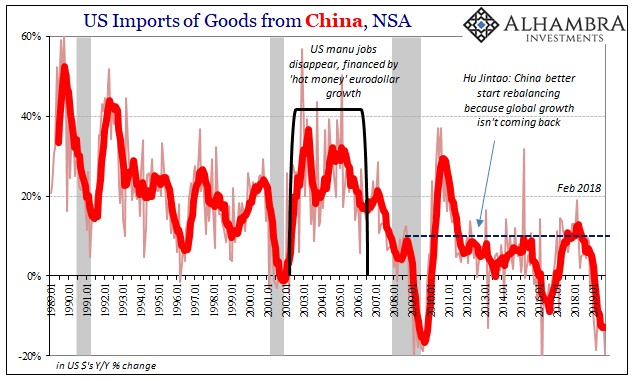

The Sudden Need For A Trade Deal

Talk of trade deals is everywhere. Markets can’t get enough of it, even the here-to-fore pessimistic bond complex. Rates have backed up as a few whispers of BOND ROUT!!! reappear from their one-year slumber. If Trump broke the global economy, then his trade deal fixes it. There’s another way of looking at it, though. Why did the President go spoiling for trouble with China in 2018?

Read More »

Read More »

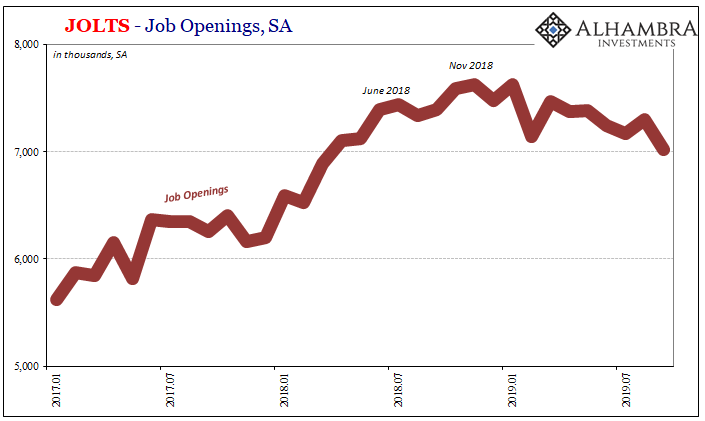

From Friends to Nemeses: JO and Jay

It was one of the first major speeches of his tenure. Speaking to the Economic Club of Chicago in April 2018, newly crowned Federal Reserve Chairman Jerome Powell was full of optimism. At that time, however, optimism was being framed as some sort of bad thing. This was the height of inflation hysteria, where any sort of official upgrade to the economic condition was taken as further “hawkishness.”

Read More »

Read More »

You Have To Try Really Hard Not To See It

In early September, the Institute for Supply Management (ISM) released figures for its non-manufacturing PMI that calmed nervous markets. A few weeks before anyone would start talking about repo, repo operations, and not-QE asset purchases, recession and slowdown fears were already prevalent.

Read More »

Read More »

Dollar Rally Stalls as Fresh Drivers Awaited

US-China relations continue to improve with news of cooperation in a major fentanyl case. Eurozone final services and composite PMIs surprised on the upside; UK Parliament will be dissolved today. Poland is expected to keep rates steady at 1.5%; Russia October CPI is expected to rise 3.8% y/y. China sold €4 bn in its first euro-denominated bond since 2004; Thailand cut rates 25 bp to 1.25%, as expected.

Read More »

Read More »

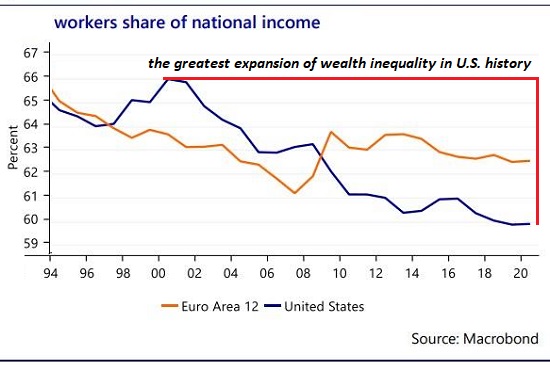

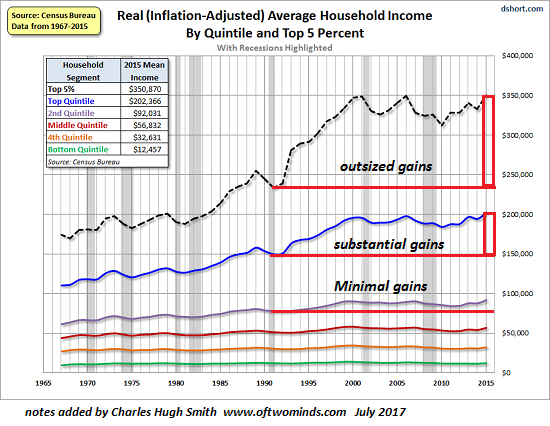

The Middle Class Is Now The Muddle Class

The net result is the muddle class has the signifiers but not the wealth, power, capital or agency that once defined the middle class. The first use of the phrase The Muddle Class appears to be The rise of the muddle classes (Becky Pugh, telegraph.co.uk) in January 2007. The "muddle" described the complex nature of defining "the middle class," which includes education, class origins, accents, and many other financial, social and cultural...

Read More »

Read More »

EM Preview for the Week Ahead

EM should continue to benefit from the generalized improvement in the global backdrop. Trade tensions have eased whilst the risks of a hard Brexit have fallen, at least for now. Yet recent developments in some major EM countries underscores how important it is for investors to differentiate between the strong credits and the weak ones.

Read More »

Read More »

More Synchronized, More Downturn, Still Global

China was the world economy’s best hope in 2017. Like it was the only realistic chance to push out of the post-2008 doldrums, a malaise that has grown increasingly spasmatic and dangerous the longer it goes on. Communist authorities, some of them, anyway, reacted to Euro$ #3’s fallout early on in 2016 by dusting off their Keynes. A stimulus panic that turned out to be more panic than stimulus.

Read More »

Read More »

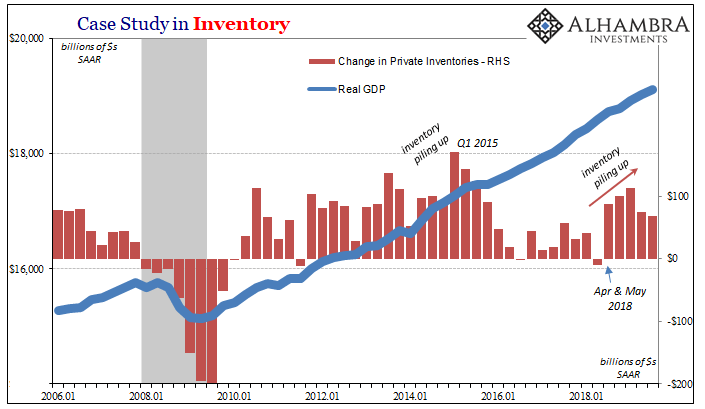

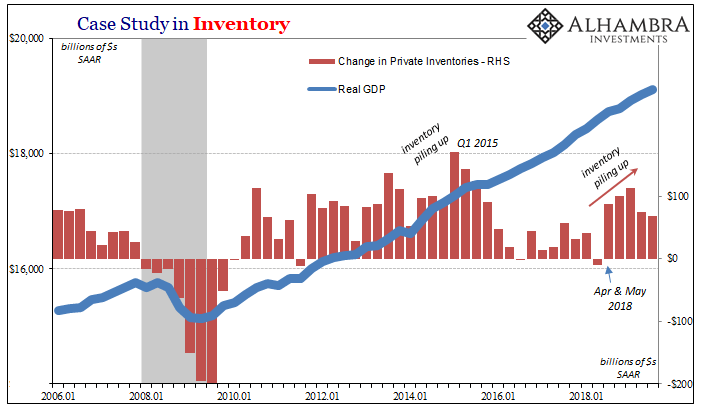

The Inventory Context For Rate Cuts and Their Real Nature/Purpose

What typically distinguishes recessions from downturns is the inventory cycle. Even in 2008, that was the basis for the Great “Recession.” It was distinguished most prominently by the financial conditions and global-reaching panic, true, but the effects of the monetary crash registered heaviest in the various parts of that inventory process.

An economy for whatever reasons slows down.

Read More »

Read More »

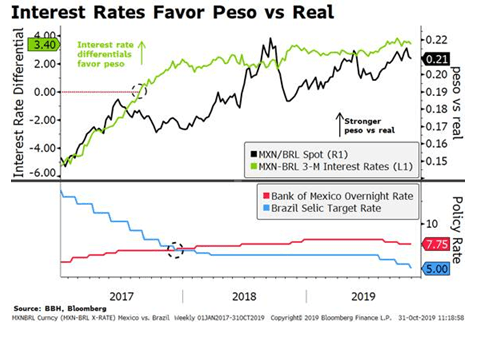

Mexico vs. Brazil Near-Term Outlook

Both Brazil and Mexico are in a good position to benefit from the current improvement in market sentiment. However, when comparing the factors driving the currencies of both countries, we think there are relatively more near-term positives for the Mexican peso than for the Brazilian real.

Read More »

Read More »

Rugby World Cup: why size matters | The Economist

The Rugby World Cup saw heavier teams take to the pitch than ever before—England’s players are on average over 10% heavier than in 1991. So what impact is the increasing size of players having on rugby? Find out more here: https://econ.st/2PJVoiS Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Isaac Newton’s second law …

Read More »

Read More »

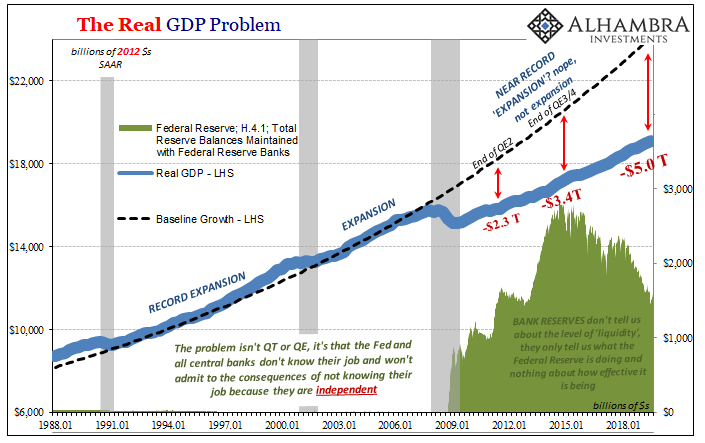

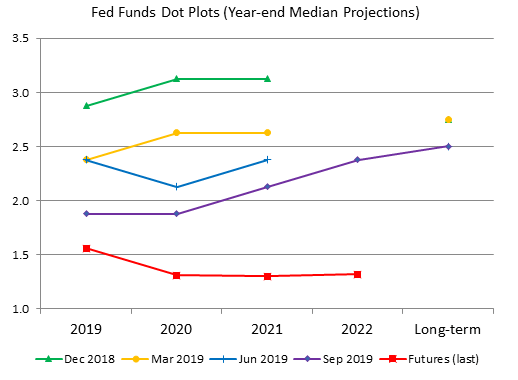

Three (Rate Cuts) And GDP, Where (How) Does It End?

The Federal Reserve has indicated that it will now pause – for a second time, supposedly. Remember the first: after raising its benchmark rates apparatus in December while still talking about an inflationary growth acceleration requiring even more hikes throughout 2019, in a matter of weeks that was transformed into a temporary suspension of them.

Read More »

Read More »

The Inventory Context For Rate Cuts And Their Real Nature/Purpose

What typically distinguishes recessions from downturns is the inventory cycle. Even in 2008, that was the basis for the Great “Recession.” It was distinguished most prominently by the financial conditions and global-reaching panic, true, but the effects of the monetary crash registered heaviest in the various parts of that inventory process.

Read More »

Read More »

The Political Parties and the Media Have Abandoned the Working “Middle Class”

Where is the line between "working class" and "middle class"? Maybe there isn't any. Defining the "middle class" has devolved to a pundit parlor game, so let's get real for a moment (if we dare): the "middle class" is no longer defined by the traditional metrics of income or job type (blue collar, white collar), but by an entirely different set of metrics:

Read More »

Read More »

FOMC Preview

The FOMC begins a two-day meeting today with the decision due out tomorrow afternoon. The Fed is widely expected to cut rates 25 bp for the third meeting in a row. What’s next? US data have undeniably softened in September. Weakness in the manufacturing sector appears to have spread to the wider economy. ISM PMI, jobs, CPI, PPI, and retail sales all came in weaker than expected.

Read More »

Read More »

Drugs in sport: can science stop the cheats? | The Economist

Science has made it is easier and faster to detect athletes who dope. So why are illicit performance-enhancing drugs still rife in sport? Read more here: https://econ.st/2Weuels Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Over the years scientific progress has made it easier and faster to detect athletes who dope. But it’s …

Read More »

Read More »

The Big Risks Left (and Right) In Europe

Another local election in Germany, another stunning defeat for the ruling center. How many more of these does anyone need before they realize the electorate is going to keep migrating toward the poles? And it all stems from the one reason; there is no and has been no economic growth. But because the so-called establishment has insisted the economy is booming, or it was, people are doing what people always do.

Read More »

Read More »

Monthly Macro Monitor: Market Indicators Review

Is the recession scare over? Can we all come out from under our desks now? The market based economic indicators I follow have improved since my last update two months ago. The 10 year Treasury rate has moved 40 basis points off its low. Real interest rates have moved up as well but not quite as much. The difference is reflected in slightly higher inflation expectations.

Read More »

Read More »