| It was one of the first major speeches of his tenure. Speaking to the Economic Club of Chicago in April 2018, newly crowned Federal Reserve Chairman Jerome Powell was full of optimism. At that time, however, optimism was being framed as some sort of bad thing. This was the height of inflation hysteria, where any sort of official upgrade to the economic condition was taken as further “hawkishness.”

Things were so good, they said, the situation was in danger of spiraling out of control inflation-wise. Consumer prices were going to accelerate because companies would definitely get pushed into bidding more and more heavily for scarce workers. It all began with the strong, epically tight labor market as given by the unemployment rate. Fed Chairs have had the unemployment rate at their backs since 2010. It hasn’t mattered yet, a fact that former policymaker Ben Bernanke knew well when he wrote about the “false dawns” the US economy had (only) experienced trying to climb out from under the Great “Recession.” No matter how low the rate might descend, no recovery has been triggered or even indicated as likely. Mere weeks before the US dollar’s exchange rate would catch him off guard, Powell, knowing full well the problem of past false dawns, started his April 2018 speech by implying this time was really different. Though by then the unemployment rate had fallen even more, well into what was supposed to be “full employment” territory, the Fed Chair readily acknowledged:

|

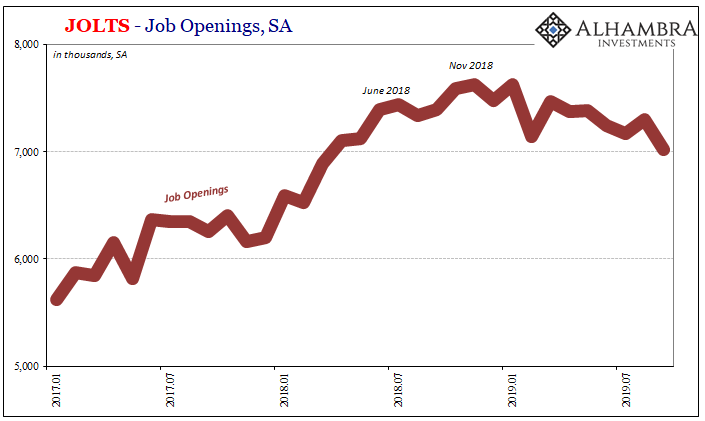

JOLTS - Job Openings, SA 2017-2019 |

The reason he could be so honest about the statistical faults within it – the same participation problems we’ve been dealing with since 2008 – was because Powell was convinced he had a broader set of employment indications to back up the single measure. You don’t like the unemployment rate because of the legitimate doubts which continue to swirl around it, fine, I’ve got others to back it up.

According to the BLS, the level of Job Openings (JOLTS JO) being posted by prospective employers was skyrocketing. It suggested that the demand for labor was as Powell has been describing ever since his first day on the job. There were doubts about JO, too, but when put together with something like the unemployment rate’s constant decline it made for a pretty compelling duo. In that case, two labor series were much better than one. The economic situation has completed changed this year, though, pulling the rug right out from underneath the former hawk (more chicken than any other sort of bird; it’s not what they say, it’s what they do – rate cuts, not hikes). The dollar remains higher, of course, but now there’s no corroboration for the unemployment rate. It has gone lower, but so, too, has the BLS (and other) measure of JO completely reversing last year’s situation and leaving the Fed Chicken Chairman with at best a split assessment of the employment situation. The latest figures for September are pretty clear as to the direction for “labor demand”: Whatever you make of 2019 so far, something has obviously changed. Through September, the latest estimates, that’s nine months in this direction ruling out statistical noise. If you believed JO was an accurate enough assessment of the jobs market situation in 2018, then you can’t just ignore how it has completely reversed in 2019 – even as the unemployment rate continues to make new lows. |

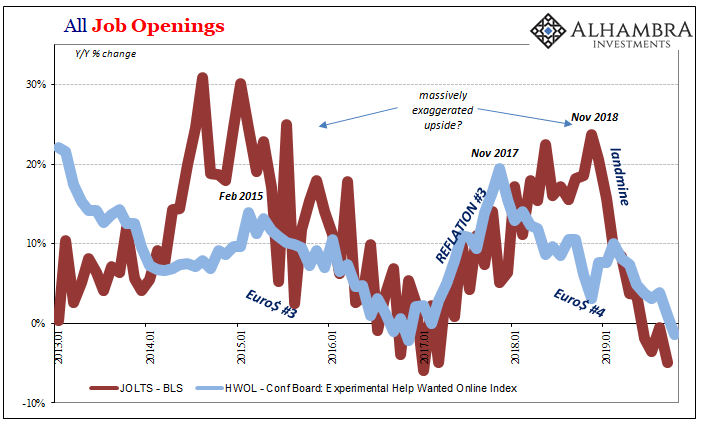

All Job Openings, 2013-2019 |

| And it’s not just that JO is down 5% year-over-year as it was in September, it’s how quickly the direction has changed at least in the JOLTS side of things (the Conference Board’s estimates for online job postings more closely match global economic indicators suggesting the same inflection point all the way back at the end of 2017 rather than 2018). Previously, Euro$ #3, it had taken several years for JO to reverse from the “best jobs market in decades” during 2014 to finally bottoming out early in 2017.

This time around, Euro$ #4 as opposed to #3, JO has plummeted from a high level of enough growth to convince Powell he could be more honest about the unemployment rate to pretty sharp contraction in less than a year. In other words, in his earliest days, the new Chairman thought he had JO in his pocket to help validate an unemployment rate everyone knows, but no one ever says, is flawed. |

ISM Purchasing Manager Indexes, 2017-2019 |

| Not much later into his term, he no longer has JO which only leaves him the faulty unemployment number he’d probably wish he hadn’t been so honest about. A single questionable metric that now increasingly isolated is supposed to be enough to stand on its own as an accurate assessment of underlying economic strength even as all these other “headwinds”, coincident to the dollar “rising”, continue to blow the US economy further off track.

That’s actually what Economists are saying counts as a “strong” economy this year. Small wonder how no one really talks about the second half rebound any longer, and in its place are only more and more rate cuts. It’s not what they say, it’s what they are forced to do. |

JOLTS - Hires, SA 2006-2019 |

The post From Friends to Nemeses: JO and Jay appeared first on Alhambra Investments.

Full story here Are you the author? Previous post See more for Next postTags: economy,employment,Federal Reserve/Monetary Policy,hires,jay powell,job openings,jolts,Labor Market,newsletter,payrolls,unemployment rate