Talk of trade deals is everywhere. Markets can’t get enough of it, even the here-to-fore pessimistic bond complex. Rates have backed up as a few whispers of BOND ROUT!!! reappear from their one-year slumber. If Trump broke the global economy, then his trade deal fixes it.

There’s another way of looking at it, though. Why did the President go spoiling for trouble with China in 2018? I don’t mean to ask what his rationale was, more along the lines of, why 2018? Why didn’t he start right out of the gate in 2017?

The answer is pretty simple.

By the middle of 2018, ignoring the eurodollar signals of course, the administration’s Economists thought they had seen enough (I know, because I met with one just a few days after May 29).

The economy was booming and therefore it had achieved a solid basis from which it would easily absorb any backlash from imposing tariffs and other restrictions.

They really thought the boom was their insurance. From such a position of economic strength, it would have given them more than enough margin, sufficient altitude to launch their trade wars. Knowing full well there would be costs, there always are, they really bought into the boom being big.

If being on the strong side of 2018’s “boom” was reason enough to be stubborn about protectionism, what might it say about how things are being viewed in 2019 now that the President seems quite eager to make a deal. Any deal.

There’s the 2020 election to consider, of course, the political optics of making sure to have a big “win” in the bag heading into the meat of campaign season. That’s certain to be a factor here.

| But there’s also the real possibility that the President’s people see the writing on the wall. They can only try to blame Jay Powell for the mess for so long. That’s because there is a mess and it’s getting bigger by the month.

There’s the nontrivial possibility that what’s really behind the push toward a trade deal is the growing official and political concern that something’s really wrong with the US and not just China’s economy. And if there is, not knowing much of anything else about it, once you realize last year’s boom didn’t boom, at least didn’t carry over very much into this year, maybe Trump’s administration is starting to reconsider the costs of continuing the argument. Nothing kills the election chances of any incumbent quite like the prospects for serious economic downturn. Just ask Bush 41. In other words, the trade deals that are in the air may be due mostly to some desperation on both ends. The Chinese aren’t faring well at all, of course, but the Americans aren’t doing so hot, either. That’s because it wasn’t trade wars to begin with. Nobody wins during the squeeze, meaning both sides at least realize they are losing if they don’t really know why and how. The Census Bureau reported today more evidence indicating as much. The trade wars are certainly real and they are having real effects. Chinese imports into the United States plummeted by almost 20% year-over-year in September, among the worst results in the entire series. |

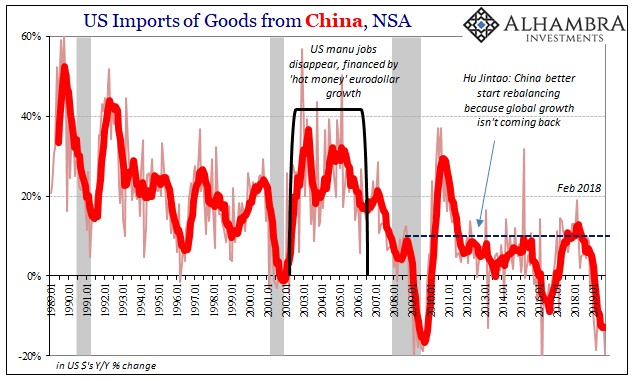

US Imports of Goods from China, NSA 1989-2019 |

| In fact, there were only two months dating back to 1989 which had been bigger contractions. But is that sharper decline all due to new restrictions, or are there some macro factors being hidden within this year’s downward lurch, too?

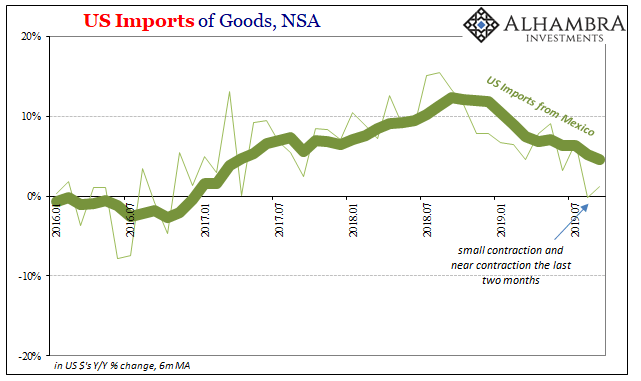

We can look at Mexico’s imports for clues. The President had been threatening to impose tariffs on Mexican goods but those threats were called off (by tweet) back in June. And yet, imports from Mexico are flat to slightly down the past two months. |

US Imports of Goods, NSA 2016-2019 |

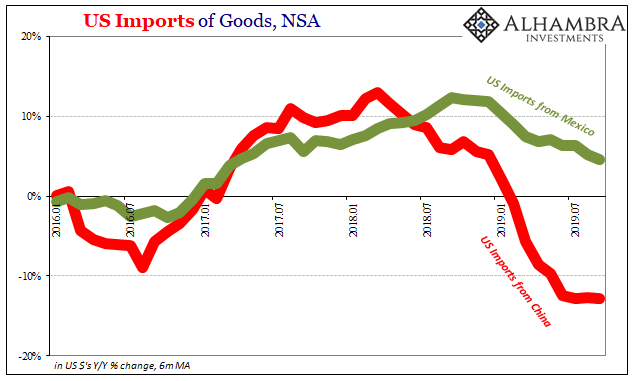

| Not only that, the timing. Going back to the middle of last year, imports from this other country have been behaving in the same way as imports coming from China. The difference in degree is likely due to that wider protectionism against China, but you can also see how there must also be macro factors in how both are acting. |

US Imports of Goods, NSA 2016-2019 |

| If the US economy was booming, then the restrictions placed upon China would lead to one or both of two possibilities. Domestic spending remaining strong would lead consumers to seek to buy the same or nearly the same amount of goods from alternate sources. Either foreign goods made in places other than China, or, as the President has been hoping and promising, the return of domestic production.

What we see of the import data, however, is that Americans are buying fewer goods overall – regardless of where they are made. Even in places where imports are rising, like inbound trade from Europe, it has still slowed down significantly this year when compared to last year. |

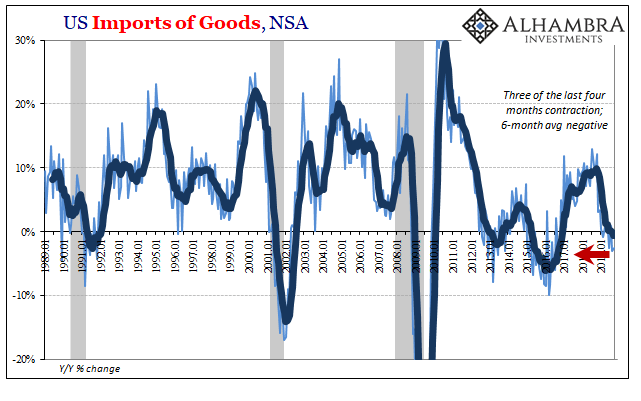

US Imports of Goods, NSA 1989-2019 |

| Overall, US imports are contracting again. The negative numbers are becoming a little bigger as well as more frequent.

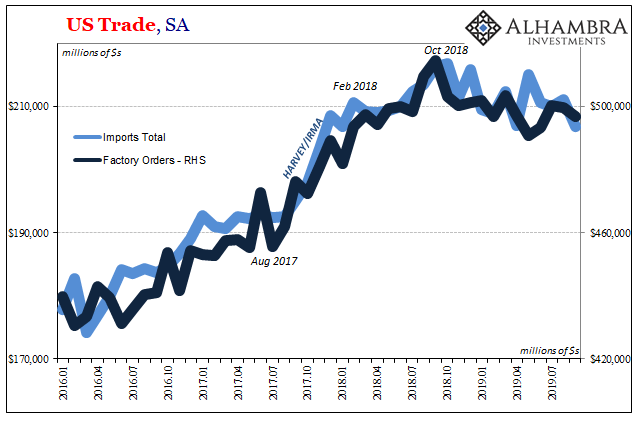

That leaves open the possibility for the best outcome which theoretically could take place; production has come home, has come back from China to revive the Rust Belt areas which gave Trump his election margin. Except, no, that’s not happening, either. The Census Bureau reported estimates for US factory orders a few days ago, the broadest forward-looking measure for the domestic manufacturing sector. Surprising only perhaps the President’s Economists, orders received by American manufacturers, both durable and non-durable goods producers, look exactly like US imports. Practically identical. |

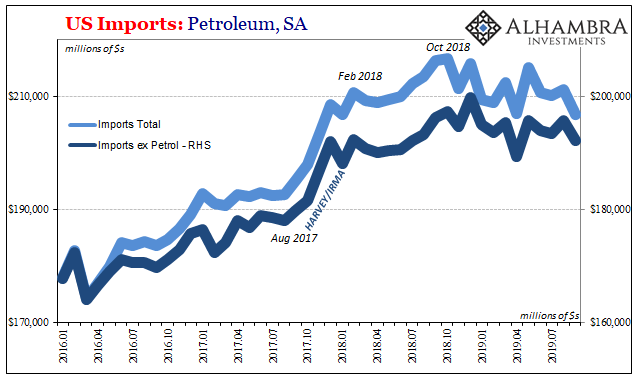

US Imports: Petroleum, SA 2016-2019 |

| The squeeze of eurodollars, not trade wars. It is the former that has come home, the “overseas turmoil” that has Jay Powell spooked, too.

It’s never so simple and straightforward, of course, but I’d bet that “trade deals” are as much macro reality hitting the administration as the politics of needing a win. If that’s right, then trade deals aren’t cause for optimism they are yet another confirmation of growing domestic trouble. It is globally synchronized downturn, after all. That much should become clear if one gets done – and the “boom” doesn’t come back. If it wasn’t trade wars which have pushed the whole global economy into downturn, then winding them down won’t accomplish much. Other than confirming they weren’t the problem. |

US Trade, SA 2016-2019 |

Full story here Are you the author? Previous post See more for Next post

Tags: China,Donald Trump,economy,EuroDollar,eurodollar squeeze,exports,Federal Reserve/Monetary Policy,imports,Mexico,newsletter,Trade Wars