Tag Archive: eurodollar squeeze

Two Years And Now It’s Getting Serious

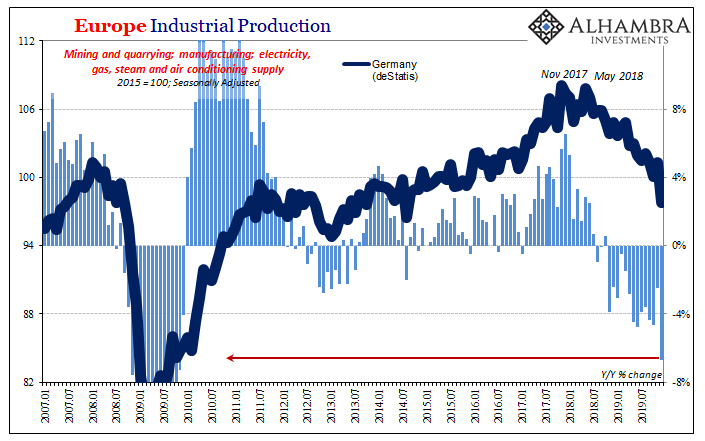

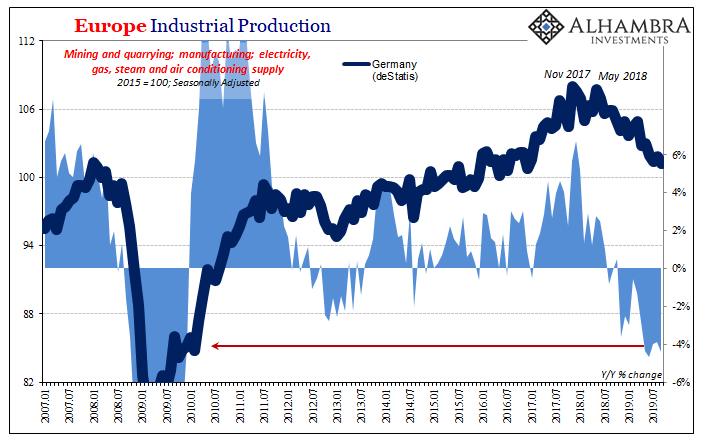

We knew German Industrial Production for December 2019 was going to be ugly given what deStatis had reported for factory orders yesterday. In all likelihood, Germany’s industrial economy ended last year sinking and maybe too quickly. What was actually reported, however, exceeded every pessimistic guess and expectation – by a lot.

Read More »

Read More »

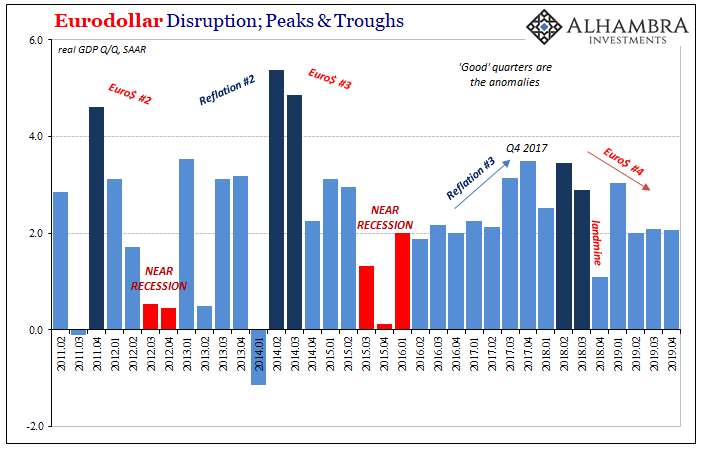

Three Straight Quarters of 2 percent, And Yet Each One Very Different

Headline GDP growth during the fourth quarter of 2019 was 2.05849% (continuously compounded annual rate), slightly lower than the (revised) 2.08169% during Q3. For the year, the Bureau of Economic Analysis (BEA) puts total real output at $19.07 trillion, or annual growth of 2.33% and down from 2.93% in 2018. Last year was weaker than 2017, the second lowest out of the six since 2013.

Read More »

Read More »

With No Second Half Rebound, Confirming The Squeeze

It’s a palpable impatience. Having learned absolutely nothing from the most recent German example, there’s this pervasive belief that if the economy hasn’t fallen apart by now it must be going the other way. The right way. Those are the only two options for mainstream analysis (which means it isn’t analysis).

Read More »

Read More »

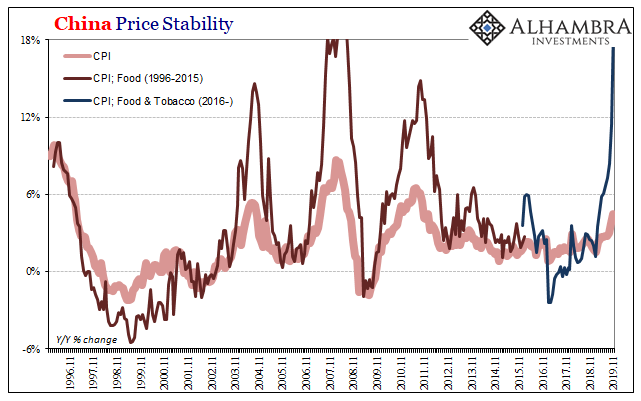

If Trade Wars Couldn’t, Might Pig Wars Change Xi’s Mind?

Forget about trade wars, or even the eurodollar’s ever-present squeeze on China’s monetary system. For the Communist Chinese government, its first priority has been changed by unforeseen circumstances. At the worst possible time, food prices are skyrocketing. A country’s population will sit still for a great many injustices. From economic decay to corruption and rising authoritarianism, the line between back alley grumbling and open rebellion is...

Read More »

Read More »

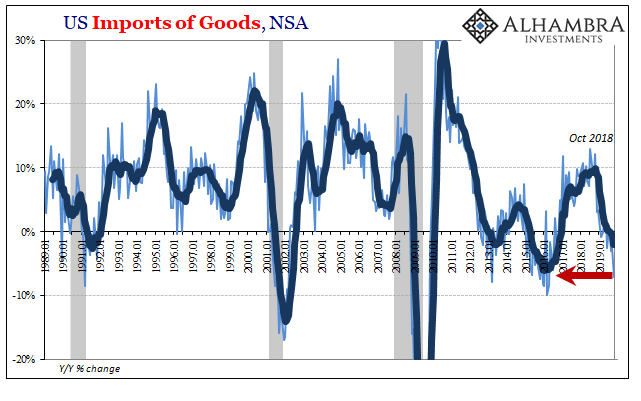

More Signals Of The Downturn, Globally Synchronized

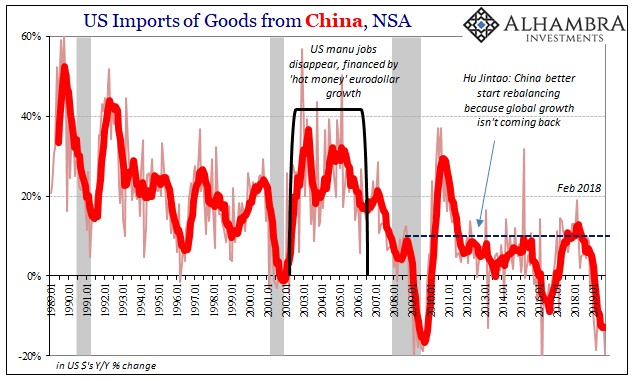

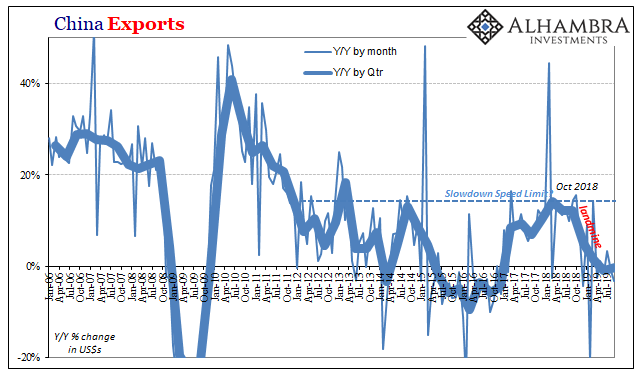

For US importers, October is their month. And it makes perfect sense how it would be. With the Christmas season about to kick into full swing each and every November, the time for retailers to stock up in hearty anticipation is in the weeks beforehand. The goods, a good many future Christmas presents, find themselves in transit from all over the world during the month of October.

Read More »

Read More »

China’s Financial Stability: A Squeeze and a Strangle

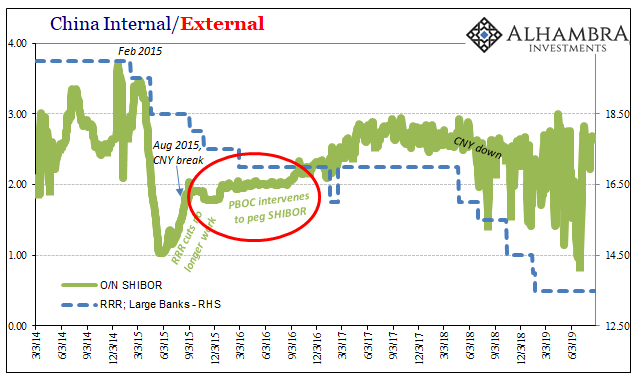

I do get a big kick out of the way Communists over in China announce how they are dealing with their enormous problems especially as they may be getting worse. Each month, for example, the country’s National Bureau of Statistics (NBS) will publish figures on retail sales or industrial production at record lows but in the opening paragraphs the text will be full of praise for how the economy is being handled.

Read More »

Read More »

A Perfect Example of the Euro$ Squeeze

Germany’s vast industrial sector continued in the tank in September. According to new estimates from deStatis, that country’s government agency responsible for maintaining economic data, Industrial Production dropped by another 4% year-over-year during the month of September 2019. It was the fifth consecutive monthly decline at around that alarming rate.

Read More »

Read More »

The Sudden Need For A Trade Deal

Talk of trade deals is everywhere. Markets can’t get enough of it, even the here-to-fore pessimistic bond complex. Rates have backed up as a few whispers of BOND ROUT!!! reappear from their one-year slumber. If Trump broke the global economy, then his trade deal fixes it. There’s another way of looking at it, though. Why did the President go spoiling for trouble with China in 2018?

Read More »

Read More »

China’s Dollar Problem Puts the Sync In Globally Synchronized Downturn

Because the prevailing theory behind the global slowdown is “trade wars”, most if not all attention is focused on China. While the correct target, everyone is coming it at from the wrong direction. The world awaits a crash in Chinese exports engineered by US tariffs. It’s not happening, at least according to China’s official statistics.

Read More »

Read More »

That Can’t Be Good: China Unveils Another ‘Market Reform’

The Chinese have been reforming their monetary and credit system for decades. Liberalization has been an overriding goal, seen as necessary to accompany the processes which would keep the country’s economic “miracle” on track. Or get it back on track, as the case may be. Authorities had traditionally controlled interest rates through various limits and levers.

Read More »

Read More »

Why 2011

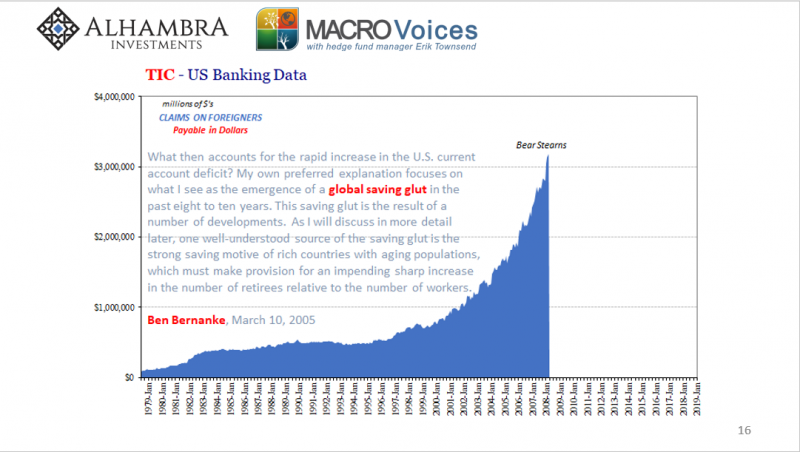

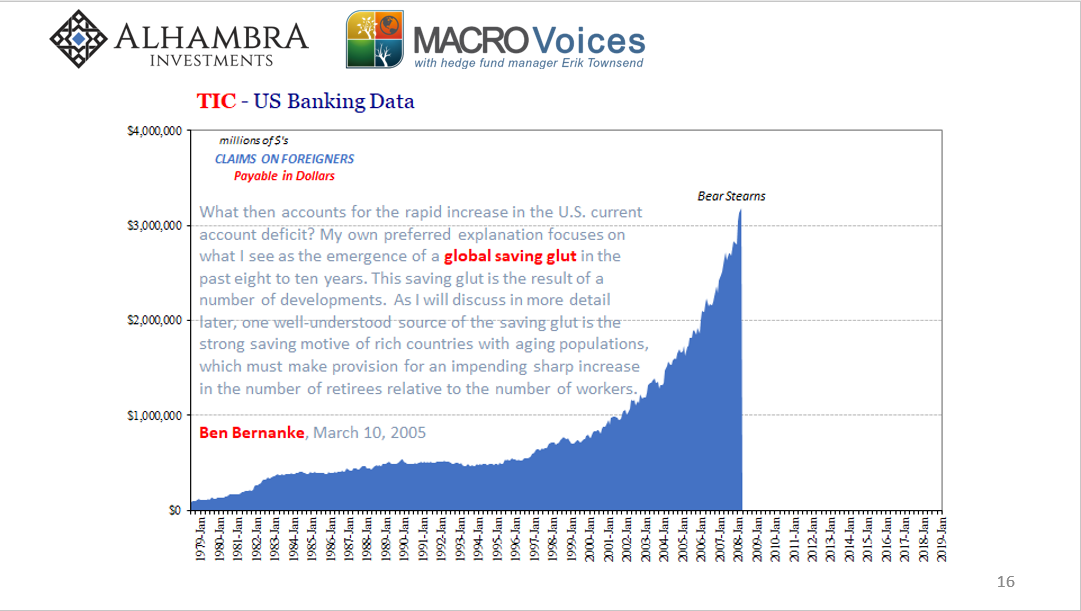

The eurodollar era saw not one but two credit bubbles. The first has been studied to death, though almost always getting it wrong. The Great Financial Crisis has been laid at the doorstep of subprime, a bunch of greedy Wall Street bankers insufficiently regulated to have not known any better. That was just a symptom of the first. The housing bubble itself was more than housing.

Read More »

Read More »