Category Archive: 5) Global Macro

EM Preview for the Week Ahead

Over the weekend, China reported stronger than expected November PMI readings while Korea reported weaker than expected November trade data. While the China data is welcome, we put more weight on Korea trade numbers, which typically serve as a good bellwether for the entire region. Press reports suggest the Phase One trade deal has stalled due to Hong Kong legislation passed by the US Congress.

Read More »

Read More »

Could America Survive a Truth Commission?

A nation that's no longer capable of naming names and reporting what actually happened richly deserves an economic and political collapse to match its moral collapse. You've probably heard of the Truth Commissions held in disastrously corrupt and oppressive regimes after the sociopath/kleptocrat Oligarchs are deposed.

Read More »

Read More »

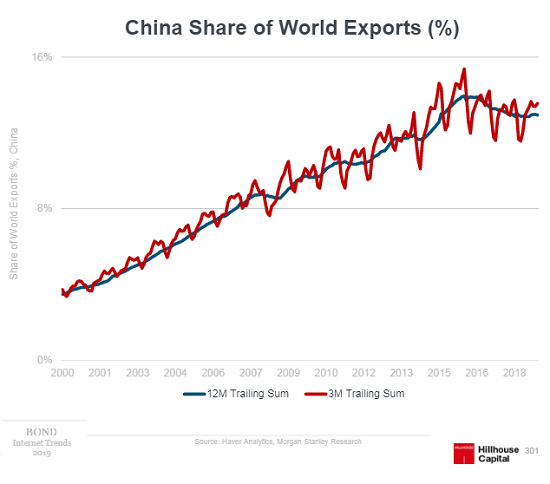

A China Trade Deal Just Finalizes the Divorce

Each party will continue to extract whatever benefits they can from the other, but the leaving is already well underway. Beneath the euphoric hoopla of a trade deal with China is the cold reality that the divorce has already happened and any trade deal just signs the decree. The divorce of China and the U.S. was mutual; each had used up whatever benefits the tense marriage had offered, and each is looking forward to no longer being dependent on the...

Read More »

Read More »

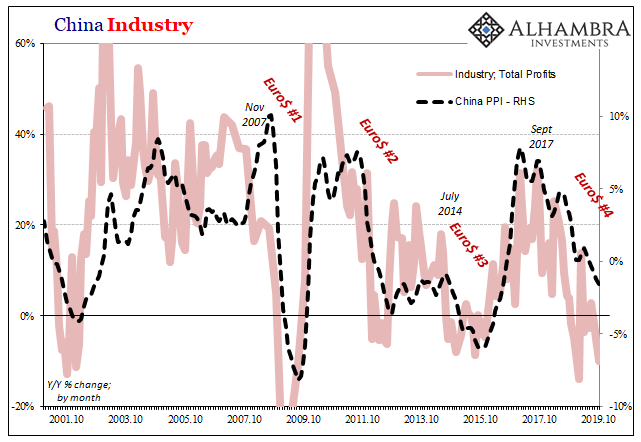

Nothing Good From A Chinese Industrial Recession

October 2017 continues to show up as the most crucial month across a wide range of global economic data. In the mainstream telling, it should have been a very good thing, a hugely positive inflection. That was the time of true inflation hysteria around the globe, though it was always presented as a rationally-determined base case rather than the unsupported madness it really was.

Read More »

Read More »

How migration could make the world richer | The Economist

Many of the recent political shifts in the West—the election of Donald Trump, the rise of populism in Europe and Brexit—can be partially attributed to the fear of mass migration. Yet increasing migration is one of the quickest ways to make the world richer. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For …

Read More »

Read More »

The Big One, The Smoking Gun

It wasn’t just the unemployment rate which was one of the key reasons why Economists and central bankers (redundant) felt confident enough to inspire 2017’s inflation hysteria. There was actually another piece to it, a bigger piece potentially complimentary and corroborative bit of conjecture. I write “conjecture” because despite how all this is presented in the media there’s very little precision to any of it.

Read More »

Read More »

We Can Only Choose One: Our National Economy or Globalization

The servitude of society to a globalized economy is generating extremes of insecurity, powerlessness and inequality. Does our economy serve our society, or does our society serve our economy, and by extension, those few who extract most of the economic benefits? It's a question worth asking, as beneath the political churn around the globe, the issues raised by this question are driving the frustration and anger that's manifesting in social and...

Read More »

Read More »

How to get migration right | The Economist

Governments need to find better ways of managing migration. Greater freedom of movement could make the world richer, but voters need convincing. Here’s how to do it. Read more here: https://econ.st/35Cs1nw Read The Economist special report here: https://econ.st/2Dlih59 Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ …

Read More »

Read More »

Charles Hugh Smith on why Eastern Europe may be the Go To Place

Charles Hugh Smith on why Eastern Europe may be the Go To Place Click here for the full transcript: http://financialrepressionauthority.com/2019/11/27/the-roundtable-insight-charles-hugh-smith-on-why-eastern-europe-may-be-the-go-to-place/

Read More »

Read More »

China’s Financial Stability: A Squeeze and a Strangle

I do get a big kick out of the way Communists over in China announce how they are dealing with their enormous problems especially as they may be getting worse. Each month, for example, the country’s National Bureau of Statistics (NBS) will publish figures on retail sales or industrial production at record lows but in the opening paragraphs the text will be full of praise for how the economy is being handled.

Read More »

Read More »

Dollar Builds on Recent Gains

The dollar remains resilient; optimism towards a Phase One deal continues to support risk appetite. There was also optimism from Fed Chairman Powell yesterday; the US economy is not out of the woods yet. Turkish President Erdogan started deploying Russia’s S-400 missile system, raising the specter of sanctions. Hong Kong reported weak October trade data; Philippine central bank Governor Diokno said a December cut was possible.

Read More »

Read More »

Darn, This Is Inconvenient: Apple Is Destroying the Planet to Maximize Profits

Stripmining the planet to maximize profits isn't progressive or renewable--it's just exploitive and destructive. How do we describe the finding that the planet's most widely-owned super-corporation is destroying the planet to maximize its smartphone sales and profits? Shall we start with "inconvenient?" Yes, we're talking about Apple, famous for coercing customers to upgrade their Apple phones and other gadgets if not annually then every couple...

Read More »

Read More »

Drivers for the Week Ahead

The dollar was surprisingly resilient last week; we look for further dollar gains ahead. It is a holiday shortened week in the US, but there are still some major data releases. There is a fair amount of eurozone data this week; UK Prime Minister Johnson unveiled his Tory manifesto. Hong Kong held local elections this weekend; tensions between Japan and Korea appear to have eased, but questions remain.

Read More »

Read More »

Seriously, Good Luck Dethroning the (euro)Dollar

Scarcely a week will go by without some grand prediction of the dollar being dethroned. Set aside how if anything is to be deposed it would have to be the eurodollar, these stories typically follow the same formulaic approach: Country X is moving away from dollar reserves, “diversifying” its holdings because of the geopolitics of Y.

Read More »

Read More »

What’s Been Normalized? Nothing Good or Positive

What's been normalized are policies and cultural norms that seek to enrich and protect the few at the expense of the many. When the initially extraordinary fades into the unremarkable background of everyday life, we say it's been normalized. Put another way, we quickly habituate to new conditions, and rationalize our ready acceptance of what was previously unacceptable.

Read More »

Read More »

The Financial System Is Broken (w/ Jeff Snider)

Jeff Snider, head of global research at Alhambra Investment Partners, has been covering the repo market breakdown since May 2018. With the recent spike in repo rates, it seems like the rest of the market has finally started to take notice. Snider explains why this problem is not coming up out of the blue and breaks down why he views recent market moves as a sign that the banks are telegraphing their knowledge of major threats to the monetary...

Read More »

Read More »

Could impeachment benefit Donald Trump? | The Economist

The impeachment hearings have raised yet more questions about Donald Trump’s conduct in office. The Democrats are hoping impeachment will undermine support for the president, but could it have the opposite effect? Read more here: https://econ.st/2OHB5Ro Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out …

Read More »

Read More »

Dollar and Equities Sink as Trade Pessimism Rises

Pessimism regarding a Phase One trade deal has intensified; further muddying the waters are recent US Congressional actions. FOMC minutes contained no surprises; regional Fed manufacturing surveys for November continue. South Africa is expected to cut rates by 25 bp to 6.25%. Korea reported trade data for the first twenty days of November; Indonesia kept rates steady at 5.0%, as expected.

Read More »

Read More »

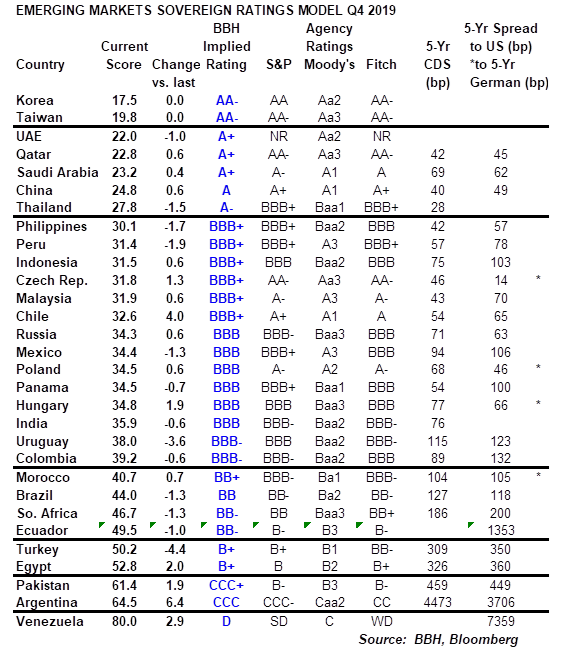

EM Sovereign Rating Model For Q4 2019

We have produced the following Emerging Markets (EM) ratings model to assess relative sovereign risk. An EM country’s score directly reflects its creditworthiness and underlying ability to service its external debt obligations. Each score is determined by a weighted compilation of fifteen economic and political indicators, which include external debt/GDP, short-term debt/reserves, import cover, current account/GDP, GDP growth, and budget balance.

Read More »

Read More »

US-China trade war: live Q&A with The Economist

What do you want to know about the US-China trade war? Soumaya Keynes, our trade and globalisation editor and Henry Curr, our economics editor, were live to answer your questions. Here are the questions that you asked Soumaya and Henry: 0:52 – What are the challenges of covering the US-China trade war? 2:10 – Where …

Read More »

Read More »