Category Archive: 5) Global Macro

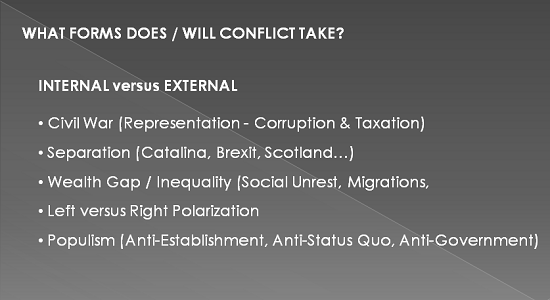

Welcome to the Era of Intensifying Chaos and New Weapons of Conflict

Geopolitics has moved from a slow-moving, relatively predictable chess match to rapidly evolving 3-D chess in which the rules keep changing in unpredictable ways. A declining standard of living in the developed world, declining growth for the developed world and geopolitical jockeying for control of resources make for a highly combustible mix awaiting a spark: welcome to the era of intensifying chaos and the rapid advance of new weapons of conflict...

Read More »

Read More »

All-Stars #85 Jeff Snider: U.S. Dollar Year End Review & 2020 Outlook

Please visit our website www.macrovoices.com to register your free account to gain access to supporting materials.

Read More »

Read More »

EM Preview for the Week Ahead

EM FX was mostly firmer last week. ZAR, PEN, and CLP outperformed while TRY, HUF, and CNY underperformed. MSCI EM traded at new highs for the cycle but ran out of steam near the 1110 area, while MSCI EM FX lagged a bit and has yet to surpass its July high. Overall, the backdrop for EM remains constructive but investors must be prepared to differentiate amongst credits in 2020.

Read More »

Read More »

Our Fragmentation Accelerates

As our fragmentation accelerates, shared economic interests are ignored in favor of divisive warring camps that share no common interests. That our society and economy are fragmenting is self-evident. This fragmentation is accelerating rapidly, as middle ground vanishes and competing camps harden their positions to solidify the loyalty of the "tribe."

Read More »

Read More »

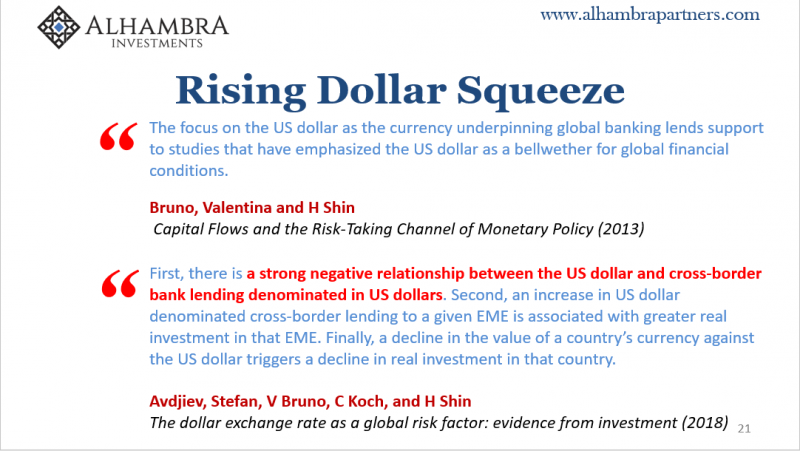

Everything Comes Down To Which Way The Dollar Is Leaning

Is the global economy on the mend as everyone at least here in America is now assuming? For anyone else to attempt to answer that question, they might first have to figure out what went wrong in the first place. Most have simply assumed, and continue to assume, it has been fallout from the “trade wars.”

Read More »

Read More »

MACRO ANALYTICS – 12 19 19 – The New Weapons of Conflict w/ Charles Hugh Smith

NOTE: THIS IS NOT AN INTERVIEW BUT RATHER AN ONGOING MONTHLY EXCHANGE BETWEEN CHARLES AND GORDON WHICH IS MADE AVAILABLE TO THE PUBLIC AS A PUBLIC SERVICE. VIDEO NOTIFICATION SIGN-UP: http://bit.ly/2y63PvX-Sign-Up VIDEO ABSTRACT: http://charleshughsmith.blogspot.com/2019/12/welcome-to-era-of-intensifying-chaos.html NEWSLETTER: 04-01-20 https://conta.cc/2X0WFWx Thank you to all Macro Analytics/Gordon T Long YouTube followers. I will continue to add...

Read More »

Read More »

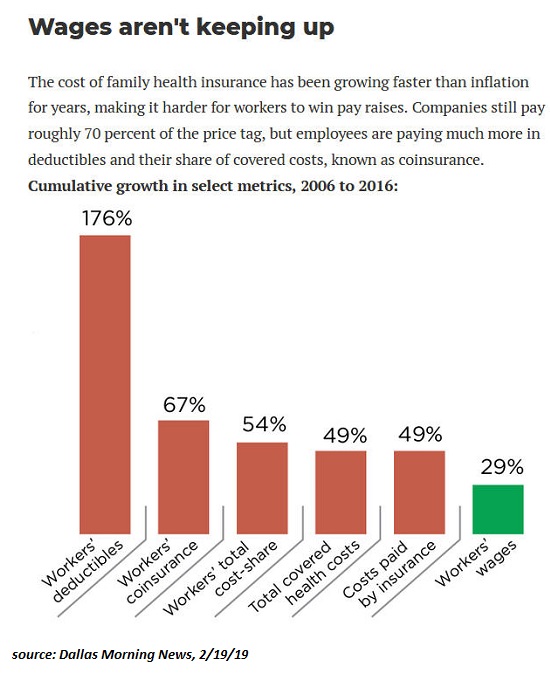

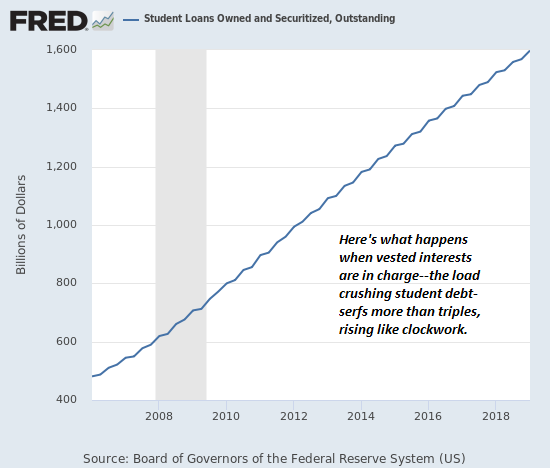

Skyrocketing Costs Will Pop All the Bubbles

The reckoning is coming, and everyone who counted on "eternal growth of borrowing" to stave off the reckoning is in for a big surprise. We've used a simple trick to keep the status quo from imploding for the past 11 years: borrow whatever it takes to keep paying the skyrocketing costs for housing, healthcare, college, childcare, government, permanent wars and so on.

Read More »

Read More »

OK Boomer, OK Fed

Eventually the younger generations will connect all the economic injustices implicit in 'OK Boomer' with the Fed. Much of the cluelessness and economic inequality behind the OK Boomer meme is the result of Federal Reserve policies that have favored those who already own the assets (Boomers) that the Fed has relentlessly pumped higher, to the extreme disadvantage of younger generations who were not given the opportunity to buy assets cheap and ride...

Read More »

Read More »

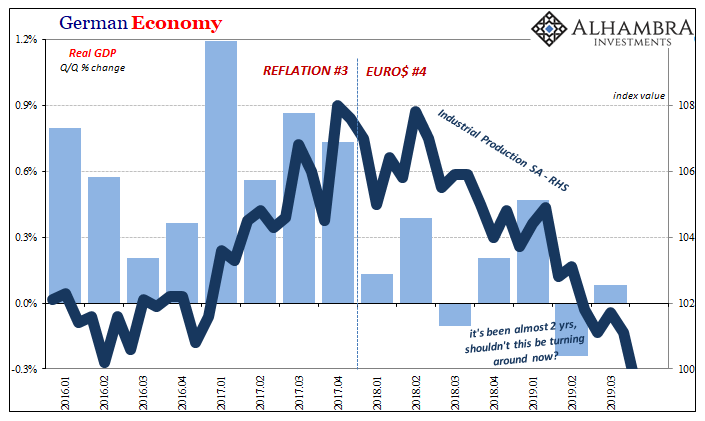

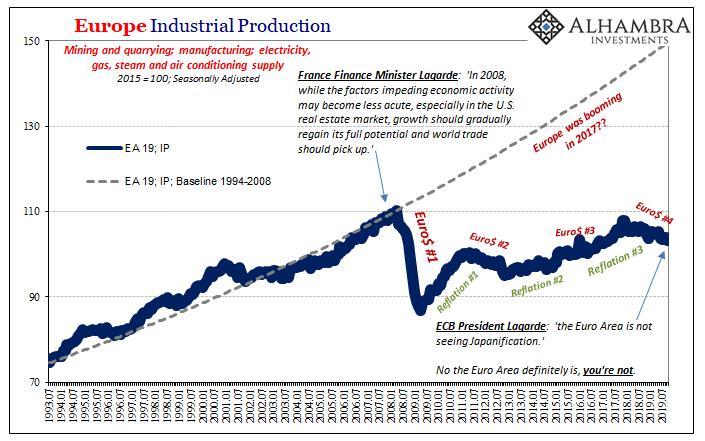

Latest European Sentiment Echoes Draghi’s Last Take On Global Economic Risks

While sentiment has been at best mixed about the direction of the US economy the past few months, the European economy cannot even manage that much. Its most vocal proponent couldn’t come up with much good to say about it – while he was on his way out the door. At his final press conference as ECB President on October 24, Mario Draghi had to acknowledge (sort of) how he is leaving quite the mess for Christine Lagarde.

Read More »

Read More »

Hard Brexit Redux?

The risks of a hard Brexit are perhaps higher than markets appreciated. Here, we set forth some possible scenarios as to what may unfold after the January 31 deadline. Uncertainty is likely to be protracted and markets hate uncertainty. As such, we see UK assets continuing to underperform.

Read More »

Read More »

How kidnapping became a big business | The Economist

Kidnapping has created a growing insurance industry, which regulates ransom demands and saves lives. But it’s a complicated business model in which poorer victims are losing out. Read more here: https://econ.st/2S97rrl Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: …

Read More »

Read More »

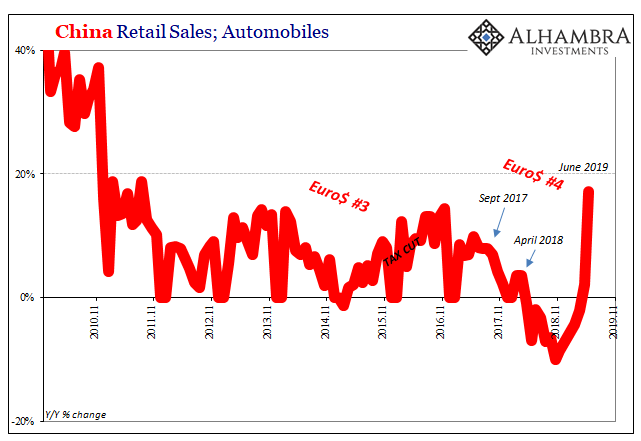

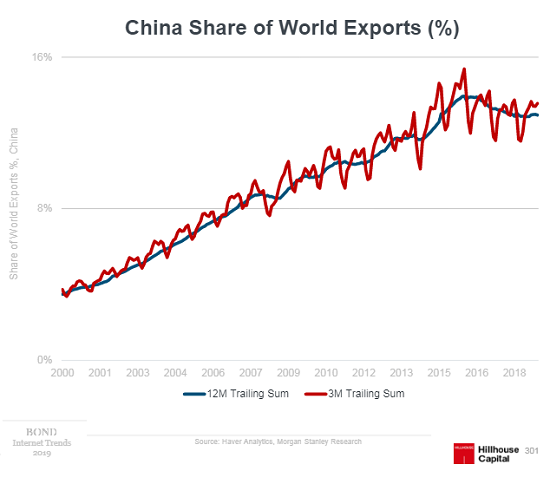

China Data: Something New, or Just The Latest Scheduled Acceleration?

The Chinese government was serious about imposing pollution controls on its vast stock of automobiles. The largest market in the world for cars and trucks, the net result of China’s “miracle” years of eurodollar-financed modernization, for the Chinese people living in its huge cities the non-economic costs are, unlike the air, immediately clear each and every day.

Read More »

Read More »

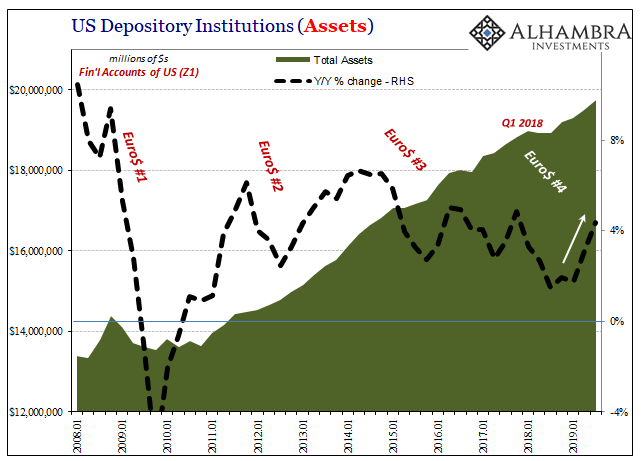

A Repo Deluge…of Necessary Data

Just in time for more discussions about repo, the Federal Reserve delivers. Not in terms of the repo market, mind you, despite what you hear bandied about in the financial media the Fed doesn’t actually go there. Its repo operations are more RINO’s – repo in name only. No, what the US central bank actually contributes is more helpful data.

Read More »

Read More »

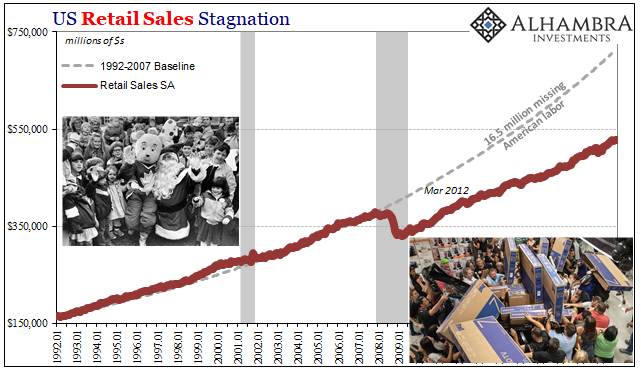

If The Best Case For Consumer Christmas Is That It Started Off In The Wrong Month…

Gone are the days when Black Friday dominated the retail calendar. While it used to be a somewhat fun way to kick off the holiday shopping season, it had morphed into something else entirely in later years. Scenes of angry shoppers smashing each other over the few big deals stores would truly offer, internet clips of crying children watching in horror as their parents transformed their local Walmart into Thunderdome.

Read More »

Read More »

The “Trade Deal”: A Pathetic Parody, Credibility Squandered

Anyone who thinks this bogus "deal" has resolved any of the issues or uncertainties deserves to be fired immediately. Here's a late-night TV parody of a trade deal: The agreement won't be signed by both parties, though each might sign their own version of it, and the terms of the deal will never ever be revealed to the public, which includes everyone doing any business in the nations doing the "deal."

Read More »

Read More »

EM Preview for the Week Ahead

Risk assets such as EM got a big boost last week, as tail risks from a hard Brexit and the US-China trade war have clearly ebbed. Still, the initial lack of details on the Phase One deal as well as uncertainty regarding the next phases have left the markets a bit jittery and nervous. Hopefully, this week may bring some further clarity and the good news is that the December 15 tariffs have been canceled.

Read More »

Read More »

A “Market” That Needs $1 Trillion in Panic-Money-Printing by the Fed to Stave Off Implosion Is Not a Market

It was all fun and games enriching the super-wealthy but now the karmic cost of the Fed's manipulation and propaganda is about to come due. A "market" that needs $1 trillion in panic-money-printing by the Fed to stave off a karmic-overdue implosion is not a market: a legitimate market enables price discovery. What is price discovery?

Read More »

Read More »

Lagarde Channels Past Self As To Japan Going Global

As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar.

Read More »

Read More »

Risk Assets Rally as Major Tail Risks Ease

The biggest tail risks impacting markets this year have cleared up; risk assets are rallying, while safe haven assets are selling off. During the North American session, US November retail sales will be reported. Russia central bank cut rates 25 bp to 6.25%, as expected.

Read More »

Read More »

UK Election: live Q&A with The Economist

Boris Johnson’s Conservative Party won the election by a landslide. What will this victory mean? Join Zanny Minton Beddoes, our Editor-in-Chief, for a live Q&A. Ask any questions you might have for her in the chatbox. Our hosts: Zanny Minton Beddoes, Editor-in-Chief Adrian Wooldridge, Political editor and Bagehot columnist Sarah Collinson, Video journalist Find The …

Read More »

Read More »