Category Archive: 5) Global Macro

A Real Example Of Price Imbalance

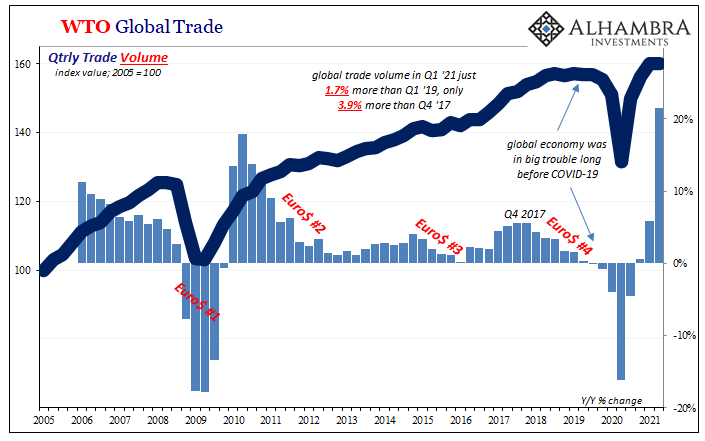

It’s not just the trade data from individual countries. Take the WTO’s estimates which are derived from exports and imports going into or out of nearly all of them. These figures show that for all that recovery glory being printed up out of Uncle Sam’s checkbook, the American West Coast might be the only place where we can find anything resembling Warren Buffett’s red-hot claim.

Read More »

Read More »

The Two Big Anniversaries of August: The Lost Decade (plus) Of The ‘Fiat’ Half Century

As my esteemed podcast co-host Emil Kalinowski has already mentioned (recurrently), we have, this year, two major anniversaries during these dog days of summer circled on our calendar. Today is, obviously, August 9 and for anyone the slightest familiar with the eurodollar story, that date is seared into their consciousness for as long as it will take to rebuild from the ashes created by the monetary fire lit that day. It has been, sadly, fourteen...

Read More »

Read More »

The End of Global Tourism?

Viewed as a complex non-linear system, the pandemic varinants can only be controlled by drastically pruning the physical connections between disparate global groups, which means effectively ending the unrestricted flow of individuals around the planet.

Read More »

Read More »

Weekly Market Pulse: What Is Today’s New Normal?

Remember “The New Normal”? Back in 2009, Bill Gross, the old bond king before Gundlach came along, penned a market commentary called “On the Course to a New Normal” which he said would be:

“a period of time in which economies grow very slowly as opposed to growing like weeds, the way children do; in which profits are relatively static; in which the government plays a significant role in terms of deficits and reregulation and control of the...

Read More »

Read More »

Should we be worried about technology? | The Economist

The covid-19 pandemic has reinforced humanity’s dependence on modern tech, but the same tools that enable remote working are also being used to spread disinformation and perpetuate cybercrime. Ambivalence towards technology is nothing new.

Read more of our coverage of Science & technology: https://econ.st/3CdkVa5

See our Technology Quarterlies: https://econ.st/3jldAN6

Why is pessimism about the impact of technology nothing new?...

Read More »

Read More »

While the Herd Slumbers, Risk Is Rocketing Higher

This wholesale transfer of risk from elites to the workers is finally becoming consequential as wealth / income / security inequality is reaching extremes that are destabilizing society and the economy.

Read More »

Read More »

Sophistry Dressed (as) Reallocation

Stop me if you’ve heard this before: About US$275 billion (about SDR 193 billion) of the new allocation will go to emerging markets and developing countries, including low-income countries.

Read More »

Read More »

What is net zero? | The Economist

More than 50 countries around the world have pledged to become net zero. But what does net zero actually mean—and is it achievable?

Find The Economist’s most recent coverage on climate change: https://econ.st/3zCt2uW

Sign up to The Economist’s daily newsletter to keep up to date with our latest stories: https://econ.st/3gJBH8D

Why do climate pledges fall short?: https://econ.st/3eVCYaI

What are nationally determined contributions to curb...

Read More »

Read More »

The Moment Wall Street Has Been Waiting For: Retail Is All In

The ideal bagholder is one who

adds more on every downturn (buy the dip) and who refuses to sell (diamond hands), holding

on for the inevitable Fed-fueled rally to new highs.

Old hands on Wall Street have been wary of being bearish for one reason, and no, it's not

the Federal Reserve: the old hands have been waiting for retail--the individual investor--

to go all-in stocks. After 13 long years, this moment has finally arrived:

retail is...

Read More »

Read More »

Golden Collateral Checking

Searching for clues or even small collateral indications, you can’t leave out the gold market. We’ve been on the lookout for scarcity primarily via the T-bill market, and that’s a good place to start, yet looking back to last March the relationship between bills and bullion was uniquely strong. It’s therefore a persuasive pattern if or when it turns up again.

Read More »

Read More »

Weekly Market Pulse: Buy The Dip, If You Can

If you were waiting for a correction in stock prices to put some money to work, you got your chance last week. The Dow Jones Industrial Average was down nearly 1000 points at the low Monday and closed down 725, a loss of a little over 2%. The S&P 500 did a little better but closed down 1.5%.

Read More »

Read More »

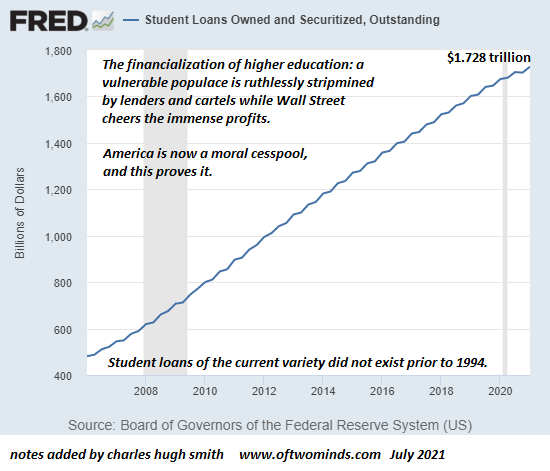

America Is a Moral Cesspool, and Student Loans Prove It

If America somehow managed to educate millions of college students without burdening them with $2 trillion in debt in 1993, why is it now "impossible" to do so, even as America's wealth and gross national product (GDP) have both rocketed higher over the past 27 years?

Read More »

Read More »

Eurodollar University’s Making Sense; Episode 89, Part 2: Let’s Crack China’s RRR Code

89.2 China Warns World of (Next?) Dollar Disorder. The People’s Bank of China lowers its bank Required Reserve Ratio to get money into a slowing economy. A lowered RRR means that there aren’t enough (euro)dollars flowing into China. Why? Because there aren’t enough (euro)dollars in the world. A lower RRR is a warning for the whole world.

Read More »

Read More »

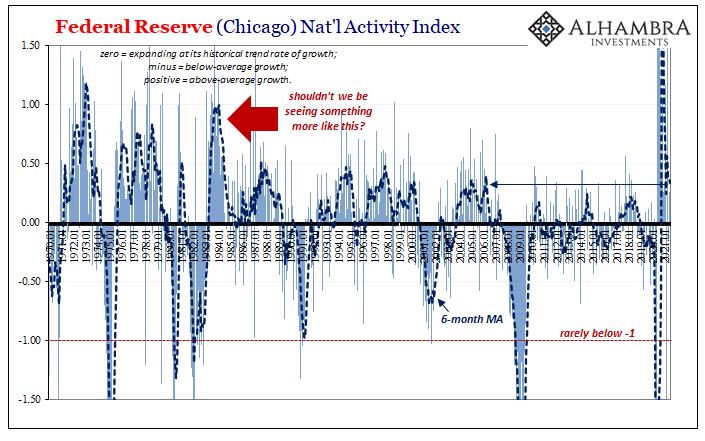

Do Rising ‘Global’ Growth Concerns Include An Already *Slowing* US Economy?

Global factors, meaning that the wave of significantly higher deflationary potential (therefore, diminishing inflationary chances which were never good to begin with) in global bond yields the past five months have seemingly focused on troubles brewing outside the US. Overseas turmoil, it was called back in 2015, leaving by default a picture of relative American strength and harmony.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Jeudi 22 juillet 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

Have We Reached “Peak Self-Glorifying Billionaire”?

Perhaps we should update Marie Antoinette's famous quip of cluelessness to: "Let them eat space tourism." As billionaires squander immense resources on self-glorifying space flights, the corporate media is nothing short of worshipful. Millions of average citizens, on the other hand, wish the self-glorifying billionaires had taken themselves and all the other parasitic, tax-avoiding, predatory billionaires with them on a one-way trip into space.

Read More »

Read More »

Lower Yields And (fewer) Bills

Back on February 23, Federal Reserve Chairman Jay Powell stopped by (in a virtual, Zoom sense) the Senate Banking Committee to testify as required by law. In the Q&A portion, he was asked the following by Montana’s Senator Steve Daines.

Read More »

Read More »

Big Tech: “Our Terms Have Changed”

So go ahead and say whatever you want around all your networked devices, but don't be surprised if bad things start happening. I received another "Our Terms Have Changed" email from a Big Tech quasi-monopoly, and for a change I actually read this one. It was a revelation on multiple fronts. I'm reprinting it here for your reading pleasure: We wanted to let you know that we recently updated our Conditions of Use.

Read More »

Read More »

Henry Kissinger: how Biden should handle China | The Economist

Henry Kissinger is a titan of US politics and one of the best-known veterans of foreign policy. He spoke to “The Economist Asks” podcast in April 2021 about current threats to the world order—and, in particular, rising tensions between America and China. Read more here: https://econ.st/3iq1OAM

Chapters

00:00 - Henry Kissinger: introduction

01:14 - Have US–China tensions risen?

02:28 - Can China and the US agree?

03:11 - What steps can Biden take?...

Read More »

Read More »