Category Archive: 5) Global Macro

(No) Dollars And (No) Sense: Eighty Argentinas

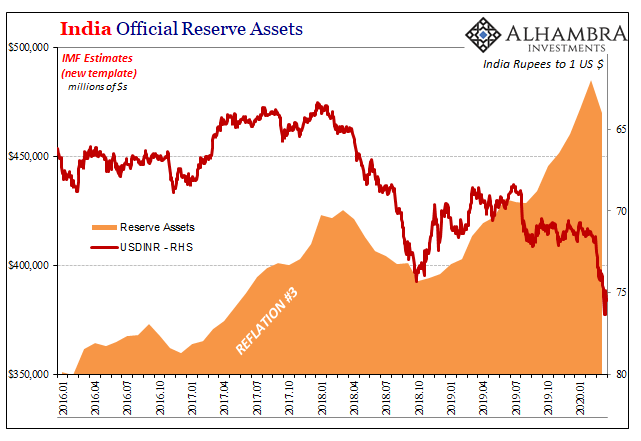

India like many emerging market countries around the world holds an enormous stockpile of foreign exchange reserves. According to the latest weekly calculation published by the Reserve Bank of India (RBI), the country’s central bank, that total was a bit less than half a trillion. While it sounds impressive, when the month began the balance was much closer to that mark.

Read More »

Read More »

The End of Globalization & Financialization Leads To A New Monetary System – Charles Hugh Smith

Thanks for watching this RTD Q&A ft. Charles Hugh Smith. Share your thoughts in the comment section below. Subscribe & click the ? icon to be notified of the next livestream. Consider becoming a supporter of the RTD Channel. All gifts add up to make a difference. Thanks RTD Patreon (Monthly Support): https://www.patreon.com/rtd RTD Donation …

Read More »

Read More »

Making Sense Eurodollar University Episode 2

Jeff Snider, Head of Global Investment Research at Alhambra Investments, and Emil Kalinowski make sense of today's global monetary system.

Read More »

Read More »

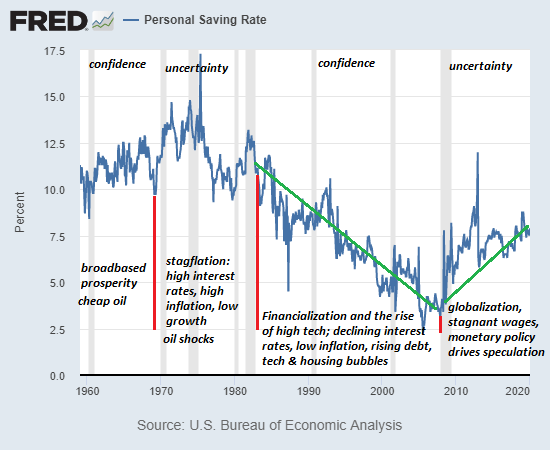

The New (Forced) Frugality

There are only two ways to survive a decline in income and net worth: slash expenses or default on debt. In post-World War II America, the cultural zeitgeist viewed frugality as a choice: permanent economic growth and federal anti-poverty programs steadily reduced the number of people in deep economic hardship (i.e. forced frugality) and raised the living standards of those in hardship to the point that the majority of households could choose to be...

Read More »

Read More »

Drivers for the Week Ahead

Markets continue to digest the implications of the Fed’s bazooka moment last week. The data highlight this week will be March jobs data Friday; key manufacturing sector data will come out earlier in the week. On Friday, BOC delivered an emergency 50 bp rate cut to 0.25% and started QE.

Read More »

Read More »

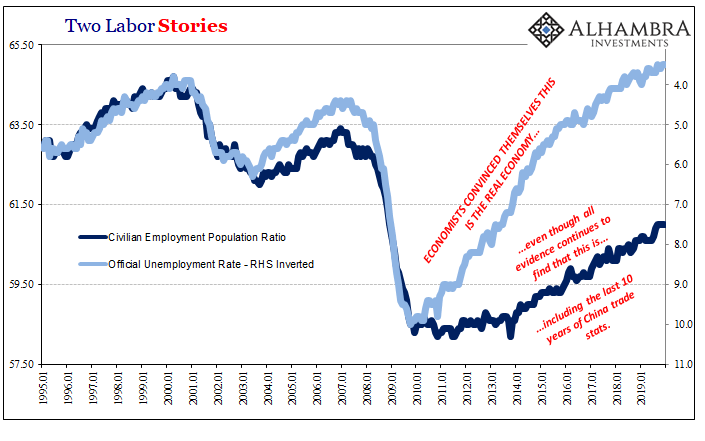

It’s Not About Jobless Claims Today, It’s About What Will Hamper Job Growth In A Few Months

You’ve no doubt heard about the jobless claims number. At an incomprehensible 3.28 million Americans filing for unemployment for the first time, this level far exceeded the wildest expectations as the economic costs of the shutdown continue to come in far more like the worst case. And as bad as 3mm is, the real hidden number is likely much higher.

Read More »

Read More »

No Further Comment Necessary At This Point

I would write something snarky about bank reserves, but why bother at this point? It’s already been said. If Jay Powell doesn’t mention collateral, no one else does even though it’s the whole ballgame right now. Note: FRBNY’s updated figures shown below are for last week.

Read More »

Read More »

How noise pollution threatens ocean life | The Economist

Noise pollution has led to multiple whale-strandings and poses a threat to thousands of ocean creatures. Meet the scientist who is mapping ocean noise in a bid to dial down the volume. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/

Read More »

Read More »

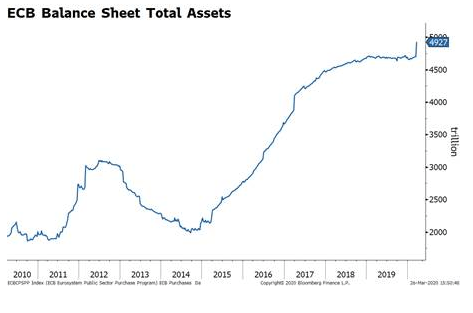

ECB Approaching its Bazooka Moment

The ECB appears to be moving closer to activating Outright Monetary Transactions (OMT). Despite being part of Draghi’s “whatever it takes” moment, OMT has never been used. If the Fed’s open-ended QE is seen as dollar-negative, then OMT should be seen as euro-negative.

Read More »

Read More »

The Pandemic Is Accelerating the Breakdown That Began a Decade Ago

The feedback loop has reversed: by saving more, people will spend, borrow and speculate less, draining the fuel from any broadbased expansion. In eras of confidence and certainty, people save less and spend more freely.

Read More »

Read More »

Three Short Run Factors Don’t Make A Long Run Difference

There are three things the markets have going for them right now, and none of them have anything to do with the Federal Reserve. More and more conditions resemble the early thirties in that respect, meaning no respect for monetary powers. This isn’t to say we are repeating the Great Depression, only that the paths available to the system to use in order to climb out of this mess have similarly narrowed.

Read More »

Read More »

Making Sense Eurodollar University Episode 1

Jeff Snider, Head of Global Investment Research at Alhambra Investments, and Emil Kalinowski make sense of today's global monetary system.

Read More »

Read More »

Covid-19: your questions about coronavirus, answered | The Economist

The novel coronavirus has killed thousands of people and is devastating the global economy. Ed Carr, The Economist’s deputy editor, and Alok Jha, our science correspondent, answer your questions on covid-19. Find all of The Economist’s coverage of covid-19 here: https://econ.st/33HyqOB Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Timecoded questions listed below: …

Read More »

Read More »

Helicopter Money: Short-Term Relief Won’t Cure our Financial Disease

The collateral supporting the global mountain of debt is crumbling as speculative bubbles deflate. A great many freebies are being tossed in the Helicopter Money basket. That households experiencing declines in income need immediate support is obvious, as is the need to throw credit lifelines to small businesses.

Read More »

Read More »

Regime Change

Stocks took another beating last week as the scope of the coronavirus shutdown started to sink in. The S&P 500 was down 15% last week with most of that coming on Monday after the Fed’s emergency rate cuts. Our accounts performed much better than that, but were still down on the week as corporate and municipal bonds continued to get marked down.

Read More »

Read More »

The System Will Not Return to “Normal,” and That’s Good; We Can Do Better

Essential home lockdown reading. The pandemic is revealing to all what many of us have known for a long time: the status quo was designed to fail and so its failure was not just predictable but inevitable. We've propped up a dysfunctional, wasteful and unsustainable system by pouring trillions of dollars in borrowed money down a multitude of ratholes to avoid a reckoning and a re-set.

Read More »

Read More »

Drivers for the Week Ahead

Risk sentiment is likely to remain under pressure this week as the impact of the coronavirus continues to spread; demand for dollars remains strong. As of this writing, the Senate-led aid bill has stalled; the US economic outlook is getting more dire; Canada is experiencing similar headwinds. This is a big data week for the UK; eurozone March flash PMIs will be reported Tuesday; oil prices continue to slide.

Read More »

Read More »

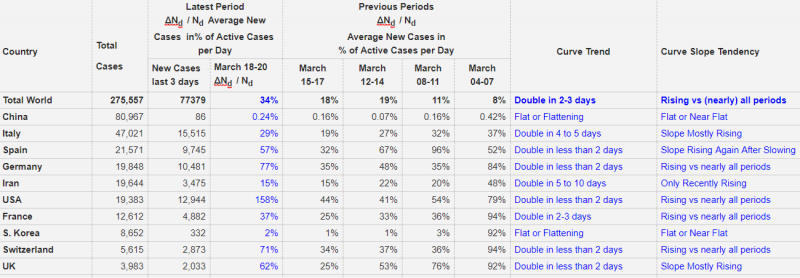

Corona’s Exponential Curve Slope Tracking, March 20

Key for understanding the expansion of the Coronavirus, is the slope (or steepness / derivation) of the curve.

This post compares the slope values of different countries.

Read More »

Read More »

Stagnation Never Looked So Good: A Peak Ahead

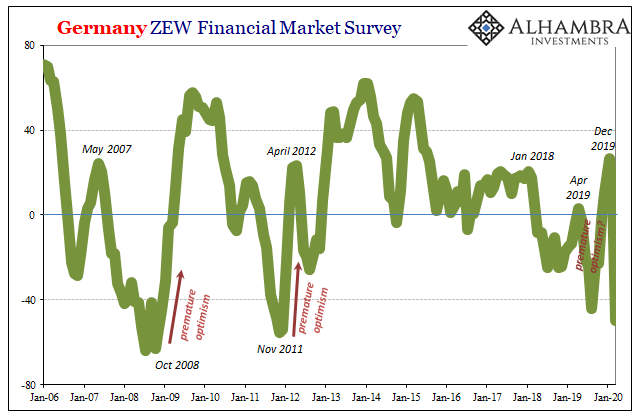

Forward-looking data is starting to trickle in. Germany has been a main area of interest for us right from the beginning, and by beginning I mean Euro$ #4 rather than just COVID-19. What has happened to the German economy has ended up happening everywhere else, a true bellwether especially manufacturing and industry.

Read More »

Read More »

The new coronavirus: how should the world respond? | The Economist

The new coronavirus is shutting down planet Earth. What lessons can the rest of the world learn from China, Singapore and South Korea? Find all of The Economist’s coverage of covid-19 here: https://econ.trib.al/LnKtbv8 Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Further reading: Covid-19 interactive web-based map from the John Hopkins Coronavirus Resource …

Read More »

Read More »