Category Archive: 5) Global Macro

Russian invasion: Ukraine continues its counter-offensive, claims 6,000 sq km of land retaken

Ukraine continues its counter-offensive against Russia after reeling under Russian strikes for almost seven months, Ukraine is fighting back to regain its territory. The war-torn country has now claimed that it has taken back six thousand square kilometers of the area which was captured by Moscow after the war began in the month of February.

Read More »

Read More »

Why This Recession Is Different

All of these are structural dynamics that won't go away in a few months or years.Let's explore what's different now compared to recessions of the past 60 years.1. Deglobalization is inflationary. Offshoring production to low-cost countries imported deflation (product prices remained flat or declined) and boosted corporate profits.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 12 septembre 2022, SMART BOURSE reçoit Thomas Costerg (Économiste senior US, Pictet WM)

Read More »

Read More »

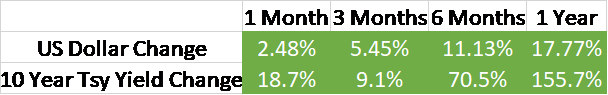

Weekly Market Pulse: No News Is…

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy.

Read More »

Read More »

Rapid advance of Ukrainian forces take Russia by surprise | Latest International News | WION

As Russia's invasion continues in Ukraine, Ukraine forces Russian troops to retreat from Izium. Meanwhile, Russia is planning to 'regroup' its troops as Izium had become key strategic city for Russian troops.

Read More »

Read More »

Russia pulls back from Izium; Ukraine encircles regions around Kharkiv | International News | WION

As Russia's invasion continues in Ukraine, Russia pulled out troops from Izium. Meanwhile, Russia has regrouped its troops in east as Izium had become key strategic city for Russian troops.

Read More »

Read More »

Is a Post-Dollar World Coming—Soon? [Ep. 284, Eurodollar University]

A Financial Times opinion column avers not only is a "post-dollar world coming" but that it is "near" and that the "decline could last... longer". We review the argument, disagree, and note no discussion of the global monetary order. Also, a prediction where the dollar is headed next.

Read More »

Read More »

Ukraine claims responsibility for Crimea attacks, took 10 Russian warplanes out of action | WION

After months of denial, Ukraine has claimed responsibility for a series of airstrikes on Crimea. One of the attacks which took place in early August targeted Russia's Saky military base and killed one person. Ukraine initially refused to admit any responsibility. Its defense minister even blamed russian soldiers smoking in the wrong place for triggering the blasts.

Read More »

Read More »

Gravitas: Why your oil bills could spike again

The OPEC Plus has decided to start cutting oil production in October by 100,000 barrels. Western sanctions on countries like Iran and Venezuela could squeeze oil supplies further. Palki Sharma tells you more.

Read More »

Read More »

What to expect from King Charles III

King Charles III has very large shoes to fill. How will he change the British royal family?

00:00 - Britain has a new king

01:08 - The English constitution

01:57 - The importance of religion

03:56 - Charles has big shoes to fill

06:09 - Slimming down the monarchy

07:21 - Will Charles be a meddling king?

08:44 - Could there be a constitutional crisis?

10:35 - The future of the British monarchy

What will Charles do now? https://econ.st/3RLTCdS...

Read More »

Read More »

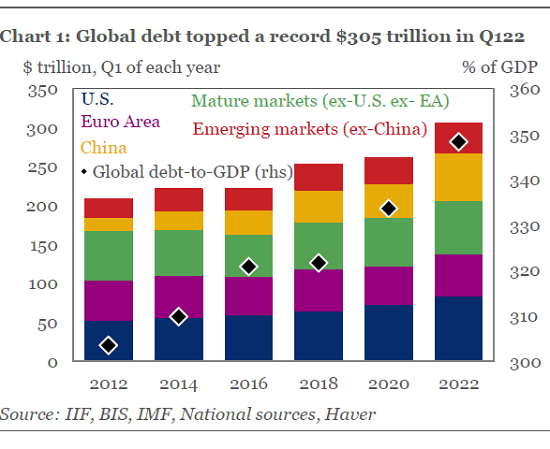

The EU’s Crisis Is Global

The EU's crisis isn't limited to energy. It is a manifestation of the global breakdown of Neocolonialism, Financialization and Globalization. The European Union (EU) was seen as the culmination of a centuries-long process of integration that would finally put an end to the ceaseless conflicts that had led to disastrous wars in the 20th century that had knocked Europe from global preeminence.

Read More »

Read More »

Be Sure to Read the Medicare Fine Print

Medicare. The government defines it as “The federal health insurance program for people 65 and older.” That seems simple enough. But there’s more to it than meets the eye because Medicare, like so many other things, has fine print that could end up costing you a lot of money if you don’t know about it.

Read More »

Read More »

Putin: Deal favouring west, at developing countries’ expense | Latest World News | WION

Russian President Vladimir Putin has said that Russia and the developing world had been cheated by the UN-brokered Ukrainian grain export deal. Putin has now called for the deals review.

Read More »

Read More »

Queen Elizabeth II: her reign in numbers

Queen Elizabeth II has died. Her 70-year reign was the longest of any British monarch—and spanned a period in which the world has radically changed. This is the story of her remarkable reign in numbers.

00:00 - Queen Elizabeth II: her reign in numbers

01:20 - How Britain transformed

03:00 - How many hours has the Queen worked?

04:14 - The Queen and the Commonwealth

04:45 - Number of countries the Queen has visited

05:58 - The Queen, Popes and US...

Read More »

Read More »

Why Some Cities May No Longer Be Viable

Any city whose lifeblood ultimately depends on hyper-globalization and hyper-financializationwill no longer be viable. The human migration from the countryside to cities has been an enduring feature of civilization.Cities concentrate wealth, productivity and power, and so they're magnets to talent and capital, offering newcomers the greatest opportunities.

Read More »

Read More »

Putin seeks closer ties with Asia as tensions with West intensifies | Latest World News | WION

Russian President Vladimir Putin attended large-scale military exercises on Tuesday involving China and several other nations, this comes as Moscow seeks to strengthen its diplomatic ties in Asia amid the ongoing western sanctions.

Read More »

Read More »

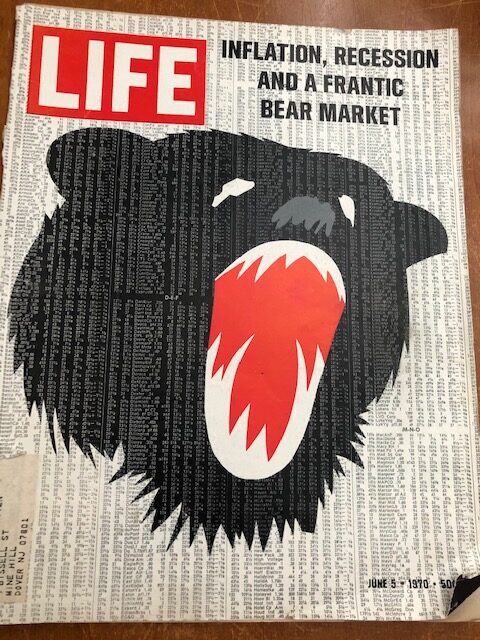

Weekly Market Pulse: The More Things Change…

I stopped in a local antique shop over the weekend. The owner is retiring and trying to clear out as much as she can before they close the doors so I paid a mere $3 for the Life magazine above. I think it might be worth many multiples of that price for investors who think our situation today is somehow uniquely bad. The cover headline could just as easily be describing today as 1970.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun compares the similarities between today’s bear market and past ones, plus last week’s data on the economy, employment, and whether the new data points to recession.

Read More »

Read More »

Gravitas: Is Ukraine using ‘fake profiles’ to lure Russian soldiers?

Is Ukraine 'honey-trapping' Russian soldiers? Reports claim, Ukrainian hackers are creating fake Facebook profiles of 'conventionally attractive' women to lure Russian troops. Palki Sharma gets you a report on the alleged honey-trapping feats.

Read More »

Read More »

Gravitas: China, Russia fire machine guns into Sea of Japan

Chinese and Russian warships fired machine guns into the Sea of Japan. Today - in a show of force, Russian President Vladimir Putin oversaw war games involving troops from several nations. Palki Sharma tells you more about Putin's powerplay.

Read More »

Read More »