Category Archive: 5) Global Macro

What Capitalism Can Do When Allowed, And Communism Never Will

Mikhail Sergeyevich Gorbachev was awarded the Nobel Peace Prize in 1990 “for his leading role in the peace process which today characterizes important parts of the international community.” Maybe, but it sure didn’t start out that way.

Read More »

Read More »

Of Incomplete Plans and Recoveries

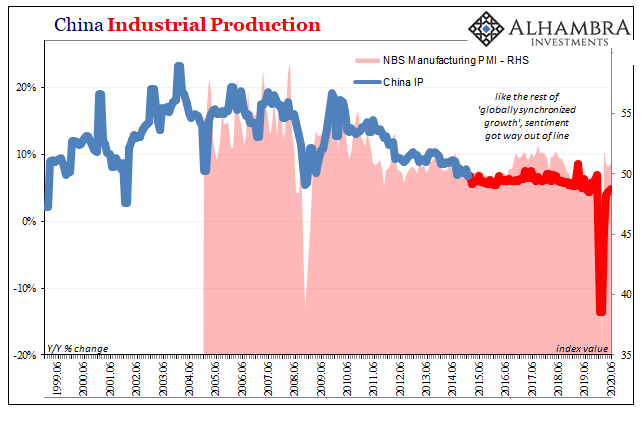

At the monthly press conference China’s National Bureau of Statistics (NBS) now regularly gives whenever the Big Three economic accounts are updated (this time along with quarterly GDP), spokesman Liu Aihua was asked by a reporter from Reuters to comment on how the global economic recession might impact the Communist government’s long range goal of reaching its assigned GDP target.

Read More »

Read More »

Welcome to the Crazed, Frantic Demise of Finance Capitalism

The cognitive dissonance required to ignore the widening gap between the real economy and the fraud's basic machinery--speculation funded by "money" conjured out of thin air--has reached a level of denial that can only be termed psychotic.

Read More »

Read More »

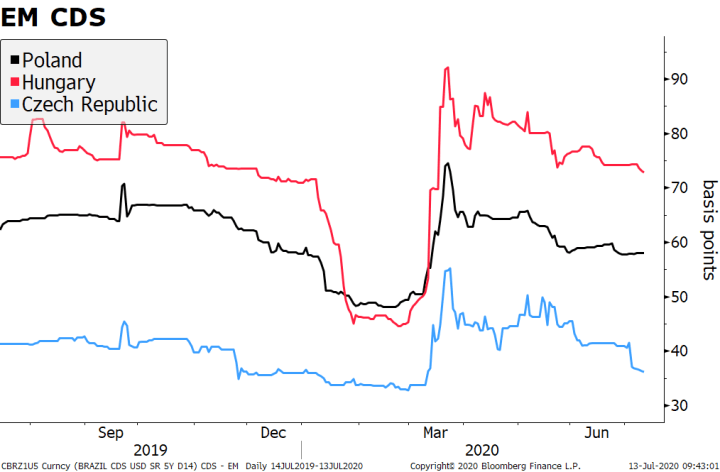

EM Preview for the Week Ahead

EM FX was mixed last week, with most risk assets continuing to fight a tug of war between improving economic data and worsening virus numbers. Sentiment may be hurt early this week over lack of consensus in the EU and the US regarding further fiscal stimulus. Three of the four EM central banks meeting this week are expected to cut rates.

Read More »

Read More »

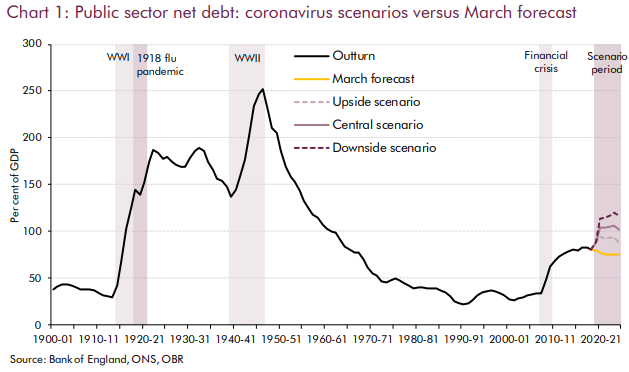

This Is a Financial Extinction Event

The lower reaches of the financial food chain are already dying, and every entity that depended on that layer is doomed. Though under pressure from climate change, the dinosaurs were still dominant 65 million year ago--until the meteor struck, creating a global "nuclear winter" that darkened the atmosphere for months, killing off most of the food chain that the dinosaurs depended on.

Read More »

Read More »

Transitory, The Other Way

After a record three straight months of decline for the seasonally-adjusted core CPI March through May 2020, it turned upward again in June. Buoyed by a partially reopened economy, the price discounting (prerequisite to the Big D) took at least one month off.

Read More »

Read More »

Wait A Minute, The Dollar And The Fed’s Bank Reserves Are Directly Not Inversely Related

One small silver lining to the current situation, while Jay Powell is busily trying to sell you his inflation fantasy, he’s actually undermining it at the very same time. No mere challenge to his own “money printing” fiction, either, the Fed’s Chairman is actively disproving the entire enterprise. While he says what he says, pay close attention instead to what he’s done.

Read More »

Read More »

Market Sentiment Dented by Weak Data and Rising US-China Tensions

Market sentiment has been dented by more than just rising virus numbers; yet the dollar continues to trade within recent well-worn ranges. California’s decision to reverse partial reopening will likely have a huge economic impact; June CPI may hold a bit more interest in usual; June budget statement is worth a quick mention.

Read More »

Read More »

How Do We Change the Leadership of our Quasi-Sovereign Big Tech Neofeudal Nobility?

You better bow low and pay up, peasant, or your voice in the digital world will disappear just as quickly as your democracy's control over Big Tech. Who's the junior partner in global hegemony, Big Tech or the U.S. government?

Read More »

Read More »

Could America Have a French-Style Revolution?

As with the French Revolution, that will be the trigger for a wholesale replacement of our failed institutions. Since it's Bastille Day, a national holiday in France celebrating the French Revolution, let's ask a question few even think (or dare) to ask: could America have a French-style Revolution? Not in some distant era, but within the next five years?

Read More »

Read More »

Dollar Rangebound in Quiet Start to an Eventful Week

Today marks a relatively quiet start to what is likely to be one of the most eventful weeks we’ve seen in a while; the dollar remains within recent well-worn ranges. The US continues to ratchet up trade tensions; the only US data report today is the June budget statement.

Read More »

Read More »

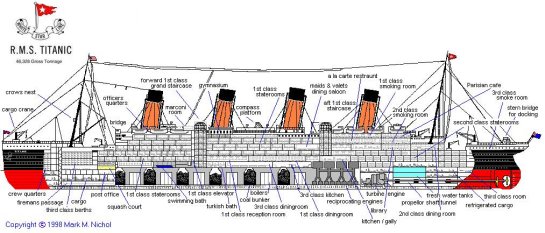

The Sinking Titanic’s Great Pumps Finally Fail

The greater fools still partying in the first-class lounge are in denial that even the greatest, most technologically advanced ship can sink. On April 14, 1912, the liner Titanic, considered unsinkable due to its watertight compartments and other features, struck a glancing blow against a massive iceberg on that moonless, weirdly calm night.

Read More »

Read More »

EM Preview for the Week Ahead

This is likely to be one of the most eventful weeks we’ve had in a while. Not only do three major central banks meet, but four EM central banks also meet, and we get important June and July data from the US, the first Q2 GDP reading from China, an OPEC+ meeting, and an EU summit.

Read More »

Read More »

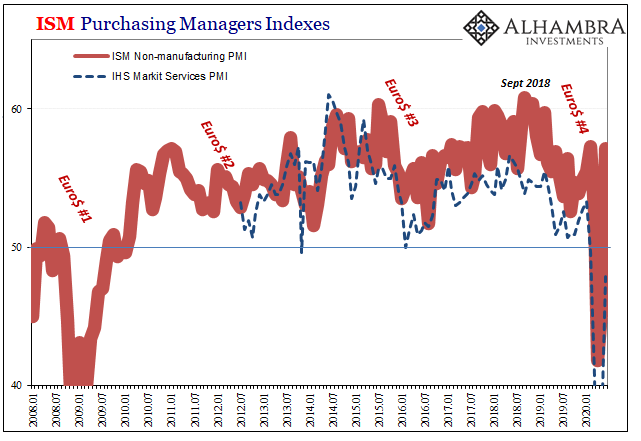

Second Wave Global Trade

Unlike some sentiment indicators, the ISM Non-manufacturing, in particular, actual trade in goods continued to contract in May 2020. Both exports and imports fell further, though the rate of descent has improved. In fact, that’s all the other, more subdued PMI’s like Markit’s have been suggesting.

Read More »

Read More »

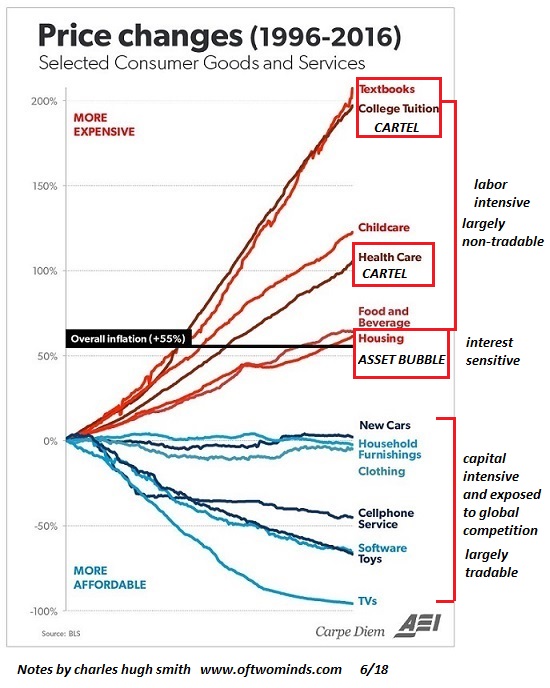

The American Economy in Four Words: Neofeudal Extortion, Decline, Collapse

Our society has a legal structure of self-rule and ownership of capital, but in reality it is a Neofeudal Oligarchy. Now that the pandemic is over and the economy is roaring again--so the stock market says--we're heading straight back up into the good old days of 2019. Nothing to worry about, we've recovered the trajectory of higher and higher, better every day in every way.

Read More »

Read More »

Dollar Bid as Market Sentiment Yet to Recover

The US has started the formal process of withdrawing from the WHO; the dollar continues to benefit from risk-off sentiment but remains stuck in recent ranges. The White House is asking Congress to pass another $1 trln stimulus plan by early August; President Trump hosts Mexican President AMLO for a two-day visit.

Read More »

Read More »

Monthly Market Monitor – July 2020

Most Long-Term Trends Have Not Changed. A lot has changed over the last 4 months since the COVID virus started to impact the global economy. Asia was infected first with China at ground zero. Their economy succumbed first with a large part of the country shut down to a degree that can only be accomplished in an authoritarian regime.

Read More »

Read More »

Gratuitously Impatient (For a) Rebound

Jay Powell’s 2018 case for his economic “boom”, the one which was presumably behind his hawkish aggression, rested largely upon the unemployment rate alone. A curiously thin roster for a period of purported economic acceleration, one of the few sets joining that particular headline statistic in its optimism resides in the lower tiers of all statistics.

Read More »

Read More »

What Makes You Think the Stock Market Will Even Exist in 2024?

Given the extremes of the stock market's frauds and even greater extremes of wealth/income inequality it has created, tell me again why the stock market will still exist in 2024? When I read a financial pundit predicting a bull market in stocks through 2024, blah-blah-blah, I wonder: what makes you think the stock market will even exist in 2024, at least in its current form?

Read More »

Read More »

EM Preview for the Week Ahead

Risk assets remain hostage to swings in market sentiment. Stronger than expected US jobs data last week was welcome news. However, the tug of war between improving economic data and worsening viral numbers is likely to continue this week, with many US states reporting record high infection rates.

Read More »

Read More »