Category Archive: 5) Global Macro

Reality Beckons: Even Bigger Payroll Gains, Much Less Fuss Over Them

What a difference a month makes. The euphoria clearly fading even as the positive numbers grow bigger still. The era of gigantic pluses is only reaching its prime, which might seem a touch pessimistic given the context. In terms of employment and the labor market, reaction to the Current Employment Situation (CES) report seems to indicate widespread recognition of this situation. And that means how there are actually two labor markets at the moment.

Read More »

Read More »

Dancing Through the Geopolitical Minefield

The elites dancing through the minefield all have plans, but how many are prepared for the punch in the mouth? Open any newspaper from the past 100 years and you will soon find a newsworthy geopolitical hotspot or conflict.

Read More »

Read More »

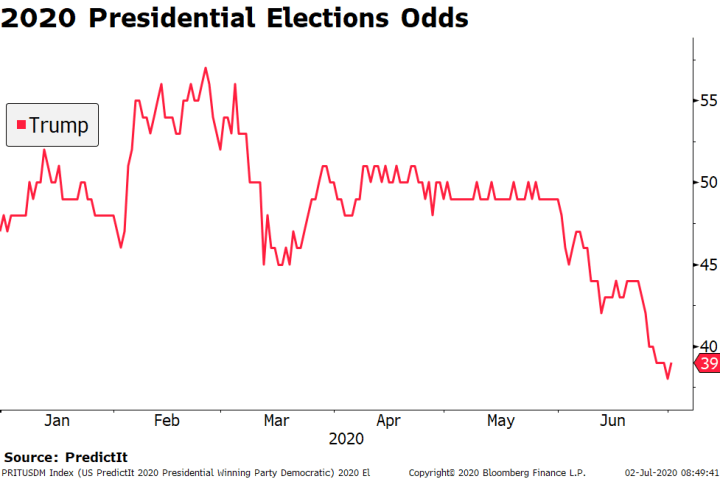

Dollar Soft Ahead of Jobs Report

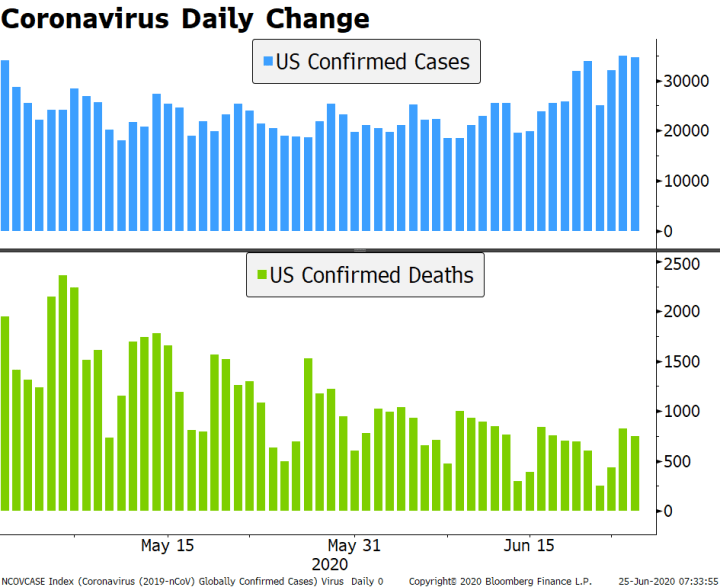

Re-shutdowns continue to spread across the US; the dollar has come under pressure again. Jobs data is the highlight ahead of the long holiday weekend in the US; weekly jobless claims will be reported. FOMC minutes were revelatory; the Fed for now will rely on “outcome-based” forward guidance and asset purchases to achieve its goals; US House passed the latest China sanctions bill.

Read More »

Read More »

An Interesting Juncture in History

Just as the rewards of central-bank bubbles have not been evenly distributed, the pain created by the collapse of the bubbles won't be evenly distributed, either. We've reached an interesting juncture in history, and I don't mean the pandemic. I'm referring to the normalization of extremes in the economy, in social decay and in political dysfunction and polarization.

Read More »

Read More »

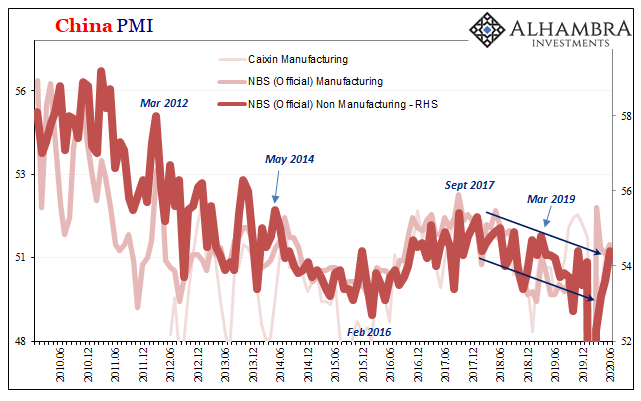

What The PMIs Aren’t Really Saying, In China As Elsewhere

China’s PMI’s continue to impress despite the fact they continue to be wholly unimpressive. As with most economic numbers in today’s stock-focused obsessiveness, everything is judged solely by how much it “surprises.” Surprises who? Doesn’t matter; some faceless group of analysts and Economists whose short-term modeling has somehow become the very standard of performance.

Read More »

Read More »

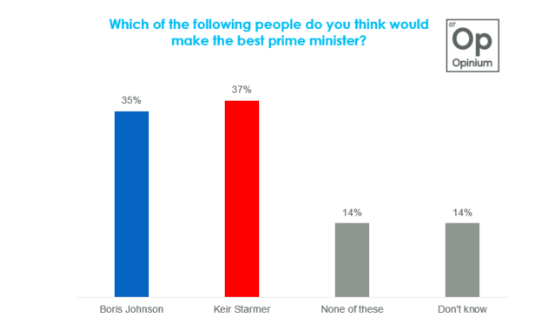

Dollar Begins the Week Under Pressure Again

The virus news stream remains negative; pressure on the dollar has resumed. The US economy is taking a step back just as Q3 is about to get under way; there are some minor US data reports today. UK Labour leader Starmer overtook Prime Minister Johnson in the latest opinion poll; Macron’s party did poorly in French local elections.

Read More »

Read More »

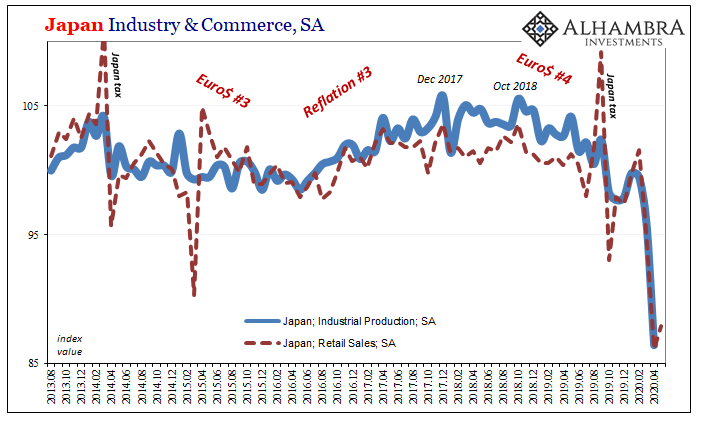

Looking Ahead Through Japan

After the Diamond Princess cruise ship docked in Tokyo with tales seemingly spun from some sci-fi disaster movie, all eyes turned to Japan. Cruisers had boarded the vacation vessel in Yokohama on January 20 already knowing that there was something bad going on in China’s Wuhan. The big ship would head out anyway for a fourteen-day tour of Vietnam, Taiwan, and, yes, China.

Read More »

Read More »

EM Preview for the Week Ahead

Risk assets came under pressure last week as the virus news stream worsened. It’s clear that large parts of the US will be forced to delay reopening until their virus numbers improve. Markets had gotten too bullish on the US recovery story and so this reality check soured sentiment. This is a very important week for US data, and we think risk sentiment will remain under pressure ahead of what we think will be a likely downside surprise in the US...

Read More »

Read More »

Forget the V, W or L Recovery: Focus on N-P-B

The only realistic Plan B is a fundamental, permanent re-ordering of the cost structure of the entire U.S. economy. The fantasy of a V-shaped recovery has evaporated, and expectations for a W or L-shaped recovery are increasingly untenable. So forget V, W and L; the letters that will shape the future are N, P, B: there is No Plan B.

Read More »

Read More »

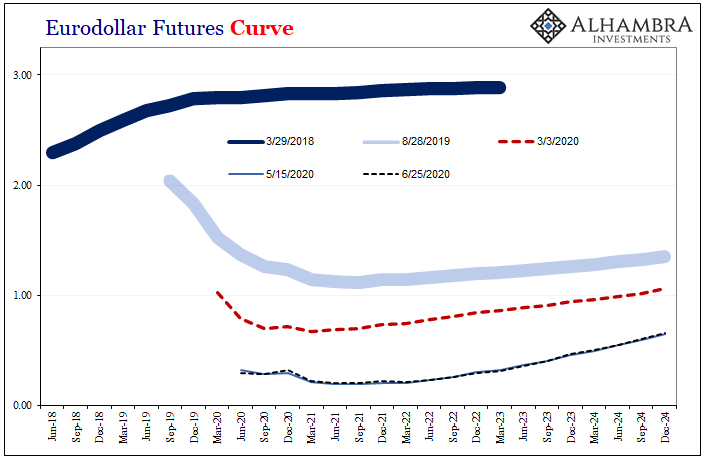

Wait A Minute, What’s This Inversion?

Back in the middle of 2018, this kind of thing was at least straight forward and intuitive. If there was any confusion, it wasn’t related to the mechanics, rather most people just couldn’t handle the possibility this was real. Jay Powell said inflation, rate hikes, and accelerating growth. Absolutely hawkish across-the-board.And yet, all the way back in the middle of June 2018 the eurodollar curve started to say, hold on a minute.

Read More »

Read More »

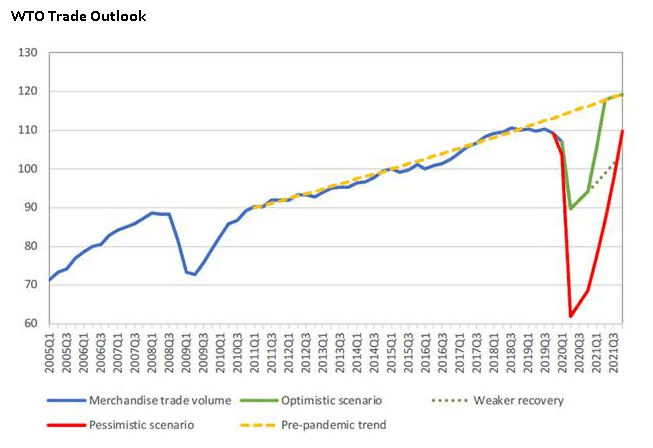

Recent Trade Developments Suggest Some Caution Ahead Warranted

There’s never a good time for a trade war. Yet here we are on the cusp of one between the US and the EU over unfair aircraft subsidies and comes at a time when renewed COVID-19 outbreaks are making the global economic outlook even cloudier. These developments suggest some caution ahead is warranted for risk assets like EM and equities.

Read More »

Read More »

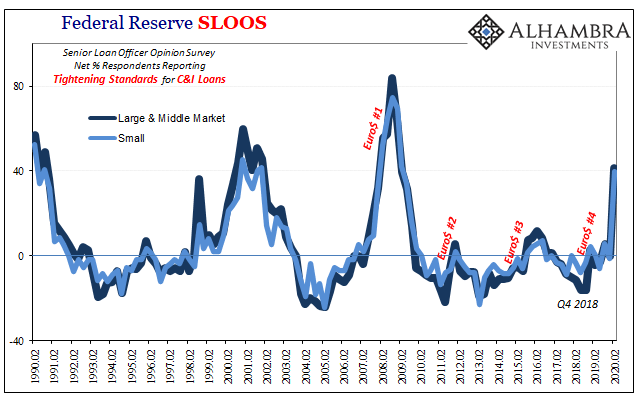

Not COVID-19, Watch For The Second Wave of GFC2

I guess in some ways it’s a race against the clock. What the optimists are really saying is the equivalent of the old eighties neo-Keynesian notion of filling in the troughs. That’s what government spending and monetary “stimulus” intend to accomplish, to limit the downside in a bid to buy time. Time for what? The economy to heal on its own.

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Persists

Higher infection numbers in the US and other countries continue to fuel risk aversion across global markets; the IMF released more pessimistic global growth forecasts yesterday. The US has rekindled trade provocations against China through Huawei; weekly jobless claims will be reported; regional Fed manufacturing surveys for June will continue to roll out.

Read More »

Read More »

Is Data Our New False Religion?

In the false religion of data, heresy is asking for data that is not being collected because it might reveal unpalatably unprofitable realities. Here's how every modern con starts: let's look at the data. Every modern con starts with an earnest appeal to look at the data because the con artist has assembled the data to grease the slides of the con.

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Returns

Risk-off sentiment has picked up from reports that the US will impose new tariffs against the EU; there’s also been a messy set of headlines regarding the virus contagion outlook in the US. The IMF will release updated global growth forecasts today; the dollar is benefiting from risk-off sentiment; another round of fiscal stimulus in the US is in the works.

Read More »

Read More »

Restricted Market Trading Comments

There were minimal changes to the status quo as the week commences. Bangladesh has announced revised trading hours on the local exchanges. No change of status in Nigeria and Kenya as they both continue to face limited liquidity. Please see trading comments below.

Read More »

Read More »

The Illusion of Control: What If Nobody’s in Charge?

The last shred of power the elites hold is the belief of the masses that the elites are still in control. I understand the natural desire to believe somebody's in charge: whether it's the Deep State, the Chinese Communist Party, the Kremlin or Agenda 21 globalists, we're primed to believe somebody somewhere is controlling events or pursuing agendas that drive global responses to events.

Read More »

Read More »

Drivers for the Week Ahead

There are some indexing events this week that could add to market volatility; the IMF will release updated global growth forecasts Wednesday. The regional Fed manufacturing surveys for June will continue to roll out; Fed speaking engagements are somewhat limited this week.

Read More »

Read More »

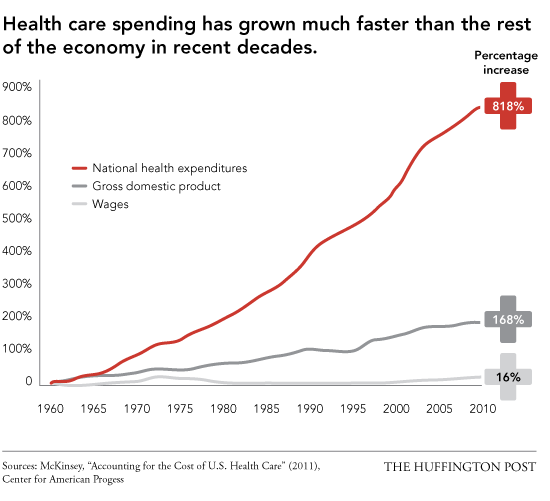

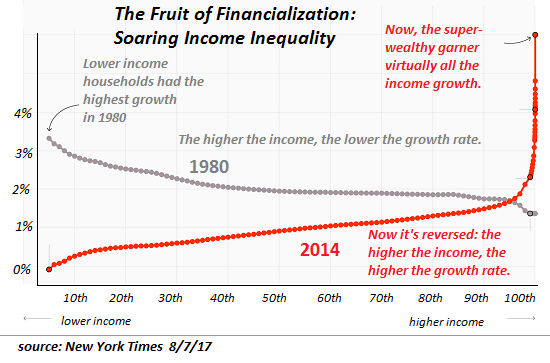

For the Rich to Keep Getting Richer, We Have to Sacrifice Everything Else

They're hoping the endless circuses and trails of bread crumbs will forever distract us from their plunder and the inequalities built into America's financial system.. The primary story of the past 20 years is the already-rich have gotten much richer, with destabilizing economic, social and political consequences.

Read More »

Read More »

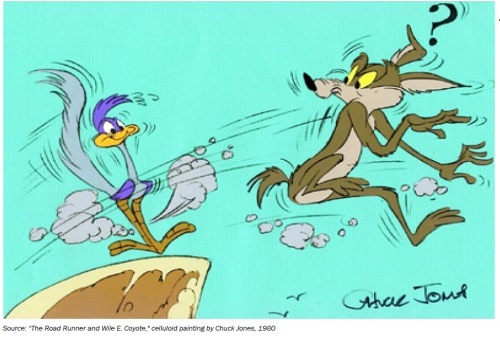

Our Wile E. Coyote Economy: Nothing But Financial Engineering

Ours is a Wile E. Coyote economy, and now we're hanging in mid-air, realizing there is nothing solid beneath our feet. The story we're told about how our "capitalist" economy works is outdated. The story goes like this: companies produce goods and services for a competitive marketplace and earn a profit from this production. These profits are income streams for investors, who buy companies' stocks based on these profits. As profits rise, so do...

Read More »

Read More »