Category Archive: 5) Global Macro

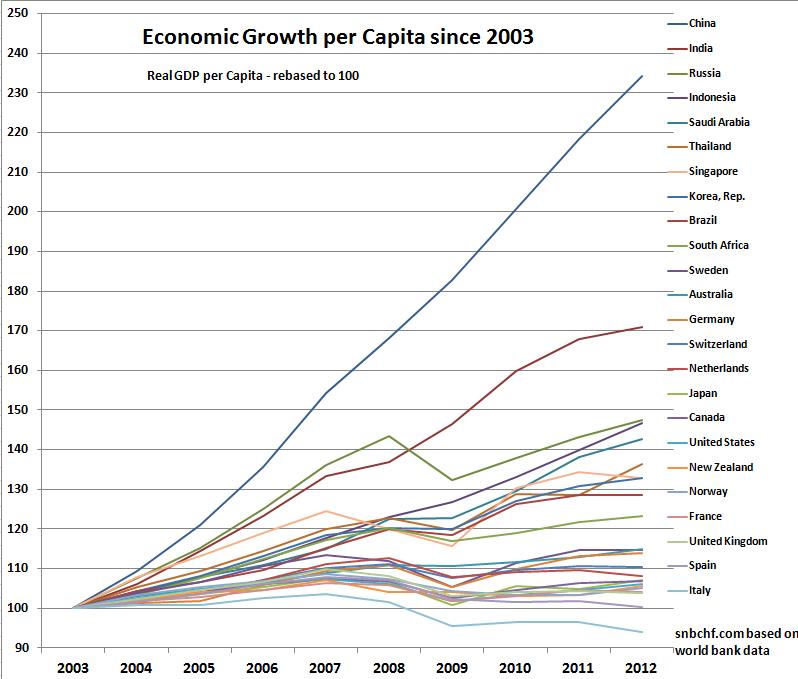

Japan Beats the United States in GDP Growth per Capita for Last Decade

Mainstream economists speak of two Japanese lost decades(s) between 1990 and 2009. Often the United States and the UK are seen as leader in growth. Some statistics might confirm this: When we look on a more subtle criteria, namely GDP growth per capita, available at the world bank, we see a different picture. China and … Continue reading...

Read More »

Read More »

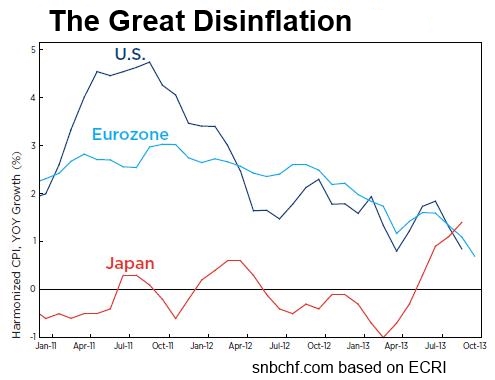

The Great Disinflation Continues, How Wonderful!

Recently investors moved out of bonds in the expectation that inflation will rise soon. But strangely inflation rates have continued to fall. The great disinflation continues.

Read More »

Read More »

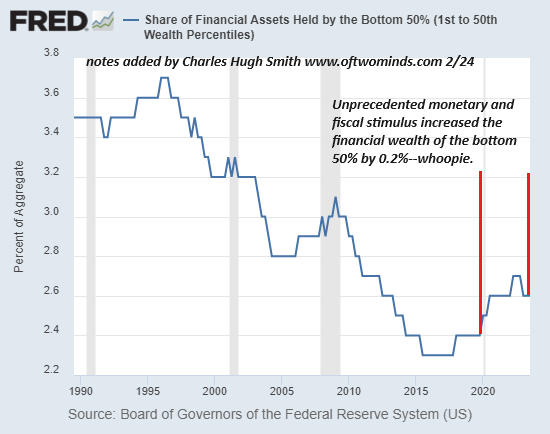

Charles-Hugh- Smith- Nearly- Free- University

Prolific author and owner of the popular alternative financial blog “Of Two Minds” Charles Hugh Smith discusses his latest book “The Nearly Free University and the Emerging Economy”With the soaring cost of higher education, has the value a college degree been turned upside down? College tuition and fees are up 1000% since 1980. Half of …

Read More »

Read More »

Charles Hugh Smith: The Nearly Free University

For full description and comments: http://www.peakprosperity.com/podcast/82941/charles-hugh-smith-nearly-free-university Our broken education model is ripe for creative disruption The cost of higher education has skyrocketed in recent decades. The average cost of tuition is up over 1,000% since the 1980s, far outstripping price inflation and most other goods and services. Yet despite the accelerated cost, the value of …

Read More »

Read More »

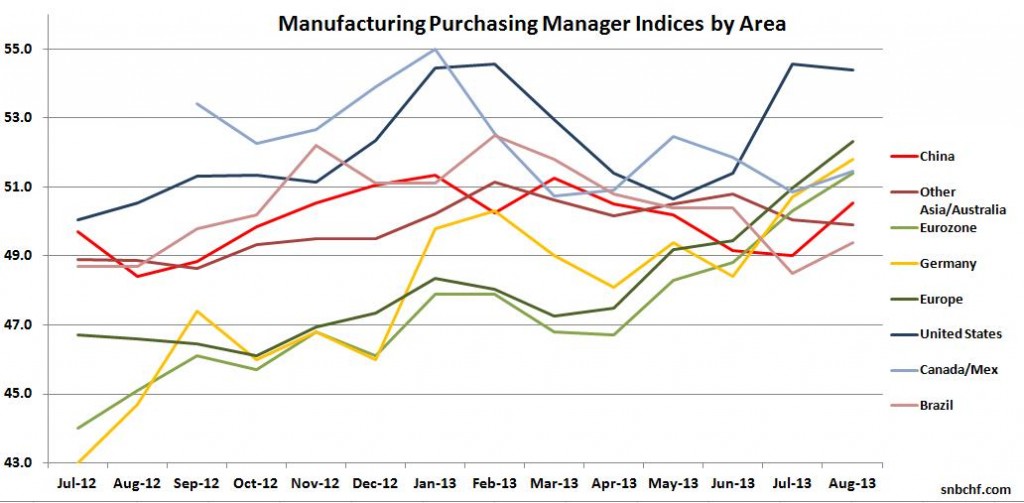

Global Purchasing Manager Indices: Europe and China Recover while other Emerging Markets Still Struggle

Emerging markets: Years of strong increases in wages combined with tapering fears have taken its toll: Higher costs and lower investment capital available. EM Companies have issues in coping with developed economies. Some of them even need to shed jobs.

Read More »

Read More »

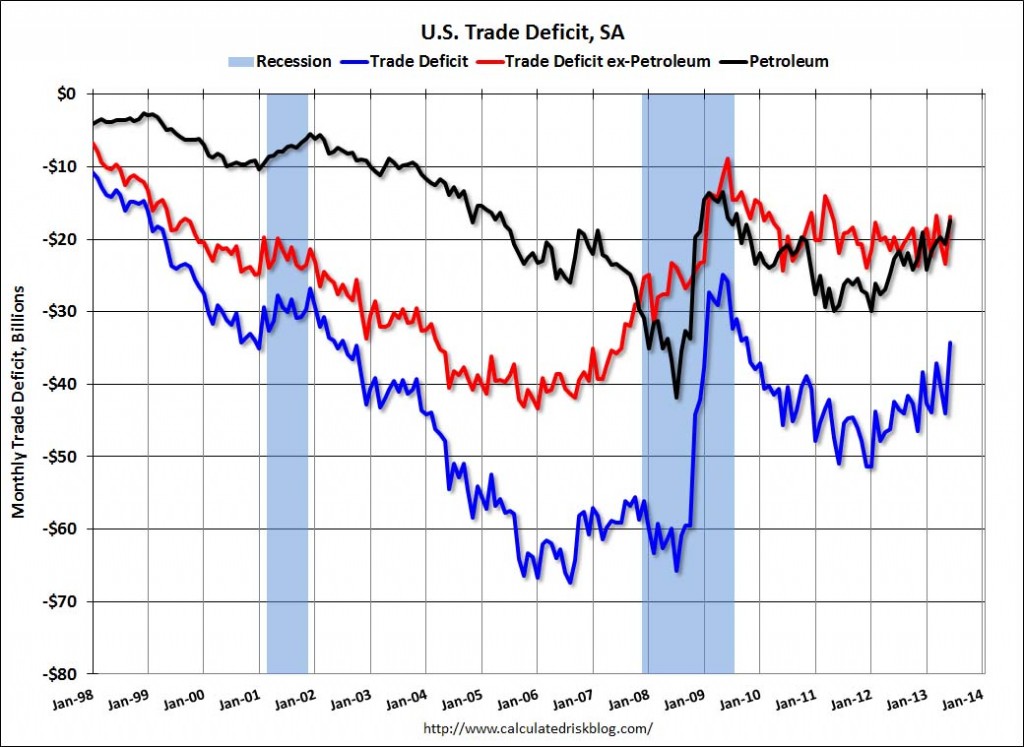

The U.S. “Oil Trade Deficit” Narrows

The United States trade balance has strengthened to a deficit of only -34.2 bln USD in June 2013. This is nearly half the record-high trade deficit of 62 bln. $ in August 2008 and not too far from record-lows of 26 bln. $ in July 2009, when oil was really cheap. In the first six … Continue reading »

Read More »

Read More »

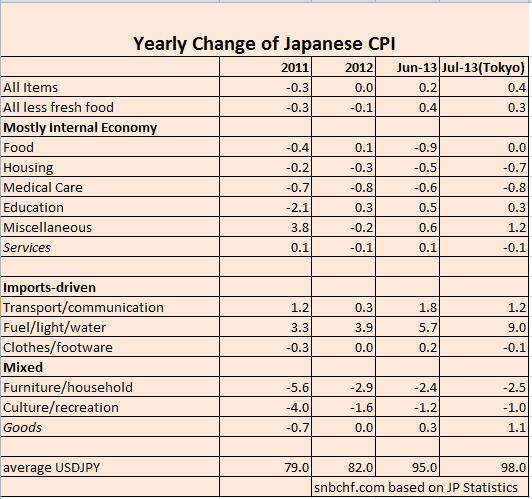

Abenomics Succeeding? Don’t Believe the Mainstream Media, Just Energy and Import Prices Are Higher

While the FT says: Abenomics is succeeding in bringing inflation back to Japan. The preferred core CPI measure, which excludes volatile food prices, rose a higher-than-anticipated 0.4 per cent in June (year-over-year), the highest reading since November 2008 and the first positive reading since April 2012. (The reading was flat in May). Overall inflation …

Read More »

Read More »

Charles High Smith–Acquire New Skills Or Become A Mover 24.Jun.13

www.FinancialSurvivalNetwork.com presents Charles Hugh Smith and I discussed the increasing knowledge gap in America. If you aren’t in a position to make connecitons and network with people who can help you get ahead, then you must increase you skill set. In previous eras you could only acquire those skills in college. Now, however, you can …

Read More »

Read More »

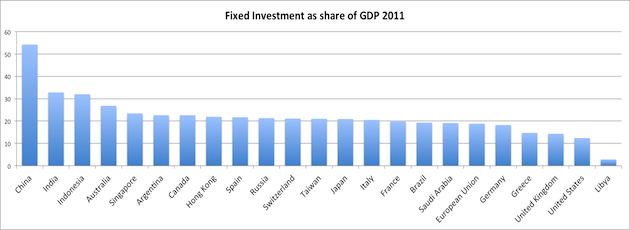

Democracies Like Bubbles, Totalitarian Regimes Hate Them

Totalitarian regimes, like China, fear bubbles and revolutions. Strangely, these regimes help to prevent asset bubbles, and the resulting unequal distribution of wealth between rich asset owners and the poor without assets. Today’s FT article shows how Chinese authorities fear the bubble and the revolution. China cash crunch deepens as PBOC withholds funding Short-term interbank …

Read More »

Read More »

Will the China Bubble Bust? Pros and Cons

Economic experts and even rating agencies remain in dis-accord about the height of Chinese total debt and if this will continue to slow the Chinese economy.

Read More »

Read More »

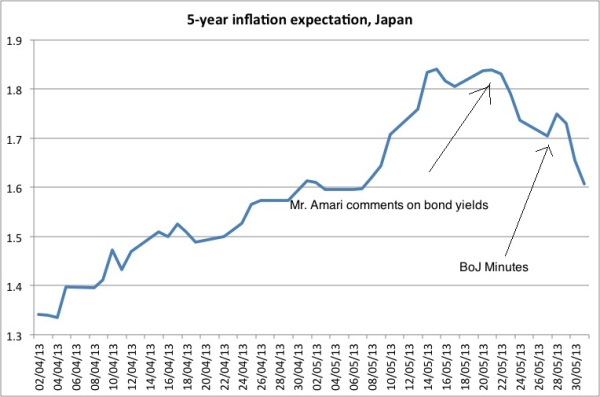

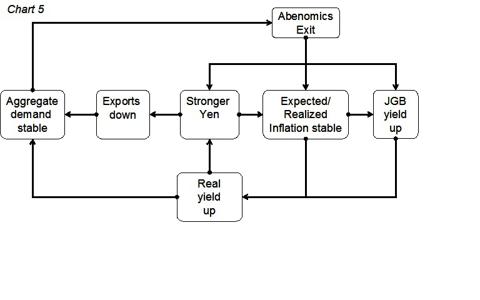

Has Abenomics Failed? Let us Go for Exchange Rate Targeting and Maintain Stability

Abenomics has failed It was doomed from the very beginning. You cannot create out of risk-averse Japanese risk-tolerating Americans. Public Japanese opinion puts enormous pressure on BoJ policy and on the government; the risks of rising JGB yields are too high. Japanese hate volatility, the government cannot risk its funding. The emphasis on the word …

Read More »

Read More »

The Cyclical and Exchange-Rate Induced Chinese Slowing

We believe in the Chinese economy, but it has just gone into a cyclical and a exchange-rate induced slowing. Any Cassandra views like recently by Charles Dumas, chief strategist of Lombard Research, but also some of Richard Koo’s earlier views, that there will be a burst of the Chinese housing bubble, are exaggerated. Markets Insight: …

Read More »

Read More »

Abenomics: A USD/JPY Trade the Smart Money Banks on

Hedge funds worldwide have been counting on a rise and subsequent fall in USDJPY, and conditions remain intact for that to happen, though not to the extremes that many once expected.

Read More »

Read More »

Don’t Worry, Inflation Will Come Back! It is already there; just not where you might live!

We name the main drivers of disinflation and manipulators of the CPI: Markets, central banks, investors, governments, statisticians, ageing, entrepreneurs, global competition, and last but least the euro.

Read More »

Read More »

Pictet Become “Secular Dollar Bulls” and Gold Bashers: Our Response

Precisely at the moment when the dollar undergoes a secular bashing with a 6% loss against the yen and 3% against the euro, Pictet publish their “secular dollar bull era” video and recommend investors to avoid gold. “Secular movements” in currency markets are mostly driven by current account (CA) surpluses or deficits, while housing …

Read More »

Read More »

Abenomics: Japanese Economy Would Have Recovered Even Without it

Response to Prof. Nick Rowe, Carleton University, Canada and Lars Christensen, the leading “Market Monetarist“. Nick Rowe: Is the Bank of Japan trying to push down bond yields? Well, yes and no. Yes, it is fighting a battle to push down bond yields, but that battle is part of a wider war for economic recovery. And …

Read More »

Read More »

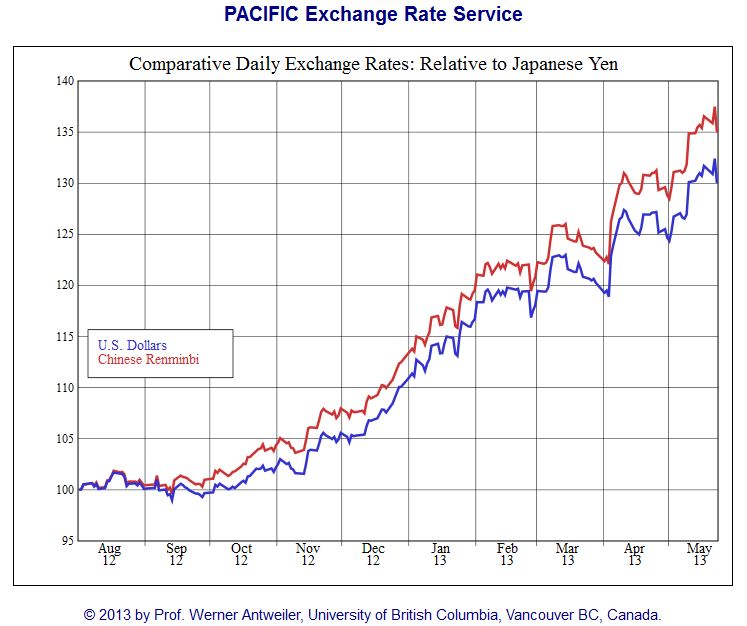

How 40% Renmimbi appreciation vs Yen Caused a Deflationary Commodity Price Shock for World Economy

Everybody is wondering why China is currently so weak, with a HSBC manufacturing in contractionary territory. No wonder, the main competitor in electronics and many more products,the Japanese yen has appreciated by nearly 40%. While China has to fight years-long appreciation of wages, the Japanese profit on years-long deflation and cheaper costs. At the …

Read More »

Read More »

Jim O’Neill’s Bullish BRICS Outlook until 2020 and our Critics

Perfect charts by Goldman's Jim O'Neill that help to understand the former and future growth of different emerging, "growth markets", the BRICS. We criticise his partially over-optimistic views.

Read More »

Read More »