Economic experts and even rating agencies remain in dis-accord about the height of Chinese total debt and if this will continue to slow the Chinese economy.

Arguments Pro bubble

The rating agency Fitch remains the biggest critique of high Chinese debt levels:

Charlene Chu at Fitch Ratings says:

- Total lending from banks et al. in China was 198 percent of GDP in 2012 versus 125 percent 4 years earlier, and there is just no way to grow out of a debt problem when credit is already twice as large as GDP and growing nearly twice as fast.

- How long can China maintain growth driven by bank lending that has allowed it to sidestep the global financial crisis?

- The assets of Chinese banks may increase by as much as 20 trillion yuan (3 trillion US$) in 2013 , compared to the $13.4 trillion of assets held by US commercial banks at the end of 2012.

- Companies’ ability to pay back what they owe is wearing away, as China gets less economic growth for every yuan of lending.

- The China Banking Regulatory Commission reports the ratio of non-performing loans declined to 0.96 percent as of March 31 from 2.42 percent at the end of 2008, but these figures are distorted. The ratio has declined mainly because credit has surged, and the regulator’s data does not reflect the real amount of debt because of the ways banks move loans off their books. Some loans, often for real estate, are bundled and sold to savers as wealth-management products, while other assets are sold to non-bank financial institutions, including trusts, to lower the lenders’ bad debt levels. Banks have substantial off-balance-sheet positions for which there is no asset-quality information.

- Regulatory loopholes and weaknesses in China’s banking system make official lending data unreliable.

- China’s total credit was 198 percent of GDP in 2012 when adding off-balance-sheet assets. A jump in the ratio is usually one of the most reliable predictors for a financial crisis.

- Companies are taking on a lot of debt but not getting comparable returns, so at some point they will have problems repaying the debt.

Fitch said the ratio of credit to GDP in China has increased 73 percent in 4 years – a 45 percent jump in the ratio from 1985 to 1990 preceded a banking crisis in Japan, and a jump of 47 percent from 1994 to 1998 preceded a banking crisis in South Korea.

Chinese banks are adding assets at the rate of an entire US banking system in 5 years.

Michael Werner at Sanford C. Bernstein said only 29 percent of aggregate financing in 2012 translated into economic growth, the lowest rate on record, as borrowers use more resources to finance outstanding debt and less for investment.

Stephen Green at Standard Chartered said everyone is talking about the credit cycle, leverage and credit-quality problems, but there is not enough good data, just a scary big black box. (source Investa Asset Management)

Who can Tell How High China’s Total Debt is? Ranges between 184 and 377% of GDP

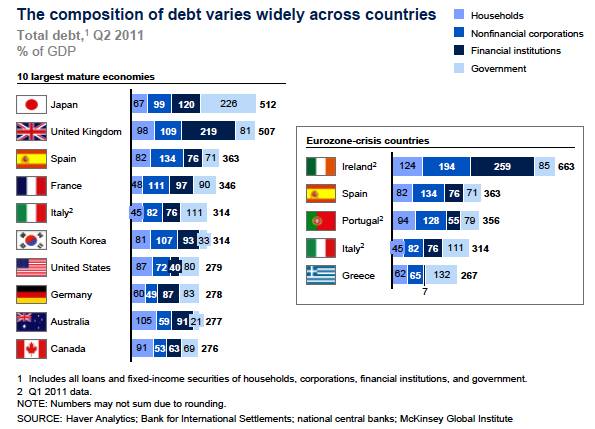

Francis Cheung at CLSA Asia-Pacific Markets estimates total corporate, household and government debt at 205 percent of GDP, versus less than 250 percent in the US and almost 400 percent in Japan.

Xu Gao at Everbright Securities sees no basis for concluding that China’s debt is unsustainable as a public debt level of 50 percent of GDP leaves room for the government to borrow more.

When we update the ratios just provided by Fitch and Everbright, we obtain:

- Household 15% of GDP (source)

- Financial Institutions 190, if we take the 198 from above and suppose that bank lending = borrowing excluding some equity

- Central/Local Governments 50

- According to an article in Project Syndicate, debt of non-financial corporations would be 122% of GDP. Many of them are state-owned, they would increase government debt.

We obtain a new total debt of 377% of GDP. This is clearly higher than McKinsey determined in their famous paper on global debt:

While the total debt-to-GDP ratio among the ten largest advanced economies averaged 348 percent at the end of 2010, the ratio was 184 percent in China, 148 percent in Brazil, 122 percent in India and 72 percent in Russia. (source McKinsey)

A value of 377% means that Chinese total debt is now comparable to developed nations. As opposed to developed nations, Chinese rely too much on debt financing, rather on equity. In developed nations we saw a large increase of both household debt and debt of non-financial corporations. This debt increase needed to be matched by debt of financial institutions.

This meant that when in Ireland the sum of household and nonfinancials debt increased by 200%, then total debt rose by 400%. A similar situation in Japan, where banks finance a the Bank of Japan purchases of JGBs.

Therefore including the debt of financial institutions is misleading and is often not contained in total debt.

As for them only the foreign loans portion is really relevant. Thanks to the Chinese current account surplus, this number should be small. Still the 122% debt of non-financial corporates is a quite number, even in comparison with other nations.

Argument Against A Bubble

High Assets Counter High Debt

Liu Li-Gang at ANZ said China’s ratio of debt to GDP is lower than in any developed Western economy, and Chu’s alarm does not take into account the enormous assets held by the government when assessing the ability to repay debt. China’s four largest banks, all majority-owned by the government, controlled 43 percent of the nation’s 134 trillion yuan (20 trillion. USD$) of banking assets at the end of 2012.

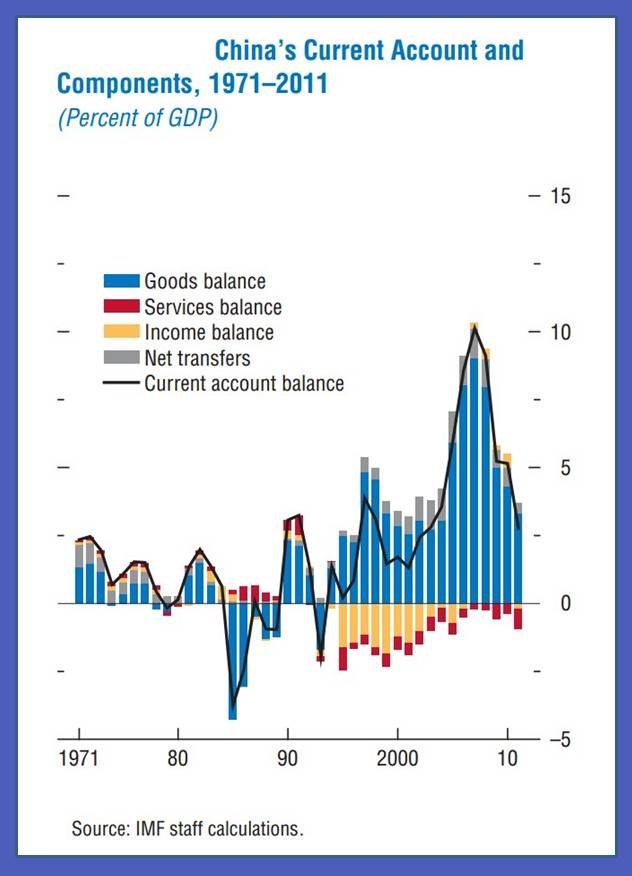

Source IMF Blog

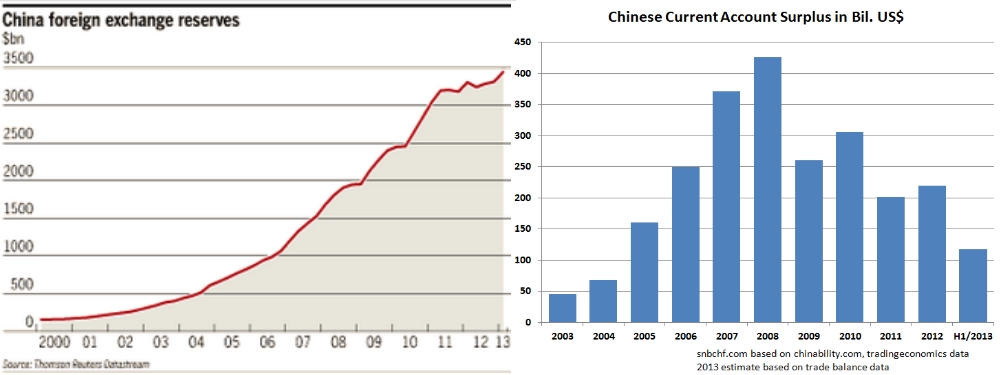

The Chinese current account shows weaker surplus to GDP ratios and seems to sustain the arguments of the pro-bubble fraction.

Liao Qiang at S&P said China is in a better position to tackle non-performing loans since in the past decade, China’s economy has quadrupled, the number of urban residents surpassed those on farms and policy makers allowed freer flows of its currency in and out of the country. Foreign-exchange reserves surged fivefold from 2004 to year-end 2012. Liao said China’s credit is mostly funded by its internally generated deposits, so a real financial crisis, normally manifested in a liquidity shortage, will not happen anytime soon.

It remains clear that the high levels of Chinese debt are mostly against Chinese citizens, but not – like in the case of Greece or Spain – against foreigners. The increase in debt ratios can be countered by the 45% FX reserves to GDP ratio and high current account surpluses.

China’s mountain of reserves reached $3.44tn – roughly the size of the German economy. (source FT)

See more for