Category Archive: 5) Global Macro

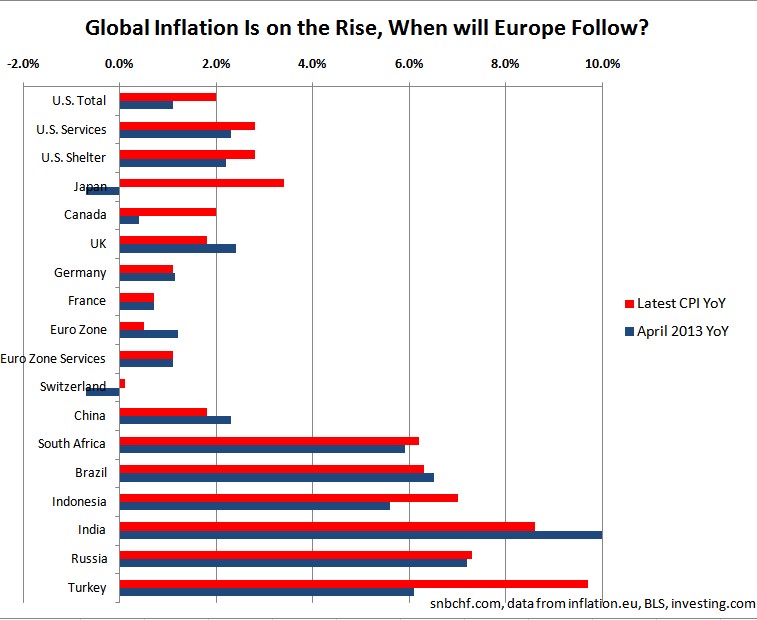

Global Inflation Spikes Up, Are You Sure About What You Are Doing Mr Draghi?

The European Central Bank (ECB) has the habit of reacting late. As seen in July 2008 and July 2011, the ECB is often the last major central bank to hike rates. They hike rates at the moment when others prepare for a recession or a significant slowing. Currently we are witnessing the opposite movement: The world is getting … Continue...

Read More »

Read More »

Labor Participation Rates: Falling in the Ageing U.S., Rising in Ageing Germany and Crisis-Hit Italy

The most effective ways of measuring employment is by looking at the Labor Participation Rate. We compare the participation rates of the United States, Canada, the U.K., Germany and Italy.

Read More »

Read More »

Charles Hugh Smith: Entrepreneur Skills A Must for Any Job

Jason Burack of Wall St for Main St interviewed economic blogger and author Charles Hugh Smith from the popular blog Of Two Minds http://www.oftwominds.com/blog.html . Charles’ blog was voted as the #7 best alternative financial blog websites by CNBC. Charles also has a new book out about entrepreneurship, jobs and careers called, Get a Job, …

Read More »

Read More »

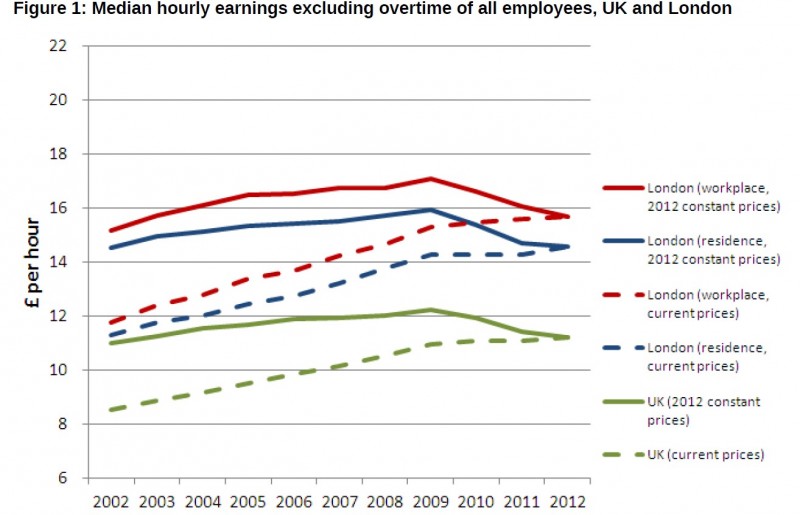

Stagnating Salaries as Main Reason for the British Home Price Boom

The major reason for rising British and American home prices is for us the relatively new phenomenon that they are to able to finance at cheap rates. Swiss or Germans have seen relatively low mortgage rates for more than three decades (with a short exception in the mid 1990s after the German reunification). The main driver of low rates …

Read More »

Read More »

The Decline of Small Business and the Middle Class

The only way to not just survive but thrive as an entrepreneurial enterprise is to destroy fixed costs and labor overhead. It is not coincidental that the middle class and small business are both in decline.

Read More »

Read More »

America’s Nine Classes: The New Class Hierarchy

Eight of the nine classes are hidebound by conventions, neofeudal and neocolonial arrangements and a variety of false choices. There are many ways to slice and dice America's power/wealth hierarchy. The conventional class structure is divided along the lines of income, i.e. the wealthy, upper middle class, middle class, lower middle class and the poor.

Read More »

Read More »

Russia, Europe, and the new international order

By Josef Janning – 09 Apr 14 Via the European Council of Foreign Relations. The premise of an international order defined by the West and shared by the rest has been shown to be faulty. Ever since the Soviet Union fell apart and nationalism re-emerged as a divisive as well as cohesive factor in Eastern … Continue reading...

Read More »

Read More »

Krimkonflikt: Über die Gleichschaltung der deutschen Medien

Der Propagandakrieg in Russland, in den USA und insbesondere in Deutschland und auch in der Schweiz geht weiter. Russische Medien trichtern den Menschen ein, dass eine riesige Flüchtlingswelle von Russen aus der Ukraine stattfindet. Deutsche Medien sind gleichgeschaltet: von links (TAZ, Spiegel, Stern) bis rechts (FAZ, n-tv.de und Welt) trichtern sie den Deutschen ein, dass …

Read More »

Read More »

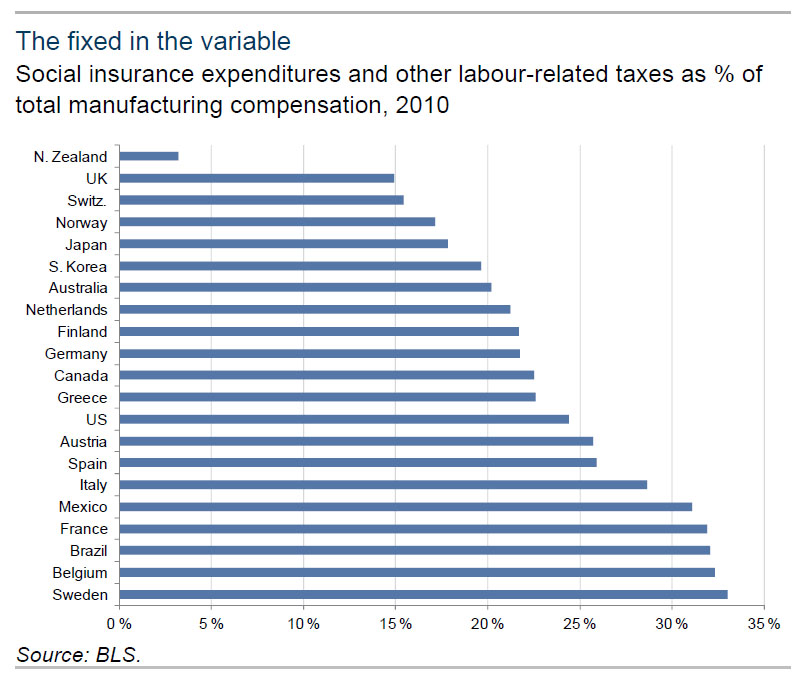

Labor Costs to Total Expenses, Global Comparison

The conflict between labor and capital is a long and illustrious one, and one in which ideology and politics have played a far greater role than simple economics and math.

Read More »

Read More »

Ukraine: About Street-Elected Overthrowers and Democratically Elected Dictators

It only needs a few years until democratically elected presidents become so-called “tyrants” and “dictators”. The bad economic situation in many emerging markets and Russia, and therefore also in Ukraine, has taken its toll. Demonstrators and Ukrainian nationalists toppled a president that has a Russian mother tongue. But Yanukovych was a protector of the country’s …

Read More »

Read More »

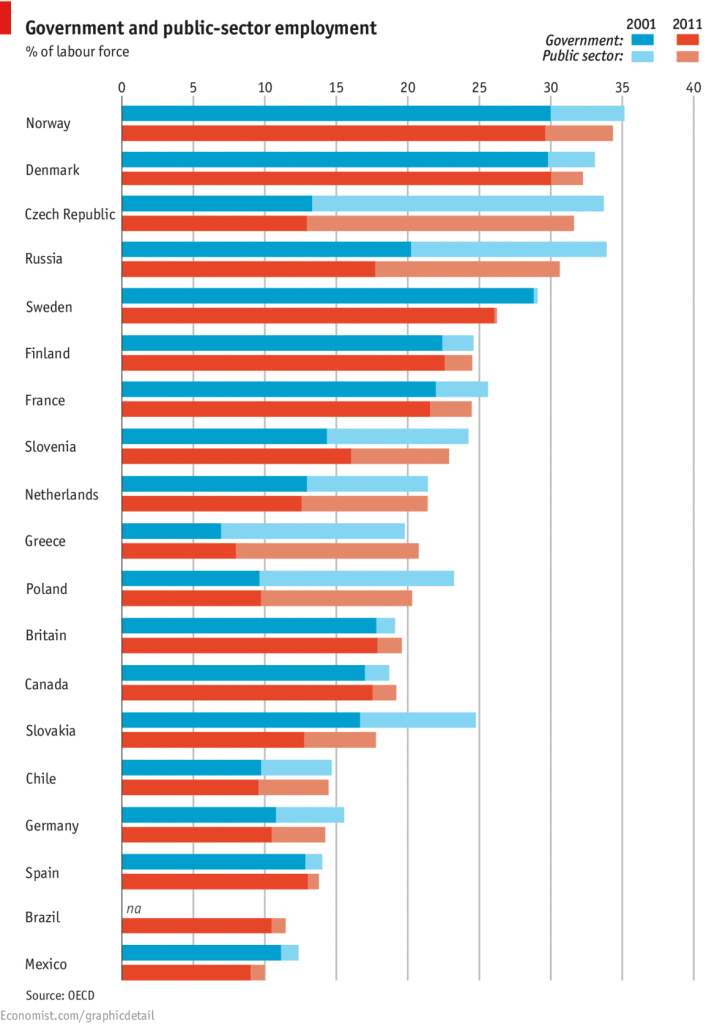

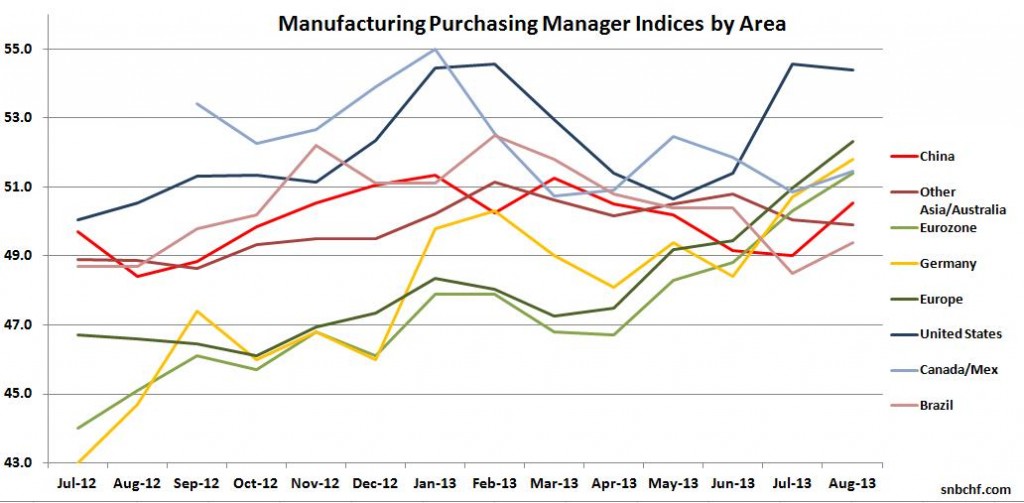

Last Week’s Sell-Off: More on the Discrepancy between Developed and Emerging Markets

Last week’s decline in stock markets was probably caused by the HSBC manufacturing PMI for China that contracted for the first time in months, and possibly also by the rapid fall of UK unemployment rates and Bank of England’s response to it. As the rising gold price showed, Fed “tapering fears” were not at the …

Read More »

Read More »

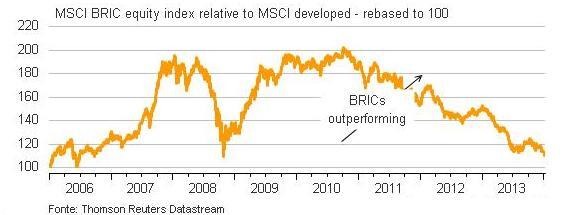

Our March 2013 Analysis: “Volcker Moment Redux”: Upcoming Weakness of Emerging Markets

The 2010 QE2 is a reason why many emerging markets started to slow considerably in the course of 2012. We reckon that this weakness will continue. Bizarrely QE2 helped to reduce global imbalances.

Read More »

Read More »

2013 Posts on Global Macro

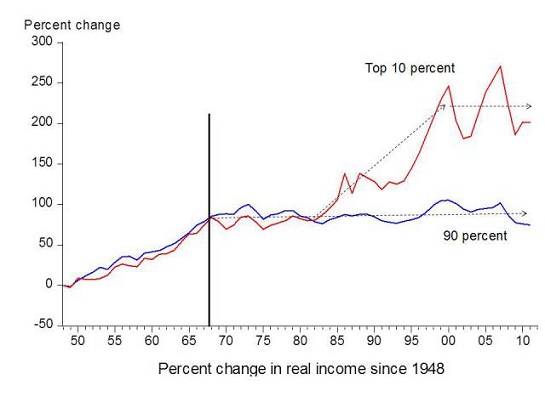

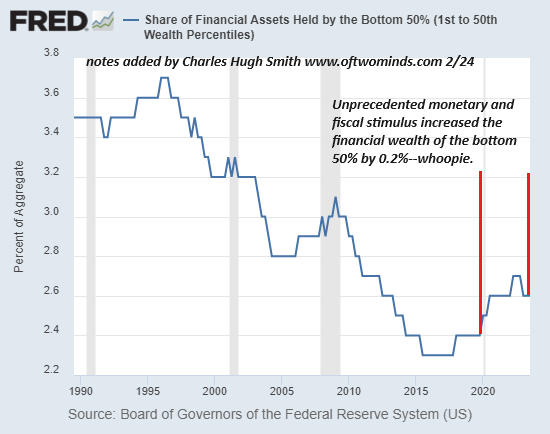

What Does It Take To Be Middle Class?

By standards of previous generations, the middle class has been stripmined of income, assets and purchasing power. What does it take to be middle class nowadays? A recent paper, The Distribution of Household Income and the Middle Class, used Census data to discuss what sort of income it takes to qualify as middle class, but reached no firm conclusion: people tend to self-report that they belong to the middle class based on income, but income is not...

Read More »

Read More »

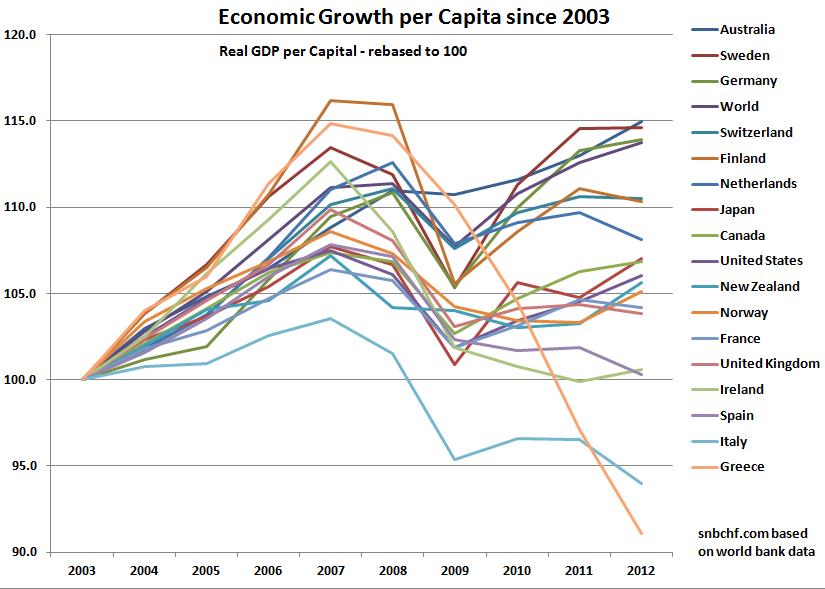

Japan Beats the United States in GDP Growth per Capita for Last Decade

GDP Growth per Capita in Developed Nations in the following order: Australia Sweden Germany Switzerland Netherlands Japan Canada United States France United Kingdom Ireland Spain Italy Greece

Read More »

Read More »