Category Archive: 5) Global Macro

04 08 15 – MACRO ANALYTICS – Nature of Work – w/ Charles Hugh Smith

Video Content Abstract at: LINK http://www.gordontlong.com/Macro_Analytics.htm#Smith-04-08-15

Read More »

Read More »

How Many Slots Are Open in the Upper Middle Class? Not As Many As You Might Think

Not only are there not that many slots in the upper middle class, the number of open slots is considerably lower. If America is the Land of Opportunity, why are so many parents worried that their princeling/princess might not get into the "right" pre-school, i.e. the first rung on the ladder to the Ivy League-issued "ticket to the upper middle class"? The obsessive focus on getting your kids into the "right" pre-school, kindergarten and prep...

Read More »

Read More »

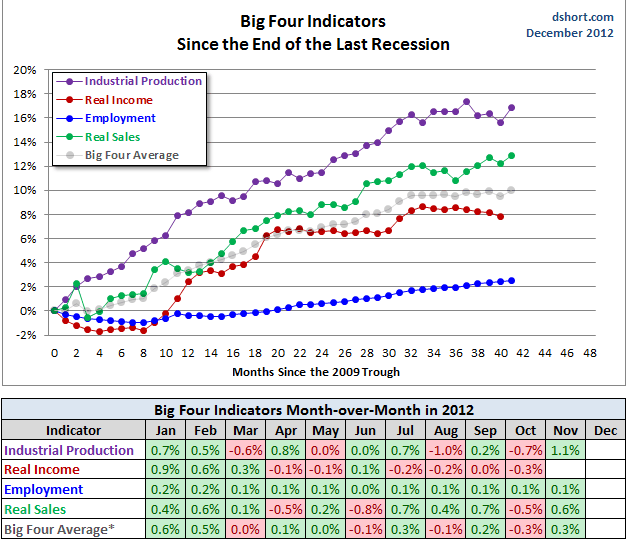

US Economic Indicators

The four best US economic indicators, in form of concurrent indicators, can be seen at Doug Short, here in detail.

Read More »

Read More »

Charles Hugh Smith–The Emperor Of Lies Has No Clothes #2525

Charles Hugh Smith has written about the we are living in An Empire of Lies. We discuss what that means and why it must eventually end. The surprising thing is how long it has lasted. This is why it’s so important to go back to the local investing and keep the money in your community … Continue reading...

Read More »

Read More »

2014 Posts on Global Macro

Charles Hugh Smith: Wealth Inequality by the Fed Now Mainstream Issue

Nov 4 – Cris Sheridan welcomes Charles Hugh Smith, author of the Of Two Minds blog. Charles notes that the Federal Reserve has been seen as all-powerful, but believes that perception is now waning. http://www.financialsense.com/subscribe

Read More »

Read More »

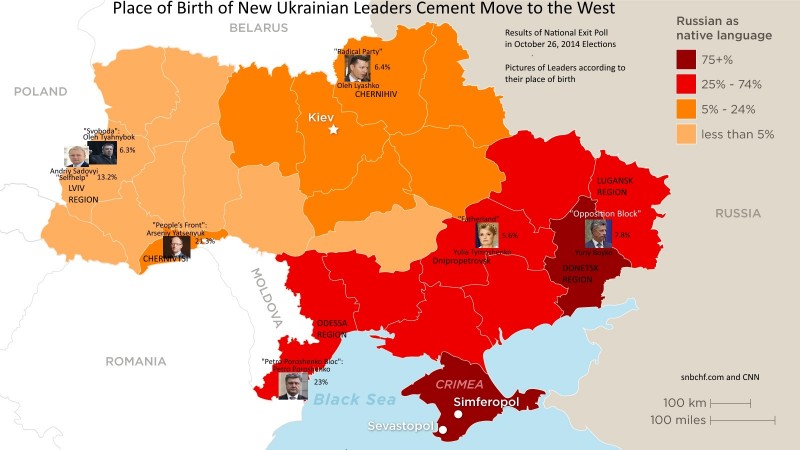

Place of Birth of New Ukrainian Leaders Cement the Country’s Move to the West and the EU

The place of birth of the Ukrainian leaders give us hints where the country is headed. Most of them come from the very West of Ukraine, from places that formerly were part of the Austrian-Hungarian empire, of Poland or Romania.

Read More »

Read More »

Charles Hugh Smith–Central Bankers Have Reached A Fork In The Road-They Should Take It #2313

Never before have quasi-omnipotent financial gods had so few powers. A lot is being written about central bank policies now as the Federal Reserve ends its primary quantitative easing (QE) program and the limitations of central bank easing become increasingly apparent in Europe and Japan. Markets across the globe are in utter turmoil. Oil is …

Read More »

Read More »

The Dollar, the ISM, Buy American and Irrational Exuberance

In this Cross Asset Global Macro Analysis we name our reasons for the current dollar strength. The main causes are ECB’s euro “downtalk”, tight monetary policy in Emerging Markets, rising savings of the aging populations. This leads to weak global spending and growth. With the help of Fed-financed higher asset prices and falling gasoline prices, …

Read More »

Read More »

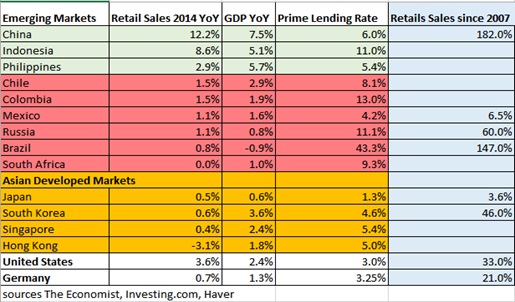

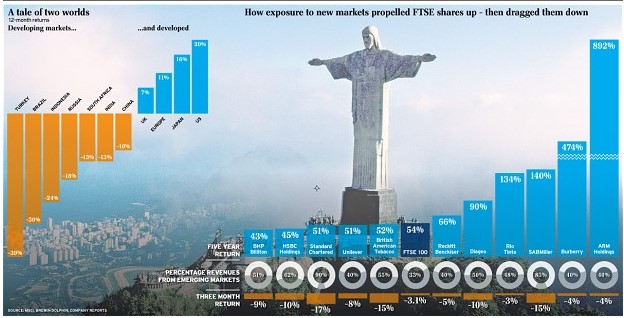

Stock Indices and Exposure to Emerging Markets

Monetary policy is and remains tight in Emerging Markets, in particular since many of their currencies collapsed in summer 2013. This created inflation and led to lower spending. We want to find out which stock indices in the developed world have which exposure to Emerging Markets.

Read More »

Read More »

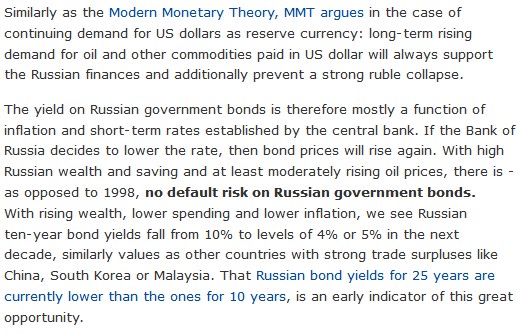

The Best Contrarian Macro Investment: Russia?

We name thirteen macro-economic reasons why Russia is currently the best place for contrarian investments.

Read More »

Read More »

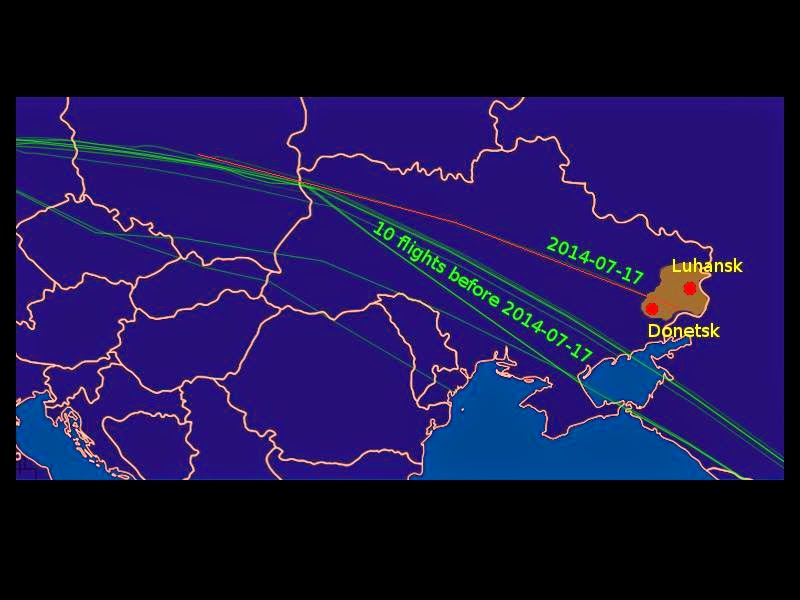

Malaysian MH17: Ukrainian&Western Propaganda against Russian Propaganda. Who is Best?

strong suspicion that Ukrainian air control deliberately facilitated and enabled the shot-down. Combining Western and Ukrainian propaganda with pro-Russian propaganda helps. In each piece of "manufactured or exaggerated news" there might be a bit of truth. Still there is only one party to this conflict that has to gain from a deliberate blowing up of MH17, this is not Russia or the so-called "Donezk People's Republic".

Read More »

Read More »

Charles-Hugh-Smith-Getting-Career-Job-Today’s-Economy

Of Two Minds blogger, prolific author, and pundit Charles Hugh Smith in an impromptu coffeehouse promo for his latest book Get a Job, Build a Real Career and Defy a Bewildering Economy. http://www.amazon.com/gp/product/B00JJX2KZM/ref=as_li_qf_sp_asin_tl?ie=UTF8&camp=1789&creative=9325&creativeASIN=B00JJX2KZM&linkCode=as2&tag=charleshughsm-20

Read More »

Read More »

Charles-Hugh-Smith-Get- Job, Build- Real Career-Defy-Bewildering -Economy

Economist, author, and pundit #CharlesHughSmith talks about his latest book: Get a Job, Build a Real Career and Defy a Bewildering Economy Get Charles book here: http://www.amazon.com/gp/product/B00JJX2KZM/ref=as_li_qf_sp_asin_tl?ie=UTF8&camp=1789&creative=9325&creativeASIN=B00JJX2KZM&linkCode=as2&tag=charleshughsm-20 I asked Charles Hugh Smith what he would do with $10,000 cash. He explains what he personally would do with...

Read More »

Read More »

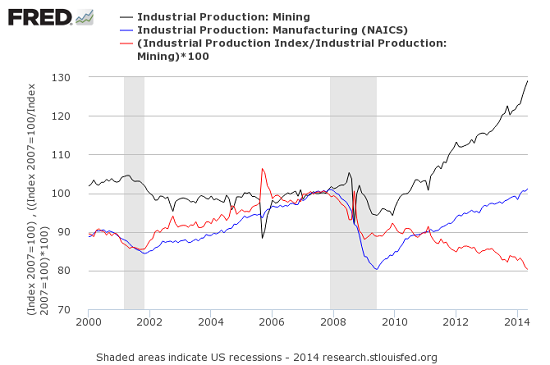

Will the Dollar Appreciate on higher U.S. Savings and a Smaller Trade Deficit?

In summer 2013, even the sceptical and "gold-friendly" economist John Mauldin followed the mainstream thinking that fracking and other technology could reduce OPEC's and the Chinese advantage in global trade and reduce the U.S. trade deficit. Recently both claims got refuted: the first with WTI crude oil prices rising to nearly 108$ despite enhanced supply. Detailed data showed that rising U.S. industrial production was not caused by more...

Read More »

Read More »

Charles Hugh Smith–Era Of The Lawless Presidency 20.Jun.14

Charles Hugh Smith has written recently about the two Most Destructive Presidencies in U.S. History: George W. Bush and Barack H. Obama. Powers once granted are almost impossible to take back. After 13.5 years, there is more than enough evidence for reasonable people to conclude that the presidencies of George W. Bush and Barack H. …

Read More »

Read More »